Nothing lasts forever—a sentiment the bond market is in the process of relearning as bond yields and borrowing costs start to rise.

Since the financial crisis, low-interest rates have been two sides of the same coin for companies and investors. For CFOs the story has played out in cheap borrowing costs, more forgiving debt covenants, and seemingly endless liquidity. For yield-starved investors that has meant accepting lower returns on worse terms, and facing tougher and tougher competition to lock those lower returns in.

It’s not a revelation to say corporations got the better of that deal. Even the riskiest borrowers enjoyed low-interest rates and easy access to credit. But the rules are changing—a change we believe will feature squeezed profits and more expensive, debt, offering more risk and more opportunity. Economic conditions are causing those dynamics to change fast, especially in “distressed” debt, which typically yields ten percentage points or more over Treasuries. But an underappreciated dynamic will also be the interplay of policy and regulatory risk on companies that are suddenly having to deal with these tougher conditions.

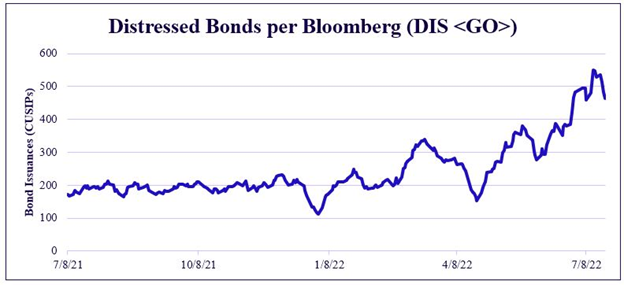

With increased inflation and greater economic uncertainty comes increased turbulence in both the equity and credit markets. As such the US corporate fixed income market has seen the number of distressed bond issuances more than triple from 131 to 464 since the beginning of the year, according to Bloomberg. The total aggregate amount of distressed corporate bonds trading in the US bond market has risen to approximately than $300 billion—and this doesn’t even include distressed corporate loans, busted convertible bonds, or distressed municipal bonds.

As this new chapter unfolds, we expect this list of distressed bond issuers to grow. And we believe policy and regulatory dynamics will play an even bigger role in separating the winners from the losers in both the C-Suite and among investors. Many of these distressed securities trade at these distressed levels not only because of economic headwinds but also because of policy-related issues that have the potential to have a significant impact on the ability of the company to pay its debt obligations and creditor recoveries should the company be forced to file for bankruptcy.

The distressed bond list features several issuers affected by a diverse mix of economic and policy-related issues that we believe investors should be following across a number of sectors we follow, including:

- Community Health Systems Inc. (CHS) and Envision Healthcare (EVHC): policy drivers center around legislative and regulatory changes related to Medicare, Medicaid, and the Affordable Care Act, CMS fee schedules and reimbursement rates, and the No Surprises Act

- Curo Group Holdings Corp.: We are monitoring risk related to federal and state regulations on payday loans in the US and potentially lower national interest rate limit in Canada

- DISH DBS Corp. (DISH): policy catalysts include the 12 GHz proceeding, potential merger with DirectTV, and if DISH Network Corp. (DISH) successfully meets its 5G network buildout requirements

- Endo/Par Pharmaceutical Inc. and Rite Aid Corporation: How will the ultimate cost of resolving opioid litigation related liabilities these companies face play out?

- Freedom Mortgage Corp: policy risks associated with CFPB rulemakings and investigations in the mortgage servicing sector; Additional regulatory headwinds from FHFA’s recently proposed enhanced Servicer Eligibility Requirements

- Ligado Networks LLC: the primary risk involves the ongoing dispute between Ligado/FCC and federal agencies like the Department of Defense related to harmful interference concerns with respect to Global Positioning System receivers

- Transocean Inc. (RIG): the forward-looking outlook for federal offshore leasing activity is a significant policy-related risk for the company

Capstone’s coverage of how policy impacts the distressed market has gone well beyond corporate bonds and includes both less liquid corporate loans, distressed municipal bonds, and post-reorg equities, including the near decade-long fiscal crisis experienced by Puerto Rico and the subsequent restructuring of over $70 billion in indebtedness as well as PG&E’s wildfire woes.

As we enter this new chapter of higher interest rates Chief financial officers and investors alike will have their work cut out for them. The turbulent economy and soaring inflation alone make it far trickier. Understanding the policy dynamics and regulatory uncertainty at play will be critical in navigating the troubled waters ahead.

ABOUT THE AUTHOR

Matt Wiederrecht

Director, Special Situations

Read more from Matt:

The Looming State and Local Government Inflation Hangover

The $900 Billion State and Local Government Opportunity

Telecom 2022 Policy Preview

What the Infrastructure Bill Means for Netflix, Google, and Other Internet Service Providers