We believe the crypto industry will benefit from regulatory clarity and increased investment established by a pro-crypto Securities and Exchange Commission (SEC). We anticipate a decrease in enforcement actions by the SEC will allow for an expansion of crypto ETFs and other products. These changes will create tailwinds for the crypto industry and spur more competition for existing crypto platforms as large banks look to get in the game.

Outlook at a Glance:

- Trump to Create Pro-Crypto Securities and Exchange Commission (SEC), a Positive for Crypto Players

- SEC to Expand Approval of Spot ETFs; Solana, Ripple, and Litecoin Likely Candidates, Creating Growth Avenue for Asset Managers and Retail Trading Platforms

- SEC to Rescind Staff Accounting Bulletin No. 121, a Positive for Banks Looking to Enter the Cryptocurrency Space

Trump to Create Entirely Pro-Crypto Securities and Exchange Commission, a Positive Crypto Players

| Winners | Coinbase Global. Inc (COIN), Robinhood Markets (HOOD), Block (SQ), Bakkt Holdings (BKKT), BlackRock (BLK), Invesco (IVZ), WisdomTree (WETF), Franklin Resources (BEN), VanEck, Grayscale, ProShares |

| Losers | Visa (V), Mastercard (MA), American Express Co (AXP), Western Union (WU) |

Capstone expects the SEC to swing to a republican majority and to be uniformly pro-crypto following confirmation of President-elect Trump’s nominees, creating tailwinds for the industry by stepping back from enforcement. We anticipate the new Commission will stop trying to classify most cryptocurrencies as securities by amending or dropping cases like SEC v. Coinbase, will lower hurdles for new spot ETFs, and will rescind Staff Accounting Bulletin No. 121 (SAB 121)—an SEC rule that’s been a stumbling block for banks looking to enter crypto—paving the way for the institutionalization of cryptocurrency. We believe there could be headwinds for traditional payment processing and transfer methods like credit card networks and remittance service providers, as institutionalization results in broader adoption.

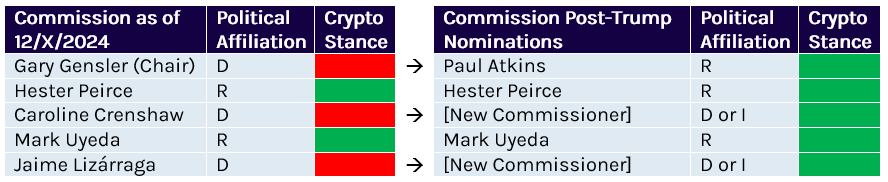

The three Democrats on the Commission have been particularly critical of cryptocurrencies, with Commissioners Caroline Crenshaw and Jaime Lizárraga voting against Bitcoin spot ETFs in January 2024. Chair Gensler and Commissioner Jaime Lizárraga (D) announced they would step down as Trump comes into office. President Biden renominated Commissioner Crenshaw, but her renomination was not moved to the floor of the Senate by the end of the current Congress.

Regardless of his nominees’ political affiliations, we expect Trump will be able to fill all three open seats with pro-crypto commissioners. Trump has openly courted the industry and surrounded himself with crypto advocates, including selecting Elon Musk as one of the heads of the Department of Government Efficiency (DOGE, itself named after a cryptocurrency) and David Sacks as his “Crypto and AI Czar.” Trump has already announced that he will nominate vocal digital currency advocate and former SEC commissioner Paul Atkins as chair. By law, no more than three commissioners can belong to the same political party, so Trump must fill the remaining seats with non-Republicans. While traditionally the president would nominate democrats for the two remaining seats, we anticipate he may nominate at least one independent, considering he likely won’t run into any confirmation issues with the healthy republican majority in the new Senate.

SEC to Expand Approval of Spot ETFs; Solana, Ripple, and Litecoin Likely Candidates, Creating Growth Avenue for Asset Managers and Retail Trading Platforms

| Winners | BlackRock (BLK), Invesco (IVZ), WisdomTree (WETF), Franklin Resources (BEN), VanEck, Grayscale, ProShares |

| Losers | Coinbase Global. Inc (COIN), Block (SQ), Bakkt Holdings (BKKT) |

Capstone believes the incoming SEC will expand approvals for spot crypto ETFs beyond Bitcoin and Ethereum, creating an opportunity for asset managers experienced in creating spot ETFs to steal potential market share away from incumbent crypto trading platforms. In 2024, the SEC approved spot ETFs for Bitcoin and Ethereum, which started trading on January 10, 2024, and July 23, 2024, respectively. In our view, the primary factors impacting the timeline for new ETFs are the underlying asset’s market integrity and clarity around the asset’s classification as a security. To that end, we anticipate Litecoin, Solana, and Ripple are prime candidates for new ETFs.

We anticipate that spot crypto ETFs will continue to capture both existing retail crypto investors and investors new to the space, customers that may otherwise trade through an existing trading platform like Coinbase. Crypto trading platforms and direct ownership through exchanges are the only way to get exposure to the asset class beyond Bitcoin and Ethereum. As the number of cryptocurrencies with spot ETFs grows, retail investors can gain diversified cryptocurrency exposure through their normal trading platforms and investment accounts.

We expect the next cryptocurrencies for which there will be new ETFs approved will be unambiguously non-securities. Ambiguity over classification as a security is an impediment to creating a spot ETF. The SEC ultimately did not classify Bitcoin and Ethereum as securities, clearing the path for ETFs and reducing the regulatory hurdles associated with approval. ETFs could theoretically be created for cryptocurrencies defined as securities, but it would exacerbate the already high levels of regulatory complexity. We believe trading volume, market capitalization, and track record are leading indicators for the SEC’s consideration of market integrity. High trading volume and market capitalization reduce the risk of market manipulation and the potential for large trades to significantly impact the overall market.

Litecoin (LTC)

We think Litecoin is the next logical candidate for the SEC to approve a spot ETF because it has the clearest path to the SEC’s clear definition as a non-security and has a long track record of market integrity. Litecoin is a fork of Bitcoin and was originally created in 2011 to be a “silver” to Bitcoin’s “gold.” Since it’s a fork of Bitcoin, the SEC has a clear logical path to classify it as a non-security. It was one of the original assets to be traded on Coinbase and has had 100% uptime since its creation. It continues to be traded at a high volume across all major exchanges, with a 24-hour trading volume of around $2 billion and a total market cap of approximately $116 billion. Canary Capital filed an S-1 on October 15, 2024, for the first spot, Litecoin ETF.

Solana (SOL)

In our view, the SEC will approve spot Solana ETFs in 2025, following the SEC’s classification of SOL as a non-security. Solana was designed around speed and scalability and is capable of high transaction throughput. It’s currently the fifth-largest cryptocurrency by market capitalization (approx. $104 billion) and has a 24-hour trading volume of around $5 billion. SOL was previously classified as a security in the SEC’s cases against Binance and Coinbase. In a court filing since, the SEC has indicated that it will stop pursuing classification of SOL as a security in the Binance case; however it has not made a similar filing in its case against Coinbase. VanEck filed an S-1 to the SEC on June 27, 2024, to list the first spot Solana ETF, and subsequently, 21Shares, Bitwise, Canary Capital, and Grayscale have all submitted filings for spot Solana ETFs. We don’t anticipate the SEC will decide on these ETFs before commissioner turnover from the new administration.

Ripple (XRP)

We expect the SEC to approve spot XRP ETFs this year. XRP was originally sold by Ripple Labs (Ripple). Similar to SOL, XRP is designed for speed and high transaction throughput, and it’s currently the third-largest cryptocurrency by market capitalization (approx. $141 billion), with a 24-hour trading volume of around $16 billion. The SEC sued Ripple, claiming Ripple illegally issued a security in selling XRP. On July 13, 2023, the US District Court in the Southern District of New York ruled that Ripple’s institutional sales constituted security sales, but its retail sales were not considered security sales, resulting in the court ordering Ripple a civil penalty of $125 million. The SEC appealed the court’s decision, seeking to reassess its interpretation of XRP as not a security. We expect the SEC to drop its case against Ripple, clearing the way for the approval of XRP ETFs. On October 2, 2024, Bitwise was the first to file an S-1 for a spot XRP ETF. Since then, Bitwise, Canary Capital, 21Shares, and WisdomTree have all filed.

SEC to Rescind Staff Accounting Bulletin No. 121, a Positive for Banks Looking to Enter the Cryptocurrency Space

| Winners | JP Morgan Chase & Co (JPM), Bank of America Corp (BAC), Citigroup Inc (C), Wells Fargo & Company (WFC), U.S. Bancorp (USB), Capital One Financial Corporation (COF) |

| Losers | Coinbase Global. Inc (COIN), Robinhood Markets (HOOD), Block (SQ), Bakkt Holdings (BKKT) |

Capstone expects the SEC will rescind Staff Accounting Bulletin No. 121 (SAB 121), opening the door for banks to better compete in the crypto industry. In March 2022, the SEC Office of the Chief Accountant released SAB 121, which indicates that financial institutions holding crypto on behalf of customers should report the assets on their books with an accompanying liability, similar to how a bank would record cash held on behalf of its customers. The rule has generally prevented banks expanding into the industry because holding their customers’ cryptocurrency would significantly increase their reserve requirements, restricting their ability to lend.

If SAB 121 is rescinded, traditional banks will be well-positioned to expand into the industry and steal market share from incumbents and first entrants. Traditional banks already have robust cybersecurity systems in place, better reputations, larger customer bases, and experience pushing new product offerings to that customer base. Once these institutions can comfortably expand their crypto offerings, they can incentivize knowledgeable customers to consolidate their financials and directly market to customers who are new to the space and being targeted by the incumbent platforms.

Capstone thinks the SEC will choose to outright rescind SAB 121 due to confusion around the rule and the expected pro-crypto makeup of the SEC. Reportedly, several large banks got a green light from the SEC to bypass SAB 121 by ensuring their customers’ assets would be protected in the event of bankruptcy or failure, among other safeguards. In our view, this pathway to avoiding SAB 121 creates additional confusion around the rule. While the SEC could keep the status quo and promote this pathway, we believe the new majority will prefer to eliminate the rule.

We believe any efforts to walk back SAB 121 will enjoy the support of Congress. In May 2024, Congress passed a joint resolution of disapproval of SAB 121 under the Congressional Review Act (CRA) after the Government Accountability Office (GAO) determined that SAB 121 constituted a rule. President Biden vetoed the resolution later that month, and Congressional efforts to overturn the veto via supermajority failed.

Even if the SEC chooses not to act on SAB 121, we believe the banking industry and Congress will pursue other paths to eliminate the rule. Under the new precedent established by the Supreme Court’s June 2024 decision in Loper Bright v. Raimondo, courts determine the best reading of statutes in cases challenging federal agencies’ interpretations. If SAB 121 stays intact, we expect banks to use Loper Bright to challenge the rule in court.

Read more from T.J.:

Firewall Frenzy: Cyber Vendors Benefit Amid Rising Global Tensions