Global Concerns to Spur Policy Opportunities as Policymakers Step Up Emissions Targets, Tech-Neutral Approaches Rise

January 1, 2023

Capstone believes the favorable policy backdrop for energy will accelerate at the state, federal, and global levels in 2023 amid global concerns over climate change, energy reliability, and energy affordability. In this report, we unpack the policy themes at each level of government that we expect to drive this trend.

Notably, we expect progressive federal and state regulators to further reduce CO2 emissions from the transportation, industrial/residential heating, and power sectors through clean energy mandates and standards. We believe this accelerating trend will increase demand for low-carbon molecules and electrons.

At the state level, we expect to see a strengthening and proliferation of programs to incentivize clean fuels like renewable natural gas (RNG) in both the transportation and utility sectors, with states like California serving as a model. We also expect that new state-level incentives for electric vehicle (EV) adoption will emerge, and states will increasingly focus on green building materials.

At the federal level, we expect continued support for crop-based fuels as a decarbonization tool from the Biden administration, despite the shift away from these fuels taking place in the EU and California. Additionally, we expect the Biden administration to move forward with several rules to reduce emissions from the power sector and increase investment in novel carbon capture technologies, all while taking environmental justice concerns into account.

While Western policymakers have historically sidelined fossil fuel production in favor of decarbonization, we expect a more tech-neutral approach to energy security and climate change will emerge at the global level. This will likely be exhibited by a heightened focus among federal policymakers on grid reliability and transmission buildout as well as continued efforts in the US Congress to enact permitting reforms to facilitate energy production and transportation.

Major State-Level Themes

Falling Low Carbon Fuel Standard Credit Prices Will Force the California Air Resources Board to Adjust Credit Generation

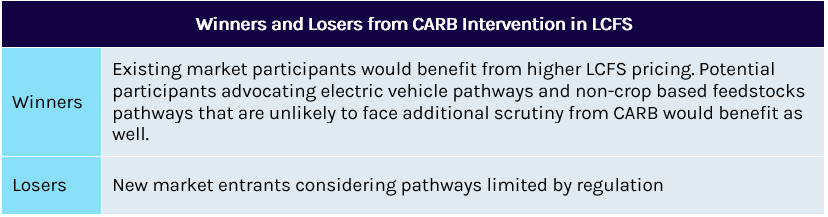

Capstone believes that the California Air Resources Board (CARB), which oversees the state’s Low Carbon Fuel Standard (LCFS), will likely take unprecedented action to adjust the supply of credits coming into the market.

While CARB has traditionally prided itself on the technology-neutral nature of the LCFS, a mix of market and political factors is likely to make the regulator take a serious look at adjusting how certain fuel pathways participate in the LCFS.

Though some of the changes considered may ultimately not be included in the rulemaking expected to be finalized by the end of this year, they provide an interesting glimpse into the potential long-term future of the LCFS.

We believe that CARB is likely to consider the following specific changes to the supply side of the LCFS equation:

- Imposing a cap on credit generation from crop-based feedstocks, including soybean oil;

- Phasing out credit for electric forklifts; and

- Adjusting the ability of renewable natural gas (RNG) to participate in the LCFS by either limiting the ability for out-of-state projects to use book and claim crediting or limiting crediting from the “avoided methane emissions” that support the economics of dairy RNG. Of all the changes, we believe this is the least likely to appear in the final rulemaking.

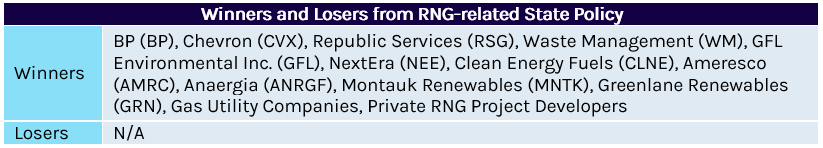

State Policy Drives Renewable Natural Gas Procurement from Gas Utilities

Capstone believes RNG project developers will likely face tailwinds in 2023 as demand from the voluntary market continues to increase. The role of RNG in the transportation sector has been well supported through the California Low Carbon Fuel Standard (LCFS) and the federal renewable fuel standard (RFS).

Still, we believe there is significant market potential through RNG procurement from natural gas utilities that have looked to low-carbon alternatives to decarbonize. For example, California will require utilities to blend 72.8 Bcf per year of RNG into their gas mix by 2030 through the newly implemented renewable natural gas standard. For comparison, the EPA anticipates that the entire US transportation sector will consume ~61 Bcf of RNG in 2023.

Increasing the supply of renewable energy in the overall energy mix and reducing greenhouse gas emissions in the home heating side of the power sector will remain important policy objectives for state governments going forward.

RNG project developers will likely face tailwinds as demand increases.

Gas utilities will still face the same environmental pressures as electric utilities and will look to RNG as a pathway to meet sustainability goals that they have set for themselves or to meet statutory mandates like the one set recently by the California PUC to satisfy S.B. 1440.

State Legislative Efforts to Incentivize RNG

Gas utilities are petitioning lawmakers and regulators to provide support in investing in RNG procurement or development because pipeline infrastructure is already in place as opposed to trying to shift to all-electric homes, which would cost consumers more in energy costs in the near term. One of the biggest barriers to entry for a gas utility to invest in an RNG project or procure low-carbon fuels is the ability to recover costs from ratepayers. New Hampshire is one of the latest states to pass legislation (S.B. 424) that allows for cost recovery—gas utilities are able to procure up to 5% of their total gas from renewable natural gas.

Another state policy that we see taking shape in other states is the Clean Heat Standard (CHS), which requires providers of natural gas to deliver a gradually increasing percentage of low-emission heating services to consumers. Colorado’s S.B. 21-264 established a CHS for gas distribution utilities (similar to state renewable portfolio standards), which requires them to cut GHG emissions by 4% by 2025 and by 22% by 2030 (compared to 2015 levels). Gas utilities are required to submit Clean Heat Plans to the Colorado Public Utilities Commission, which demonstrates their pathway to cutting emissions through clean heat sources like electric heat pumps, RNG, and green hydrogen. Although California’s RNG blending mandate is a more prescriptive pathway than the CHS to push procurement, we believe that we will see both frameworks pick up in other states, which will serve as huge demand drivers for RNG.

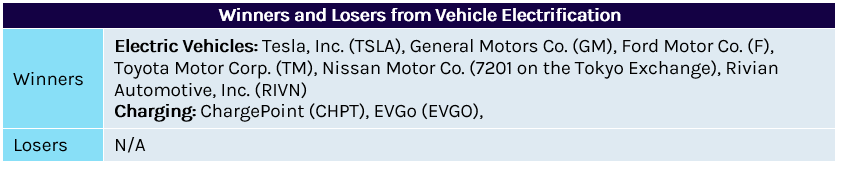

State Electric Vehicle Incentives to Expand from National Funding and Expanding State Regulation

Electric vehicle (EV) policy and adoption expanded rapidly in 2022 despite persistent supply chain snares that increased the cost of a lithium-ion battery for the first time in several years. In 2022, total EV sales in the US exceeded 800,000 vehicles, nearly 6% of overall vehicle sales, up from about 440,000 fully electric vehicle sales in 2021 despite an overall auto sales decrease of 8% over the same time frame.

In 2023, the US will see significant nationwide policy support for EVs and associated charging infrastructure. Though National Electric Vehicle Infrastructure (NEVI) funding passed in the Infrastructure Investment and Jobs Act (IIJA) began in late 2022, each state will now have a full year’s worth of funding beginning in 2023 as states aim to fill gaps in major highway corridors that do not have sufficient EV charging infrastructure. NEVI funding programs, while established by the IIJA, vary by state and are set to broaden in scope after the programs fill current gaps, allowing further charging infrastructure buildout in additional regions of each state.

In 2023, the US will see significant nationwide policy support for EVs and associated charging infrastructure.

Additionally, we expect California’s EV policies to expand to additional states, increasing the extent of its ambitious EV adoption goals. Already, seven states have announced that they will commit to California’s 100% EV sales by 2035 goal this year. Ten states plus the District of Columbia follow the mandate’s predecessor, at least some of which—particularly Democratic-leaning states in the Northeast and Mid-Atlantic—will likely follow suit. A similar set of states have indicated or committed to following a similar California policy aimed at driving medium- and heavy-duty electrification.

Major Federal-Level Themes

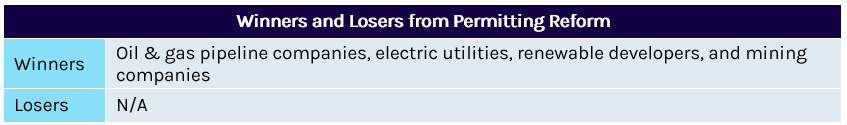

Style Over Substance Led to Defeat for 2022 Permitting Reform; Likely to Help Effort in 2023

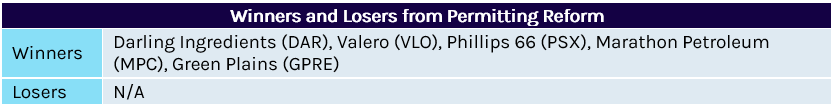

In late 2022, Congress failed to pass permitting reform despite consensus among moderate Democrats and Republicans on the need to expedite energy infrastructure development. We attribute this failure to Republican reluctance to give Democrats, particularly Sen. Manchin, a political win leading into the 2024 election.

However, just as Sen. Manchin threw his support behind the core of Build Back Better—after rebranding the effort as the Inflation Reduction Act (IRA)—we believe a similar phenomenon could occur in 2023 as Republicans take ownership over permitting reform with control of the House.

That said, Republican leadership in the House has had a shaky start in the new Congress—with House Speaker Kevin McCarthy (R-CA) failing 14 times to garner enough votes before claiming the gavel. This divide within the Republican party may create challenges for deal-making on permitting reform.

Biden Administration to Resist Progressive Opposition to Crop-Based Biofuels

While California and Europe are souring on using crop-based fuels to decarbonize transportation, we believe the Biden administration will continue to support these technologies due to its ambitions to quickly scale sustainable aviation fuel (SAF) and other clean fuels. The administration laid out a clear role for crop-based fuels in its SAF roadmap, which aims to increase domestic SAF production to 3 billion gallons per year by 2030.

While the renewable diesel industry largely viewed the proposed volumes under the RFS for 2023-2025 as detrimental to growth, we believe the final volumes will increase following pushback from industry and policymakers. We believe the political weight of the US agricultural sector will continue to sway policymakers during the implementation of key policies, such as the clean fuel tax credits in the IRA and the RFS.

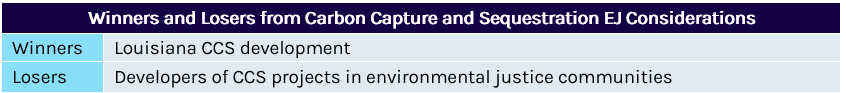

Environmental Justice Presents a Double-Edged Sword for Carbon Capture & Sequestration

Capstone believes that developers must pay increasing attention to EJ implications of CCS development in 2023, as this focus will provide increasing policy certainty yet also increase the risk of local pushback and litigation. We believe the emerging policy environment augurs Louisiana as a favorable location for carbon sequestration due to burgeoning case law and the increased policy certainty for the state’s efforts to assume regulatory authority for sequestration.

The Environmental Protection Agency (EPA) is coalescing policy around environmental justice for Class VI wells, providing more certainty for applicants and states. In a December 9th letter to state governors, EPA Administrator Michael Regan announced that $50 million in grants from the Infrastructure Investment and Jobs Act would be disbursed in the coming weeks to assist states in pursuing primacy, explicitly outlining EPA’s expectations on environmental justice elements that state applications for primacy over their own programs should include.

We expect further local and environmental justice activism, as well as litigation, in 2023.

We believe this policy provides additional clarity for states on the administration’s longstanding EJ emphasis rather than posing an existential risk or even a significant surprise to existing state primacy efforts. This underscores the increasing EJ policy certainty at EPA, where the agency also reviews individual permits to ensure no significant, disproportionate adverse impacts that cannot be mitigated for low-income or overburdened communities, analogous to other environmental reviews with potential project-specific risks but no programmatic threats.

Going forward, we believe developers, companies, and investors will have to increasingly account for the potential that more community-level activism will occur in the space. For example, Livingston Parish Council in Louisiana voted unanimously this fall to enact a moratorium on carbon dioxide sequestration test wells for one year, citing the need for stricter local regulation and expressing potential safety concerns. Prospective developer Air Products sued in federal district court, seeking a declaration that the moratorium is preempted under state law enshrining this regulatory authority at state agencies. At the end of December, the court concluded that the lawsuit could proceed and, further, temporarily stayed the moratorium on the grounds of state law preemption while the litigation is pending.

Though the recent decision is encouraging for CCS development, it is neither a final decision (which we would expect sometime in 2023) nor binding in other jurisdictions. Capstone expects further local and environmental justice activism, as well as litigation, on CCS community impacts in 2023.

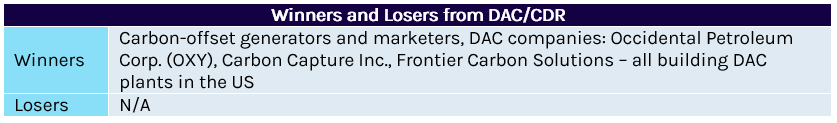

Federal Support for Direct Air Capture and Carbon Dioxide Removal Will Continue To Boost this Growing Industry

Capstone expects that 2023 will see a continuation of the newfound support for direct air capture (DAC) and carbon dioxide removal (CDR) at the federal level.

Capstone sees CDR momentum generated by the 2021 IIJA, which invested in CDR, and the 2022 IRA, which boosted the 45Q CCUS tax credit, as well as by Department of Energy’s (DOE) Carbon Negative Shot initiative announced in November 2021, which is the third of the Department’s “Energy Earthshot” initiative. In 2023, we expect advances in funding for CDR and DAC.

In December 2022, the DOE released its guidelines for awarding the $3.5 billion in IIJA funding for the establishment of four regional DAC hubs. Under their planned timeline, DOE expects to receive applications and disburse the first $1.2 billion this year. DOE set a deadline of January 24 for mandatory letters of intent and March 13 for full applications. Pre-selection interviews are planned for the summer and notification of selection is planned for June 30 followed by award negotiations on November 30.

Other DOE efforts expected to boost CDR include the DAC Commercial and Pre-Commercial Prizes, Carbon Utilization Procurement Grants, and the Technology Commercialization Fund.

Apart from DOE’s efforts, Congress recently included $140 million in the federal omnibus bill passed in December for research, development, and demonstration of CDR removal technologies. The funding will be distributed to the DOE’s Office of Fossil Energy and Carbon Management (FECM), Office of Energy Efficiency and Renewable Energy (EERE), and Office of Science.

Notably, the omnibus also includes a direction to the DOE to establish a pilot procurement program for “competitive” purchases of carbon dioxide “removed from the atmosphere or upper hydrosphere.” This would be the first program of its kind, demonstrating significant interest from Congress and the Biden administration and potentially offering a meaningful price signal for the market if and when purchases begin.

Finally, the CDR tailwinds generated by DOE are also riding on the global community’s approval last year of CDR as a tool in promoting the climate agenda. In April, the United Nations’ Intergovernmental Panel on Climate Change (IPCC), for the first time, described CDR as necessary to meet climate targets. We expect this inclusion to bolster support for CDR and help counter criticisms from progressives and climate activists that the process is energy intensive and wrongfully detracts from focusing on growing renewables.

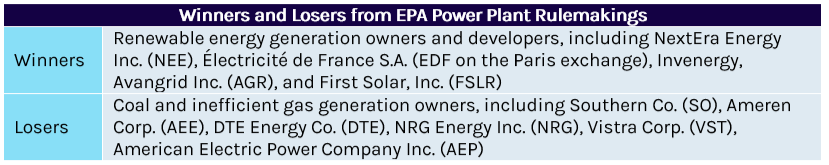

EPA Power Plant Rulemakings in 2023 Pose Headwinds for Coal and Gas Generation

Capstone believes ongoing litigation and legal deadlines, in conjunction with the Biden administration’s clean energy priorities, will push the EPA to propose or finalize updates to rules impacting power plants in 2023 despite concerns over increasing energy prices.

These rulemakings will increase compliance costs and environmental requirements, therefore accelerating retirements for coal plants and mandating retrofits for some coal and inefficient gas generation. We expect coal retirements and increasing costs for fossil fuel operations will create opportunities for renewable generation.

That said, we expect the EPA will provide for reliability safety valves similar to the provision within coal ash regulations.

Coal retirements and increasing costs for fossil fuel operations will create opportunities for renewable generation.

We anticipate that two rulemakings in particular—the finalization of the Cross-State Air Pollution Rule (CSAPR) update and the proposal of a new rulemaking on power plant emissions following the West Virginia v. EPA Supreme Court decision—will pose significant headwinds for fossil fuel generation. The EPA’s update to the CSAPR rule alone is expected to accelerate the retirement of significant coal generation capacity in regional markets: SPP (37%), ERCOT (55%), MISO (34%), and PJM (15%).

Additionally, continued enforcement and updates of other rulemakings—including the Coal Combustion Residuals (CCR) rule, the National Ambient Air Quality Standards (NAAQS) for ozone and particulate matter, and the Effluent Limitation Guidelines (ELGs)—will erode opportunities for leniency.

PFAS Regulation Ramps in 2023

Capstone believes that EPA is likely to make substantial progress toward finalizing key regulations for long-chain PFAS chemicals PFOA and PFOS in 2023.

We assign a 75% probability that EPA will finalize a Superfund designation for these two chemicals by the end of the year, imposing a regime of strict, joint and several, and retroactive liability for companies that may be found to be owners or operators, disposal arrangers, or transporters of the contaminant at a contaminated site.

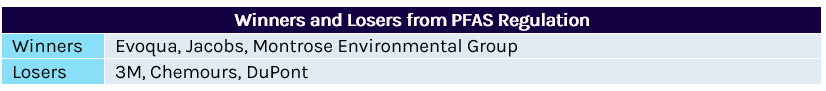

We believe this site-by-site process, for which EPA has already begun evaluating the presence of PFAS at existing Superfund sites, is likely to culminate in a long tail of $2.9B in liability for 3M and $4.8B for Chemours, DuPont, and Corteva, while presenting opportunities for environmental remediation companies such as Evoqua, Jacobs, and Montrose Environmental.

Capstone has long expected EPA’s proposed rule establishing drinking water standards for PFOA and PFOS will be released this quarter—the rule has been under White House Office of Management and Budget (OMB) review since October, the penultimate step before releasing regulation.

Although the EPA is aiming to finalize drinking water standards by the year’s end, Capstone believes this timing may slip into early next year and assigns an 80% likelihood of finalization by H1 2024. After finalization, water utilities will have three years to make the necessary compliance upgrades, spurring tailwinds for water remediation providers like Evoqua and Jacobs.

Meanwhile, we expect water utilities to mount litigation against PFAS manufacturers and dischargers under theories of product liability to recover the costs of these upgrades and mitigate rate shock.

In tandem, we expect these regulatory developments to result in a costly third wave of PFAS tort litigation against manufacturers and dischargers.

A Growing Focus on Building Material Decarbonization at all Levels of Government

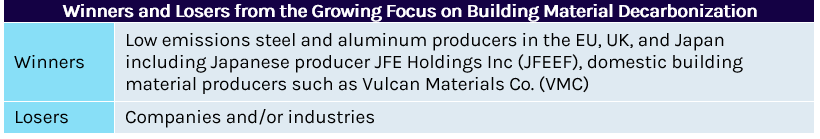

With policy incentives for decarbonizing the power and transportation sectors rapidly growing, policymakers are turning their attention to industrial decarbonization. The Biden administration is leveraging trade policy and provisions within the IRA to reward producers of low-carbon building materials. States have also begun wading into industrial decarbonization. California and New York recently passed laws aimed at reducing the carbon intensity of building materials. We expect interest in industrial decarbonization at both the state and federal levels to grow.

Federal Efforts

In 2021, the United States and European Union agreed to pursue the first-ever emissions-based framework on steel and aluminum trade as a part of a deal to roll back tariffs imposed on European exports to the United States by former President Trump. Under the agreement, existing tariffs on EU exports will be replaced with a new tariff rate quota (TRQ) system in which the EU can export steel and aluminum up to a certain threshold before being subject to the existing 25% tariff on steel and 10% tariff on aluminum. The agreement also establishes a technical working group to discuss the formation of a global arrangement on sustainable steel and aluminum that would encourage similar economies to participate to promote the trade of “carbon-friendly” steel and aluminum. Members of this arrangement could restrict market access to economies that do not meet these low-carbon standards or contribute to excess capacity. The parties have a goal of reaching an agreement by the end of this year.

The IRA also included numerous provisions that provide funding for sustainable building materials initiatives. This includes $5.8 billion for existing facility upgrades through the Advanced Industrial Facilities Deployment Program and $2.2 billion for the purchase of low-emission construction materials to be installed in General Services Administration (GSA) buildings. The IRA allocated $2 billion to the Federal Highway Administration (FHA) to incentivize the use of low-emission construction materials for eligible projects on federal highways, tribal transportation facilities, and federal lands transportation facilities. This will be implemented as a reimbursement to developers for the increased cost of using sustainable materials. Funding will be available after the Biden administration reviews low-embodied carbon construction materials that can be used.

State Efforts

In 2022, California Governor Gavin Newsom (D) signed AB 2446, a law requiring CARB to create a framework to measure, and a plan to reduce, the average carbon intensity of new building materials. New York Governor Kathy Hochul (D) similarly signed the Low Embodied Carbon Concrete Leadership Act (SB S542A) in 2021. The law establishes a framework for the acquisition of low-carbon concrete. It stipulates that all state construction contracts mandate that contractors certify that a given project acquired and was completed with concrete that meets the minimum standards for carbon-embodied concrete. Such laws are the first of their kind in the United States and will likely set a precedent for these and other states. We expect similar legislation to receive increasing consideration, particularly in left-leaning states.

Global Energy Themes to Watch

Focus on Energy Security to Intensify, Particularly Across Fossil Energy Supply Chains

A renewed appreciation for energy security was a key theme in energy markets globally this past year. While access to inexpensive, reliable fossil energy supply remains the key to national energy security, we have not yet seen this reality translate fully into Western energy policy to the degree that we expect it will in the coming years. While the pendulum of energy policy swung away from decarbonization in 2022, we expect it will move further in the direction of security in 2023.

The persistent shortfall in fossil energy supply globally, exemplified by declining inventory levels and continued stagnation of upstream capital expenditures, will exacerbate the energy insecurity seen in 2022. We anticipate that this dynamic will amplify geopolitical tensions globally by emboldening a subset of new countries to pursue increasingly assertive foreign policy. The relative influence and bargaining power of countries that control fossil energy supply chains, including Turkey, Brazil, Qatar, Saudi Arabia, and Norway, will continue growing until we begin to see a resurgence in investment directed toward the development of oil, natural gas, and coal resources as well as in the related critical infrastructure that underpins these sectors.

In coming years, we expect the waning role of US shale as the key global swing producer of fossil energy commodities will also have broad implications for US domestic and foreign policy and, more broadly, geopolitics globally. The Biden administration’s pivot toward increasingly protectionist rhetoric on US fossil energy exports in 2022 marks a turning point for the growth of US geopolitical influence stemming from its abundance of domestic resources.