Introduction

Capstone believes a new European Commission (EC) agenda and Parliament elections will drive a host of underappreciated national and EU-level policy implications across industries as European Union (EU) as policymakers double down on prioritizing strategic autonomy and global competitiveness in 2024.

We expect a shift to the right to have greater implications on EU decision-making in 2024. Global companies and investors in the EU will have to grapple with tough decisions around competing subsidies from the US and China, EU regulatory burdens on business, and the economic consequences of climate policy.

The populist right has been galvanized by Giorgia Meloni’s victory in Italy, local election gains for the Alternative for Germany (AfD), and the recent success of Geert Wilders in the Netherlands. Polls for European Parliament elections, slated for June 2024, currently point to gains for the far-right Identity and Democracy (ID) and Meloni’s European Conservatives and Reformists (ECR).

A working majority on the right faces major obstacles within the Centre-right European People’s Party (EPP), which will remain the largest group. The heads of member state governments in the European Council, where liberals and socialists outweigh the populist right, will play a crucial role in setting the policy agenda for the EU. The EPP’s Ursula von der Leyen is also favourite to remain at the helm of the EC in 2024.

That said, the populist right in Europe has forced mainstream political parties to rethink their approach. Given the shifting dynamics at play, we expect a slowing energy transition to pose risks for sustainable aviation fuel and low-carbon shipping fuel producers, targeted state aid to benefit EU technology projects, new regulatory initiatives focused on US Big Tech to take a breather, and a slow-down in the pace of pan-European financial services legislation that promotes greater EU integration.

EU Climate Legislative Progress to Slow, Decarbonisation of Aviation, Shipping Risks Stall

Parliament Elections Present Implementation Risks for the EU Energy Transition

Capstones believe the outcome of the 2024 parliament elections will hinder progress on climate policy as policymakers struggle with the increasing popularity of right-wing political forces. There is growing concern within industries involved in the green transition about the potential impact of the rise of climate change-skeptical parties in Europe.

Given a right-wing coalition is not our base case, we expect the EU’s commitment to the climate agenda to transcend the five-year electoral cycle. However, a stronger centre-right and weaker green party will support the argument for a reduction in the green transition’s regulatory burden on business.

While we expect the energy transition to remain central to future policymaking, we believe the setting of climate goals will become increasingly politicised ahead of the 2024 elections. This comes as policymakers seek to balance the competing priorities of climate sustainability, energy security, and the cost-of-living crisis, presenting increased uncertainty for green energy companies over the next 12-18 months.

Of particular significance is also the Parliament’s influence on funding allocation of the next EU budget. The current Multiannual Financial Framework (MFF), covering 2021 to 2027 with a total of €1.2 trillion, along with the €800 billion Recovery and Resilience Facility, prioritizes green transition, constituting about a third of the budget. The European Parliament shapes the budget through its ability to approve, amend, or reject the MFF proposal and by advocating for its own priorities, including adjustments to spending allocations across various policy areas.

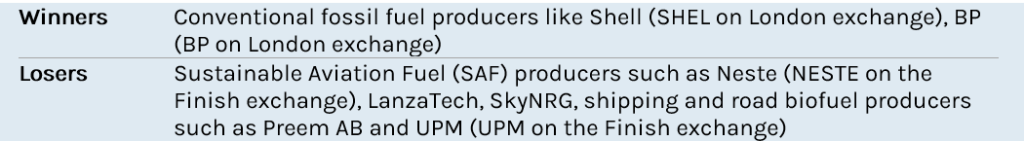

Material Delays to Energy Taxation Directive Revision Could Dilute SAF Competitiveness

EC President Ursula von der Leyen has prioritised the climate and energy transition via the Green Deal’s ‘Fit-for-55’ package, which aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. The European Parliament, presently the most environmentally conscious co-legislator, played a significant role in shaping the package implementation, which began in 2021.

The new European Parliament in 2024 holds the potential to impact several pending areas of legislation, including the revision of the Energy Taxation Directive (ETD).

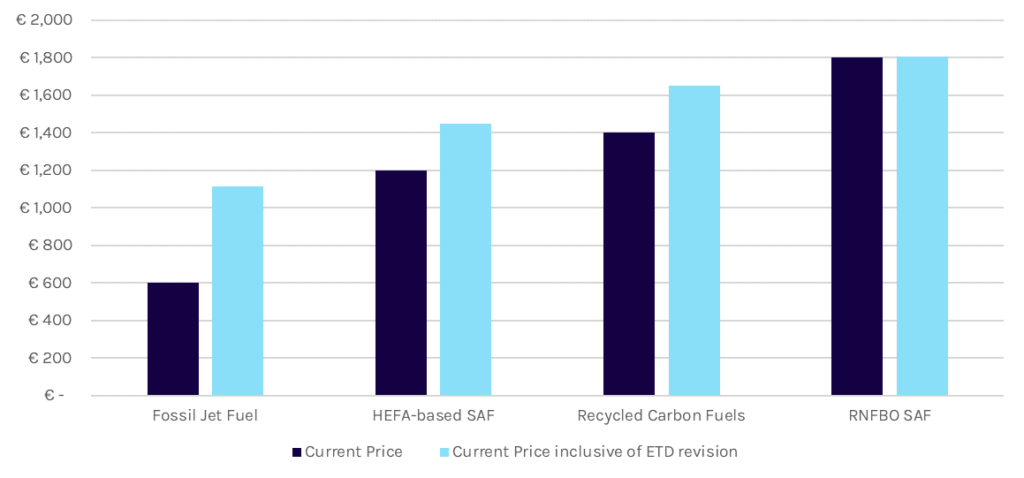

The proposed revision of the ETD would align the taxation of energy products with their environmental impact. Currently, taxation is based on energy content (lower energy content, higher tax), leading to instances where biofuels face higher tax rates than conventional fuels. Additionally, the taxation system, tied to the fuel product, results in blends like diesel with biodiesel being taxed as 100% fossil fuels. The second significant change the revision would introduce is a gradual lifting of tax exemptions on aviation and shipping fuels for intra-European Economic Area (EEA) flights. It also outlines a 10-year transition schedule for jet fuel.

In August 2023, the proposed revisions encountered resistance, primarily from member states hesitant to raise fuel prices, driven by concerns about public sentiment ahead of the European Parliamentary elections. The issue is reminiscent of France’s 2018 fuel tax increase proposal, which sparked widespread protests. The ongoing delay in the legislation raises concerns about its approval potentially extending beyond the elections. This poses the risk of diluted provisions, especially considering the expected growing presence of climate skeptics within EU regulatory bodies following the elections.

Notably, the ETD is a tax measure, which requires unanimous approval in the Council, unlike other climate legislation, which only requires a qualified majority. In the context of an increasingly fragmented Council, reaching an agreement may prove challenging.

As such, we see this as posing a risk for the competitiveness of sustainable aviation fuel (SAF) producers such as Neste (NESTE on the Finish exchange), LanzaTech, SkyNRG, and low-carbon shipping and road fuel producers such as Preem AB and UPM (UPM on the Finish exchange).

Aviation Fuel Tax Rates Post ETD Implementation

Source: Capstone analysis

*assuming stable aviation fuels costs across the period.

—Dhanush Arun, [email protected]

—Charlotte Bucchioni, [email protected]

Swath of Tech Support Schemes to Bolster Deep Tech, Cleantech, Biotech Companies

Proposed Strategic Technologies for Europe Platform (STEP)

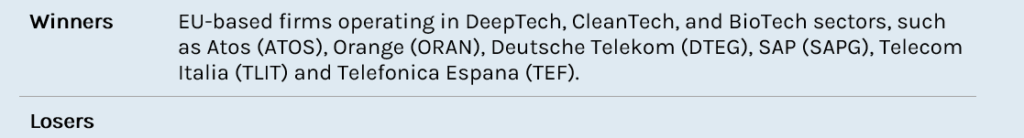

Capstone believes the EC will continue to prioritize the EU’s strategic autonomy in its agenda in 2024tah. Corporates and investors in EU companies are increasingly concerned about the bloc’s competitiveness and challenges from the US and China. We believe a centre-right Parliament will continue to push for a strategic response from the EU on these issues.

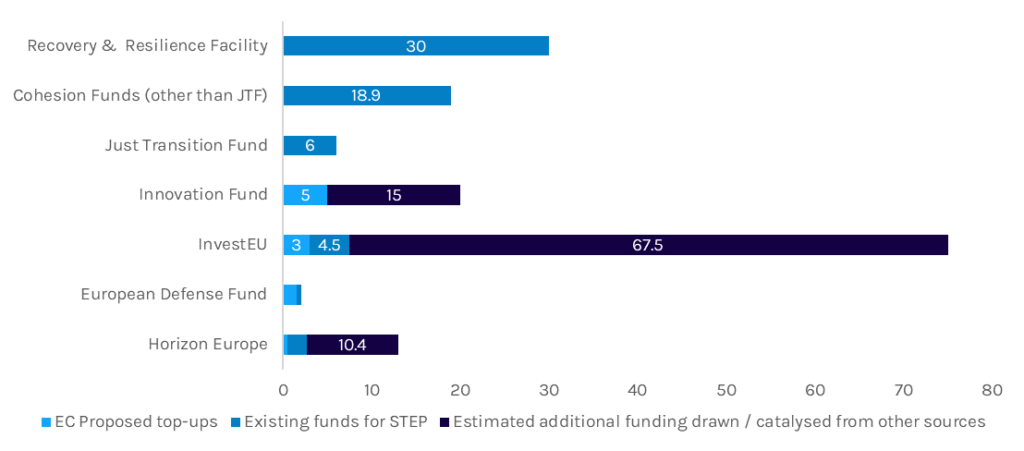

Exhibit 1: EU STEP Funding Sources (in € billions)

Source: European Commission, European Parliament.

In June 2023, the EC tabled a proposal establishing the Strategic Technologies for Europe Platform (STEP). Through the mid-term revision of the multiannual financial framework (MFF) for 2021-2027, STEP has been supported by largely reprogramming existing EU funding instruments. The Commission has proposed an additional budget of €10 billion for the initiative, with MEPs calling for a further €13 billion. In total, the EC aims to leverage up to €160 billion, although this figure relies heavily on tapping private investment. The following categories of companies are eligible:

- Deep technologies, including microelectronics, high-performance computing, quantum technologies, cloud and edge computing, artificial intelligence, cybersecurity technologies, robotics, and 5G.

- Clean technologies, including electricity and heat storage, heat pumps, renewable fuels of non-biological origin, sustainable alternative fuels, electrolysers and fuel cells, carbon capture, utilisation and storage, energy efficiency, and hydrogen.

- Biotechnologies, including biomolecules, pharmaceuticals and medical technologies, crop and industrial biotechnology, and biomanufacturing.

The proposal includes measures to introduce several favourable conditions for financing. It allows a higher degree of funding from the EU, and no co-financing would be required. In addition, greater pre-financing, up to 30%, for eligible companies would be allowed starting in 2024,ensuring access to liquidity before a project begins. We expect STEP will be approved before the June elections.

While funding allocations under these schemes, including Member State initiatives, have been available through a range of fragmentated initiatives, going forward we expect a renewed focus on sectors of strategic importance and bolstering digital sovereignty, including in industries dominated by US and Chinese players. For instance, in December, the EC authorized state aid of up to €1.2 billion for 19 companies developing cloud technology projects, including Atos, Orange, Deutsche Telekom, SAP, Telecom Italia, and Telefonica Espana. The investment underscores the EU’s ambitions to compete against cloud computing majors, such as US’ Amazon, Microsoft, and Google.

Subsidy and Company-specific Policy Support Remain Important for Investment Plans

The STEP represents a gradual shift of the EU’s approach to state aid, going beyond research to development and manufacturing. This has been seen in the EU Chips Act, changes made to the Important Projects of Common European Interest (IPCEI) framework, and reforms to Article 2.8 of the Temporary Crisis and Adjustment Framework to enable greater access to state aid. In our view, the availability of subsidies, as well as other company-specific policy support, should increasingly form part of European tech corporates’ strategies and investors’ analyses . While STEP enjoys broad support, certain quarters of the European Parliament, particularly from the liberal Renew Europe (RE) group, advocate for greater ambition. We expect MEPs will mandate the Commission to conduct an interim evaluation of STEP by 2025, including considering a fully-fledged ‘European Sovereignty Fund’ in the next MFF period, which begins in 2027.

The EPP is likely to be in a stronger position post the 2024 election and although the centre-right party will continue to support measures that seek to enhance the EU’s competitiveness, they also continue to express opposition to a European Sovereignty Fund. Political concerns regarding further shifts of fiscal powers to EU authorities, risks of distortions to competition, and imbalances between richer and poorer Member States (Germany, France, and Italy account for 78% of state aid) will continue to prevent a more empowered fiscal role for the EU. Seeking to address this, 50% of the Innovation Fund’s (an EU fund for low-carbon technologies) €5 billion top-up will only be made available to member states whose average GDP per capita is below the EU average (€31k). The lack of fiscal capacity across the Union, considering Covid-19, energy-crisis-related public expenditure, and higher debt servicing costs, also remains a significant impediment.

—Doug Wood, [email protected]

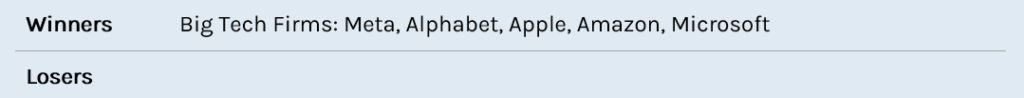

Political Shift to Provide Breather for Big Tech Even amid EU Autonomy Push

Focus Shift from Big Tech

Capstone believes a political shift toward centre-right in the European parliament in 2024 is likely to play out positively for Big Tech. EU policymakers have been focused on addressing dominance of US tech platforms in Europe, and going forward we believe the EC will continue to prioritize the EU’s competitiveness in the technology sector. However, we believe the right-leaning shift may temper calls for regulatory intervention in areas such as network tax.

The increasing scrutiny has largely been driven by centrist European political groups. The EPP, Socialists and Democrats (SD), and RE, have aligned on responding to the growing market power of big tech companies with new regulations, and a ‘more Europe-focused’ agenda. The aim is to implement harmonized European rules and create a ‘Brussels Effect’; EU-designed comprehensive rulebooks for digital services and new technologies that are adopted globally. As such, the EU’s digital competitiveness and sovereignty have been key drivers for new tech regulations.

In addition, rapidly growing power and influence of tech companies have also led to social issues such as – data privacy, misinformation threatening democracy and public interest, electoral manipulation, exploitation of small businesses, which are primary concerns for the more established political groups and ideologies. On the contrary, populist leaders, far-right views, and fringe ideas have thrived on social media platforms.

It’s still unclear where far-right parties will take a stand on some key issues around big tech companies but focus and priorities will likely shift elsewhere, and more towards member state level. We wouldn’t overestimate the potential for a working majority of right-wing parties, but such a prospect faces severe obstacles within the centre-right EPP, which will likely remain the largest group. Nevertheless, the populist right has forced mainstream political parties to re-think their approach and we expect their greater influence in decision-making in Europe. Such a shift is likely to be welcomed by big tech firms that are already grappling with new obligations, increased liability, and compliance challenges from new regulations.

The right-leaning ID and ECR are currently the fifth and sixth largest groups. Both are projected to make significant gains and will compete for third place with liberal RE. Their parliament members have, on average, abstained from voting on issues related to data privacy and cross-broader data transfers, and were the strongest opponents of the digital services and markets acts (DSA and DMA), which ultimately passed in 2022.

Network Tax Proposals Likely to Lose Momentum

In terms of ongoing legislation, ID and ECR have thus far been divided on the pending EU AI act. However, the ECR has strongly opposed imposing a network tax for big tech companies like Netflix, Meta, and Alphabet. As large traffic generators, the idea is these companies should pay their “fair share” towards the funding of telecommunication infrastructure upgrades across Europe. The tax has long been lobbied by big European network operators, including Orange SA and Telefonica SA but EU net neutrality rules ensuring operators treat all network traffic equally have kept this off the table. The idea had gained some momentum in the EP over the year and the EC launched an exploratory consultation about reforms to telecom rules. The idea of charging big tech companies still found weak support given the threat to net neutrality and the potential for EU consumers to face higher prices. The initiative is not entirely dead given rising network upgrade costs and political commitments to roll out fiber, however, less likely to see the light of day in 2024 with a more influential ECR.

-Eva Borbely,[email protected]

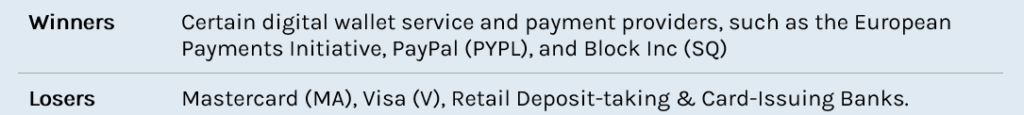

Central Bank Digital Currencies to Threaten US Card Networks; Right- Leaning MEPs to Slow Progress on Digital Euro

Capstone believes the European Central Bank (ECB) will issue usable retail central bank digital currencies (rCBDC) in the next five years, posing challenges for Visa Inc. (V) and Mastercard Inc. (MA) in the long term. We believe the political shift to the right in Europe in 2024 will slow down progress owing to MEP skepticism, but the digital Euro, will still be implemented.

The ECB and EC are strong proponents of a digital euro. The ECB has noted the aim of the digital euro is to strengthen the Euro’s strategic autonomy by growing its independence from non-European payment solutions. Two-thirds of all cross-border card payments in Europe are made through US’ Visa and Mastercard.

We believe European politicians’ scrutiny surrounding the proposed Digital Euro, which has largely been a technocratic ECB-led debate so far, will begin in earnest in 2024. The emerging consensus among policymakers is to design a ‘two-tiered’ (or ‘hybrid’) model for the currency. Central banks will provide the infrastructure, be responsible for currency minting and burning, and hold the liability, while Payment Service Providers (PSPs) will offer user-facing services such as currency distribution and KYC checks.

Mandatory Bank Participation & Merchant Fee Caps Hold Political Support

In June 2023, the EC’s legislative package proposed to establish the framework for a digital euro, whereby its distribution would be compulsory for banks with a retail business, but not other PSPs, and must be accepted by merchants. Commercial banks would compete with the ECB for retail deposits. CBDCs could enable a low-cost funding source for digital wallet providers. Transactions would be possible offline as well as online.

However, the Commission expressed concern that, given merchants’ limited countervailing power in the card-acquiring market, intermediaries will overcharge merchants’ services. Therefore, the digital euro would be free for ‘basic use services’, and would be granted, like cash, legal tender. The proposal also noted that the ECB will determine the maximum amounts of merchant fees, based on a methodology outlined in legislation. Fees may not exceed those for comparable means of payment, despite the required technical investment for banks. We expect a maximum holding cap will be implemented to avoid any potential large-scale deposit replacement, particularly in times of banking instability. The ECB has suggested a €3,000 limit, although this may rise over time. While the private sector will provide front-end digital wallets, but the draft law requires front-end services developed by the ECB to always be offered to end users.

MEP Skepticism of Digital Euro, Legislative Ambition from EC Needed for Adoption

In our view, there are several outstanding questions inherent to the digital euro’s design that the ECB has yet to adequately answer. This will become further apparent in 2024, particularly as right-wing MEPs have been more skeptical of the merits of a digital euro, and critical of the risks it presents. In September, MEPs from the European Conservatives and Reformists (ECR) and European People’s Party (EPP) groups requested that the ECB postpone the introduction of the digital euro.

The ECB stated that citizens need risk-free money, as cash fades away, but commercial bank money up to €100,000 is covered by the EU’s deposit guarantee scheme. A CBDC would provide instant payments, but, under a separate Commission proposal, this will become mandatory for PSPs to offer. Privacy remains politicians’ largest concern, with the European Data Protection Board in October pushing for the Commission and ECB to implement further safeguards, including a value threshold that exempts anti-money laundering checks. Central bankers generally agree the digital euro should not be interest-bearing, like cash, although MEPs want the ECB to keep this option on the table. This amounts to seigniorage, would lower adoption, and would not enable a CBDC to be used as a tool of monetary policy.

In our view, merchants have the most to gain from widespread adoption of a digital euro, as it would meaningfully lower transaction fees. The extent of adoption, however, is dependent on consumers. Precedent from other countries, as well as the limited benefits consumers would have in adopting a digital euro, suggests adoption will be very limited. For instance, according to the People’s Bank of China, and despite the state’s best efforts, the e-CNY constitutes a mere 0.16% of total yuan in circulation in the country, as of June 2023. We would note, however, that policymakers have a range of legislative tools at their disposal to push adoption. For the digital euro to be a success, we believe the Commission and ECB would need to go further in implementing these.

—Doug Wood, [email protected]

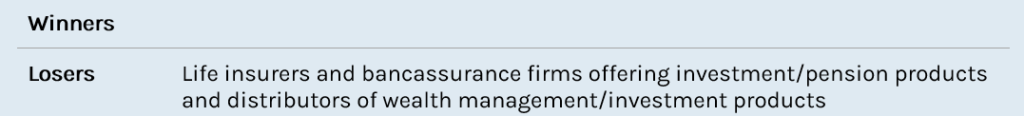

Delay of Retail Investment Strategy Likely; Focus on Value Benchmarks as National Enforcement Ramps Up

Material Delays Expected in Retail Investment Strategy

Capstone believes the upcoming European Parliamentary elections in 2024 will delay the implementation of the Retail Investment Strategy (RIS) rather than meaningfully change the current direction of the policy. In 2024, we believe European distributors of wealth products and life insurance will focus on impact of member state initiatives around value-for-money benchmarks, with increasing regulatory scrutiny of pricing in the European savings and unit-linked market.

The EC proposed its RIS on 24 May 2023, aiming to amend relevant EU legislation in 2025 and to give member states one year to amend relevant national legislation. Following a “grace period”, the RIS would become binding six months later. We expect this “grace period” to be extended to at least 12 months following industry and member state feedback, pushing the binding effect to or beyond 2027.

For this timeline to be viable, a political compromise between the EU Commission, Parliament, and Council would have to be reached before April 2024, i.e., only 10 months after the publication of the proposal. Otherwise, the RIS may be postponed significantly.

Given the politically sensitive nature of certain proposals included in the RIS, we believe it is highly unlikely that such an agreement would be reached before April 2024. On average, it takes around 1.5 years to find a compromise on proposed financial services regulation.

Draft Parliament Report Proposes Further Watering-Down of Commission Proposals

The RIS published by the EC stopped short of proposing a full ban on commission payments but did, however, propose a ban on inducements for execution-only services. In October 2023, the European Parliament’s rapporteur responsible for the RIS, Stéphanie Yon-Courtin, published a draft response that aimed at watering down the EC’s proposal. The Rapporteur believes the ban on execution-only sales is not justified and does not address issues of conflict of interest. The latter should instead be addressed by increased transparency. Moreover, Yon-Courtin sees the Commission’s “value for money” benchmark proposals as disruptive to the market as it would reduce diversity of products and slow innovation. Yon-Courtin said she would like to continue discussions on this proposed provision rather than including it in the current text. Left-leaning parties in parliament, including the S&D and the Greens, are, however, in favour of a total ban on inducements and are pushing for a fundamental review of the RIS. A vote on the position of the EU parliament, reflecting all parties’ positions, is scheduled for 20 March 2024.

Focus on Member State Regulatory Initiatives in 2024

We don’t believe the EU parliament’s position will deter national regulators from continuing to focus on value for money in retail financial products. In the past, both the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Authority (ESMA) have highlighted concerns regarding product costs, which in the context of high inflation, are eroding returns for retail investors. We believe pressure from these regulatory authorities resulted in the recent proposals on the RIS featuring a strong focus on “value for money”.

At the member state level, the German financial supervisory authority – BaFin – recently issued a more detailed consultation on how it assesses ‘value’ in IBIPS, namely that the return after costs must be at least the expected rate of inflation. BaFin added that it would focus on the top 25 percentile of most expensive products and product providers. Italian insurance authority IVASS set out its expectations in October 2023, requiring a “consumer-side profit test” to be conducted. We expect increasing scrutiny from other national regulators in 2024.

—Sebastiaan Bierens, [email protected]