Key Points:

- Current SAF volumes represent just 0.3% of the global total jet fuel consumption, constrained by inconsistent policy mechanisms, high prices, and competition from renewable diesel production. However, corporate use of SAF for voluntary Scope 3 emissions reduction claims has begun to rise, with recent commitments from major buyers alone approaching 50% of current annual global SAF production.

- We expect upcoming guidance from the Science Based Targets Initiative (SBTi) and Greenhouse Gas Protocol (GHGP), expected to be finalized by 2027, to provide greater clarity on SAF’s permissibility for Scope 3 claims while progressively curtailing the use of carbon offset credits, which corporate reduction efforts rely on almost entirely today. We expect the new standards to support SAF adoption through both direct procurement and indirect book-and-claim accounting mechanisms. However, liquidity challenges and price premiums will continue to limit the significant uptake of SAF.

- With limited alternatives for aviation decarbonization, we expect corporate SAF demand to increase, especially in the technology, professional services, and financial sectors, where business travel represents a major share of total emissions.

- We expect book-and-claim certificates to play a critical role in scaling SAF adoption by decoupling physical volumes from environmental attributes. This mechanism parallels the transformation of their respective markets by renewable energy certificates and carbon credits.

Corporate SAF Demand

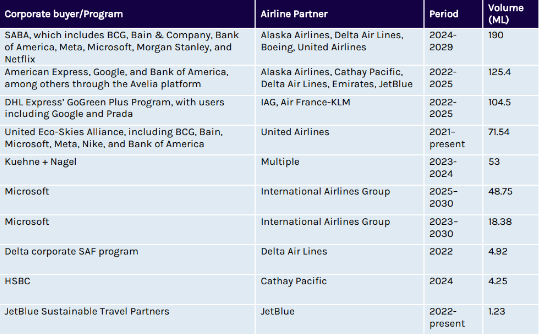

Among end-users, we expect SAF purchases to be driven by corporates to support voluntary decarbonization claims, given that individual passengers continue to have limited interest in SAF. Corporate SAF deals are usually facilitated through collective buyers’ alliances, direct bilateral agreements with airlines, or corporate travel platforms. Since 2021, purchases from corporate end-users include SAF volumes of up to 620 million liters (ML), with 190 ML committed by the 37-member Sustainable Aviation Buyers Alliance (SABA). Structured as multi-year purchase agreements, the aggregate volume from the listed deals below accounts for 48% of the current 1.3 billion liters of global annual SAF production volume.

Key Corporate SAF Purchases

Source: Company announcements

Along with purchase agreements, corporate efforts have focused on addressing liquidity constraints in SAF uptake. A key mechanism involves the development of book-and-claim SAF certificates (SAFC), which represent the environmental attributes of a verified batch of SAF and which can then be transferred as a discrete commodity, decoupled from the associated physical SAF volumes. Similar to renewable energy certificates (REC) and carbon offset credits, SAFCs intend to establish a centralized trading mechanism for SAF-enabled emissions reductions, expanding buyer access regardless of geographical constraints.

Corporate SAF platforms such as Avelia exclusively offer SAFCs, with certificates also included in the broader purchase agreements listed above. In December 2023, SABA, in collaboration with the Rocky Mountain Institute and the Environmental Defense Fund, launched a SAFC registry, which has issued SAFCs accounting for over 100 ML of SAF so far.

SAFC registries extend the SAF traceability and accounting framework until the final end-use point, similar to accounting requirements under regulatory schemes, which are, however, generally limited until the retail fuel blending stage. These registries allow a batch of SAF to be claimed by an airline under Scope 1 and by the end-use customer under Scope 3 emissions. This separation of the Scope boundary between airlines and end-users avoids double-counting and is an accepted method under current GHGP rules on emissions accounting for fuel use.

Sector Focus

Corporate SAF purchases have been driven by the technology, professional services, and financial sectors, companies where Scope 3 accounts for a major share of total emissions. In the professional services sector, particularly, business travel could claim as much as 83%.

The majority of these firms have established net-zero by 2050 targets, with additional interim goals by 2030. Current emissions reduction efforts for these companies prioritize carbon offset purchases, with companies like EY even buying credits in excess of their total emissions. As such, companies spearheading voluntary SAF purchase efforts are also among the largest buyers of carbon offset credits. Notably, SABA member-companies are also involved in similar buyers’ alliances in the carbon offsets space, such as Frontier and the Symbiosis Coalition, that have established targets to invest over $1 billion by 2030 to secure high-integrity carbon credits.

However, the current reliance on carbon offsets faces risks from forthcoming guidance on corporate emissions reduction claims. While these governance frameworks will restrict carbon offset eligibility, we expect them to provide clearer pathways for SAF-based emissions claims.

Corporate Claims Governance

Voluntary climate commitments extend beyond regulatory requirements, necessitating uniform global benchmarks to ensure credibility and comparability. Guidance on corporate emissions claims is developed by independent standard-setting bodies, with the SBTi’s Corporate Net-Zero Standard (CNZS) specifying the criteria for verifiable corporate net-zero claims, while GHGP provides methodologies for measuring and reporting emissions. Together, these standards establish a broadly accepted benchmark for “credible” corporate emissions reduction claims and eligible decarbonization pathways. SBTi targets have been set by 11,688 companies, with over 10,000 using GHGP standards to report their emissions. GHGP guidance has additionally informed government rules on corporate disclosures in the EU, UK, and California. As such, Capstone expects SBTi and GHGP guidance to be critical in determining corporate demand for environmental attribute certificates (EAC), including carbon offsets, SAFCs, and RECs. In addition to allowing direct SAF uptake as a credible emissions reduction pathway, we expect these bodies to also permit SAFC use for Scope 3 claims.

SBTi: SBTi has historically taken a conservative approach to offset use, with current carbon credit use limited to residual unabated emissions. An ongoing revision to the CNZS limits the applicability of offsets to residual emissions only within Scope 1, while restricting use in Scope 3. However, in addition to full endorsement of direct SAF use by both CNZS and aviation-sector guidance, the draft CNZS 2.0 intends to allow the use of book-and-claim SAF as an “indirect mitigation” measure toward Scope 3 targets, expanding the eligibility to include SAFCs.

GHGP: The current GHGP Scope 3 Guidance restricts the use of offsets for all three emissions scopes. We believe existing guidance on business travel is sufficient to allow the accounting of emissions benefits from direct SAF use; however, book-and-claim provisions are not explicitly addressed in the current language. As part of the ongoing revision to the standard, expected to be finalized in 2027, GHGP is specifically assessing the inclusion of indirect accounting methods for SAF, with stakeholders’ inputs to the revision process unanimously in favor of allowing book-and-claim accounting for Scope 3 SAF claims.

Limited alternate decarbonization options for aviation and SAF traceability constraints under current market conditions are broadly accepted by the standard-setting bodies. This has enabled the SBTi’s endorsement of indirect SAF accounting methods, and we expect the GHGP revision to similarly permit the use of SAFCs. Specific rules on double-counting and chain-of-custody tracing are expected to be included in the final standard revisions, with SAFC methodologies mirroring current quality standards for book-and-claim accounting for the Scope 2 use of RECs. However, we believe indirect book-and-claim accounting will be allowed as an interim measure for SAF and that an eventual expansion of the SAF market would likely restrict SAFC permissibility in favor of direct physical SAF volumes. SAFCs are still expected to be offered wider applicability than carbon offsets for Scope 3 claims.

Greenwashing Concerns

Unsubstantiated emissions reduction claims expose corporates to litigation risks. Current active lawsuits target several companies, including Apple, Etsy, and Delta Air Lines, for “carbon-neutral” claims through the use of offsets. Voluntary carbon markets have moreover faced increased scrutiny following several high-profile integrity allegations against individual projects, leading to project cancellations and lawsuits against the project proponents. These cases challenge the fundamental integrity of carbon offsets, alleging that actual emissions reductions achieved are vastly overstated. These issues have soured some corporate interest in carbon offsets, leading to significantly reduced investments since 2022, though ongoing work to improve investor confidence in the integrity of the market is expected to help address these concerns over time.

Similar greenwashing lawsuits have been brought against airlines for SAF use, primarily in the EU. However, unlike offsets, these cases do not challenge the fundamental environmental integrity of SAF but rather take issue with airline decarbonization claims, given the limited actual share of SAF in the total fuel volumes used by these airlines. We believe that this distinction is a key benefit for the growth of SAF uptake.

Voluntary SAF Certification

Similar to regulatory requirements, SAF volumes used for voluntary corporate claims still need to be certified by a recognized scheme such as the International Sustainability and Carbon Certification (ISCC) or the Roundtable on Sustainable Biomaterials (RSB). As such, in addition to specific certification pathways for CORSIA and EU requirements, both ISCC and RSB currently offer equivalent frameworks for voluntary settings. However, based on our outreach with stakeholders, the lack of explicit guidance for sustainability requirements has resulted in corporate SAF volumes being certified based on existing regulatory requirements. We expect this practice to continue and for standard-setting bodies to establish CORSIA and EU requirements as a baseline for acceptable SAF quality standards for voluntary use.

Outlook

Although supply-chain bottlenecks and price premiums will likely continue to limit significant SAF uptake, we expect guidance from standard-setting bodies to de-risk voluntary SAF purchases for corporate buyers, while progressively curtailing the use of other mitigation pathways such as offsets. Limited alternatives for aviation decarbonization are expected to especially elevate SAF demand in sectors where business travel accounts for a major share of company emissions.

SAF has not mirrored the more robust uptake of traditional liquid biofuels in the road transportation sector. However, we expect SAFCs to follow the historical trajectory of RECs and carbon offsets that enabled both increased financing for individual projects and expanded access to corporate buyers for the associated environmental attributes. In the US, voluntary REC investments during 2014-2023 were estimated at a cumulative $5 billion, with a $3 billion total in carbon offset purchases during that period. Following the enactment of the Paris Agreement in 2016, several companies began setting climate goals, leading to increased investments in EACs. Investments in RECs and offsets saw the highest increase, at 250%, in 2021, when the SBTi first adopted CNZS. Thereafter, interest in RECs continued, but investments in offsets declined steeply, given the various integrity concerns plaguing voluntary carbon markets and the consequent increase in scrutiny from standard-setting bodies.

SAFC registries already mirror existing market frameworks for RECs and carbon offsets, and we expect SAFCs to eventually emerge as a more liquid environmental commodity, similar to conventional EACs and US clean fuel credits. We expect this to additionally expand investment channels toward SAF production and reduce the current price disparities across regions.

What’s Next

The revised SBTi CNZS and GHGP standards are expected to be finalized by 2027. Capstone will continue to monitor additional developments governing voluntary SAF uptake.

Charlotte Jenkins, Energy Analyst

Ishteyaq Sheikh, Energy Analyst

Read more from Capstone’s Energy Team:

Trump, the Endangerment Finding, and the Potential Cascading Chaos for Climate Regulations

Shifting Gears in Environmental Policy: Federal Slowdown, State Action

The Rise of Loper Bright: The Coming Political Tug of War Amid the Death of Agency Deference