Introduction

Capstone believes significant changes to IRA tax credits remain unlikely in any 2024 election scenario, even as Republican proposals to repeal key incentives created by the Inflation Reduction Act (IRA) become more common.

The tax incentives created as part of the IRA are likely to withstand calls from Republicans to eliminate parts of the law because Republicans would have to win the presidency and both chambers of Congress, and then also reach consensus on which programs to kill or shrink, even as many of the projects benefit their constituents.

In addition, we believe addressing quality issues in voluntary carbon markets (VCM) is going to be a top priority for standard-setting groups and the Commodities Futures Trading Commission (CFTC) and these changes will boost buyer confidence and ultimately drive market growth.

We also believe increasing clarity around the incentives contained in the IRA and the flow of federal money to states will embolden state policymakers to pursue more ambitious climate policies and regulations, creating tailwinds for renewable energy, electric vehicles (EVs), and clean fuels.

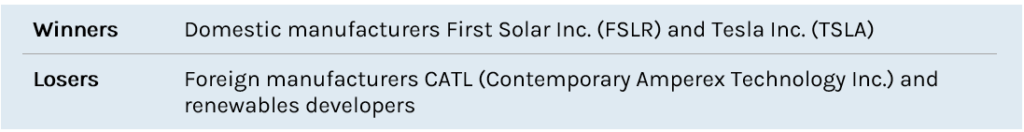

2024 Election Poses Tech-Specific Risks and Opportunities

Full IRA Repeal Unlikely Regardless of Election Outcomes, Although Headline Risk to Intensify

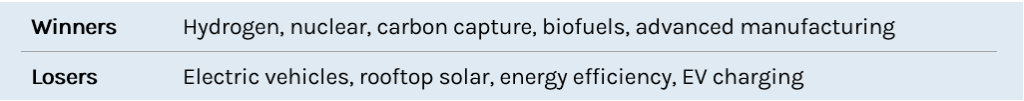

Capstone expects the upcoming 2024 election campaign to amplify headline risks to the IRA, with former President Trump and other Republican candidates likely to continue their calls for repeal. That said, we believe the prospects for legislative change to the IRA are unlikely as Republicans would first have to sweep the election and, after that, achieve consensus on which tax credits and programs to address. This would likely prove difficult given the various ideological and geographic factions within the party. In a scenario where Republicans sweep in the election and introduce a budget reconciliation to target the IRA—which would require only a simple majority in the Senate to pass—we believe incentives for EVs, rooftop solar, energy efficiency, and EV charging will be most at risk, given the number of bills Republicans introduced bills targeting those sectors in the past legislative session (see Exhibit 1).

Exhibit 1. Legislation Introduced in 2023 Targeting IRA Incentives (Newest Bills First)

Source: Capstone Research. 1: The Energy Efficiency category includes cuts to the IRA’s Greenhouse Gas Reduction Fund, which allocates money to states to fund a range of emission reduction priorities, including energy efficiency, as well as other federal grant programs for energy efficiency. 2: 45X refers to the clean energy manufacturing production tax credits included in the IRA.

On the other hand, we believe incentives for nuclear, hydrogen, carbon capture, clean fuels, and manufacturing will likely be safe, given Republican support for these technologies (see “Upcoming Guidance in IRA Tax Credits Creates Near-Term Catalysts for Hydrogen, Clean Fuels, Nuclear, and Solar Manufacturing Companies,” November 21, 2023). If a Republican wins the presidency but control of Congress remains split, we expect to see unilateral changes to Treasury implementation rules that increase the stringency of domestic content requirements for bonus credits and loosen the methodology underpinning carbon intensity (CI) based incentives for clean fuels (e.g., 45Z), power (e.g., 45Y), and hydrogen (e.g., 45V).

Uncertainty Likely to Persist Due to IRA Implementation Timeline

Timeline for Investment Tax Credit Rules to Delay Certainty for RNG Developers

Capstone expects Treasury will issue final regulations on the Section 48 investment tax credit (ITC) in late-Q2 or early-Q3 2024. However, the uncertainty that project developers the RNG sector in particular face will likely persist due to the content in the proposed rule issued in November 2023. On November 17, 2023, the Internal Revenue Service (IRS) issued a Notice of Proposed Rulemaking (NPRM) clarifying eligible costs for the 30% ITC for a variety of previously eligible technologies—including solar, offshore wind, combined heat and power systems, and geothermal—as well as technologies included under the expanded IRA provisions such as biogas properties and microgrid controllers. The IRS will take comments on the proposed rule until January 17, 2024, and hold a public hearing on the proposal on February 20, 2024.

Biogas

In November 2023, the IRS proposed defining eligible costs for the 30% ITC as all “functionally interdependent” components necessary to convert biomass into biogas. This proposed definition means that one component could not enter service to produce energy without the other components. However, through this reasoning, the proposal excludes RNG upgrading equipment that removes CO2 and other impurities to convert the biogas to pipeline-grade RNG. This interpretation would reduce eligible costs from roughly 70% to 40% of typical capital expenditures for a digester-based project and nearly all costs for landfill projects with existing gas collection systems.

We expect to see significant pushback from the industry in their comments given the explicit inclusion of gas “cleaning and conditioning” equipment as eligible in the IRA text, and we believe the IRS—or the courts if necessary—will likely change course to include RNG upgrading as eligible. Generally, we believe the November proposal was largely a misunderstanding of the terms of art “cleaning and conditioning” used by the RNG industry. However, we do not expect to see additional clarity on this from the IRS before the final rule comes out in late-Q2 or early-Q3 2024, creating uncertainty for project developers.

Hydrogen Tax Credit Rulemaking and H2Hubs Evolution to Catalyze Sentiment in the Sector

Capstone expects that 2024 will be a defining year for the long-term role of clean hydrogen in the US government’s decarbonization toolkit. Most notably, we expect that Treasury will publish the Section 45V NOPR between December 15, 2023, and January 15, 2024, and it will include provisions to immediately facilitate final investment decisions (FID) for the backlog of clean hydrogen projects in the US following the IRA’s passage in August 2022. Subsequently, we believe Treasury will initiate a 60-day comment period and finalize the Section 45V rule no later than July 2024 to minimize the risk of its eligibility for repeal under the CRA following the 2024 election. The historical look-back window for a rule’s eligibility for repeal under the CRA typically is between May and August and most frequently occurs in July. Capstone notes that the exact date for the Section 45V rulemaking’s CRA eligibility is difficult to predict because it will depend on the legislative calendar, which is subject to change. Given this dynamic, we expect Treasury to do everything possible to finalize the rulemaking by July 2024.

Despite investor enthusiasm surrounding the US clean hydrogen sector following the IRA’s passage, the absence of project FID decisions, coupled with rising interest rates that have challenged most capex-intensive clean energy sectors, has undermined support for the sector in the past 12 months. In part, we believe the current lack of investor enthusiasm for the sector is the result of a lack of clarity on the trajectory of clean hydrogen project deployment in 2024 and beyond.

We expect that the combination of the Section 45V NOPR’s publication and the progression of the hydrogen hubs (H2Hubs) and related demand side incentive, which the US Department of Energy (DOE) is still working to finalize, will largely clarify the long-term role of the clean hydrogen sector in the US and the sectors where hydrogen is most likely to replace incumbent, emissions-intensive alternatives. As a reminder, the first “planning” stage of the H2Hubs rollout will last 12 to 18 months, and investors should know more about the structure of the hubs and participating companies by the end of 2024.

In short, we believe 2024 will be a decisive year in determining whether clean hydrogen will be a linchpin in the US’s long-term decarbonization strategy or if it is destined to meet the same fate it did in the early 2000s and fail to live up to expectations.

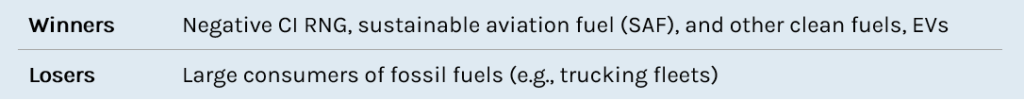

Treasury Regulations on IRA Clean Fuel Tax Credits Likely to Benefit Negative Carbon Fuels

Capstone expects Treasury to issue a proposed rule in Q2 2024 clarifying that carbon-negative fuels can receive more than $1.00/gallon under the Section 45Z clean fuel production tax credit (PTC). There is nothing in the IRA text prohibiting negative CI fuels from receiving more than the baseline value.

Capstone also understands that there is broad consensus from key officials at DOE, Environmental Protection Agency (EPA), and US Department of Agriculture (USDA) that the Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) model necessarily incorporates methane avoidance crediting—meaning negative CI fuels should be eligible to receive more than the $1.00/gal baseline. Further bolstering our expectation is a report that the Joint Committee on Taxation issued in April 2023, noting that “An emissions rate for a fuel could be a negative number, which would result in a fraction greater than one” to establish credit values.

Biden Administration to Advance Several Power Market Regulations Ahead of the Election

EPA Power Plant Rules Finalized by Year-End, Facing Risks of Future Reversal

Capstone expects that EPA will prioritize finalizing key power plant rules, most notably its new carbon standards rule for new and existing fossil plants. EPA’s slate of power plant rules—including the carbon rule, new coal ash requirements for inactive ponds, and more stringent effluent limitation guidelines—set new compliance requirements that will raise costs for coal and gas operators. However, despite these efforts, we expect that the election of a Republican administration will roll back some rule provisions and compliance timelines. We believe the new carbon rule is most at risk for rollback given the lack of legal precedent supporting it and the opposition it has drawn from grid operators, Republican lawmakers, and power plant operators.

FERC Transmission Planning Final Rule Expected, New Commissioner Appointments

In 2024, Democratic commissioners will have a 2-1 majority at the Federal Energy Regulatory Commission (FERC), increasing the likelihood that the commission acts on transmission planning, interregional transmission buildout, and grid-enhancing technologies (GETs) requirements. We expect the commission’s long-awaited transmission planning final rule will be finalized in 2024 once Republican Commissioner James Danly—who opposes the rule—leaves FERC at the end of 2023. Transmission owners and renewable developers applauded the proposed rule for its provisions accelerating transmission buildout and expansion including longer-term planning windows, regional planning requirements, state involvement in cost allocation, and reinstatement of a limited right of first refusal (ROFR) for jointly owned transmission projects.

Commissioner Allison Clements’ term ends in 2024, likely motivating the Biden administration to put forward new commissioner nominations by Q3 2024 to prevent the loss of quorum (fewer than three commissioners). In contrast to EPA rules, we believe rulemakings that FERC finalizes in 2024 face fewer political risks, even if the makeup of FERC changes.

Renewable Developers to Face Continued Supply Chain Headwinds

Supply Chain Challenges Will Become Even More Complex

The solar industry has been through a gauntlet of supply chain challenges in recent years, with imported modules contending with President Trump’s Section 201 tariffs, the Biden administration’s circumvention investigation, and the detention of shipments as a result of enforcement of the Uyghur Forced Labor Prevention Act (UFLPA). However, we did see progress on some of these issues in 2023. The US Department of Commerce issued a final determination in its circumvention investigation in August outlining a certification process that would allow modules produced in Southeast Asia to enter the US without being subject to anti-dumping duties. Media sources have indicated that for the first time since enforcement began in 2021, modules produced with polysilicon sourced from China have been released from detention.

Despite the progress on these issues, new challenges for the solar supply chain and clean energy supply chains are emerging:

Forced labor enforcement is not going away: While the clearance of shipments with Chinese-sourced polysilicon is undoubtedly good news for importers, UFLPA enforcement is still expanding. UFLPA enforcement in recent months has expanded beyond the large Tier I module suppliers that were its traditional target. Consequently, a broader swath of solar imports faces risk of potential UFLPA detentions. Additionally, the decision by the US Department of Homeland Security (DHS) to hire Laura Murphy, an academic who has written extensively about forced labor, could provide a catalyst for additional enforcement in other industries. Murphy has written on forced labor in EV battery supply chains and flagged concerns about many of the companies, including Contemporary Amperex Technology Limited (CATL). US Customs and Border Protection (CBP) is detaining a small number of EV batteries, but that number could increase. Lithium-ion batteries used for battery storage purposes also face potential detentions.

Tariffs remain a risk: Although the Biden administration is conducting a review of Section 301 tariffs imposed on China, President Biden has not been the force for trade liberalization that many in the renewable energy industry had hoped for. While we do not expect the Section 301 review to result in significant changes to the tariffs as a whole, small changes are possible, in our view. One potential change could adjust tariffs applied to imports of battery cells and modules from China, currently subject to 25% and 7.5% tariffs, respectively. While lowering the tariff on cells to the 7.5% applied to modules is supported by manufacturers dependent on importing cells, it is equally likely that the Biden administration could raise the tariff on modules to the 25% applied to cells to accelerate the onshoring of battery supply chains. While the timing of such a move is uncertain, we believe it will likely occur early in 2024.

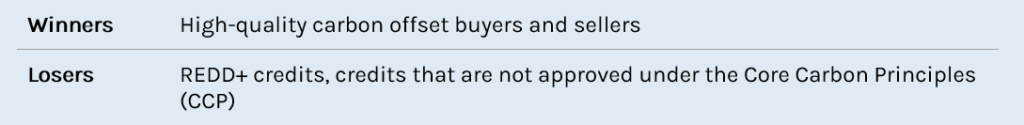

2024 Likely to be Pivotal Year for Voluntary Carbon Markets Following Bumpy 2023

Private Sector Initiatives Entering Implementation Phase to Improve Quality

Pseudo-regulatory standard-setting groups looking to drive quality improvements in offset supply and increase buyer confidence and literacy on the demand side will meet critical benchmarks in their efforts to unveil final guidance in 2024. On the supply side, the Integrity Council for the Voluntary Carbon Market (IC-VCM) is planning to begin applying the Core Carbon Principle label to offsets that meet its quality standards for in Q1 2024 and continue with additional releases through the year. On the demand side, the Voluntary Carbon Market Integrity Initiative (VCMI) is planning supplemental releases to its Claims Code of Practice throughout the year, enabling corporate buyers to plan sustainability strategies and incorporate the use of high-quality offsets to attain their goals. The cumulative impacts of the guidance will help drive quality improvements on the supply side and buyer confidence on the demand side, resulting in market growth.

Commodity Futures and Trade Commission to Release Final Rules on VCM

Capstone believes the CFTC’s new proposal, the Proposed Guidance Regarding the Listing of Voluntary Carbon Credit Derivative Contracts, will be finalized before the end of President Biden’s current term. We expect that finalization will mark a major turnaround in the VCM narrative, which has been criticized in the press as a wholly unregulated market where there are concerns about the quality and integrity of credits. We believe the involvement of a major and respected US regulator taking on an oversight and enforcement role via the finalized guidance will be pivotal to combating market contraction and will help improve investor confidence in the quality of offset supply and the market overall.

States to Accelerate Decarbonization Policies with Economy-wide and Sector-Specific Programs

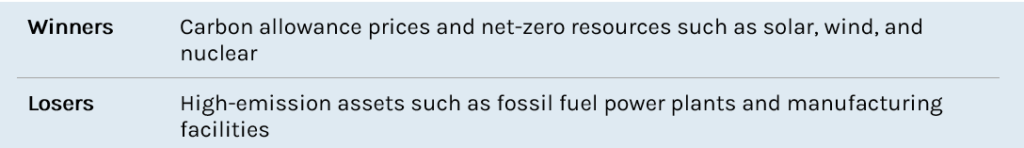

New York to Work on Cap-and-Trade Program in Earnest While California, Washington Debate Program Changes, Potential Linkage

New York

New York aims to finalize a new cap and invest program by the end of 2024, expanding the penetration of compliance carbon markets in the US. Following the passage of the 2023 state budget, state regulators are statutorily required to enact the New York Cap-and-Invest (NYCI) program. Regulators began the stakeholder feedback processes in H2 2023 with the goal of publishing initial regulation by January 1, 2024. Although we expect to see proposed regulation in Q1 2024, we believe regulatory delays and controversy over key provisions—including cost containment options, interaction with Regional Greenhouse Gas Initiative (RGGI) credits, and whether to allow trading—could push this timeline further.

Capstone expects that New York’s new program will bolster demand for carbon allowances (notably the program excludes carbon offsets) and raise compliance costs for emissions-producing industries. However, we expect the impacts to the power sector will be limited given the state’s continued participation in RGGI.

California and Washington

We expect to see discussions accelerate on program reforms as the California Air Resources Board (CARB) looks to enact new allowance budgets and Washington state contemplates program changes in response to record-high prices and its ambition to link with California’s cap and trade program. We believe these efforts will continue to drive high demand for credits, although uncertainty about program reforms in Washington could lead to price fluctuations. By contrast, California’s program is more stable, and we expect prices to remain consistently high in 2024 as compliance entities attempt to acquire allowances ahead of budget reductions.

CARB is expected to finalize regulations in 2024—with initial regulatory documents likely in Q1 2024 and a board vote in Q2 2024—to reduce 2025-2030 allowance budgets. Following recent CARB workshops detailing potential budget reductions, California carbon allowances (CCAs) have hit record high prices. As a result of potential price shocks, we expect that CARB may remove some allowances from cost containment reserves, such as allowance price containment reserves (APCR) and price ceilings, and may raise the APCR tier levels. The reforms will significantly reduce the number of banked allowances in the program, reducing flexibility as regulators consider the program’s future post-2030.

In November, the Washington State Department of Ecology announced its intention to pursue linkage with California’s cap and trade program. Ecology has stated that the programs could be linked by 2025. However, we believe linkage will not occur until 2027 at the earliest (with post-2030 as more likely) because CARB has not initiated linkage discussions and is wary about a connection with Washington’s nascent program, which has seen significant price volatility in the past year. Washington plans to examine proposals in the coming legislative sessions to reform the program to align with California’s and address concerns about high prices.

Pennsylvania Likely to Join RGGI While Virginia’s Exit Could be Hamstrung by Courts

Pennsylvania

Capstone believes the Supreme Court of Pennsylvania will end the years-long debate over the commonwealth’s participation in RGGI, paving the way for it to join RGGI in Q4 2024 or Q1 2025. We expect the Democratic majority on the court, which recently increased to 5-2 following the November 2023 elections, will rule in favor of the Shapiro administration and environmental groups in Q3 2024. We believe Pennsylvania’s entrance into the carbon trading program will be a negative for coal and gas plants, but provide incremental benefits to nuclear plants, which will not face these higher compliance costs.

Virginia

While we expect Pennsylvania’s litigation to finally end, the legal challenges to Virginia’s decision to withdraw from RGGI have just begun. We expect in Q1 2024 that the Floyd Circuit Court will rule on whether Virginia’s Air Pollution Control Board had the authority to withdraw the commonwealth from RGGI, given that the legislature had authorized the state to join the program. The case was recently transferred from Fairfax County to Floyd County, limiting the time the new court has to review the proceeding and consider any requests for injunctive relief. We believe Floyd Circuit Court is unlikely to grant injunctive relief before December 31st, the date Virginia is scheduled to officially exit RGGI. As a result, Virginia’s participation in the program will remain in limbo while it awaits court decisions (which are likely to be appealed). However, we believe courts will rule in favor of the plaintiffs, a group of nonprofits, requiring Virginia to reenter RGGI.

New Jersey Poised to Increase Renewable Portfolio Standard

We expect the New Jersey legislature to consider a bill in 2024 to supplement the state’s existing Renewable Portfolio Standard (RPS) 50% clean energy by 2030 with a new 100% clean electricity standard by 2035, 65% of which must come from in-state generation. New Jersey’s Senate Environment and Energy Committee recently decided to cancel the scheduled vote on the bill for December 18th. which makes passage in this session very unlikely. However, we believe the bill could pass in the 2024 legislative session contingent on support from key stakeholders including labor, environmental justice groups, and utilities.

We expect New Jersey’s new standard, as currently written, would be positive for PJM Interconnection’s (PJM) renewable energy credit (REC) prices, utilities, and renewables developers. These ambitious decarbonization targets will increase demand for PJM RECs, likely raising prices, and also require expansion of in-state renewable generation, which is likely to drive rate base growth for utilities and demand for renewable development.

States to Continue Targeting Heating Sector Emissions Through Policy Carrots and Sticks

Capstone expects US states to continue to target heating sector emissions both through mandated emissions reduction targets and policies incentivizing gas utilities to procure RNG.

In the past year, several state legislatures have introduced legislation or passed laws incentivizing gas utilities to procure RNG by passing on the costs to ratepayers. In other states with existing policies, gas utilities are building momentum on blending RNG into their gas systems. For example, Southern California Gas Co. is currently soliciting bids from RNG producers to meet the requirements of California’s S.B. 1440, which mandates the state’s gas utilities jointly procure 17.6 billion cubic feet of RNG annually by 2025, increasing to 72.8 billion cubic feet by 2030 (~12.2% of total 2020 gas consumption in the state). Nevertheless, decarbonizing the heating sector through RNG is facing some pushback from progressive states in the Northeast that favor electrification over low-carbon fuels to decarbonize the gas grid. The Massachusetts Department of Public Utilities (DPU), for example, recently issued an order in its Future of Gas proceeding that rejected blending RNG in the gas grid as a solution to meet its heating sector emissions goals.

However, we expect pro-RNG policies to continue to proliferate across states in 2024 and after. We expect the Texas legislature to reintroduce and pass H.B. 2262 when the next legislative session begins in 2025. The bill would allow gas utilities to seek cost recovery for RNG procurement. The New Jersey legislature will likely reintroduce bipartisan legislation (S. 1366) in 2024 that would allow gas utilities to recover the costs associated with blending up to 10% RNG in their gas systems through 2029. Additionally, we expect gas utilities in states with existing policies to continue actualizing the blending of RNG. For example, we expect Colorado regulators to issue decisions on utilities’ clean heat plans required under S.B. 21-264. Xcel Energy Inc. (XEL) proposed in its preferred clean heat plan to procure 512,512 MMBtu/year in 2024, increasing to 2,821,289 MMBtu/year in 2026.

New States Likely to Follow California’s Lead on Transportation Electrification Mandates

We expect more states will follow California’s lead in adopting Advanced Clean Cars (ACC) II regulations that promote the sale of EVs by phasing out the sale of new internal combustion engine (ICE) vehicles. ACC II does this by increasing percentages each year beginning in 2026 and culminates in a ban on new ICE vehicle sales in 2035. The regulation builds on California’s initial ACC regulation governing model years 2015 through 2025. Under the Clean Air Act (CAA), states have the option to adopt California’s regulations, at least in part, or follow EPA’s less stringent auto emissions requirements. Seventeen states have incorporated California’s initial ACC rule in part: Colorado, Connecticut, Delaware, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Vermont, Virginia, and Washington.

Some of these states also adopted, at least in part, the ACC II zero-emission vehicle rules. They include Colorado, Delaware, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Virginia, and Washington. We expect additional states, particularly those with Democratic-led legislatures such as Maine and Nevada, to consider adopting the more stringent rules in the next year.

Clean Fuels Move into Overdrive with New Federal- and State-Level Incentives

California Likely to Strengthen Low Carbon Fuel Standard

California’s Low Carbon Fuel Standard (LCFS), which is designed to lower the carbon intensity of the state’s transportation fuel mix, has been suffering from persistently low credit prices since 2020, disincentivizing participation in the program. On September 8, 2023, CARB released its Standardized Regulatory Impact Assessment (SRIA), which proposed changes to the LCFS that were broadly in line with prior Capstone predictions that credit generator-friendly changes are likely. Major changes included a 30% CI reduction in the 2030 standard, a 5% CI threshold step down in 2025, and an auto acceleration mechanism that would automatically lower the CI threshold without board intervention.

The SRIA also proposes phasing avoided methane crediting for dairy and swine manure RNG projects by 2040. Applications certified before 2030 would be eligible for a 10-year crediting period and applications would be eligible for an additional five-year crediting period if their first period expires between 2030 and 2035. The SRIA also proposes phasing out book and claim crediting for RNG projects by aligning its deliverability requirements with those for other fuels that have to be physically consumed in California. Capstone notes, however, this proposal is sparse on details.

We believe CARB is targeting aggressive CI reductions to address a years-long unfavorable credit environment and reinvigorate investment in the program. While policy items like the CI reduction, step down, and auto acceleration mechanism were CARB’s priority in the SRIA, we expect the board will approve a final rule that includes the phaseouts of avoided methane crediting and book and claim for RNG.

Capstone expects CARB to release the rulemaking package in late-Q4 2023 or early-Q1 2024, followed by a 45-day public comment period and board meeting in Q1 2024 to vote on the proposal. CARB has been vague on the implementation timeline of the rulemaking but maintains that changes will be implemented in 2024. Stakeholders Capstone has spoken with agree that implementing new changes mid-year in 2024 is possible.

New States Likely to Move Ball Forward on Clean Fuel Programs and SAF Tax Credits

Capstone also has been tracking the efforts of other states to implement LCFS-like programs. We have identified three states that we believe have the best chance at authorizing a clean fuel/transportation standard in 2024, New York, Minnesota, and New Mexico, and two that we believe will enact SAF tax credits in 2024: Michigan and Oregon.

New York

Capstone believes passing a clean fuel standard (CFS) via the state legislature is feasible in 2024, but it first must gain the support of key assemblymembers.

Capstone previously assigned a 44% probability that a CFS would be authorized administratively or be signed into law in New York in 2024. We believe that probability is unchanged at this time due to CFS opposition from key lawmakers and a small number of outspoken stakeholder groups.

Clean fuels legislation, S. 1292, passed the state Senate on the last day of session—June 8, 2023—but was not brought to the assembly floor for a vote due to political opposition from Environmental Conservation Committee Chair Deborah Glick (D). Chair Glick and other progressive lawmakers have voiced opposition to a clean fuel standard for prolonging greenhouse gas (GHG) emissions, especially in disadvantaged communities that are disproportionately affected by the harmful effects of excess emissions. The state legislature will reconvene in January 2024, at which point assemblymembers could reconsider S. 1292.

New York Governor Kathy Hochul (D) can authorize a clean fuel standard administratively, but we believe she will not want to risk drawing further criticism from outspoken environmental stakeholders after receiving pushback for proposing to change the state’s GHG accounting timelines in the 2023 executive budget.

We believe assembly passage is feasible if certain environmental justice and related provisions are included. S. 1292 passed the state Senate by an overwhelming majority of 51-11 and, despite opposition from a small number of outspoken groups, enjoys the support of most environmental stakeholder groups that maintain strong influence with state legislatures. We believe S. 1292’s success in 2024 will largely depend on environmental groups’ abilities to convince Chair Glick and key assembly members to soften their opposition to the bill.

Minnesota

Capstone believes Minnesota has the best chance of implementing a clean transportation standard, or CTS, (the term is considered interchangeable with “clean fuel standard”) in 2024 based on the strong support of the governor and a robust stakeholder working group. Capstone previously assigned a 56% probability that Minnesota will authorize a CTS in 2024, which we are leaving unchanged at this time.

Minnesota Governor Tim Walz (D) is a strong proponent of a CTS. The governor has publicly supported the idea on multiple occasions, allocated funds in the FY24-25 revised budget for a CTS economic impact study and working group, and released a Climate Action Framework in September 2022 that called for a variety of decarbonization initiatives in Minnesota, including a clean fuel standard.

On May 21, 2023, the Minnesota State Legislature passed a transportation budget package that established a Clean Transportation Standard Work Group. The working group is meeting regularly to prepare a report for the legislature with recommendations for implementing a clean transportation standard. The working group consists of representatives from major stakeholder groups in the state (biofuels producers, agriculture stakeholders, tribal representatives, etc.) that will develop recommendations for structuring a CTS to reduce the carbon intensity of transportation fuels used in the state below a 2018 baseline level by 25% by the end of 2030, 75% by the end of 2040, and 100% by the end of 2050. Thus far the working group is strongly considering flexible CI reduction goals rather than targets, a review process every three to five years, and third-party verification of fuel pathways. The working group will continue to consider fuel eligibility, land use, and environmental justice in future meetings.

We believe there is some opposition to a clean transportation standard from agriculture stakeholders in the state who are concerned about a CTS’s effect on fuel prices, but the working group is mitigating these concerns.

New Mexico

Capstone believes support in the state legislature for a CFS is strong among Democratic members but faces nearly unified resistance from Republicans, who believe it will lead to higher gas prices. Capstone previously assigned a 41% probability that New Mexico will authorize a CFS in 2024, which we are leaving unchanged due to political opposition and legislative time constraints.

Recent attempts to pass a clean fuel standard have come very close. In 2022, the state legislature considered S.B. 14 to implement a CFS in the state. The bill passed the Senate 25-16 but due to political disagreements among House Democratic members the bill received a 33-33 vote in the House of Representatives and did not advance out of the chamber. Clean fuel legislation in 2023, H.B. 426, did not have enough political momentum and failed to advance out of the House.

We believe the biggest obstacle to the New Mexico legislature passing a clean fuel standard is not politics but time. Legislative sessions are very short statutorily. Per New Mexico’s Constitution, the legislature meets for 60 days in odd-numbered years and 30 days in even-numbered years. Given that the legislature will be meeting for 30 days in 2024 and the Democratic majorities of both chambers, CFS legislation must be a priority for party leaders from the beginning. We believe moderate Democratic members may be hesitant to vote for a clean fuels program in 2024 due to concerns that its perceived effect on gas prices will adversely affect their reelection chances. We believe the likelihood of CFS legislation passing will depend on stakeholder influence and education of moderate Democratic members.

New Mexico Governor Michelle Lujan Grisham (D) supports a clean fuel standard and praised the passage of S.B. 14 out of the state Senate in 2022. However, we believe the governor is hesitant to authorize a CFS administratively over fears of drawing criticism from Republican lawmakers and oil and gas stakeholders, and would prefer the issue to be approved via the legislature. With the shorter 30-day legislative session ahead in 2024, the Gov. Grisham will have a big influence on the issues the legislature considers. Capstone does not expect her to make a CFS a priority given the opposition to clean fuel programs from certain stakeholder groups and reflected by members of the legislature.

Michigan and Oregon Likely to Join Wave of States Enacting SAF Tax Credits

We believe that Michigan and Oregon are poised to become the fourth and fifth states with sustainable aviation fuel tax credits in 2024. The states would join Illinois, Minnesota, and Washington in offering the tax incentive for the SAF industry.

Michigan’s SAF tax credit legislation was introduced in 2023 under S.B. 447 and would give the credit to airlines using the SAF for flights departing in-state. Biomass-derived SAF is eligible, while palm feedstocks are excluded. The credit value would be $1-$2/gal, with an increase of $0.02 for each percentage-point improvement in CI score above 50%, as measured by either the GREET or Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) model. It is possible the legislation will be modified similar to Washington’s so that either the producer or consumer of fuel can get the credit to attract a wider coalition of biofuels groups. Oregon does not currently have SAF tax credit legislation, but there is a is robust advocacy in the state to supplement the clean fuel standard with an additional tax incentive for SAF, with agencies and stakeholders working on the topic.