Capstone’s Education 2023 Preview: Stimulus Helps but Uncertainty Looms in K-12; Pressure on For-Profits; Job Training Compromise Possible

December 21, 2022

Capstone believes COVID-19 stimulus funds for elementary and secondary education will continue to bolster the financial position of state and local districts and provide tailwinds for technology and learning loss solutions vendors. We anticipate that persistent enrollment declines and the specter of a possible recession will introduce some medium-term financial uncertainty for states and districts and bolster industry calls for an extended timeline for spending stimulus funds.

We expect a renewed push for federal school choice legislation, and we will be closely following the impacts of the US Supreme Court’s Carson v. Makin decision, which could open the door for publicly funded schools run by religious institutions.

Additionally, Capstone expects new or finalized rules aimed at increasing institutional responsibilities for receiving Title IV financial aid funds and the long-awaited resolution to the ongoing student debt relief court fight.

We see potential for bipartisan compromise to renew the Workforce Innovation and Opportunity Act (WIOA) and to allocate additional funding for work training and upskilling. We expect that Republicans will try to amend the existing statute to expand employer-sponsored training and the use of individual training accounts, and to reduce the impact of state and local workforce development boards. We also see room for compromise on the creation of a short-term Pell Grant program that could present new opportunities for Title IV businesses to offer or expand short-duration training and certificate programs.

We expect a host of new rules in 2023 that will increase institutions’ Title IV responsibilities when participating in federal student loan programs.

Key Themes in K-12 Education in 2023

Stimulus Funds Liquidation Extension and K-12 Funding Concerns Moving Forward

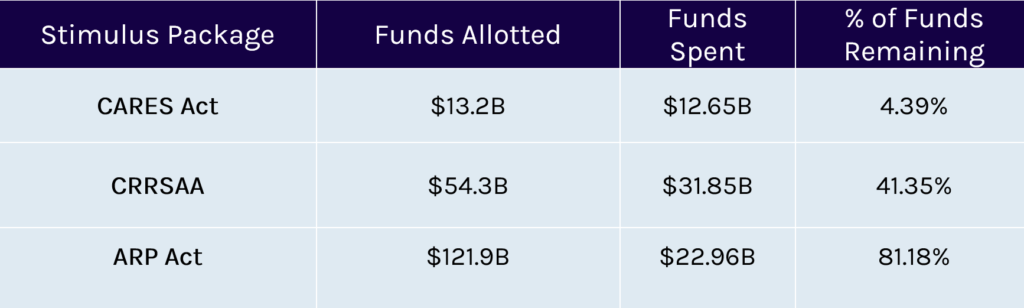

Reporting from the US Department of Education (ED) indicates that nearly $122 billion in education stimulus funds were unspent as of September 2022. Based on the rate of stimulus spending during the past year, Capstone believes that nearly $110 billion in relief funds will remain at the beginning of 2023.

We expect the timeline for spending the remaining stimulus funds will be extended. While Congress has shown no interest in extending the deadline for obligating or committing to spend funds, the Department of Education has indicated that it will consider extending the liquidation deadline for stimulus dollars. Under a liquidation extension, the funds would have to be committed to a contract or dedicated purpose by the applicable obligation deadline but could be spent down over 18 months rather than the current 120-day liquidation timeline. ED granted an extension for CARES funds, but the decision was announced so late that it was of little use to state education agencies (SEAs) and local education agencies (LEAs). State departments of education and industry groups have urged ED to grant subsequent extensions with more lead time for districts to prepare.

Exhibit 1: Education Stimulus Funding Spend by Relief Package

We expect that the department will acquiesce to the extension requests, particularly as more alarming evidence emerges about the effect of school shutdowns and remote instruction on student learning outcomes. If extensions are granted, as Capstone believes likely, LEAs will be able to spend CRRSAA funds through early 2025 and ARP funds through early 2026. Data on the use of education stimulus funds, particularly across CARES and CRRSAA funds, are uneven. Funds were rushed to SEAs and LEAs to stabilize instruction, and systems of reporting were not well-developed.

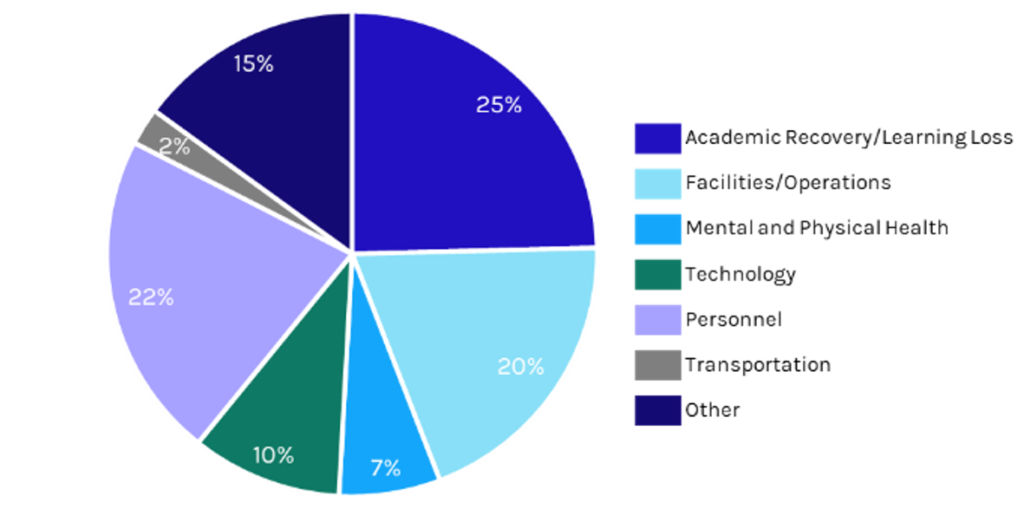

Exhibit 2: Average Planned Spending of ARP Education Stimulus Funds

However, to receive ARP funds, state and local education agencies were required to develop public plans on the uses of allocated funds. Capstone has reviewed those plans and found that proposed funds uses are largely homogenous (see Exhibit 2). Districts are investing heavily in addressing learning loss (20% of ARP funds required to address learning loss) and new facilities or improvements to them and spending heavily on teacher salaries and recruitment, as well as digital infrastructure, software, and devices.

Conversations with districts, state education officials, and industry associations indicate that spending for remaining funds is steady, though districts are beginning to refocus spending decisions to better address learning loss, respond to acute teacher shortages, and prepare for an eventual “funding cliff” as stimulus funds are depleted and enrollment trends potentially reduce state education funding.

Districts continue to invest heavily to try to accelerate learning from students whose academic progress was slowed by the pandemic and resulting interruptions in instruction. After-school programs, tutoring investments, and summer school are the primary tools that are being employed to address learning loss. There is, however, an increased focus by districts on improved teacher training, more expansive use of data to better target classroom instruction, and the use of more effective assessment tools to benchmark student achievement.

As districts invest stimulus dollars, they also are closely monitoring their long-term financial stability and ongoing staffing concerns. Industry pundits have also discussed a so-called fiscal cliff for schools when the temporary stimulus funds are exhausted. Concerns about the fiscal cliff have been amplified as school enrollment has not rebounded to pre-pandemic levels and the possibility of economic recession looms.

To shore up long-term stability, some states are encouraging districts to use stimulus funds for ongoing operating expenses and push forward traditional operating funds into future years. States typically require districts to maintain a funding reserve and some are now asking states to push traditional revenues into 2025 and 2026 to smooth over a funding decline. Districts are also dealing with acute teacher shortages, heightened administrative turnover, and a threat of recession which may result in state education spending reductions. Capstone will continue to monitor the impact of the stimulus funding for districts, spending patterns, and the uncertain fiscal outlook for K-12 throughout 2023.

Renewed Federal Push for School Choice and Early Implications of Carson v. Makin

After more than a dozen states significantly expanded their “school choice” offerings, 2021 was dubbed “the year of choice” among proponents. In 2023, as the House of Representatives changes hands, Capstone expects a renewed push for federal legislation to expand funding for school choice initiatives. While the composition and leadership of the House Education & Labor Committee is undecided—Representative Virginia Foxx (R-NC) is expected to resume leadership of the committee—school choice legislation promises to be a key priority.

Establishing new schools or increasing funding will amplify the buying power of private and charter schools, making them a more attractive market for vendors.

A number of legislative proposals that expand school choice offerings have been proposed in recent years, and Capstone expects Republicans to coalesce behind support of the Educational Choice for Children Act (ECCA). The proposed legislation would create a tax credit for individuals and corporations that make charitable donations to not-for-profit scholarship granting organizations. More specifically, the bill would amend the Internal Revenue Code (IRC) to provide up to $10 billion in tax credits. Annual credits for individuals would be limited to 10% of adjusted gross income not to exceed $2,000 and credits for corporations would be capped at 5% of taxable income. Eligible scholarship granting organizations would have to be nonprofits that provide education scholarships for students whose household income does not exceed 300% of the median income in the relevant geography.

The American Enterprise Institute estimates that the ECCA would provide scholarships for up to 2 million students annually with average scholarships of $5,000 and almost immediately triple the number of students participating in school choice programs. While the proposal expands school choice—a key Republican education priority—and limits the role of the federal government in determining an allocation of funds, another key tenet of Republican education policy, Capstone expects the proposal will meet stiff opposition from Democrats in the Senate.

In addition to school choice expansion, Capstone will be closely observing the ripple effects of the Supreme Court’s recent Carson v. Makin decision. Maine’s constitution requires that towns provide a free public education for children, but many of the state’s school districts do not run a middle or high school. To account for that, the state allows local districts to contract with neighboring districts or pay tuition at a public or private school of the parent’s choosing provided that the private school is nonsectarian.

In the June decision, the Supreme Court ruled that Maine’s prohibition on public tuition payments to sectarian, or explicitly religious, institutions was unconstitutional. The high court relied heavily on the recent Trinity Lutheran v. Comer and Espinoza v. Montana Department of Revenue cases in which the Supreme Court determined that the denial of broad-based state funds to religious organizations based purely on their religious affiliation violated the Free Exercise Clause of the Constitution. Advocates for school choice and religious education argue that Carson could severely limit the future use of so-called Blaine Amendments, which prevent public funding for private, religious schools in more than 30 states.

Some states could take steps to extend existing tuition aid or choice programs to sectarian schools. In Oklahoma, Attorney General John O’Connor (R) issued a legal memo indicating that the state’s prohibition on public funding for religiously affiliated charter schools is likely unconstitutional in light of the Carson decision. His memo was issued in response to a question from the state’s virtual charter school board about nonsectarian funding requirements after the Archdiocese of Oklahoma City informed the board of its plan to launch a virtual charter school. Notably, the AG’s 15-page legal opinion concludes that religiously affiliated charter schools should not only be allowed to receive public funds, but also operate their schools and provide instruction “in accordance with their faith.” While Oklahoma is the first state to formally apply the Carson decision and adjust state policy to accommodate publicly funding religious charter schools, other states with similar political profiles may follow suit.

Some states could extend existing tuition aid or choice programs to sectarian schools.

The federal push for school choice, state-level school choice advocacy, and the Carson decision could expand the school choice landscape with potentially significant impacts for industry participants. First, significant state-level expansions of school choice have the potential to divert some funding from public schools, constraining K-12 budgets and contributing to greater fragmentation of the buyer market. However, establishing new schools or increasing funding will amplify the buying power of private and charter schools, making them a more attractive market for vendors even as the impact of stimulus funds for non-public schools wanes.

Key Themes in Higher Education

Capstone believes the Department of Education and the Biden administration will continue to scrutinize for-profit institutions and take steps to more closely regulate receipt of Title IV financial aid funds. We expect a host of rules to be issued or go into effect in 2023 that will increase institutions’ Title IV responsibilities to participate in federal student lending programs. Additionally, we expect the Supreme Court to rule on the constitutionality of the Biden administration’s student debt relief plan sometime during the early summer.

Gainful Employment Rules

During the past decade, the Department of Education has vacillated between a “gainful employment” rule, depending on the party in control of the White House and ED. Under the Obama administration, the Department of Education wrote a gainful employment (GE) rule, which was finalized in 2014, that established a debt-to-earning (D/E) metric to measure gainful employment, a previously undefined requirement of vocational training programs at all institution types and programs at all for-profits to provide under the amended Higher Education Act (HEA) of 1935. In 2019, then-Education Secretary Betsy DeVos (R) rescinded that rule.

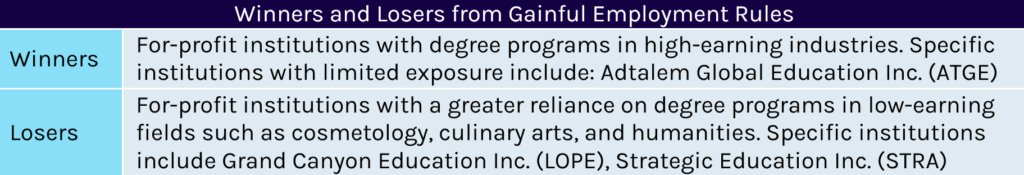

Data from the Obama administration’s GE rules suggest a large number of certificate and degree programs could be at risk of losing their Title IV eligibility.

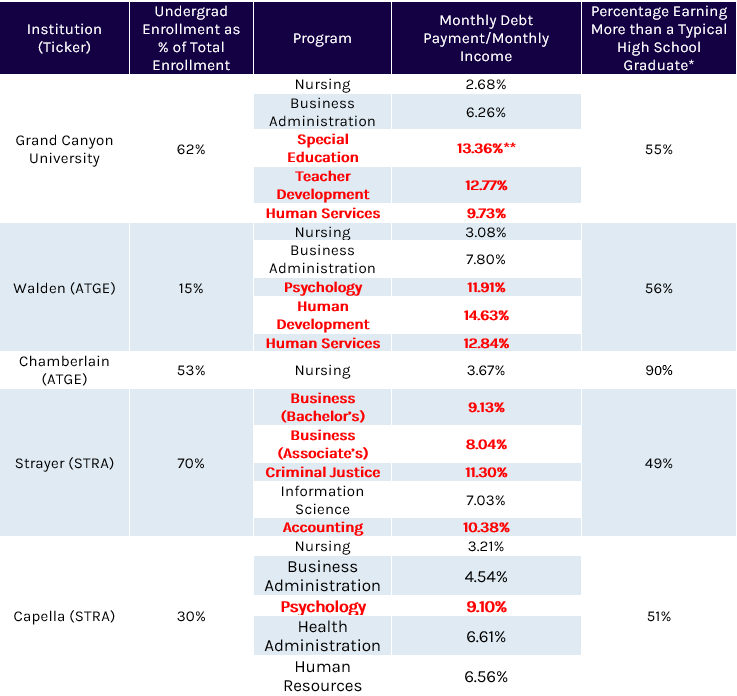

Capstone expects the Biden administration will release a rule in Q2 2023 that largely resembles the Obama era gainful employment rules. We expect that certificate and degree programs at for-profit colleges will be deemed compliant with the GE rule if an average student’s annual debt payments are less than 8% of their total income or 20% of their discretionary income (defined as income above 150% of the poverty line). Programs with annual debt payments of 8%–12% of total income and 20%–30% of discretionary income will be considered “in the zone” and allowed four years to improve before Title IV funding is rescinded. Finally, programs whose students’ annual debt payments exceed 12% of total income and 30% of discretionary income would fail, and those out of compliance for both the debt-to-earnings ratio and discretionary income ratio metrics for two years in a three-year period would lose access to Title IV funding

The rule is also expected to include an additional test to determine continued Title IV eligibility. A new earnings threshold test would compare the incomes of program graduates to high school graduates. If the median annual earnings for graduates from certificate or degree programs do not exceed the annual earnings for a working adult ages 25–34 with only a high school diploma, then the program would fail the gainful employment test. Failure in two of any three consecutive years on the new earnings threshold would make a program ineligible for Title IV funds.

A review of data from the Obama administration’s GE rules suggests that a large number of certificate and degree programs could be at risk of losing their Title IV eligibility. Per the 2017 data, 23% of covered programs would have either failed or been in the “warning zone” of the Obama-era rule. A March 2022 issue paper outlining the possible contours of a new GE rule maintains the original D/E criteria and adds another layer of comparison through absolute earnings, and we expect a new rule will result in similar metrics for institutions.

Among publicly traded companies, Capstone believes Strategic Education and Grand Canyon Education (given its reliance on Grand Canyon University) face the greatest risk under a new rule (see Exhibit 3). Meanwhile, Adtalem appears slightly better positioned, given that graduates of Chamberlain University’s largest program, nursing, have an average D/E ratio well below the warning zone entry threshold of 8%, and earnings far exceed that of a typical high school graduate. Under the previous rule, cosmetology programs, culinary certificates, and medical assistant programs fared poorly and will likely perform similarly under the reproposed rules.

Exhibit 3: Compliance with 2014 Gainful Employment Rule of For-Profits’ Largest Programs

*Calculated as the share of individuals who received federal student aid, were working, and were not enrolled in school that earned more than the typical high school graduate six years after entering college.

**Red indicates the program will either fail or fall into the warning zone of the 2014 gainful employment rule.

As the rule will be released in 2023, the earliest the rule can go into effect will be July 1, 2024, though penalties for institutions that are out of compliance will likely not be assessed until 2027 or beyond. Notably, any change in control of the White House and Department of Education could result in another recission of proposed GE rules.

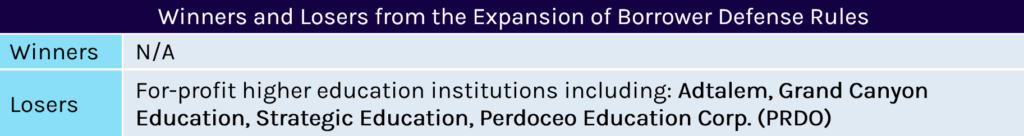

Borrower Defense Rules Expanded, Exposure to Recovery Proceedings Increased

In late-October 2022, the Department finalized a “borrower defense to repayment” rule, significantly expanding the existing grounds on which borrowers could seek to have their student loans discharged. Borrower defense regulations generally allow borrowers to seek loan discharge and partial or full repayment considering alleged wrongful conduct by schools they have attended. The finalized rules make a number of important changes to the borrower defense eligibility and lower the burden of proof for students who believe they were misled by their school or university. Under the finalized rule, borrower defense claims can be based on a substantial misrepresentation from the university, an omission of fact, a breach of contract, aggressive or deceptive recruitment, or federal or state judgement against an institution. While some of those justifications were present in the previous rule, the revision expands the definition of “misrepresentation” and the range of recruitment tactics that could trigger a viable borrower defense claim.

The new rule also signals a more aggressive stance from the Department of Education toward recovery proceedings against institutions with a significant volume of loans discharged under borrower defense proceedings. The rule indicates that adjudication of borrower defense claims will be separate from recovery proceedings but administration officials have indicated that they plan to try to recoup the cost of discharged loans from institutions. ED has initiated recovery proceedings against DeVry University, seeking to recoup $23 million in loans discharged under borrower defense settlement that wiped away $415 million in debt for 1,800 borrowers based on alleged misrepresentations to borrowers from 2008–2015. DeVry has countersued the Department of Education, alleging that ED has overstepped its authority in recouping funds.

The “borrower defense to repayment rule” signals a more aggressive stance from the Department of Education.

Under the new rule—which enters effect on July 1, 2023—recovery proceedings will be based on the borrower defense (BD) rule in effect when a loan was issued. As the borrower defense threshold will be lower, Capstone believes the risk of discharge is higher than under previous BD rules and increases possible exposure to recovery proceedings. Barring a wholesale rejection of its legal authority to recoup discharged loans in the lawsuit with DeVry, we anticipate the Department of Education will adopt a more aggressive stance toward recovery proceedings as part of its broader effort to protect borrowers and limit for-profits’ aggressive recruiting and misrepresentation of student results.

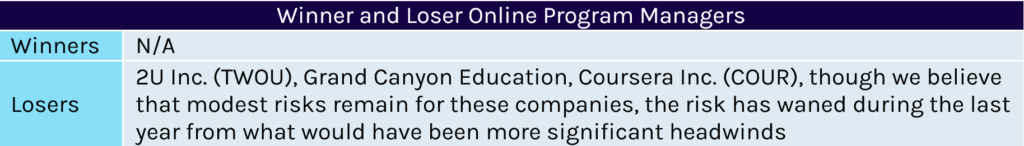

Online Program Managers and the Bundled Services Exemption Revisited

Notably, the exemption has not been codified in regulations or federal law and has faced heightened scrutiny during the last several years. Most recently, in early December 2022, five bicameral Democratic lawmakers sent a letter to Education Secretary Miguel Cardona (D) calling on the department to conduct a legal review of its bundled services exemption and its inclusion of tuition revenue-sharing arrangements, as well as review the transparency disclosure requirements to students that OPMs may be subject to.

A move to a fee-for-service model will lessen the demand for online program managers.

Despite this, we believe additional information provided through the GAO report mitigates the risk of a full recission of the incentive compensation ban exemption for OPMs. The GAO report found that approximately 90% of the colleges that were identified as working with an OPM are public or nonprofit colleges—a figure that we believe neutralizes the staunchest Democratic critics of OPMs given the lawmakers’ previous positions on ensuring nonprofit colleges can compete with for-profits. For example, amid criticism of OPMs at a Center for American Progress (CAP) event in October, Representative Bobby Scott (D-VA) remarked on the need to distinguish between “good actors” and “bad actors” in the OPM space, indicating some reluctance to a blanket rescission of the bundled services exemption for OPMs.

As legislative scrutiny continues, Capstone believes there is a 30% probability that the Department of Education will rescind its 2011 guidance on the “bundled services exemption” by eliminating tuition-sharing agreements entirely by the end of 2024. We believe a rescission of the bundled services exemption will negatively impact OPMs such as 2U and Grand Canyon Education, as well as Coursera, by requiring them to switch to a fee-for-service model, which is less optimal for universities given the large upfront costs associated with a fee-for-service model. We expect that a move to this model, which exists in the market today but is far less prevalent, will lessen the demand for OPMs in the market. Rather than a full rescission of the application of tuition-sharing agreements under the bundled services exemption 2011 guidance, we expect ED to increase guardrails on OPM agreements with educational institutions by clarifying its 2011 guidance. Capstone has assigned a 65% probability that ED clarifies its 2011 guidance by imposing limitations on online program manager tuition-sharing agreements by the end of 2024, such as by stipulating that university-OPM partnerships must switch from a tuition-sharing model to a fee-for-service model after a set period (or after certain criteria are met), imposing requirements for specific fee-for-service offerings, and/or limiting the share of revenue that OPMs can charge.

A modification of the 2011 guidance will likely pose modest headwinds to OPMs and other providers that operate predominantly through tuition-sharing agreements. Grand Canyon likely generates all of its revenue through tuition-sharing agreements, with 87% sourced from just one institution (Grand Canyon University). Meanwhile, 2U’s degree segment revenue, which is sourced directly from tuition-sharing agreements and accounts for 63% of total revenue, is most at risk from recission or modification of the 2011 guidance. A rescission or modification of the 2011 guidance would affect tuition-sharing revenue in all three segments of Coursera’s US-based operations, comprising 51% of total revenue.

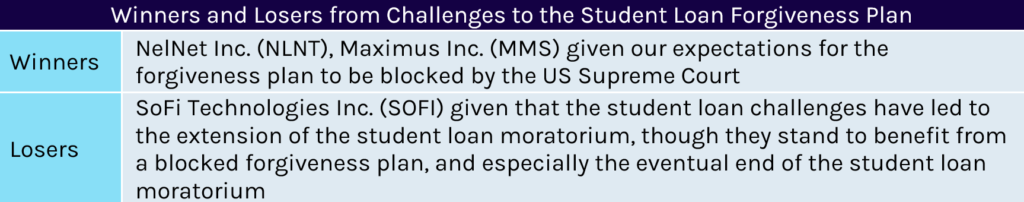

Final Decision for President Biden’s Student Loan Relief Plan

President Biden’s student loan forgiveness plan, announced in August 2022, has faced a litany of legal challenges during the past several months. The plan seeks to forgive $10,000 of student debt per borrower with income less than $125,000 ($250,000 for married couples) and $20,000O for those borrowers that received a Pell Grant, which is estimated to entirely wipe the debt of 20 million borrowers. In its legal justification of the debt relief plan, outlined in a memo in conjunction with the student debt relief announcement, the administration relies on the Higher Education Relief Opportunities for Students (HEROES) Act of 2003, which provides the secretary of education with the authority to “waive or modify” statutory or regulatory provisions applicable to Title IV financial assistance programs in connection with “war or other military operations or national emergency.” ED has made the argument that it has the authority to implement its debt relief plan under the HEROES Act to address the financial impacts of the COVID-19 pandemic.

Two cases have emerged as the most viable challenges to the forgiveness plan. On November 30th, the US Court of Appeals for the Fifth Circuit unanimously decided not to grant the White House’s request to overrule the November 10th decision by Judge Mark Pittman of the Northern District of Texas staying the program on the grounds the administration’s student debt forgiveness plan is unconstitutional, saying the administration overstepped its statutory authority under the HEROES Act to enact broad debt forgiveness. Meanwhile, on November 14th, the US Court of Appeals for the Eighth Circuit placed a preliminary injunction on the student relief plan in a case brought by six Republican state attorneys general. In separate announcements in December, the Supreme Court agreed to hear both cases in late February or early March 2023, with a decision likely around the end of June 2023.

The escalation of the cases to the Supreme Court significantly favors the challengers.

We have long viewed standing as the biggest hurdle for a successful legal challenge. Having been granted by several courts, we believe the escalation of the cases to the Supreme Court significantly favors the challengers, and we expect the student loan forgiveness plan to be blocked, especially given the adverse decisions from the Supreme Court limiting authority of the executive branch. Recent decisions on the eviction moratorium, workplace COVID-19 vaccination requirements, and expansion of the “major questions doctrine” are all indicative of the high court’s perspective on sweeping executive action.

We believe the likely blockage of the administration’s student loan forgiveness plan benefits loans servicers such as Nelnet and Maximus as the loans they service are less likely to be wiped away. Loan servicing revenue from Department of Education contracts accounted for 29% of Nelnet’s revenues in 2021. The impact for Maximus is de minimis given its diversity of operations, but still positive to the extent the forgiveness plan is blocked.

Blocking the administration’s student loan forgiveness plan benefits servicers such as Nelnet and Maximus.

Meanwhile, facing an indefinite student loan moratorium, SoFi has sharply lowered its reliance on its student lending portfolio as it has grown its personal lending business. According to SoFi’s latest filing, its personal lending segment now makes up 77% of its origination revenue, while student lending sits at 12%—drastically different from pre-pandemic when personal loans accounted for 27% compared to student loans’ 63% of origination revenue in Q1 2020. Still, the loan refinancing firm faces ongoing headwinds under the student loan moratorium, putting increasing pressure on its personal and home lending operations into the new year to recover additional student lending revenue losses for at least H1 2023. In conjunction with its student loan forgiveness announcement in August, the White House initially declared the student loan moratorium extension through the end of 2022 to be the final extension. However, as legal challenges mounted, the White House announced an additional extension through the end of June 2023, which we believe will coincide with a decision from the Supreme Court.

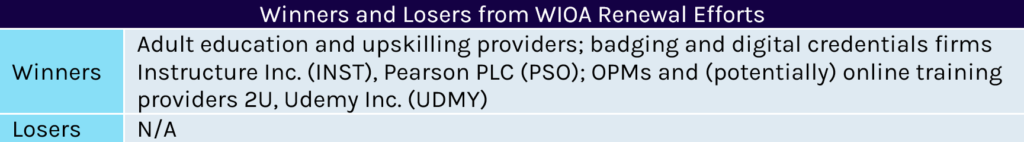

Key Themes in Workforce Development and Training

The WIOA is the primary federal workforce development program. Passed in 2014, the law aims to centralize and coordinate federally funded workforce training and career services. In May 2022, a WIOA reauthorization bill, H.R. 7309, passed the Democrat-controlled House of Representatives on a near party-line vote. The bill was not advanced in the Senate.

We expect the House Education & Labor Committee will renew efforts to reauthorize the federal workforce development program.

Capstone expects that the Republican-controlled House Education & Labor Committee will renew efforts in 2023 to reauthorize WIOA though we expect any Republican-backed legislation to differ significantly from H.R. 7309. Like their progressive colleagues, House conservatives support some expansion of funding for workforce training and development but have voiced displeasure with some of the implementing features of the current legislation. In particular, we expect that Republicans will try to reduce the amount of funding that helps support one-stop centers, workforce information and education offices that centralize delivery of career services. Representative Virginia Foxx (R-NC) has also expressed a desire to expand funding available for individualized training accounts, fund employer-based reskilling and upskilling, and expand opportunities for distance and online worker training. While there are partisan hurdles to WIOA reauthorization, broad agreement on the need for expanded workforce training supports provides a basic performance for compromise in 2023.

Any expansion of federal funding for worker training, as well as ongoing efforts to better support training of the labor force, will provide ongoing tailwinds for training providers in the medium and long term. Capstone expects that providers that partner with employers to deliver training or curriculum and firms that facilitate credentialing and badging solutions will likely benefit from increased workforce development spending.

Legislative Push for Short-Term Pell Grants

Currently, Pell Grant eligibility certificate or training programs are limited to individuals enrolled in programs that are at least 15 weeks and require 600 clock hours (16 semester hours). Low-income participants in shorter-term training programs are not eligible to receive Pell Grant support. However, there is bipartisan support to develop a short-term Pell Grant program to facilitate greater participation in limited duration training programs for low-income workers.

The creation of a short-term Pell Grant program nearly became a reality in 2022. The America COMPETES Act, which passed the House in spring 2022, included an amendment that would have created a short-term Pell Grant program. Notably, the program envisioned in the COMPETES Act would have excluded online and for-profit providers from program participation—features that drew significant opposition from conservatives. The short-term Pell Grant program proposal was dropped from the legislative package that became CHIPS Plus during conferencing between the House and Senate.

Capstone believes there will be attempts in 2023 to revive short-term Pell Grant proposals, but partisan differences in program structure and eligibility will have to be resolved. Quality assurance measures for participating programs and the eligibility of online and for-profit providers are sticking points between Democrats and Republicans. As with WIOA, Capstone believes the broad bipartisan support for Pell Grant expansion provides an opening for compromise on program details. Any creation of a short-term Pell program, particularly one that includes for-profit and online providers, would provide significant opportunities for investor backed Title IV businesses to expand short duration distance and in-person training programs.