Capstone believes President Trump will use tariffs aggressively, prioritizing tariffs on products imported from China, and will move forward with a 10%-20% universal tariff. These actions threaten import-exposed industries, including energy, autos, tech, retailers, and healthcare. However, we believe President Trump’s protectionist instincts may be tempered by a broader concern for the stock market and retaliatory tariffs from China, resulting in tailored tariffs.

Outlook at a Glance:

- Trump Will Target China, with Batteries, Transformers, and Other Products of Strategic Concern as Initial Targets; China Will Retaliate, Likely Targeting Soybeans

- A 10-20% Tariff on all Imports Will Likely be Announced in 2025, But There Will Be Ample Opportunities for Large US Trading Partners to Negotiate Exclusions

- Threatened 25% Tariffs on Canada and Mexico Are Likely Just Noise, Deflating Risks for the Automotive, Agricultural, and Steel Industries

- US-EU Trade Friction Likely to Resume Under Trump, With Looming Deadlines for Industrial Sector

Trump Will Target China Early, with Batteries, Transformers, and Other Products of Strategic Concern as Initial Targets; China Will Retaliate, Likely Targeting Soybeans

| Winners | Domestic manufacturers like Fluence Energy Inc. (FLNC) and Tesla Inc. (TSLA), manufacturers that have relocated manufacturing outside of China, and EU manufacturers that can replace US exports |

| Losers | Chinese manufacturers like Contemporary Amperex Technology Co., Ltd. (300750 on the Shenzhen exchange) and BYD Co. Ltd. (002594 on the Shenzhen exchange), consumer electronics companies including Apple Inc. (AAPL), pharmaceutical products, US agricultural exporters Archer-Daniels-Midland Co. (ADM) and Bunge Global SA (BG) |

Trump Likely to Focus on China and Raise Section 301 Tariffs in Q2 2025

Capstone expects increasing tariffs on Chinese imports to be an early priority for the Trump administration. On the campaign trail, Trump promised to increase existing Section 301 tariffs on Chinese imports to 60%, which he could do without approval from Congress. Capstone believes Trump’s decision to surround himself with China hawks, including Senator Marco Rubio (R-FL) as his nominee for Secretary of State and Peter Navarro returning as Senior Counselor for Trade and Manufacturing, signal that he is preparing to follow through on promises to decouple supply chains from China. Under the Section 301 investigation conducted by the US Trade Representative (USTR) during Trump’s first term, Trump would already have the authority to increase tariffs on Chinese imports. Given this, we believe Section 301 tariffs are a natural starting point for Trump when examining how to limit US reliance on Chinese goods.

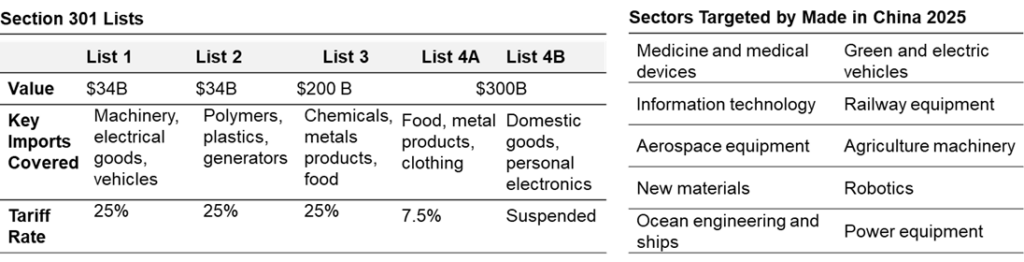

Capstone believes the Trump administration will stagger its Section 301 tariff increases instead of increasing the tariffs all at once. We expect Trump to first focus on tariffing products of strategic importance and industries receiving subsidies from China’s Made in China 2025 policy, as he did during his first term (see Exhibit 1). This includes electrical transformers, semiconductors, and lithium-ion batteries. The Trump administration likely will spare consumer-facing products, such as clothing and personal electronics, from initial tariff increases. During Trump’s first term, he imposed Section 301 tariffs on consumer-facing products only after China took retaliatory measures, an indication that this is possible in his second term but is not a primary focus.

Capstone believes higher Section 301 tariffs on Chinese imports will be effective in Q2 2025. The process for raising tariffs will likely move relatively quickly once the Senate confirms relevant nominees and USTR staff have conferred with their Chinese counterparts. A caveat to this timeline is the discretionary authority Trump will have in determining when and how to raise Section 301 tariffs. Historically, after the proposed tariffs are announced, USTR will hold a 30-day comment period, which could be longer with review, and then allow a one to two-week buffer before implementation.

The Chinese government will reciprocate any tariff increases against its exports. In response to the Section 301 tariffs the first Trump administration imposed, China imposed tariffs on a range of US exports, including agricultural and food products, oil, chemicals, and transport equipment. Capstone expects US exports such as soybeans to be likely targets for China’s retaliatory tariffs. China will also likely consider imposing export controls on critical metals and investigating US companies operating in China.

Exhibit 1: Early Section 301 Lists Focused on Products of Strategic Concern and Industries Receiving Made in China 2025 Subsidies

Source: US Trade Representative, Made in China 2025

A 10%-20% Tariff on all Imports Will Likely be Announced in 2025, But Large US Trading Partners Will Have Ample Opportunity to Negotiate Exclusions

| Winners | Domestic manufacturers not reliant on imports, like steelmakers |

| Losers | Apple Inc. (AAPL), Walmart Inc. (WMT), Target Corp. (TGT), Lowe’s Companies, Inc. (LOW), and Dollar Tree, Inc. (DLTR), US agricultural exporters, import-dependent manufacturers (ex. automakers) |

Trump Administration to Use the Universal Tariff as Leverage in Trade Negotiations

Capstone believes the Trump administration will announce an unprecedented universal tariff on all imports in 2025. On the campaign trail, Trump proposed levying a 10% or 20% tariff on all US imports to generate revenue and onshore jobs. Revenue generation will be necessary for Republicans as they prioritize financing the extension of the Tax Cuts and Jobs Act (TCJA) in 2025. Although the revenue generated by the universal tariff will not be officially scored unless legislated by Congress, the Trump administration will likely align the tariff’s effective date with the expiration of TCJA provisions at the beginning of 2026.

Capstone believes the incoming Trump administration will state its intention to enforce the tariff at a particular date and then allow US trading partners to negotiate agreements to avoid the tariff in 2025. The threat of a universal tariff will be an essential negotiating tool for the Trump administration. We expect key trading partners with large trading balances with the US to be best positioned to successfully offer concessions in exchange for exclusions from the universal tariff. Companies and industries sourcing their imports from countries like Canada and Mexico, which we believe will be well-positioned to negotiate exclusions, will be shielded from the impact of the universal tariff.

Capstone believes countries will retaliate against a universal tariff, even as they try to negotiate exemptions with the incoming Trump administration. We believe US products historically targeted by retaliation, including agricultural products and staple US brands, will be at risk.

The stock market’s reaction to the universal tariff could influence how Trump implements it. The market volatility likely to follow any announcement of a universal tariff could lead Trump to moderate his plans. In response to this volatility, he could become more amenable to granting for domestic industries and negotiating product-specific exclusions with trading partners.

Trump Likely Has the Statutory Authority to Implement the Tariff Unilaterally

No president has used existing statutes to implement a universal tariff, which creates uncertainty about the legality of Trump’s proposal. Based on our conversations with trade policy experts and lawyers, we believe the president will likely leverage the International Emergency Economic Powers Act (IEEPA) to implement the tariff. IEEPA grants the president the authority to introduce barriers during declared emergencies. Trump could declare a national emergency, potentially citing the US trade deficit as the basis, and introduce a universal tariff as a remedy.

We believe the history of legal precedent protecting the president’s authority to raise trade barriers during times of emergency would support the universal tariff to withstand anticipated legal challenges. Historically, the Court of International Trade, which hears challenges to US trade actions, has deferred to the executive on matters of national emergency and security. During Trump’s first term, the Court of International Trade affirmed his ability to impose Section 232 tariffs on steel imports against legal challenges. He also asserted that he had exceeded his authority and said there was no “impending threat” to national security.

Threatened 25% Tariffs on Canada and Mexico Are Likely Just Noise, Deflating Risks for the Automotive, Agricultural, and Steel Industries

| Winners | Automotive industry, US steel exports, US agricultural exports |

| Losers | N/A |

Significant Economic Impact of Tariffs Likely Dissuade Trump from Implementation

Capstone does not expect Trump to implement the 25% tariff on all Canadian and Mexico imports that he threatened in November. We believe that the sweeping economic implications of introducing a 25% tariff on all imports from the United States’ two largest trading partners will dissuade Trump from introducing the tariff. Moreover, we believe Trump threatened the tariffs to call attention to immigration and drug trafficking and will use the threat of tariffs to extract concessions on these issues from Canada and Mexico. There would be a significant impact on the automotive industry, for example, which relies heavily on the preferential tariff treatment under the US-Mexico-Canada Agreement (USMCA) to allow auto parts to traverse the southern border multiple times before being assembled into a final product. A 25% tariff would effectively halt production in the automotive industry, impacting thousands of unionized workers.

Retaliation from Canada and Mexico may further dissuade Trump from implementing a tariff. During his first term, Trump implemented Section 232 tariffs on Canadian and Mexican steel and aluminum imports. Canada responded to Trump’s tariffs within five weeks with reciprocal tariffs on US steel, aluminum, and other goods. Mexico responded with tariffs targeting US agricultural and steel exports. After one year, the three countries reached an agreement to suspend the 232 tariffs. If Trump implements a 25% blanket tariff on Canada and Mexico, we expect retaliation to target a more significant dollar value of goods across several different sectors.

We believe that Trump is more likely to target Mexico than Canada with the threat of tariffs. Trump’s tariff threats against Mexico and Canada were tied to fentanyl trafficking and immigration policies, two issues that leave Mexico more exposed than Canada. Mexico also runs a larger trade surplus with the United States than Canada. We expect Trump to focus on trade imbalances as he considers tariffs.

In the event Trump does implement a blanket tariff on Canada and Mexico, we expect the countries to swiftly challenge the measure through the USMCA dispute process. Although a blanket tariff may violate the terms of USMCA, the agreement cannot compel the United States to change its trade policy. Capstone further believes Canada and Mexico would quickly impose tariffs on US goods, similar to 2018 when Canada and Mexico retaliated against the Section 232 tariffs. We expect Canada and Mexico to target agricultural and industrial products.

USMCA Review in 2026 Looms Over Canada and Mexico Trade in 2025

We expect Trump to use trade actions and tariff threats in 2025 to build a negotiating posture for the USMCA review in July 2026. As part of the review, the three USMCA countries will decide whether they want to renew the agreement for another 16 years. If either the US, Canada, or Mexico opt not to renew the agreement, that decision will trigger an annual review of the deal for the next 10 years. If, at the end of that period, the countries decide not to extend the deal, then the agreement will be terminated.

Capstone believes it is unlikely that the Trump administration will withdraw from USMCA. President Trump touted the success of the USMCA, and withdrawing from it would effectively condemn a deal his administration had negotiated while significantly harming many US industries. Additionally, Trump did not criticize the USMCA heavily on the campaign trail, indicating its repeal will not be a priority for him.

Capstone expects the US, Mexico, and Canada to try to renegotiate certain aspects of the USMCA during the agreement’s review in 2026. We expect the Trump administration to focus on renegotiating the USMCA’s automotive rules of origin, addressing energy policy reforms in Mexico and agricultural practices in Canada, and combatting illegal immigration from Mexico to the US.

US-EU Trade Friction Likely to Resume Under Trump, with Looming Deadlines for Industrial Sector

| Winners | US steel companies and domestic manufacturers with limited exposure to the EU |

| Losers | Harley-Davidson Inc. (HOG), Airbus SE (AIR on the Paris exchange), LVMH Moët Hennessy Louis Vuitton SE (MC on the Paris exchange) |

Section 232 Tariffs on Steel and Aluminum Will Loom Over Negotiations

During his first term, Trump imposed Section 232 tariffs on steel and aluminum imports from the European Union. In retaliation to these tariffs, the EU imposed tariffs on US agricultural products, steel and aluminum products, and other manufactured goods. Upon taking office, President Biden sought to smooth relations with the EU and negotiated a tariff rate quota with the EU, which allowed some steel and aluminum products to enter the US free of Section 232 duties.

The Biden administration tried to negotiate a sectoral trade agreement with the European Union with the intent to replace the tariff rate quota, but negotiations ultimately failed to yield any results. To support the negotiations, the Biden administration announced in late 2023 that the tariff rate quota would extend to December 31, 2025, after which the Section 232 tariffs will come back into full effect.

Capstone believes the Section 232 tariffs will play a key role in any US-EU trade negotiations. Trump likely has the authority to suspend the tariff rate quota or bring forward its expiration date. We believe trade relations with the EU will be a priority for Trump because the US runs a large trade deficit with the bloc. During his first term, Trump was willing to create friction in the US-EU relationship to extract concessions from the EU, and we expect a similar dynamic to emerge in his second term.

Carbon Border Adjust Mechanism (CBAM) and Digital Service Taxes Could Spur Tariff Actions

We believe the EU’s planned CBAM will create friction in the US-EU trade relationship. The EU plans to charge a tariff on all imported goods across various industrial sectors beginning in 2026 based on goods’ embedded emissions. When the EU was first considering the CBAM, Senate Republicans, including nominee for Secretary of State Marco Rubio, wrote to President Biden urging him to push back against the EU’s plans and calling the tariff “unfair.” We expect Trump to be similarly opposed to the CBAM and use it as a pretext to threaten new tariff measures. The Section 232 tariffs are set to resume the same day the EU will begin collection levies through the CBAM, which could set the stage for tariff escalation from both trading partners.

During Trump’s first term, France introduced a digital services tax that the US determined would discriminate against US tech companies. In response, the US threatened tariffs of up to 100% on a variety of French products. USTR Robert Lighthizer also identified digital service tax policies in Austria, Italy, the UK, Spain, and Turkey that could prompt future tariffs. We believe Trump will again threaten to use tariffs if France or other European countries try to move forward with digital service taxes.

Read more from Andrew:

For Every Action, an Equal Reaction: Renewed China Trade Conflict and the Likely Chinese Response

Why the Price of Batteries, and the Energy Transition, May be Poised to Rise

Trade Policy’s Coming Bipartisan Moment