Decarbonization was never going to be easy.

In the last six months, Joe Biden and climate-focused US policymakers have been subjected to a crash course on all the ways it can go wrong.

At the start of 2022, we expected policymakers to pursue aggressive action to address climate change. The specter of an increasingly conservative Supreme Court and the upcoming midterm elections increased the urgency for climate action while Democrats still maintain control over Congress. However, this year to date has repeatedly poured cold water on Democrats’ most ambitious objectives.

This year to date has repeatedly poured cold water on Democrats’ most ambitious objectives.

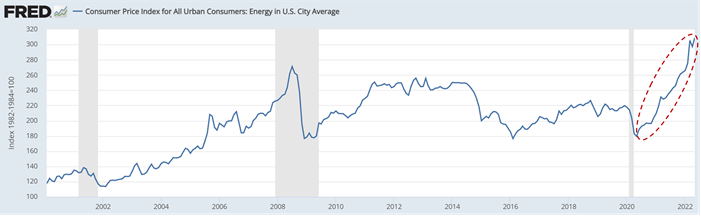

The worsening US economic backdrop— highlighted by rising energy prices, inflation, growing fears of a recession, and worsening consumer confidence—is driving the issue of energy policy to the center stage of US politics, for the first time in over a decade.

We believe the prevailing concerns over high energy prices, in addition to mounting resource adequacy challenges across several US wholesale power markets, are the types of underappreciated tensions and challenges that will remain central features on the bumpy, arduous road to decarbonization—a path that will have wide-ranging implications for investors and companies alike. The events of this year have also served as a reminder of the importance of taking a balanced, measured policy approach to the energy transition, given the real, often unappreciated, costs of pursuing net-zero ambitions.

Consumer Price Index for All Urban Consumers: Energy in US City Average, 2000-2022

With the 2022 US midterms fast approaching, one of the key challenges the Democratic party will grapple with in the months ahead is its position on energy policy—especially since losing one or both chambers of Congress would itself dampen the likelihood of establishing more aggressive climate policies.

During the first eighteen months of his tenure, Biden has made clear that his party’s number one energy policy priority has been to accelerate the transition to a far less carbon-intensive energy system; one that will facilitate the successful achievement of long-term net-zero objectives. The trajectory of Democratic energy policy has been guided first and foremost by climate change mitigation.

But the balancing act of maintaining a focus on decarbonization while also ensuring energy affordability is a hard one—the perils of which we believe are not always well understood. The challenge of winding down the supply of fossil fuels—but not so quickly before demand has adjusted accordingly—won’t go away. Relative to the aspirations of many Democratic policymakers, we anticipate that fossil fuels will continue to play a bigger role in the US energy mix for longer than most would hope.

We anticipate that fossil fuels will continue to play a bigger role in the US energy mix for longer than most would hope.

To the extent energy policies designed to reduce emissions begin to challenge economic growth, voters’ allegiances could shift to favor near-term economic security over carbon emissions reductions. Voter concern for the state of the economy remains the fulcrum constraint for policymakers seeking political longevity. The subtle shifts taking place in Biden’s energy policy highlights his administration’s awareness of this reality.

We believe as a global leader in both GDP per capita and energy usage per capita, the US is a case study on the relationship between energy consumption and human quality of life. Energy consumption is the engine that drives economic growth. In turn, the increase in per capita energy consumption over the last two centuries is largely to thank for the improvement in human living standards globally. To this day, fossil fuels—including oil, coal, and natural gas—remain the bedrock of that energy system, both here in the US and throughout the global economy.

Our energy system is underpinned by three essential criteria: availability, affordability, and reliability.

For US voters, the consumer-friendliness of the current energy system is generally taken for granted as the norm. Our energy system is underpinned by three essential criteria: availability, affordability, and reliability. Before this year, in the eyes of US voters, the inclusion of emission intensity as a fourth consideration in our energy system has not come at a direct cost to the other three attributes.

The most immediately pressing challenge facing President Biden and Democratic policymakers today is in refined product markets, where the reduction in US refining capacity—exacerbated by tight global oil and gas supply in the wake of COVID reopenings, production reductions during the pandemic, and Russia’s invasion of Ukraine— has turbocharged the rise in prices for gasoline, diesel, or other distillates. Unfortunately for Democrats, a meeting held earlier this week between US Energy Secretary Jennifer Granholm and domestic refiners highlighted that there is little in the way of feasible policy solutions to address high energy prices in the near term.

A lack of effective policy options has become a recurring theme for the Biden Administration, which in recent months has thrown a litany of policy tools at the White House wall in an attempt to address the country’s energy affordability challenges. The long list of policy proposals discussed to date includes the implementation of restrictions on crude oil and refined product exports, the suspension of gas taxes, environmental regulations, and Jones Act requirements, the reparation of foreign relations with Saudi Arabia and Venezuela, and the release of crude oil from the US Strategic Petroleum Reserve.

We believe rising price pressure will give Democrats the political narrative they need to pass a slew of legislation to support decarbonization and support for clean energy measures.

For Democrats, in the middle of these challenges, there is one silver lining: we believe rising price pressure will give Democrats the political narrative they need to pass a slew of legislation to support decarbonization and support for clean energy measures. The improving budget reconciliation outlook bodes well for the $330 billion in clean energy tax credits that the Senate Finance Committee proposed in December 2021—including the nuclear production tax credit (PTC), enhanced 45Q carbon capture credit, renewable energy tax credits, investment tax credits (ITC) for storage and transmission, clean energy manufacturing tax credits, hydrogen PTC, and clean fuel tax credits.

However, looking forward to the coming midterm elections and beyond, it seems increasingly clear that there is no policy-oriented silver bullet to address the run-up in US energy price inflation. We believe Democrats will continue struggling to alleviate the mismatch between energy demand and supply well after the upcoming Midterm elections. Even without politics and geopolitical instability, it would be difficult to get the glide path to net-zero exactly right. We don’t expect the ride to get any less bumpy, and for companies and investors alike understanding the policy dynamics at play will continue to be essential.

ABOUT THE AUTHOR

Adam Cotterill

Vice President, US Energy & Industrials

Read more about Adam here.