2023 Insurance Preview: More Scrutiny For Private Equity; Regulator Focus on Climate Aids Private Flood, Florida Property Insurers, Wildfire Insurtech

December 28, 2022

Capstone believes actions by regulators in the coming year will have a significant impact on which subsectors of the US insurance industry are attractive for investment and which will face greater challenges. We believe regulatory attention on climate risk and natural disasters will yield opportunities across the insurance and insurtech space. Key areas of interest include wildfire insurtech, ESG compliance solutions, Florida property insurance, and private flood insurance.

We expect regulators will scrutinize technological innovation in the insurance industry, posing challenges for firms trying to adopt new tools in the new year. We believe the National Association of Insurance Commissioners (NAIC) will continue to examine how insurers use artificial intelligence (AI) and machine learning (ML), which could affect AI-powered underwriting, claims processing, marketing, and other tools insurers have begun to embrace.

State insurance commissioners made clear at the NAIC’s National Meeting in December 2022 that they are prepared to pursue regulatory initiatives to shore up their authority to avoid federal intervention. We believe this focus will drive many of the regulatory trends we identify in this preview.

The NAIC’s focus on preserving authority at the state level is most evident in its recent focus on private equity investment in the insurance industry, which has caught the attention of Senate Banking Committee Chair Sherrod Brown (D-OH). In May 2022, Sen. Brown wrote a letter to the NAIC imploring commissioners to investigate the harm that private equity investments could have on end-consumers.

State insurance commissioners are driving regulatory trends this year.

Separately, we believe efforts by the government-sponsored enterprises’ (GSE) to reduce closing costs by supporting innovative alternatives to title insurance could introduce long-term risks to the title insurance market.

In this US Insurance 2023 Preview, we discuss several key themes including: NAIC’s scrutiny of private equity-owned insurers; climate disclosure regimes for insurers; risks and opportunities of new wildfire insurance regulation; regulation in the Florida property insurance market; regulatory tailwinds in the private flood insurance market; regulatory scrutiny of artificial intelligence in insurance; and GSE policy changes disrupting the title insurance market.

A Deeper Look

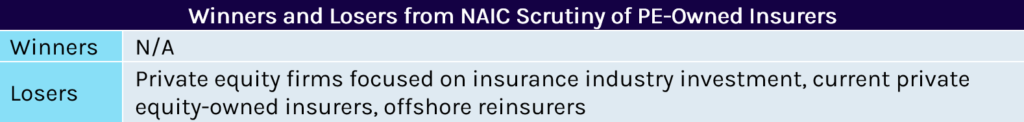

Private Equity-Owned Insurers Face Mounting Risks from State Insurance Regulators

Capstone believes private equity (PE) investment in the insurance market is likely to face headwinds in 2023 as the NAIC continues its internal review of risks such investments pose to policyholders. On December 7, 2021, the NAIC voted to publish a list of “regulatory considerations applicable (but not exclusive) to [PE] owned insurers” for a 30-day comment period. The summary identifies 13 topics of consideration related to PE ownership of insurance companies. The list covers a wide range of topics, including investment management agreement structure, private equity owner investment horizon and affiliated investments, increased investments in less-liquid structured securities, use of offshore reinsurers, and pension risk transfers. To date, the NAIC has assigned various internal working groups and task forces to investigate each area of concern and determine whether further action—in the form of industry guidance or model law—is warranted.

Ownership Thresholds and Control

NAIC working groups will have a lot to say about how private equity firms structure their relationships with insurers.

On December 14th, the NAIC Group Solvency Working Group discussed the first two items of concern related to presumption of control. While no formal action was voted on in the meeting, commissioners agreed to reevaluate disclosure requirements, particularly for parties that may have less than 10% ownership but retain less clear levers of control; educate examiners on complex control structures; and facilitate better communication across state insurance departments. In addition, the NAIC’s Statutory Accounting Principles Working Group (SaPWG) recommended exposing for consideration until February 10, 2023, a clarification to the NAIC statutory accounting principles (SAPs) that “any invested asset held by a reporting entity which is issued by an affiliated entity, or which includes the obligations of an affiliated entity, is an affiliated investment.” We believe the NAIC working groups will continue to pursue policy changes—through model laws, guidance, or further SAP updates—that increase disclosure around investment management agreement structure and presumption of control which could impact the way that private equity firms are able to structure their relationships with insurers.

Offshore Reinsurers

We believe offshore reinsurance is another area of growing focus for the NAIC. Reinsurance is an essential tool for insurance companies to manage the risk and capital they are required to hold to support those risks. In a typical contract between a reinsurer and an insurer, the insurance company transfers risk to the reinsurance company, which assumes all or part of one or more insurance policies issued by the insurer. US insurers that cede business to authorized reinsurers—insurers licensed to accept reinsurance in a state or territory—can recognize a liabilities reduction without a requirement for the reinsurer to post collateral to secure its payment of reinsured liabilities.

Before 2011, reinsurers not licensed in a US state were required to post collateral equal to 100% of their reinsurance transaction. In 2011, the NAIC revised its Credit for Reinsurance Model Law and Credit or Reinsurance Model Regulation—which, together, establish rule under which reinsurance credit is allowed to be claimed by a US ceding insurer. The reforms allow reinsurers in qualified jurisdictions to become eligible for reduced reinsurance collateral requirements (on a sliding scale) based on the financial strength of the reinsurer and the rigor of the home jurisdiction’s regulatory regime. Seven jurisdictions have “qualified jurisdiction” status.

State insurance commissioners are tightening their focus on offshore reinsurance.

In 2019, the NAIC revised its reinsurance model laws to establish the concept of “reciprocal jurisdictions”—jurisdictions that have in-force agreements with the US (both the European Union and the UK have these in place), meet certain NAIC accreditation requirements, or are determined by state insurance commissioners to meet all applicable requirements to be a reciprocal jurisdiction. Only three jurisdictions outside the EU and UK have reciprocal jurisdiction status (Bermuda, Japan, and Switzerland).

Insurers often look to non-US domiciled (“offshore”) reinsurers to conduct reinsurance transactions given several benefits including more favorable tax treatment, more flexible regulatory requirements, and the ability to avoid punitive reserve requirements in the NAIC model law revisions. The NAIC included in its list of PE-related considerations “insurers’ use of offshore reinsurers (including captive insurers), and complex affiliated sidecar vehicles” to maximize capital efficiency and reduce reserves. The NAIC’s primary concern with offshore reinsurers is the potential for increased investment risk when 1) offshore reinsurers are not held to the same capital standards as the insurer; and 2) regulators have less visibility into arrangement structures than there is in domestic reinsurer deals. During its meeting on December 13th, a NAIC joint task force indicated that regulators have had several confidential meetings on this, both with reciprocal and qualified jurisdictions and insurers. The joint task force indicated it is investigating ways to allow regulators to more easily identify risks and the economic impacts of offshore reinsurance transactions—work that will continue in 2023. State regulators’ reconsideration of reciprocal jurisdiction status or reconsideration of the 2011 and 2019 reforms to NAIC model laws could have major implications for reinsurers. Capstone plans to track NAIC working group progress on the issue closely in 2023.

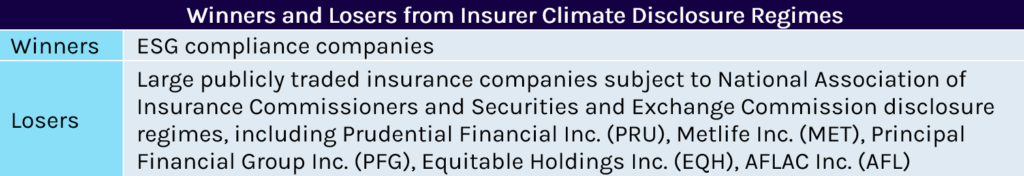

Insurers Face New Climate Disclosure Regimes from the NAIC and SEC

State insurance commissioners are increasingly focused on addressing the risks that climate change pose to the insurance industry. On April 7, 2022, NAIC adopted recommendations to revise its Climate Risk Disclosure Survey—a framework for climate disclosure reporting that has been around since 2010. The revisions made disclosure requirements mandatory for insurers with more than $100 million in annual premiums in the 14 states (and the District of Columbia) that have regulations in place implementing the Climate Disclosure Survey. The NAIC estimates adoption in these 14 states makes the model law applicable to 80% insurance market in 2022 (the deadline for submission was November 30, 2022). The new disclosure regime aligns with the framework established by the international Task force on Climate-Related Financial Disclosures (TCFD)—a leading international benchmark for climate disclosure. Currently, insurance regulators from France, Switzerland, and the UK also require TCFD-aligned disclosure reports. The new survey requires insurers to make nonconfidential disclosure on:

- Publicly stated goals and board and management oversight of climate-related financial risks;

- The impact of climate-related risks on insurers’ business and explain the resiliency of their strategy to address those risks;

- The risk management processes insurers follow to address climate-related risks; and

- Metrics the insurer uses to assess climate-related risks must be disclosed. Scopes 1 and 2—and Scope 3, if applicable—emissions must be disclosed, along with goals the insurer set to reduce emissions and whether they hit the targets.

The NAIC initially proposed the new disclosure regime on March 21, 2022—the same day the Securities and Exchange Commission (SEC) proposed its own climate disclosure rule—also based on the TCFD framework. If the SEC rule is implemented, publicly traded insurers will be required to comply with the SEC climate disclosure rule, as well as the NAIC Climate Risk Disclosure Survey if they reside in one of the adopting 14 states or the District of Columbia. We believe both disclosure regimes will require a new level of reporting and disclosure from the insurance industry—which will increase enforcement and litigation risk. That said, we believe the SEC rule faces an uphill battle to implementation with legal challenges likely. More broadly, we believe regulatory and secular shifts toward increased focus on ESG issues create tailwinds for companies providing compliance services that insurers and other companies can leverage to ensure compliance in the evolving ESG regulatory landscape.

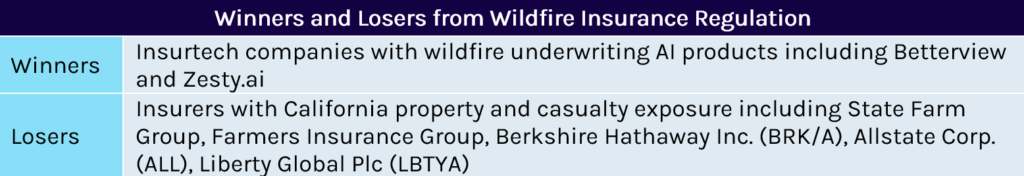

Wildfire Insurance Regulation Could Pose Risks to Industry; Opportunities for Emerging Wildfire Insurtech Companies

We believe recent reforms proposed by the California Department of Insurance (CDI) could significantly impact how personal and commercial property insurers operate in the state. In February, the CDI introduced the Safer from Wildfires Framework to improve wildfire safety and reduce insurance costs for homeowners and businesses. Under the new regulation, all admitted insurance carriers in California must recognize and reward the wildfire safety and mitigation efforts that homeowners and businesses make. The framework requires insurers to take into account 11 mitigation measures across three layers of protection to provide consumers with a “wildfire risk score” that impacts consumers’ and businesses’ premiums:

- Protecting the structure covers various “home-hardening” measures including installing a Class-A Fire rated roof, a 5-foot ember-resistant zone around a home, maintaining non-combustible 6 inches at the bottom of exterior walls, installing ember and fire-resistant vents, and upgrading windows (double paned or added shutters).

- Protecting immediate surroundings covers measures including clearing vegetation and debris from under decks; moving combustible sheds and other outbuildings to at least a distance of 30 feet; and maintaining “defensible space” compliance.

- Working together as a community to establish clearly defined boundaries and conduct a local risk assessment with the local fire department, including identifying evacuation routes and funding mitigation measures.

The regulation was implemented on October 17th, and all admitted insurance carriers in California are now required to establish a process for implementing the new framework and establishing wildfire risk determinations within 180 days of the this date—which many in the industry view as a heavy burden on such a tight timeline.

The insurance says the Safer from Wildfires Framework imposes heavy burdens while consumer advocates argue it’s easy to sidestep.

Consumer groups have pushed back on the regulation, arguing it does not require insurance carriers to consider mitigation steps when selling a consumer a policy. Consumer advocates also say insurers can sidestep the regulation simply by avoiding selling policies to residents and businesses in fire-prone areas. We believe the CDI could look at ways to remedy this in 2023. In 2018, California enacted S.B. 824, which prohibits insurance companies from canceling or refusing to renew a policy for one year after a state of emergency is declared—if the sole reason for the cancelation is the structure is within a designated wildfire area. The CDI has imposed several moratoriums on policy cancelations to help protect impacted homes and businesses. Targeted use of this authority would help the CDI more narrowly regulate how insurers respond to the new Safe from Wildfire Framework regulation, though not as a long-term solution given the law’s time limits on the moratoria.

We believe the regulatory response to growing wildfire risk is likely to be a key topic for the NAIC heading into 2023. At the NAIC Fall National Meeting, the NAIC Climate Resiliency Task Force heard updates from various insurance commissioners regarding other actions taken to protect homeowners and mitigate wildfire risk in their states. Many states indicated they are also exploring options similar to the California Safer from Wildfires Regulation that give consumers credit for home hardening actions taken. Notably, the Oregon Department of Insurance Commissioner announced indicated that the state was “just a few years behind California” in terms of implementing a similar regime and that the state legislature would be pursuing related policy changes in the upcoming legislative session.

Insurers will turn to technology as regulators force them to reckon with wildfire risk.

As regulators expand regimes requiring insurers to reckon with wildfire risk, we believe insurers will look to integrate new technology to help enhance their underwriting capabilities. Companies such as Zesty.ai—currently partnered with Farmers Insurance—are looking to fill this role in the insurance market. In July 2021, Zesty.ai’s Z-FIRE underwriting model became the first AI model to obtain regulatory approval for underwriting and pricing wildfire risk at the individual property level. Another player in the space is Betterview, an insurtech firm that in August 2022 announced a partnership with the National Fire Protection Association (NFPA) —a nonprofit focused on fire risk mitigation—to help insurers comply with California’s Safer from Wildfires regulation.

Florida Implements Changes to Stabilize Residential Property Market

We expect Florida’s Office of Insurance Regulation to implement the changes the state legislature passed through 2023, expanding the market of potential private policyholders and reducing reinsurance and litigation costs, providing tailwinds for insurers in the state. The reforms mark the most significant effort to limit litigation against property insurers in the state after provisions passed in May proved ineffective, especially after Hurricane Ian.

Florida legislators are pursuing policies that will benefit insurers with significant exposure in the state.

In the near term, we believe reforms will limit homeowners’ eligibility for policies from Citizens Property Insurance Corporation, the state-run insurer of last resort. The changes seek to counteract the pricing disparity created by limitations on Citizens’ annual price increases. Meanwhile, private insurers have been raising prices significantly every year (as approved by Florida’s Office of Insurance Regulation) to deal with higher costs resulting from litigation for roof damage claims made possible by the state’s plaintiff-friendly approach. While the new law does not change the “glidepath” for price increases by Citizens, it does require rates to be actuarily sound and “noncompetitive” with private insurers. It also requires policyholders to have flood insurance, which will result in additional costs. Additionally, the homeowner will be ineligible for a Citizens policy if they receive a quote for comparable private coverage with premiums 20% higher or less. We expect these provisions will allow private insurers to proceed with planned price increases in 2023 without losing potential policyholders to Citizens.

The state legislature also seeks to lower insurer expenses by discouraging litigation. It expands opportunities for mandatory arbitration and prohibits the assignment of benefits (AOB), a tool contractors use to control the claims process, although critics have argued homeowners are unaware that their claims will be litigated. The law also eliminates one-way attorney fees (where only the plaintiff can recover attorney fees in a court decision). We expect these changes to be challenged in court and provide only a modest cost benefit for insurers in 2023.

The state legislature’s changes demonstrate a willingness to significantly reform the residential property market, which we see as a response to constituents that have faced increasing annual insurance costs. While the new law does not directly reduce costs, effective tort reform would translate to lower premiums. If the law is blocked, or rendered ineffective due to the loopholes like the use of power of attorney instead of AOB, we believe legislators will continue working at the issue until the litigation rate goes down, ultimately favoring property insurers in the state.

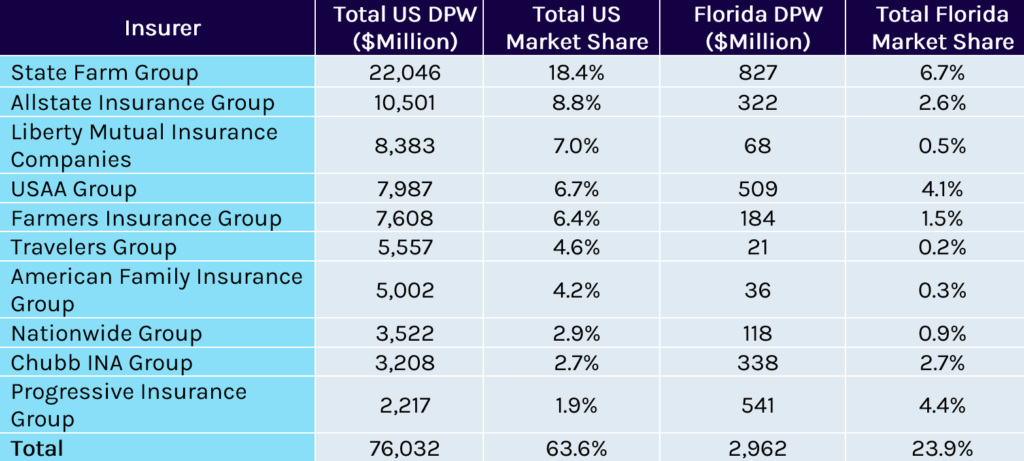

Florida is reliant on specialty and regional insurers, as large national operators avoid the state because of higher catastrophic risk and the challenging litigation environment. Nearly all of the 10 largest insurers by direct premiums written (DPW) are underexposed to Florida (see Exhibit 1). In total, the top 10 insurers have 63.6% of national DPW market share, compared to only 23.9% of DPW market share in Florida.

Exhibit 1: Market Share for Largest US Insurers

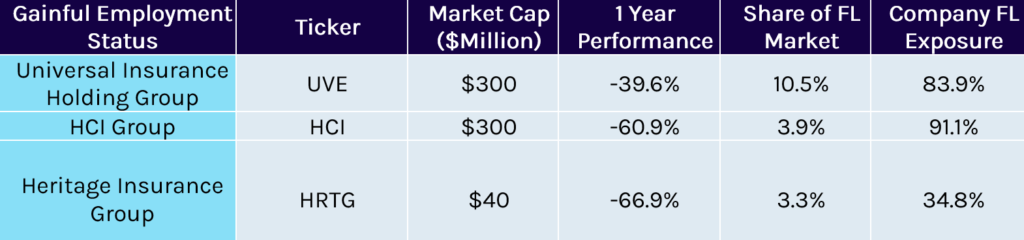

We believe the legislative changes, and continuing favorable legislative approach, will benefit insurers with significant exposure in Florida, which have seen significant share value loss over the past year (see Exhibit 2). We anticipate these companies can leverage data for successful underwriting in the state and sustained high premiums, which will translate to greater profitability when litigation costs decline.

Exhibit 2: Publicly Listed Insurers with High Florida Residential Property Exposure

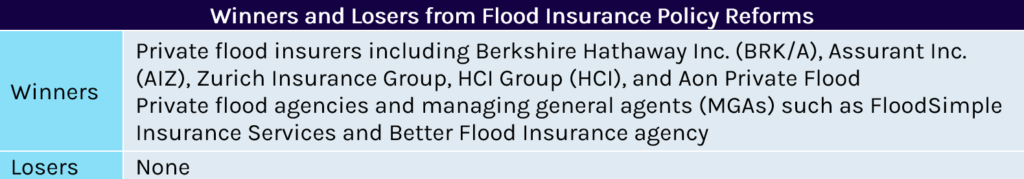

Flood Insurance Market Poised for Growth as National Flood Insurance Program Subsidies Phased Out, Rates Increase; HUD Policy Reform Supports Private Flood Insurance

We believe several policy tailwinds will fuel the growth of the private flood insurance market in 2023 and beyond. The National Flood Insurance Program, established by the National Flood Insurance Act of 1968 to offer primary flood insurance to US properties with severe flood risk, is run by the Federal Emergency Management Agency (FEMA). Today, the NFIP provides more than 95% of flood insurance policies in the US—with the balance provided by the private flood insurance market—given historical challenges insurers have had with properly underwriting the risks.

Typically, NFIP premiums are assigned based on FEMA’s determination of the actuarial risk faced by property. However, Congress directed FEMA not to charge actuarially sound rates on some properties and to provide subsidies for certain existing properties in flood zones to ensure policyholders could afford flood insurance. The largest category of subsidy is for properties that were built before FEMA established flood insurance rate maps (FIRMs), which represent 13% of total policies (~624,000)—referred to as pre-FIRM. In 2012, passage of the Biggert-Waters Act initiated a gradual phasing out of pre-FIRM premium subsidies, which continues today. Current law requires that pre-FIRM premiums increase by a minimum of 5% and at most by 18% annually until they reach an actuarially sound rate. Over the long-term, we believe the phaseout will facilitate greater competition from private flood insurers on pre-FIRM properties.

Additionally, recent reforms to the way FEMA prices NFIP premiums are likely to support near-term growth of the private flood insurance market. In 2021, FEMA implemented major reforms to its flood insurance premium calculations, termed Risk Rating 2.0, to better reflect an individual property’s flood risk. It incorporates certain new datapoints (such as distance to water, type of water, and elevation relative to the flooding source) that rely on a property’s location within a flood zone. These changes resulted in premium rate increases for 77% of NFIP policyholders (according to FEMA) bringing NFIP rates closer to actuarial sound levels, which we believe will allow private flood insurers to more effectively compete for market share.

We believe a recent policy change implemented by the US Department of Housing and Urban Development (HUD) presents additional opportunities to the private flood insurance market. Federal law requires that all homeowners in participating communities with federally backed mortgages within a special flood hazard area (SFHA)—as designated by FEMA—purchase flood insurance through either the NFIP or a private insurer. Until recently, HUD did not accept private flood insurance in lieu of an NFIP policy to satisfy the requirement. However, HUD announced that effective December 21, 2022, it will allow homeowners with FHA-insured mortgage financing to obtain private flood insurance or NFIP policies to satisfy the flood federal flood insurance requirement. This policy change will grant private flood insurers access to the ~12.4% of the mortgage market currently insured by FHA.

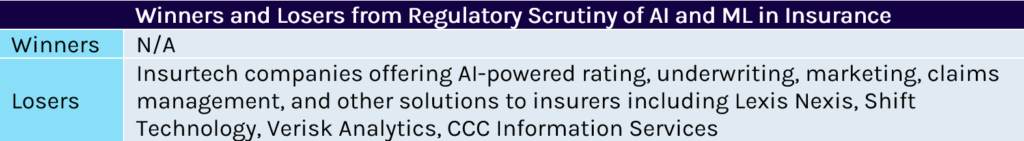

Regulatory Focus on Artificial Intelligence and Machine Learning Could Narrow Opportunities for Insurtech

Capstone believes insurance regulators’ growing focus on AI and ML could pose risks to insurtech companies looking to partner with insurers to enhance underwriting capabilities. In 2020, members of the NAIC adopted a set of guiding principles on artificial intelligence. The principles were based on those developed by the Organization for Economic Cooperation and Development (OECD)—an intergovernmental organization established to stimulate economic progress and world trade. State insurance regulators indicated that careful oversight of AI-based systems is essential to mitigating concerns that insurance companies were using the technology to mask illegal discrimination or biased decision-making. The principles call for insurers to be fair and ethical, accountable, compliant and transparent, and that their practices be safe, secure, and robust.

On December 13th, Maryland Department of Insurance Commissioner Kathleen Birrane announced during a meeting of the NAIC’s Innovation, Cybersecurity, and Technology Committee that the NAIC will publish a model bulletin to act as a guiding framework to address risks that AI/ML decision-making pose to the industry and end-consumers. The decision came as a shock to many who viewed the work around AI/ML as too polarizing across state insurance departments for the NAIC to pursue any collective action. Development of a model bulletin (while it does not hold the same weight of an NAIC model law) sends a clear message to insurers that regulators will be increasingly focused on AI/ML decision-making in the coming years. Commissioner Birrane indicated that the framework established in the model bulletin would be principles-based rather than prescriptive and “would apply generally to the use of AI supported decision-making as opposed to specific use cases and application.”

We believe commissioners took this approach to avoid disagreements on finer points of the framework and to allow for a certain level of state-by-state interpretive flexibility.

We believe commissioners took this approach to avoid disagreements on finer points of the framework and to allow for a certain level of state-by-state interpretive flexibility. The framework at this point, Commissioner Birrane stated, will focus on governance requirements and the establishment of AI use protocols that rely on external objective standards. Notably, the NAIC indicated that there is a “strong preference” among commissioners to place the responsibility of complying with the framework on licensees (insurers) versus the third-party data or model vendors insurers license AI/ML technology from. She also indicated that the bulletin draft remains in the very early stages of development and no timeline for completion has been established. However, it will include regulatory expectations for the use of AI in insurance and accompanying governance requirements, enterprise risk management expectations, and expectations for regulatory oversight, among other things. We believe substantive progress will be made on the bulletin throughout 2023 and periodically exposed portions the draft bulletin will help make clear the direction of travel for wholistic insurance regulation of AI.

We believe key actions by individual insurance commissions—particularly in California and Colorado—also could reshape the regulatory landscape for AI in insurance. On July 6, 2021, the governor of Colorado signed S.B. 21-169, prohibiting insurer use of external consumer data and information sources as well as use of algorithms and predictive models using external data in a way that unfairly discriminates based on protected status (such as race, religion, sex, sexual orientation). The law requires the Colorado insurance commissioner to adopt rules based on different insurance types and practices (including marketing, underwriting, pricing, utilization management, reimbursement methodologies, and claims management). The law became effective on September 6, 2021, and any rules the Colorado Department of Insurance (CO DOI) adopts may become effective after January 1, 2023. We believe the rule will require insurers to shore up internal governance on the use of AI technology and to more carefully vet third-party vendors they may partner with.

Concerns about how AI makes use of personal information could lead many states down Colorado’s regulatory path.

We believe other states could adopt similar regulatory regimes on AI in insurance in the coming years. Near term, we expect California will follow suit. The CDI released a bulletin in June, reminding insurers of their “obligation to market and issue insurance, charge premiums, investigate suspected fraud, and pay insurance claims in a manner that treats all similarly-situated persons alike.” It detailed several examples of discrimination and made clear that insurers are responsible for avoiding both conscious and unconscious bias or discrimination that result in racial bias, discrimination, or disparate impact. The CDI followed up with a workshop in September examining racial bias and discrimination in insurance via AI and ML. We believe the California legislature, in partnership with the CDI, could make AI in insurance a priority in 2023.

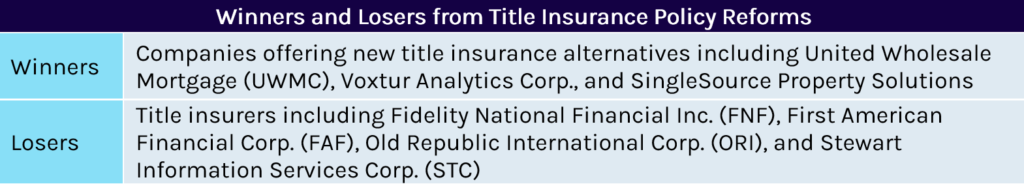

GSEs’ Policy Changes Support Emerging Risk to Title Insurance Industry

We believe the traditional title insurance industry will be forced to reckon with new entrants offering lower cost, regulatory-compliant alternative products in 2023. Title insurance is designed to help provide home buyers and their mortgage lenders necessary protection against losses resulting from unknown defects to the title that occur prior to the closing of a real estate transaction. Unknown defects, for example, could include outstanding liens on the property or anything else that may hinder the owner’s write to ownership such as errors or omissions, fraud, or forgery. Title insurance policies will cover the insured party for certain covered losses and legal fees that may arise. The policies are usually paid for with a one-time premium at the closing of the real estate transaction. Today, most mortgage lenders require homebuyers to purchase their title insurance policy equal to the amount of the loan.

The GSEs—Fannie Mae and Freddie Mac—also require title insurance on any loans they purchase. However, dating back to May 2020, Freddie Mac has permitted the use of an attorney opinion letter (AOL), deeming it meeting certain specifications in lieu of traditional title insurance. In April 2022, Fannie Mae followed suit announcing that the GSE also would be accepting AOLs in lieu of title insurance as long as the letters meet specific criteria.

On the heels of this change, the GSEs both released Equitable Housing Finance Plans that included stated goals to reduce the cost of title insurance for borrowers as part of broader efforts to reduce overall closing costs. In Freddie Mac’s plan, the GSE indicates it intends to develop “lower cost title solutions” by year-end 2022 with the goal of supporting originations of 5,000 loans with a lower cost title solution in 2023 before expanding the program in 2024. Fannie Mae indicated in its plan that it intends to execute a special purpose credit program (SPCP) pilot to support the reduction of borrower closing costs, including the cost of title products. To do so, Fannie Mae intends to

- Publish initial research on how closing costs impact people of color and low-income populations in 2022;

- Update its selling guide to encourage lenders to leverage attorney opinion letters in lieu of traditional title products more often (which it has now done); and

- Pilot additional options to reduce title insurance costs such as coordinating bulk purchases of title insurance.

We believe new entrants want to take advantage of these policy changes.

We believe new entrants want to take advantage of these policy changes. Immediately following Fannie Mae’s announcement that it will be accepting AOLs in lieu of title insurance, Voxtur analytics Corp. announced that it now offers a fully compliant alternative to title insurance through its Attorney Opinion Letter Program. Voxtur’s AOL product provides an attorney’s opinion of title and is backed by a mortgage service provider errors and omissions liability insurance wrapper for the full amount of the loan for the life of the loan. The policy is issued by surplus lines carriers and cover Voxtur, the issuing law firm as a service provider, and the lender as a third-party beneficiary.

Voxtur claims its policy is fully compliant with Fannie Mae and Freddie Mac guidelines and is available in all 50 states. Notably, Voxtur’s management team presented on its AOL product at the NAIC Fall National Meeting in a special Title Insurance Task Force on December 14, 2022. According to Voxtur management, the product provides the same protections as traditional title insurance but can lead to savings of 20%–70% relative to traditional title products. On October 1st, the largest US wholesale mortgage lender, United Wholesale Mortgage (UWM) announced its roll out of a new title review and closing (TRAC) product designed to streamline the closing experience and remove the need to a lender title policy. In its announcement of the new product, UWM claimed the product can save borrowers up to $1,100 on purchase loans and up to $800 on refinance closing costs.

These new entrants have faced fierce pushback from title industry advocates, most notably the American Land and Title Association (ALTA). On September 6th, ALTA sent a letter to the Federal Housing Finance Agency (FHFA) Director, Sandra Thompson, raising concerns around the GSEs Equitable Housing Plan goals to reduce the cost of title insurance and support cheaper alternatives. ALTA argued in the letter that title insurance alternatives do not typically provide the same level of coverage to lenders and borrowers—particularly related to fraud or forgery of title documents. ALTA pointed out this is one of the largest sources of claims paid in the industry and has not been historically covered by AOLs products. We believe title insurance advocates will continue to push back on the use of alternatives in 2023 and the ultimate viability of title alternatives remains to be seen. However, GSE support for alternative products that lead to lower borrower closing costs has paved a potential path forward for disrupters to take market share away from the title insurance industry. Capstone will be following developments around the issue closely heading into 2023.