August 28, 2023

By Keegan Ferguson, Capstone Financial Services analyst

A tough year for regional banks is about to get tougher.

On Tuesday, August 29th, the Federal Deposit Insurance Corporation (FDIC) will announce new, more onerous rules for large regional banks that will hoist new stricter regulatory standards on them, further eroding the Trump-era tailoring framework, which drew sharp distinctions between globally systemically important banks (G-SIBs) and large regional banks (<$700B in assets).

Under the new proposal, all banks with more than $100 billion in assets will be required to meet new total loss-absorbing capacity (TLAC) and long-term debt (LTD) requirements, designed to facilitate the resolution of failing banks using a single point of entry (SPOE) strategy. With a single point-of-entry resolution strategy, losses to subsidiaries preceding bank failure would be passed upward to the bank’s holding company, and long-term debt at the holding company would be distributed downward to subsidiaries to stabilize and recapitalize their operations. In theory, this localizes resolution to the bank’s holding company while subsidiaries continue to function. In practice, it means regional banks will have to issue more debt to satisfy these requirements and more limitations on what they can do.

Until now, TLAC and long-term debt requirements were solely reserved for global systemically important banks (G-SIBs). Now the regional banks will be treated like the G-SIBs without the ability to operate like one; a reality that will pose l regulatory and operational challenges for them.

Now the regional banks will be treated like the G-SIBs without the ability to operate like one; a reality that will pose l regulatory and operational challenges for them.

The shots across the bow have been many. Earlier this summer, the Federal Reserve, Office of the Comptroller of the Currency (OCC), and FDIC unveiled the US’s gold-plated Basel III Endgame proposal. The proposal makes a series of changes to the existing regulatory framework for all banks with more than $100B in assets. Regulators estimate that it will increase risk-weighted assets (RWA) across banks by an estimated 20%, with most of that increase accruing to the largest banks. By ratcheting up RWA, banks will be required to hold more capital.

The forthcoming TLAC requirements have been heavily telegraphed by regulators. The FDIC’s 2022 request for information on bank mergers referenced an interest in new TLAC requirements, as did Fed Vice Chair for Supervision Michael Barr during remarks last fall announcing his planned review of capital requirements. The most forceful signal, however, came in Spring 2022 when Comptroller of the Currency Michael Hsu gave a speech suggesting that large bank mergers were potentially destabilizing to the financial system and that large regional bank resolution measures were insufficient absent TLAC and long-term debt requirements. In October, the Fed, OCC, and FDIC released an advance notice of proposed rulemaking (ANPRM) concerning the establishment of TLAC and long-term debt requirements for other large banking institutions. When it was released, the ANPRM suggested that regulators were only considering establishing new TLAC and LTD requirements for banks with more than $250 billion in assets.

The goalposts have since moved.

Any chance of exclusion from new TLAC rules for larger regional banks faded this spring after the dramatic collapse of Silicon Valley Bank, Signature Bank, and eventually First Republic Bank. On August 14th, FDIC Chair Martin Gruenberg cited the events of this past spring as evidence that the failure of regional banks poses serious financial stability risks, and he indicated that the forthcoming rule would include all banks with more than $100B in assets.

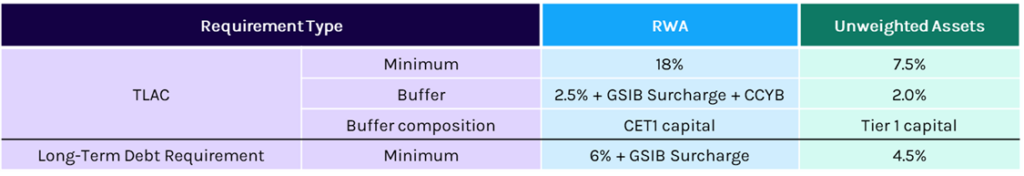

Under existing rules, the G-SIBS are required to hold TLAC equal to 18% of risk-weighted assets or 7.5% on weighted assets (total leverage exposure) plus additional buffers. TLAC can be composed of tier 1 capital and a minimum amount of long-term debt. Minimum long-term debt must be held equal to the greater of 4.5% of total leverage exposure or 6% of risk-weighted assets (plus the G-SIB surcharge). If the Basel III Endgame proposal is any indication, we expect that the TLAC and LTD requirements for large regional banks will not be meaningfully reduced for banks with $100B to $700B in assets.

Exhibit 1: Existing TLAC/LTD Requirements for U.S. G-SIBs

Source: Federal Reserve

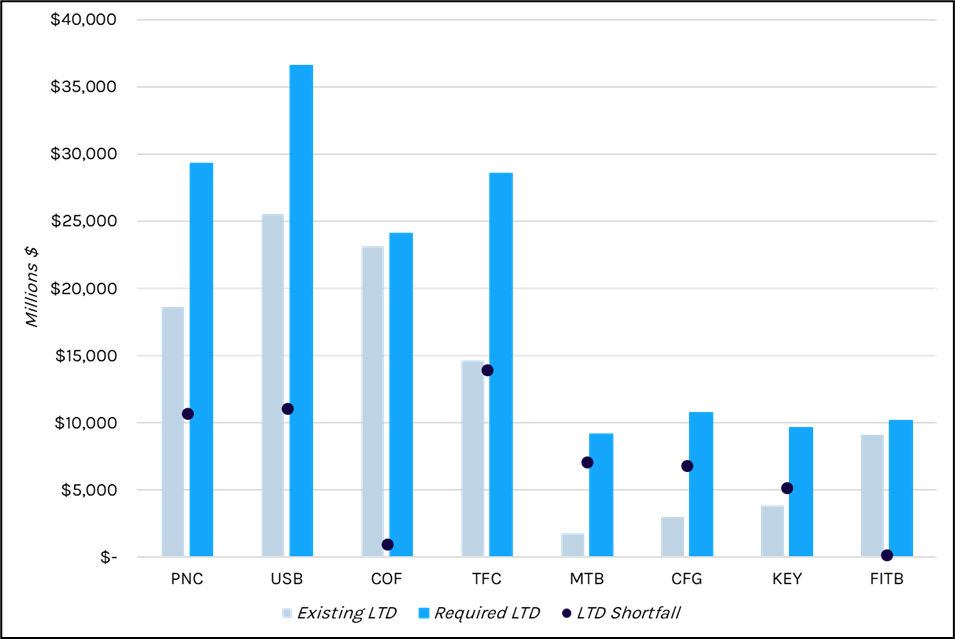

If the TLAC/LTD proposal does not meaningfully tailor thresholds for non-G-SIBs, Capstone believes that the impacted banks will be required to issue significant amounts of new long-term debt at the holding company level. This new holding company debt will have to be “vanilla” and cannot provide holders with contractual rights to accelerate payment, cannot be structured notes, cannot be converted into equity, or have other credit-sensitive features that adjust based on bank creditworthiness. We estimate that the impact of meeting a long-term debt threshold equal to the greater of 6% of risk-weighted assets or 4.5% of total leverage exposure would be significant. Among domestic banks that we expected to be included, we estimate that U.S. Bancorp (USB), Truist Financial Corporation (TFC), PNC Financial Services Group Inc (PNC), and Capital One Financial Corp (COF) would be forced to issue ~$36B in additional eligible debt through the phase-in period of the proposal to be compliant. We also estimate that smaller banks like KeyCorp (KEY), Fifth Third Bancorp (FITB), Citizens Financial Group (CFG), and M&T Bank Corporation (MTB) would be forced to raise ~$20B in eligible debt.

Exhibit 2: Estimated Long-Term Debt Short Falls for Regional Banks

Source: FactSet, FR Y-9C, Company Filings

Note: Estimates based on Q2 2023 data across all institutions. S&P Conducted a similar analysis based on Q1 2022 data with broadly similar findings related to LTD shortfalls for PNC, USB, COF, and TFC. Their analysis did not include Cat. IV banks. Our estimates utilize LTD relative to risk-weighted assets as the binding LTD constraint rather than leverage exposure as these banks are not yet subject to the supplementary leverage ratio that is utilized to calculate total leverage exposure for larger institutions. Failure to meet required TLAC and LTD thresholds would result in graduated restrictions on capital distributions and bonuses.

We anticipate that industry will push back against the proposal, particularly if it does not tailor TLAC and LTD requirements considerably. Industry advocates contend that TLAC/LTD requirements would shift the funding mix for regional banks away from low costs deposits, which would translate to increased borrowing costs for consumers.

New Resolution Plans

Beyond the proposal of new TLAC and LTD rules, the FDIC is also expected to seek input on a proposal to increase the resolution planning responsibilities of banks above $50 billion in assets.

We expect new resolution planning requirements to force banks to provide greater granularity around how the institution could be taken into receivership and transformed into a bridge bank, and how different franchise components could be separated and sold to facilitate acquisition. The proposed rulemaking is a clear response to the FDIC’s concern about a reliance on emergency ‘purchase and assumption’ sales for large failing banks that seemingly limit the universe of potential acquirers to large G-SIBs as well as concerns that existing resolution plan requirements were insufficient to support the FDICs resolution of Silicon Valley or Signature Bank in a preferred manner.

The proposed rulemaking is a clear response to the FDIC’s concern about a reliance on emergency ‘purchase and assumption’ sales for large failing banks.

Overall, it has become abundantly clear that regional banks are being swept into the regulatory regime that was historically reserved for only the biggest banks. The enhanced capital requirements under the Basel III endgame, the LTD and TLAC rules, and the new resolution planning requirements are just the first three examples in a growing list. Regulators are also rumored to be considering new liquidity rules, changes to deposit insurance pricing, and even changes to stress tests. While second-quarter earnings show the system has, for now, stabilized, regulators are just beginning the process of tightening the screws on regional banks, with tough years ahead.

Keegan Ferguson, Capstone Financial Services analyst

Read more from Keegan:

The Promises and Perils of the Fed’s New Payment System

Education Cracks Start to Show: Despite Pandemic Stimulus, Financial Uncertainty Will Spur Policy

Looming Disruptions to the Business of Higher Education

Read Keegan’s bio here.