By Matt Wiederrecht and Elena McGovern

March 28, 2023 – The phrase “atmospheric river” is quickly becoming a household term among Americans this year, joining the likes of “bomb cyclone” and “polar vortex.” These and other extreme weather events, as well as (the more routinely named but no less serious) hurricanes, are becoming more frequent, more intense, more deadly, and—a key focus of Capstone’s work—more costly. And as the Intergovernmental Panel on Climate Change’s report released this week states, the Earth is going to pass that oft-warned 1.5 degree Celsius threshold for global average temperatures above preindustrial levels in the first half of the 2030s, and the “projected long-term impacts are up to multiple times higher than currently observed.”

Despite the unchartered waters we are entering, we can imagine what’s to come by remembering where we’ve been. Take hurricanes and tropical storms. The names Katrina, Sandy, Harvey, and Irma are all seared into our—and our client’s—minds. Indeed, while hurricanes and tropical storms make up less than 20% of the total number of recorded US disasters, they account for half of the total damage costs. The unfortunate reality is that the list of noteworthy extreme weather event names is only going to grow.

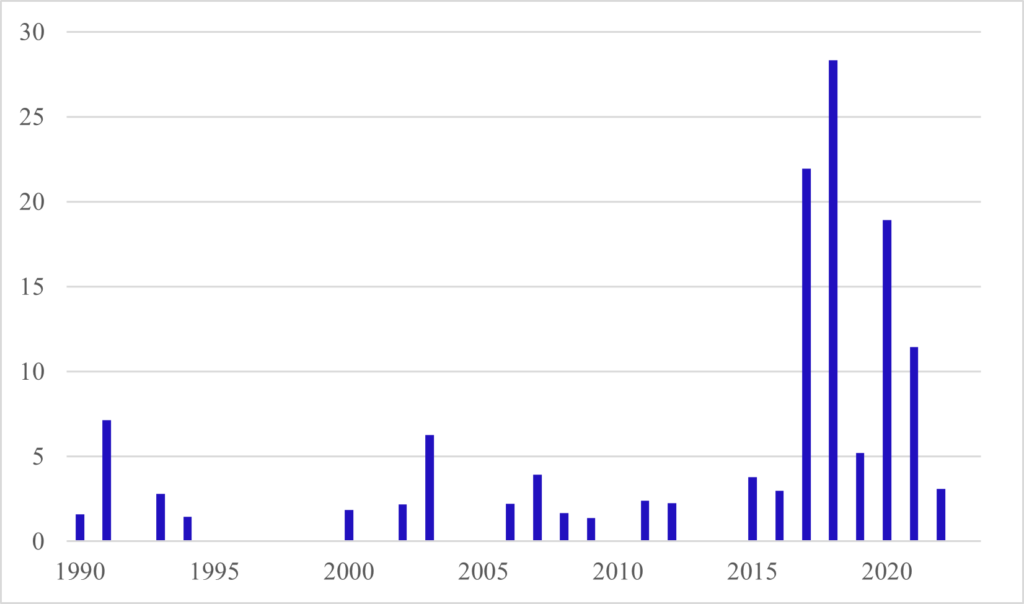

The data speaks for itself, with a clear and consistent increase in both the number of US-based disasters and the average economic toll of each event. Between 1980 and 2022, data from the National Oceanographic and Atmospheric Administration (NOAA) report that the US has suffered approximately $2.5 trillion in economic damages from large natural disasters and extreme weather events. Each of these “large” individual event caused at least $1 billion in damage. On an inflation-adjusted basis, the average annual damages incurred by these large disasters rose from $20.5 billion in the 1980s to more than $145 billion annually by the 2020s. In terms of frequency, the US is now experiencing nearly 20 large disaster events annually. In the 1980s, it was an average of 3.1. During that same time frame, the number of deaths per year caused by large disasters grew by more than 60%.

The data speaks for itself, with a clear and consistent increase in both the number of US-based disasters and the average economic toll of each event.

But as a growing number of US citizens can attest, it’s not just the hurricanes that are wreaking havoc. Indeed, no part of the country is immune to these events, with coastal regions along the Eastern and Gulf coasts contending with hurricanes, Western states grappling with intensifying wildfires, states on the Great Plains and in the US Southwest more exposed to droughts, and states along the Mississippi river heavily exposed to major floods.

The Soaring Costs of Wildfires

1980-2022, Cost of Damages ($ billions, CPI adjusted)

Source: NOAA, Capstone analysis

Policy here matters a lot. According to the Georgetown Climate Center, 28 out of 50 states, or 56% of the country, currently lack a state-led adaptation plan. Capstone believes that local-level adaptation and resiliency planning is even far less comprehensive. And data gaps are endemic, with a significant percentage of the policy, regulations, standards, and codes for the US-built environment based upon certain assumptions regarding 100-year flood events, average temperatures, and average rainfalls that are increasingly outmatched by record-breaking weather and climate outcomes. The US federal government is stepping up, including through programs like FEMA’s Building Resilient Infrastructure and Communities (BRIC) program, which invests in pre-disaster mitigation. States and localities are doing the same, including investing in sea walls and flood protection, updating building codes, and the like. But way more needs to be done, across the entire country and at all levels of government.

At Capstone, we see investments in adaptation, mitigation, and resiliency becoming an economic imperative, and therefore creating opportunities for industries capable of mapping and modeling, building, and innovating across the range of products and services in the climate resilience and disaster management space. Companies that are focused on helping recover faster and rebuild stronger are also going to be increasingly in demand.

At Capstone, we see investments in adaptation, mitigation, and resiliency… creating opportunities for industries… in the climate resilience and disaster management space.

Capstone has extensive experience in this space and has worked with our investor and corporate clients to better understand both the risks and opportunities these large natural disasters present. Some of our engagements include:

- Developing a marketing and product strategy for federal, state, and local governments as well as commercial customers to use AI to support disaster prediction, response, and recovery efforts.

- Disentangling the complicated web of overlapping areas of responsibility for dealing with natural disasters across federal, state, and local governments and how the private sector can navigate this network of stakeholders.

- Understanding the flow of federal and state funding related to natural disasters and how these funds can be accessed by public sector agencies and lead to business opportunities for our investor and corporate client base.

- Advising clients on post-disaster policy reforms by public utility commissions or state governments like those adopted in the wake of the 2018 wildfires in California and Winter Storm Uri in 2021.

- How large one-time influxes of federal funding for disaster recovery and reconstruction efforts impact both state and local budgets as well as economic activity.

Finding the opportunity to play a role in safeguarding the future will mean navigating the murky regulatory and policy waters that abound. Investing and building in these spaces requires comprehensive policy and regulatory diligence, particularly as shifting regulatory requirements over time will create unique opportunities for the prepared investor.

Elena McGovern, Head of Private Markets and Co-Head of National Security Practice

Read more from Elena:

Outlook for US Outbound Investment Restrictions

The Coming Scrutiny of Overseas Investment

The $900 Billion State and Local Government Opportunity

Read Elena’s bio here.

Matt Wiederrecht, Head of Special Situations

Read more from Matt:

Uncovering Risks for State and Local Governments

US Telecommunications 2023 Preview

Navigating The Coming Distressed Debt Moment

Read Matt’s bio here.