October 21, 2024

By Dhanush Arun and Dhanendra Kumar

This note was co-written with Dhanendra Kumar, a member of Capstone’s India Advisory Board. Kumar was formerly the executive director at the World Bank and the first chair of the Competition Commission of India and oversaw the framing of India’s National Competition Policy. Read more about Capstone’s India Advisory Board here.

Capstone believes investment opportunities in India’s hydrogen sector for foreign investors are set to expand as the Indian government introduces incentives of up to $2.4 billion. These include 100% Foreign Direct Investment (FDI) with no governmental approval required. Additionally, sector standards and projects to decarbonise select industries are underway. We have identified key players, agencies, and opportunities for investors.

- India is positioning itself as a global leader in clean hydrogen, aiming for energy independence and net energy exporter by 2047. The government has opened the sector to 100% foreign direct investment (FDI) under the automatic route, which eliminates governmental approval requirements. Additionally, there are several flexible funding options for new investors. With renewable energy capacity growing by 50 GW per year, India targets fulfilling up to 50% of its energy demand through renewables by 2030.

- The Indian government’s National Green Hydrogen Mission (NGHM) set an initial allocation of $2.4 billion. The Strategic Interventions for Green Hydrogen Transition (SIGHT) programme under this mission, which accounts for the majority of the funding, aims to scale domestic hydrogen production capabilities to produce 5 million tonnes of green hydrogen annually by 2030 and reduce its price to $1/kg by 2030 from ~$5/kg currently.

- Projects are underway to use green molecules to decarbonise mobility, steel and fertiliser production, shipping and other industries. Standards are being developed with global benchmarks, ensuring streamlined application.

- Additionally, several Indian federal states have announced incentives for the green hydrogen economy, including stamp duty exemptions on land purchases/leases and electricity taxes.

Background

At COP26 Summit in Glasgow in 2021, India committed to achieve net zero emissions by 2070, and become energy independent by 2047. To reach its low-carbon ambition, India plans to heavily depend on green hydrogen, which is gaining popularity for its potential to decarbonise sectors such as transportation, shipping, and steel— major contributors to the country’s GHG emissions. Production of fertiliser, methanol, steel, and chemicals that rely on fossil fuels can use green hydrogen, reducing industrial dependence on carbon-intensive fuels.

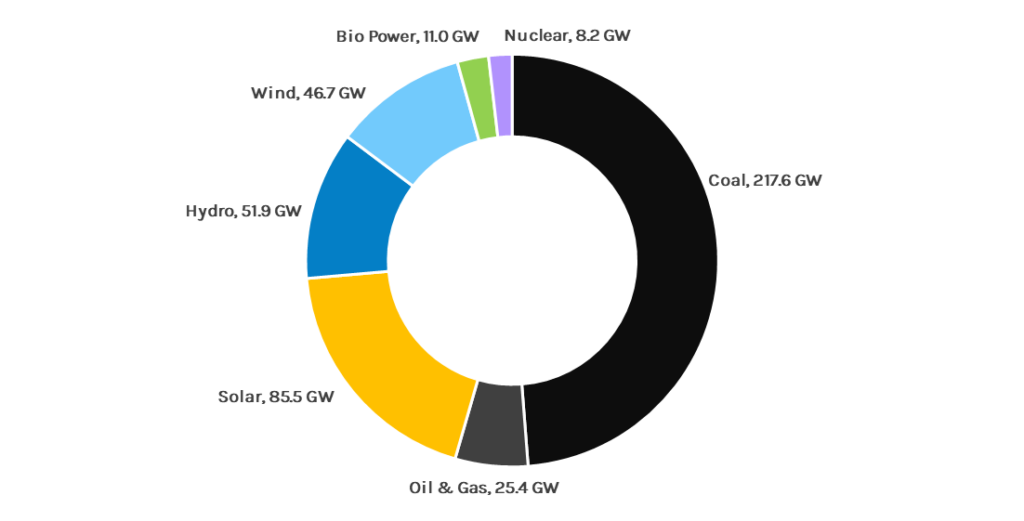

India’s location in the solar belt, between 40°S to 40°N, coupled with its long coastline, makes it ideal for generating solar and wind energy to support green hydrogen production. India’s total renewable energy capacity, including large hydropower, as of June 2024 stood at 195 GW. Solar power contributes 43.8% to this capacity, while wind accounts for 24%. India aims to install 500 GW of renewable energy capacity by 2030, targeting an addition of 50 GW per year. This is set to address 50% of the country’s energy needs. For perspective, as of June 2024, the total installed capacity for power generation in India is 446.20 GW.

Exhibit 1 – Breakdown of installed capacity for power generation in India as of June 2024

Source: NITI Aayog

National Green Hydrogen Mission (NGHM)

In January 2023, the Indian government launched the National Green Hydrogen Mission with a total initial outlay of $2.4 billion. Of this, $2.1 billion is allocated to the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme, $176 million for pilot projects that include low-carbon steel, mobility, and shipping pilots, and $46 million for R&D. The mission, targeting 5 million tonnes of annual green hydrogen production by 2030, will be implemented in two phases.

Phase I, scheduled from 2023 to 2026, will focus on creating demand while expanding domestic electrolyser manufacturing capacity to ensure adequate supply of green hydrogen. Under the ‘Make in India’ initiative, the government offers incentives (discussed in the following sections) to encourage both domestic and foreign companies to manufacture in India, aiming to develop the entire value chain and reduce import dependency. We expect pilots in steel production, long-haul heavy-duty trucking, and shipping will be conducted in this phase.

Additionally, regulations and standards are being developed to align with global practices, aiming to reduce green hydrogen costs by scaling up production and expanding deployment in Phase II. The goal is to bring down the cost of green hydrogen to $1/kg by 2030 from the current $4-5/kg.

Phase II, planned for between 2027 and 2030, aims to make green hydrogen cost-competitive with fossil fuel alternatives in sectors such as fertiliser manufacturing and mineral oil refining. We believe as costs and market demand evolve during this phase, commercialisation of green hydrogen in steel, trucking, and shipping will be explored. Further, we expect pilot projects in railways and aviation will likely be conducted to expand green hydrogen’s use across all sectors and decarbonise the economy.

Exhibit 2 – Projected Green Hydrogen Demand in India by 2030

| Industry | Hydrogen Demand (in million tonnes) | Investment Required (in billion) |

|---|---|---|

| Mineral Oil Refining | 1.8 | $32.5 |

| Natural Gas Blending | 0.54 | $9.7 |

| Fertiliser | 1.32 | $28.5 |

| Exports | 1.25 | $26.9 |

| Other | 0.1 | $1.7 |

| Total | 5 | $99.4 |

Source: Ministry of New and Renewable Energy

Key Players

Green hydrogen has attracted interest from major Indian players, such as Reliance Industries Limited (RIL on the NSE) and Adani Group, as well as Public Sector Undertakings (PSU), such as National Thermal Power Corporation (NTPC) and Oil India Limited (OIL). Currently, various projects are ongoing or being set up, focusing on exports, power microgrids, mobility, steel, and shipping.

RIL aims to transition from grey hydrogen to green by 2025 and is investing $10 billion over three years for this. The company has been awarded SIGHT subsidies for manufacturing 300 MW of alkaline electrolysers per year and for producing 90k tonnes of green hydrogen annually. Adani Group has partnered with French energy major TotalEnergies to invest $50 billion in India’s green hydrogen market over 10 years, targeting 3 million tonnes of clean gas production by 2032. They have also been awarded a SIGHT subsidy for manufacturing 198.5 MW of alkaline electrolysers annually.

NTPC is developing India’s largest green hydrogen production facility in Andhra Pradesh, spanning 1,200 acres, while OIL has commissioned the country’s first 99.99% pure green hydrogen plant in Assam, powered by solar energy. The plant is currently producing 10kg of green hydrogen per day. Several other PSUs are also running projects and pilots for various applications.

Opportunities for Investors

Green hydrogen and its derivatives are pivotal to India’s goal of energy independence and becoming a leading global energy exporter. The sector has been opened to receive 100% Foreign Direct Investment (FDI) under the automatic route, allowing foreign investors to invest without any government approval. Nearly $18 billion of investment in India’s renewable sector has come through FDI. India’s total hydrogen demand, which stood at 6 million tonnes per year in 2020, is projected to reach 28 million tonnes by 2050, 80% of which is expected to be met by green hydrogen. Aside from the SIGHT incentives, state subsidies also support the sector, with opportunities for electrolyser manufacturing and green molecule production.

Capstone believes the Indian green hydrogen sector offers global energy players opportunities to enter or expand via joint ventures or consortiums with domestic companies. We also believe that the government is particularly supportive of players that plan to export green hydrogen globally.

Implementing Authorities

The NGHM is being implemented through coordination among various government bodies and agencies. India’s Ministry of New and Renewable Energy (MNRE) is the regulatory authority for the mission. The ministry prescribes regulations and guidelines for available incentives. The Bureau of Energy Efficiency, under the Ministry of Power, is the nodal authority for accrediting agencies to oversee the monitoring, verification, and certification of green hydrogen production projects.

The Solar Energy Corporation of India (SECI) implements the SIGHT programme with MNRE. They provide managerial and implementation support and conduct auctions for subsidies under the programme. Further, Invest India, an independent government agency, advises and guides investors in India, free of cost.

Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme

The SIGHT programme aims to accelerate green hydrogen production through R&D and supports pilot projects. Financial incentives under this programme are divided under:

- Component I, which offers incentives to promote domestic electrolyser manufacturing. Total funds available under this component are $534 million. In January 2024, eight companies had been selected to receive subsidies in the first auction. These companies will produce electrolysers with total capacity of 1.5 GW annually and must commission production within 30 months from the date of issuance of award letter. The bid submission for the second auction, intended to fund additional 1.5GW of electrolyser manufacturing capacity, closed in July 2024. Results are awaited.

Bids are categorized into three buckets:

- Bucket 1: Electrolyser manufacturing based on any technology stack, accepting a maximum of 1.1 GW total capacity.

- Bucket 2A: Electrolyser manufacturing based on domestically developed technology stack, accepting a maximum of 300 MW total capacity.

- Bucket 2B: Electrolyser manufacturing based on domestically developed technology stack for smaller units, accepting a maximum of 100 MW total capacity.

Bucket 2B is evaluated first, with any unallocated capacity then transferred to bucket 2A, which is evaluated next. Bucket 1 is evaluated last and receives any remaining unallocated capacity from the other buckets.

To be eligible for the auctions, bidders — either single company or joint venture/consortium — must have a net worth at least $120k per MW of quoted manufacturing capacity in buckets 1 and 2A, and at least $36k per MW for bucket 2B.

Subsidy under this programme will be provided as ₹/kW, corresponding to manufacturing capacity. The base incentive for the first year of manufacturing is set at ₹4,440/kW or $53.31/kW, decreasing annually over five years from the commencement date of electrolyser manufacturing.

The part of electrolyser sales eligible for incentives in a year will be either the manufacturer’s allocated capacity or the net sales of electrolysers (in kW) achieved in that year, whichever is lower.

Exhibit 3 – Subsidies available to electrolyser manufacturers

| Year of Sales | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Base subsidy available in ₹/kW | 4,440 | 3,700 | 2,960 | 2,220 | 1,480 |

| Equivalent in $/kW | 53.31 | 44.43 | 35.54 | 22.65 | 17.77 |

Source: Ministry of New and Renewable Energy

- Component II, which offers incentives for production of green hydrogen. Total funds available under this component are $1.56 billion. In the first auction, 10 companies were selected to produce 412k tonnes of green hydrogen per year. Each auction can allocate up to 450k tonnes per year, with bids called in 2 buckets.

- Bucket 1: Technology agnostic pathway to produce green hydrogen, with total production capacity of 410k tonnes per year.

- Bucket 2: Biomass based pathway to produce green hydrogen, with total production capacity of 40k tonnes per year.

Bids under Bucket 1 are evaluated before evaluating bucket 2. Any remaining unallocated capacity is transferred to the next auction.

Eligible bidders can either be a single company or a joint venture/consortium whose net worth must be at least $1.8 million per tonne of quoted production capacity in bucket 1, and $180k per tonne for in bucket 2.

Under this component, a direct subsidy of ₹/kg of green hydrogen production will be provided for three years from the commencement of production. The maximum subsidy will be reduced annually as follows:

Exhibit 4 – Subsidies available to green hydrogen producers

| Year of Production | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Direct subsidy available in ₹/kg | 50 | 40 | 30 |

| Equivalent in $/kg | 0.6 | 0.48 | 0.36 |

Source: Ministry of New and Renewable Energy

Supporting Policies

In August 2023, the Indian government defined the emission threshold for hydrogen to be classified as ‘green’ at 2kg CO2eq emitted per kg of H2 produced, averaged over 12 months. This standard applies to hydrogen produced through electrolysis and from biomass. The MNRE has yet to define a methodology for tracking, reporting and verifying lifecycle emissions from green hydrogen production. Notably, major policies by the government to support green hydrogen in India are:

- ISTS Charges Waiver: Green hydrogen/ammonia production units are exempt from Inter-State Transmission charges for 25 years from the project’s commissioning date. The waiver also applies to transmission of power from pumped storage systems and battery storage systems. The exemption is valid for green hydrogen plants commissioned before 31st December 2030; post this, they will be levied graded transmission charges.

- Open Access Grid: The Green Energy Open Access Rules 2022 reduced open access transmission limit from 1MW to 100kW, allowing small customers to purchase renewable energy from distribution companies that are obliged to procure and supply it.

- Environmental Clearance: Green hydrogen and ammonia plants are exempt from prior environmental clearances under the Environmental Impact Assessment Notification 2006, granted by the Ministry of Environment, Forest and Climate Change.

Incentives from States: Indian federal states have enacted policies to promote green hydrogen production. Notably, Maharashtra, West Bengal and Andhra Pradesh offer 100% exemption on stamp-duty for purchase, lease or conversion of land, while Odisha, Uttar Pradesh and Rajasthan provide 100% exemption on electricity duty, among other incentives. Additional states are currently drafting their own green hydrogen policies.

Dhanush Arun, EU Energy & Industrials Director

Dhanendra Kumar, Capstone India Advisory Board Member

Read more of Capstone’s hydrogen research:

EU Hydrogen and Decarbonised Gas Package Presents Hydrogen Opportunities

The Unstoppable IRA Wave: Why the Clean Energy Bill Will Withstand Repeal Efforts and other Challenges

Waves at The Ballot Box: Why EU Electoral Dynamics will Have Underappreciated Implications Across Industry