Capstone believes the incoming Trump administration will usher in a volatile 2025 for health insurance payors. There are several themes within payors that investors are underappreciating, primarily involving the Affordable Care Act (ACA) subsidy extension, Medicare Advantage’s (MA) tailwinds, and nuanced risks, and the target Medicaid spending and Medicaid managed care organizations (MCOs) have on their back.

Outlook at a Glance:

- Pathway to Partial Extension of ACA Subsidies Exists, Avoiding Worst-Case Scenario for ACA Insurers

- Trump Win is Positive for Medicare Advantage Insurers, but Underappreciated Pockets of Risks Exists, With Funding Cuts Possible

- Medicaid is the Largest Target for Spending Cuts Within Healthcare, with Reforms Ranging from Changes to Block Grant Funding, Work Requirements, and FMAP Changes

- Integration of Medicare-Medicaid Duals Plans to Benefit Medicaid-Focused Insurers Centene, Molina While Hurting Duals Membership for United, Humana

Pathway to Partial Extension of ACA Subsidies Exists, Avoiding the Worst-Case Scenario for ACA Insurers

| Winners | N/A |

| Losers | Centene (CNC), Elevance (ELV), Molina (MOH) |

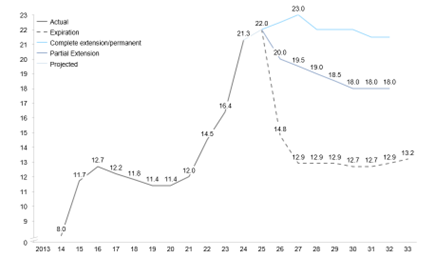

Capstone believes there is an underappreciated path to the partial extension of the ACA-enhanced American Rescue Plan Act (ARPA)subsidies before their expiration at the end of 2025. Despite the Republican trifecta, we believe a partial extension minimizing enrollment loss is possible as part of a larger TrumpCare rebrand package, likely towards the end of 2025. Partial extension will avoid the worst-case scenario for both ACA insurers, including Elevance Health (ELV), Molina Healthcare (MOH), and Centene (CNC) and hospitals, including Community Health Systems (CYH), HCA Healthcare Inc. (HCA), and Tenet Healthcare Corp. (THC).

Baseline ACA subsidies are built into the program but were enhanced during the COVID-19 pandemic to reduce the uninsured rate and increase access to healthcare. As a result, enrollment on the exchanges has grown significantly in recent years, and insurer participation is at its highest.

Despite opposition to the ACA exchanges from many Republican lawmakers, the program’s recent growth has made complete expiration politically unfavorable, particularly given the share of enrollment growth attributable to Texas and Florida, Republican foothold states. Forty percent of all ACA enrollees sit within three Republican states: Florida, Texas, and Georgia. Without a subsidy extension, the Congressional Budget Office (CBO) has estimated a ~33% enrollment loss beginning in 2026. This would materially reduce membership rolls for ACA-focused insurers, simultaneously increasing uncompensated care rates for hospitals. We believe the hospital lobby will play a large role in partial extension.

The subsidies are set to expire at the end of 2025, leading to membership loss beginning January 1, 2026. We expect extension talks to begin in earnest in early 2025, potentially as part of a broader healthcare package that includes pharmacy benefit manager (PBM) or physician fee schedule (PFS) reform. We believe the best chance of subsidy extension is a TrumpCare rebrand, which would likely focus on building on the ACA and rooting out fraud, waste, and abuse.

If the enhanced subsidies are allowed to expire in their entirety, it will likely be because lawmakers decide letting ACA membership drop is a risk worth taking. In recent months, key Republican leaders in Congress had backed off anti-ACA sentiment, a positive sign for partial subsidy extension. However, this was before the Republican sweep. If the same lawmakers view strong Republican performance in the 2024 election as a sign that the political scarlet letter of promoting repeal and replace is over, they may reverse their tune. Capstone will closely watch lawmakers’ and Trump’s comments on the ACA. As the new Republican lawmakers in leadership coalesce around their perspectives towards the ACA in the coming weeks, we will formalize our probability of extension and perspectives on enrollment loss in each scenario.

Exhibit 1: ACA Subsidy Scenarios, millions of beneficiaries enrolled

Source: Congressional Budget Office

Trump Win is Positive for Medicare Advantage Insurers, but Underappreciated Pockets of Risks Exists, With Funding Cuts Possible

| Winners | CVS Health (CVS), Humana (HUM), UnitedHealth Group (UNH), Elevance (ELV) |

| Losers | – |

While a Trump win is more positive than a Harris win would have been for MA, we believe investors are underappreciating how nuanced Trump administration support could be for the program. Undersecretary appointments within the Department of Health and Human Services (HHS) will shape MA policymaking, but we believe more positive rate updates may be paired with broader spending cuts that implicate insurers in the program, namely UnitedHealth Group (UNH), Humana Inc. (HUM), CVS Health (CVS), and Elevance Health (ELV).

Medicare Advantage insurers are poised to enjoy more positive rate updates and less oppressive technical changes under a second Trump administration. The appointment of Dr. Mehmet Oz to be the Administrator of the Centers for Medicare and Medicaid (CMS) indicates that favorable Republican sentiment will likely uplift rate notices year over year after two years of negative rate updates under the Biden administration. However, Dr. Oz’s lack of robust policy background (aside from voicing support for the role of private insurance in the Medicare program) creates potential for other civil servants within HHS and OMB to be able to influence policymaking. If appointments are made to key policy positions from, for example, the Paragon Institute, there is still risk that ancillary reforms branded as “fiscally responsible” could permeate rulemaking. However, the appointment of Dr. Oz as CMS head indicates a directionally positive trend for MA payors over the next four years.

Looking at a near-term standpoint beginning in plan year 2026, a Republican CMS could potentially halt the final year of phase-in for the v28 risk model reform, and remove the final year of the Indirect Medical Expense (IME) phase out from the 2026 benchmark, resulting in in a higher average benchmark update. Looking out over the next four years, it is possible that the next risk model implemented by CMS, such as v30 or v32, could see a positive reweight of prevalent diagnoses such as vascular disease without Complications, Morbid Obesity, and Diabetes with Complications.

The second Trump administration may also revisit smaller non-rate related policies, such as those included in the 2026 policy and technical changes rule, though Capstone believes the rule is largely benign, reducing the need for reversal. Capstone has written in depth about election dynamics impacting insurers and will continue to cover the MA space closely, with the next catalyst being the 2026 rate update likely to be released in early 2025.

Medicaid is the Largest Target for Spending Cuts Within Healthcare, with Reforms Ranging from Changes to Block Grant Funding, Work Requirements, and FMAP Changes

| Winners | N/A |

| Losers | Community Health Systems Inc. (CYH), HCA Healthcare Inc. (HCA), Tenet Healthcare (THC), Universal Health Services Inc. (UHS), Centene Corp. (CNC), Molina Healthcare Inc. (MOH) |

We believe the Medicaid program is ripe for cuts, with the incoming administration likely to focus on reducing overall government spending significantly. Policies floated thus far have included mandating work requirements or limiting eligibility, which would reduce membership for MCOs, including Centene (CNC) and Molina Healthcare (MOH), as well as cuts to federal Medicaid dollars, which would likely reduce payments to the insurers and may also indirectly impact provider rates.

Medicaid payors face a variety of potential changes in 2025 under a Trump 2.0 Administration. Near-term headwinds include the ongoing redetermination process and existing margin pressure for MCOs due to post-pandemic utilization and acuity changes. However, most membership losses from the redetermination process have been realized, and MCO-state rate negotiations in January and July should alleviate margin pressure, at least partially.

Outside of these existing dynamics, there are two primary ways that Medicaid funding could be cut in 2025. Broadly, throughout the 2024 election cycle, there has been a growing discussion among House Republicans and conservative think tanks about Medicaid spending reform. These proposals aim to limit federal spending on Medicaid. The first is block grant funding, which the House Republican Study Committee (RSC) examined in its FY25 budget plan. Block grant funding would cap federal payments to states, allocating federal funding on a per capita basis rather than paying a fixed percentage of total costs. This would place budgetary pressures on states, potentially incentivizing reductions in a state’s Medicaid population, whether through expansion reversal or changes to eligibility.

The second way Medicaid funding could be cut is through changes to the Federal Medical Assistance Percentage (FMAP) for both regular and expansion populations. Regular population FMAPs vary by state, ranging from 50% to 77%; expansion population FMAPs are consistent across states at 90%. Proposed cuts include lowering all states’ regular FMAPs to 50% or lowering expansion FMAPs to the regular FMAP level. Both would produce large cost-savings for the federal government and place budgetary pressures on states. Lowering the regular or expansion, FMAP would likely lead some states to reverse expansion, reducing the estimated 23.8 million Medicaid expansion enrollees in June 2023.

Integration of Medicare-Medicaid Duals Plans to Benefit Medicaid-Focused Insurers Centene, Molina While Hurting Duals Membership for United, Humana

| Winners | Molina (MOH), Centene (CNC), Elevance (ELV) |

| Losers | CVS Health (CVS), Humana (HUM), UnitedHealth Group (UNH) |

In addition to potential Medicaid cuts, we believe investors are underappreciating the potential implications of the transition to fully integrated dual-eligible plans where the same parent organization must provide the Medicare and Medicaid benefits. We expect this trend, though early innings, to benefit insurers with incumbent Medicaid contracts, including Centene and Molina, while potentially limiting dual membership for those without.

Integration of Dual Eligible Special Needs Plans (D-SNPs) continues to be a focus of both the federal and state governments. Integration of D-SNP plans refers to caring for Dual Eligible beneficiaries under the same parent organization for both their MA and Medicaid coverage. At the federal level, CMS has issued rulemakings that incentivize the integration of D-SNPs nationwide. For example, in the 2025 MA Policy and Technical Changes Rule, CMS finalized a provision to allow a monthly special enrollment period (SEP) for integrated D-SNP plans. However, current rulemaking has encouraged, not forced, D-SNP plans to integrate. CMS proposed in the 2026 MA Policy and Technical Changes rule ancillary reforms to how integrated D-SNPs issue beneficiary coverage cards and perform in-home health risk assessments, but have not taken concrete steps to push integration further.

At the state level, however, governing entities have begun to force the transition of D-SNP integration. In California and New York, for example, D-SNP plans are set to take place over the next 3-5 years, requiring those beneficiaries enrolled in MA who are dually eligible for both Medicare and Medicaid to receive their benefits from one parent organization.

D-SNP integration will favor payors who have established managed Medicaid contracts. As integration is forced at the state level and encouraged at the federal level, only those payors that have state Medicaid contracts or win them in state RFP processes can offer fully integrated plans for dual eligibles. While a payor can offer an MA contract anywhere within a given calendar year once it is approved by CMS annually, a state Medicaid contract is usually only awarded to 2-4 payors and is awarded for 3-5 years. Therefore, those existing managed Medicaid payors who can successfully offer MA contracts in states requiring integration are poised to receive dual-eligible enrollment due to integration.

Read more from Grace:

Signals from Harris’ Healthcare Platform

The New Front in the Private Equity Healthcare Battle: State AGs

How Harris Diverges from Biden on Healthcare Policy