By: Josh Price, Capstone Energy Analyst

February 12, 2023 – Whether developing market-entry strategies for corporate clean energy clients, conducting due diligence on renewable platforms for private equity clients, or analyzing publicly traded renewable companies for hedge fund clients, a common question has emerged following the passage of the Inflation Reduction Act (IRA):

While the IRA tax credits are a clear positive for the renewable industry, when should we expect the existing constraints facing renewable development to ease up, if ever?

The shortlist of the most-discussed constraints generally includes: 1) the potential lack of demand for newly-transferable renewable tax credits, 2) significant grid interconnection queue backlogs, and 3) concerns over shifting supply chains. Capstone does not expect these issues to be resolved overnight; however, we see several policy and market developments over the next 2-3 years that will likely remove—or at least mitigate—major bottlenecks facing renewable development today.

Several policy and market developments over the next 2-3 years will likely remove—or at least mitigate—major bottlenecks facing renewable development today.

Starting with the positives, the IRA provided an estimated ~$330 billion over 10 years in clean energy tax credits across several technologies, including wind, solar, and storage projects and domestic clean energy manufacturing. The bill also provided an option outside of tax equity for project developers with limited or non-existent tax liabilities to monetize their credits by transferring (selling) the credits to entities with income tax liabilities.

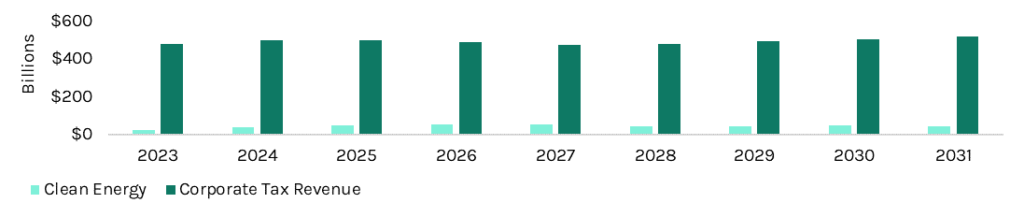

This new transferability provision leads to our first potential constraint: what if there isn’t sufficient demand for the upcoming flood of tax credits generated under the IRA, leading to steep discounts? First, even if only a subset of companies with tax liabilities participate in this new market, we still expect ample demand for credits given the significant delta between projected costs of clean energy provisions and corporate tax revenue. Based on estimates from the Congressional Budget Office (CBO) and the University of Pennsylvania, from 2022-2031 the annual cost of the IRA’s clean energy provisions will vary between $20.5-$53.1 billion/year (credit supply) while corporate tax revenue (potential credit demand)—including the new 15% Alternative Minimum Tax—will fluctuate between $475-$520 billion/year.

Projected Cost of IRA Clean Energy Provisions vs. Corporate Tax Revenue, 2023-2031

Source: Capstone analysis, Congressional Budget Office, Penn Wharton

Second, while the market for transferable tax credits is novel in the context of renewable energy, similar models at the state level—including for tax breaks tied to film production—have existed for decades. We have no doubt that sophisticated bankers, lawyers, and tax strategists will establish a similar market for new tax credits by 2025 once the IRA is fully implemented, leading to price discovery and associated discounts based on the risk profile of projects (e.g., well-established, utility-scale solar vs. nascent offshore wind) and credit structure (e.g., cost-based, forward-looking investment tax credits vs. generation-based, backward-looking production tax credits).

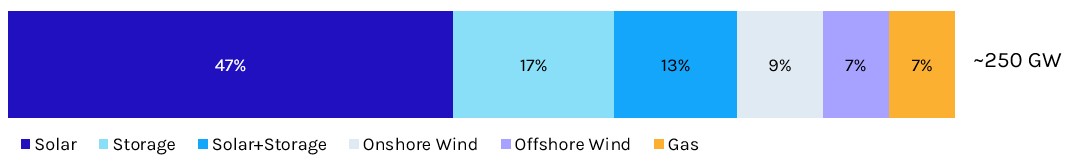

Project delays or cancellations due to long interconnection timelines and/or stunningly high network upgrade costs are another pain point for renewable energy developers and investors. However, unlike the uncertainty concerning the outlook for new tax credit markets, the interconnected-related frustrations are driven by years of lived-experience and disappointment. For example, PJM has roughly 250 GW of active projects pending in its queue, almost 80% of which is solar, standalone storage, or solar-plus-storage. This backlog represents 65 GW more than total installed capacity in PJM (185 GW). While only ~10% of these projects will likely enter service, PJM’s queue demonstrates the scale of the issue facing developers. The introduction of the IRA’s $3/kg hydrogen tax credit this year will further exacerbate these issues by spurring additional demand for renewable power to feed electrolyzers.

Active Projects in PJM’s Interconnection Queue by Resource Type

Source: Capstone analysis, PJM interconnection

Capstone believes upcoming action by the Federal Energy Regulatory Commission (FERC) to reform interconnection procedures across the US will help alleviate long queues once fully implemented in 2025. The proposed rule would require transmission providers to study grid impacts and allocate upgrade costs among clusters of projects, rather than the existing project-by-project models used in most Regional Transmission Organizations (RTOs). Additionally, the proposal would increase readiness deposits to weed-out speculative projects and potentially impose deadlines on interconnection studies. We expect FERC will act on this proposal by mid-2023, likely providing ~18 months for RTOs to submit compliance filings, FERC to act on the compliance filings, and begin implementation.

Of the three constraints facing renewable development discussed in this commentary, we believe supply chain issues—namely, accelerated decoupling from China and increased focus on labor conditions—are the hardest to address. While tariffs have all but shut the door on solar cell and module imports from China, 53% of imported structural aluminum for panel assembly came from China in 2022. It’s a similar story for other clean energy technologies—54% of imported lithium-ion batteries and related parts, and 22% of imported gearboxes for wind turbines came from China in 2022. We believe batteries, in particular, could be in the crosshairs as the Biden administration re-evaluates tariffs on Chinese products put in place by the Trump administration. Additionally, increased policymaker focus on human rights issues in China and the Democratic Republic of the Congo (DRC)—evidenced by a recent hearing in the House Natural Resources Committee—raises the specter of further action to restrict imports.

Of the three constraints facing renewable development discussed in this commentary, we believe supply chain issues—namely, accelerated decoupling from China and increased focus on labor conditions—are the hardest to address.

While there is no simple fix to supply chain disruptions caused by tariffs, forced labor laws, or lingering impacts from COVID-19, we believe the steady ramp in US manufacturing capacity for solar modules, batteries, and wind components will mitigate increased scrutiny and constraints on foreign imports. Since the passage of the IRA—which included billions in direct subsidies for domestic clean energy manufacturing—companies have announced nearly $90 billion in new investments in clean energy projects, including dozens of new manufacturing facilities.

Over the next 2-3 years, we believe the combination of supply- and demand-side incentives in the IRA for domestic manufacturing will help alleviate supply chain-related issues. Capstone remains optimistic about the outlook for renewable development despite existing and potential headwinds. On tax credit uncertainty, we believe there will be sufficient appetite from corporate buyers for transferable IRA tax credits, given the significant delta between estimated credit generation and the universe of potential demand. On interconnection issues, we believe FERC will act in the coming months to reform queue procedures, cost allocation, and impact studies, helping clear the backlog of existing projects while facilitating new entrants in 2025. Finally, we believe the flood of investment in domestic clean energy manufacturing capacity will mitigate supply chain issues for renewable development.

Josh Price, Capstone Energy Analyst

Read more from Josh:

The Taming of FERC’s Ambitious Climate Goals

No Easy Button: Why Natural Gas Infrastructure Has to Get Done the Hard Way

Energy & Industrials 2022 Policy Preview

The Coming Second Life of Pipelines in a Decarbonized World

Read Josh’s bio here