October 16, 2023

By Matt Wiederrecht, Capstone’s Head of Special Situations

This year the US has set another grizzly record— a record no one wants, but one we believe companies and investors will have to continue to get used to.

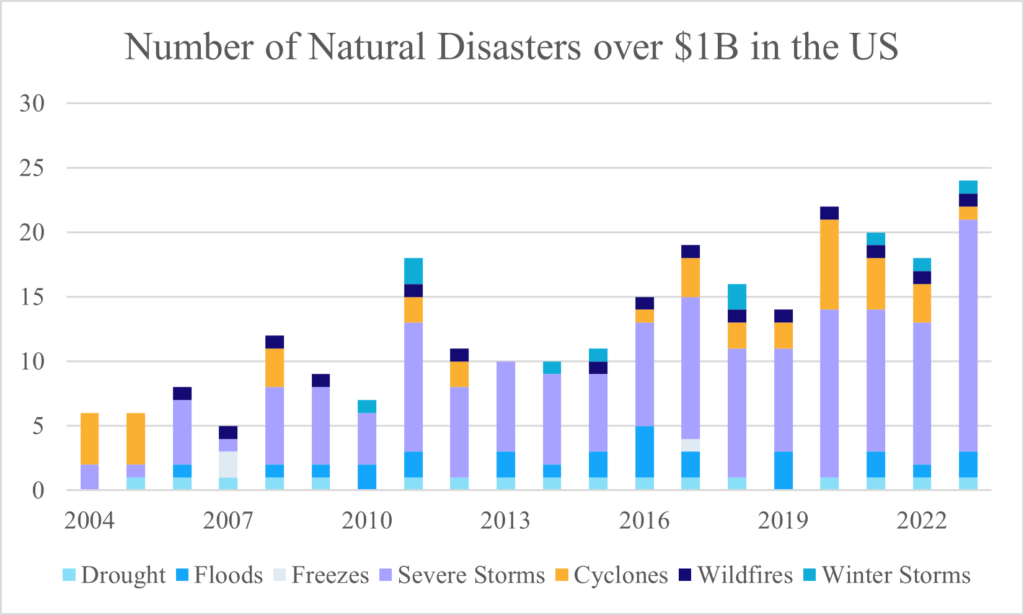

In 2023 America experienced 24 enormous natural disasters that have caused damage of more than $1 billion each time, setting a record for the number of major disasters experienced with this price tag.

From floods, fires, and extreme cold, the human toll of natural disasters has been profound, and incalculable. For businesses and investors, the staggering losses will only get costlier, with impacts on business, supply chains, and whole economies, and implications that can linger for years.

For businesses and investors, the staggering losses will only get costlier, with impacts on business, supply chains, and whole economies, and implications that can linger for years.

When the waters recede, and the embers die down, over the last few decades, we’ve been left with a substantial increase within the US in the number of natural disasters causing $1 billion or more in economic damage. Those staggering losses have only gotten costlier. Between 1980 and 2007, the US experienced only an average of six large disasters annually. Since then, not a year has passed without the US experiencing at least 10 of these $1 billion-plus natural disasters. The average cost of all major disasters experienced in a given year routinely exceeds $100 billion annually.

At Capstone, we expect natural disasters to continue to reveal new risks and spur transformative policy decisions. The impact of these disasters and the resulting policy decision-making is felt on the damage and recovery side and by what we see as a rapidly growing resilience economy with new products and services aimed at increasing societal and economic defenses against climate change.

This increase in the frequency and intensity of major weather events is clearly a function of climate change. As the Earth warms, that increases the likelihood that extreme weather events that cause natural disasters will occur. Warmer global temperatures inevitably lead to more extreme droughts in drought-prone areas, more moisture in clouds, more intense storms that often lead to flooding, and warmer ocean temperatures fuel more intense tropical cyclones. This greater intensity in weather extremes helps explain why large natural disasters are becoming more frequent and destructive.

Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters

Policymakers at the federal, state, and local levels are acutely aware of how the increasing severity and frequency of weather-related events are impacting communities. As such, they are not sitting idly by. They are increasingly adopting policies explicitly designed to either help reverse the effects of or deal with the increased risk associated with climate change. Policymakers are also heavily involved in both responding to natural disasters like wildfires and floods as well as being involved in post-disaster cleanup and mitigation efforts.

Natural disasters pose a significant risk given how they often can result in massive unforeseen and uncompensated costs for companies and state and local governments. These events can trigger ratings downgrades for bond issuers, the destruction of critical infrastructure, and a disruption to the local economy while also simultaneously being a potential opportunity for firms that take advantage of the influx of public and private capital that flows into affected communities to help fund recovery efforts.

That said, Capstone believes the risks and opportunities associated with policy developments related to climate change and extreme weather events are poorly understood. This is an extremely dynamic and complicated area of public policy that often involves multiple agencies and layers of government with overlapping areas of authority and complex regulatory regimes. If public funding is available, it is often not easy to access. Helping clients better understand these complexities in how government is responding to climate change across different states and agencies is where Capstone comes in.

Capstone believes the risks and opportunities associated with policy developments related to climate change and extreme weather events are poorly understood.

Much of Capstone’s work across our policy verticals has involved either helping investors better understand exactly how these policy responses will impact their investments or helping our clients find ways to take advantage of these policy developments to support their expansion into new products and services like weather intelligence services, carbon monitoring and verification, mission-critical wireless networks for critical infrastructure providers and first responders. A few examples we would highlight are as follows:

- Assisting PG&E investors in understanding how California would respond to the wildfires that drove the company into bankruptcy in 2019 and what steps the state would take to help facilitate PG&E’s emergence from Chapter 11 as a going concern.

- Advise clients across our private equity and capital markets client base on Puerto Rico’s recovery from back-to-back Category 5 hurricanes in 2017 and what impact federal recovery funding would have both on Puerto Rico’s economic recovery and complex debt restructuring process.

- Create a strategy for a client looking to invest in wildfire detection and risk analysis tools as to how to position better the company to engage with policymakers and develop a viable commercial product for use by federal, state, and local agencies tasked with preventing and suppressing wildfires.

- Advise clients on rate base growth opportunities for regulated utilities with respect to investments in grid hardening and resilience investments and policy responses from state legislatures and regulators to blackouts caused by severe weather events like Winter Storm Uri in Texas and Hurricane Ida which badly damaged power lines around New Orleans.

We have increasingly found our corporate and investor clients have needed help in better understanding both the risks and opportunities associated with how policymakers respond to natural disasters and climate change. Capstone will continue to closely follow these policy developments across all levels of government on a firm-wide basis as we have found that when an issue like climate change is dealt with in a “whole of government” manner, no sector of the economy is not in some way impacted by these sorts of policy developments.

Matt Wiederrecht, Capstone’s Head of Special Situations

Read more from Matt:

The Coming Thaw at the FCC

The Growing Disaster Resilience and Recovery Economy

2023 State & Local Government Preview

Read Matt’s bio here.