Supreme Court Timing Will Hamstring CFPB into 2024; States Likely to Play Larger Regulatory Role

By: John Donnelly, Jackie Davey, and Thomas Dee

In this report, we highlight the latest consumer finance developments, that we think companies and investors should be paying attention to, including our latest view on the legal challenge to the Consumer Financial Protection Bureau (CFPB) and a continued focus on the state and federal level on consumer-facing fees.

March 22, 2023 – Capstone believes the US Supreme Court’s recent decision to hear a challenge to CFPB’s constitutionality during the court’s October 2023 term will limit the bureau’s near-term regulatory agenda and hinder its enforcement authority and ability to finalize rules, including the proposed reduction in the credit card late fees safe harbor.

However, the court’s timing staves off, for now, a decision that could carry broad and underappreciated implications for financial regulators, consumers, and industry alike.

The Supreme Court on February 27th granted the CFPB’s writ of certiorari related to the decision from the US Court of Appeals for the Fifth Circuit in Community Financial Services Association of America (CFSA) v. Consumer Financial Protection Bureau, which found the bureau’s appropriations model unconstitutional. However, the Supreme Court did not agree to expedite the case and hear it in the current term, which the CFPB had requested based on the uncertainty created by the Fifth Circuit’s decision.

That uncertainty will now persist until the Supreme Court releases its opinion, which will likely be late-Q2 2024. Courts, even those outside the jurisdiction of the Fifth Circuit, have granted stays to companies involved in litigation with the CFPB, such as MoneyGram International Inc. (MGI) and Populus Financial Group (doing business as Ace Cash Express). Other litigants, including Credit Acceptance Corp., will use the cert decision to support similar requests as TransUnion (TRU) did in a February 28th motion to stay all proceedings pending the Supreme Court opinion. With litigation mostly frozen, companies that the CFPB is investigating are less likely to settle charges, unless they view the terms as highly favorable.

Similarly, we believe industry participants will be successful in preventing new regulations from going into effect. The direct impact of the Fifth Circuit’s decision in CFSA was to vacate the bureau’s small dollar lending rule. Following that logic, we expect that operators within the Fifth Circuit’s jurisdiction could challenge new rulemaking and will likely be granted an injunction blocking implementation. Rules such as the CFPB’s proposal to lower the credit card safe harbor late fees are increasingly likely to be tied up in the courts, which shifts the timeline closer to allowing a potential Republican appointee at the CFPB to rescind the rules in early 2025, even if the CFPB does prevail in the Supreme Court.

If the Supreme Court determines that the CFPB’s funding is unconstitutional, then the implications will be more severe and could reach beyond the bureau. Legal experts we have spoken with largely agree that, if the Supreme Court rules in favor of CFSA, its opinion will allow the CFPB to continue to exist and avoid vacating all its historical actions. The view relies, in part, on Chief Justice John Roberts’ opinion in Seila Law v. CFPB that said eliminating the CFPB and reverting its authority to the agencies previously responsible would “trigger a major regulatory disruption and would leave appreciable damage to Congress’s work in the consumer-finance arena.” Chief Justice Roberts also noted that the Office of Thrift Supervision no longer exists and the other agencies cannot absorb the CFPB’s operations, leading him to find “it is far from evident that Congress would have preferred no CFPB to a CFPB led by a Director removable at will by the President.” Extending this argument, the Supreme Court now is expected to determine that it is unlikely Congress would prefer no CFPB to a CFPB subject to direct appropriations.

However, it is possible that the Supreme Court, which has been increasingly skeptical of administrative authority, could take Justice Clarence Thomas’ view, which he voiced in his partial dissent in Seila Law, that the unconstitutional provision is not severable. Such a finding would have led him to deny enforcement of the civil investigative demand in question. In CFSA, such a decision would result in the small dollar lending rule being vacated. This would create a precedent for similar challenges to succeed until Congress acted to change the CFPB appropriations. This could neuter the bureau for years or create a regulatory vacuum by vacating enabling regulations such as the qualified mortgage safe harbor or an exemption from the definition of student lender for educational institutions. It also risks severely restricting consumer credit. In its decision, the Fifth Circuit was critical of what it called the CFPB’s “double insulation” from congressional appropriations as it could draw up to 12% of the total operating expenses for the Federal Reserve, which is itself independently funded. A similar focus from the Supreme Court will likely implicate only the CFPB, which is uniquely structured. A more expansive opinion that found that any agency must be subject to direct congressional appropriations would create the potential that the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), National Credit Union Administration (NCUA), and Federal Housing Finance Agency (FHFA)—which are all independently funded by fees or assessments from regulated entities—would face legal challenges and could ultimately be subject to a similar remedy. The remedy could range from amending the appropriations structure to reimagining the existing framework for financial regulation. As a result, while we believe the CFPB will attempt to continue business as usual in the near term, we note that the risk for a momentous Supreme Court decision is underappreciated.

The Month in Review

Enforcement Activity

- CFPB issues enforcement action against TitleMax for violations against military families. The CFPB on February 23rd ordered TitleMax to pay a $10 million fine for making illegal loans at unlawful rates, falsifying information to cover it, and charging unlawful fees for unnecessary products. The bureau found that the company charged annual interest rates that were higher than the legal limit of 36% and often more than 100%, to military families and doctored personally identifiable information so that borrowers would not be identified as servicemembers or covered dependents, who are protected under the Military Lending Act (MLA). The action requires TitleMax to pay $5.05 million in redress to consumers, stop engaging in illegal lending practices, and pay a $10 million fine to the CFPB. TitleMax has been under a CFPB consent order since September 2016 for its lending and debt-collection practices, although we believe the manageable penalty is indicative of the type of settlements the CFPB will be able to attain under its current legal cloud.

- CFPB shuts down mortgage lender for repeated violations against military families. The CFPB on February 27th ordered RMK Financial Corp. to exit the mortgage lending business and pay a $1 million penalty to the bureau’s victims’ relief fund. The CFPB issued an order against RMK in 2015 for sending advertisements to military families falsely representing that it was affiliated with the federal government, among other charges. The bureau found that RMK continued to engage in a series of repeat offenses despite the 2015 consent order’s prohibitions on this behavior. In addition, the CFPB cites harm to military families by deceiving borrowers about interest rates and key terms, misrepresenting loan requirements, and lying about projected savings from refinancing.As evident by the plurality of enforcement actions in the past month alone, repeat offenders, especially when coupled with military-related consumer protection violations, have remained a key focus for the CFPB under Director Rohit Chopra.

Public Activity

- CFPB and FTC request public comment on renter background screening. The Federal Trade Commission (FTC) and CFPB issued a request for information (RFI) on February 28th asking for public comment on the impact of background screening issues for those seeking rental housing in the US. The announcement is part of a broader whole-of-government effort to address background screening issues for renters. The agencies want input on a variety of issues affecting tenant screening, including the use of criminal and eviction records by landlords in making housing decisions, potential impact of record inaccuracies, application and screening fees, use of algorithms or automated decision-making technology in the process, and ways to improve the current process.

- CFPB releases issue spotlight on high fees on public benefits. The CFPB published an issue spotlight on March 1st on the prevalence of high fees for recipients of public benefits. It notes that public benefits are eroded by fees, particularly by prepaid card administrators by way of maintenance, balance inquiry, customer service, or ATM fees. In 2020, prepaid card administrators collected $1.3 billion in transaction fees on the $409 billion in public benefits distributed, resulting in uneven access to benefits across states with different laws. The CFPB also noted that individuals experience inadequate customer service across public benefits programs and could be trapped by a lack of choice, competition, and how they receive benefits.

- Bureau released buy now, pay later report. The CFPB published a report on March 2nd analyzing the financial profiles of buy now, pay later (BNPL) borrowers. The report found that BNPL customers have lower-than-average credit scores, are more likely than non-BNPL users to have high volumes of debt, and are delinquent on other forms of credit. Additionally, black, Hispanic, female, and lower-income (between $20,001 and $50,000) consumers are more likely than average to use BNPL products. In the press release, Director Chopra stated that since BNPL is like other forms of credit, the bureau is working to ensure that borrowers have similar protections and companies play by similar rules. We believe the findings are in line with prior CFPB comments on BNPL, although it moves the industry back into the spotlight as Director Chopra continues to signal further actions.

- CFPB and NLRB announce information sharing agreement. The CFPB and the National Labor Relations Board (NLRB) signed an information-sharing on March 7th to protect American consumers and workers by addressing unlawful practices involving employer surveillance and employer-driven debt. The agreement will help identify and end financial practices that harm workers, and better enforce consumer protection and labor laws. The announcement follows an inquiry by the CFPB in June 2022 on practices that leave workers indebted to their employers.

Consumer Advocate Corner

Earlier this month, the Public Interest Research Group (PIRG) issued a report on the prominence of the big credit bureaus among CFPB complaints. The report noted that consumer complaint totals set new records in 2021 and again in 2022, with complaints against the National Consumer Reporting Agencies (NCRAs) topping all complaints among both credit reporting products and all categories of complaints. Contrary to the defense the NCRAs provided, the report noted that the CFPB has rejected the claim that credit repair organizations (CROs) are responsible for the increased total complaints. The report provides a host of recommendations to ensure adequate consumer protection, suggesting policymakers resist efforts to weaken the CFPB’s structure, consumer file complaints with the CFPB and use the database when making financial choices, and the bureau continue supervisory, enforcement, and educational actions across the marketplace of consumer reporting and debt collection, and conduct further rulemaking to defend state rights to enact and enforce federal and state consumer laws to hold consumer reporting agencies accountable.

On March 13th, the National Consumer Law Center (NCLC) released a report on the role of junk fees in increasing rising rents. The report includes survey results citing the prevalence of 13 types of fees assessed in rental housing, which found that 89% of respondents paid rental application fees and 87% experienced excessive late fees. NCLC argued that these fees can present barriers to affordability for rental housing in an environment where rising prices are already creating financial struggles for renters.

The Center for Responsible Lending (CRL) issued policy recommendations on March 14th for states and the CFPB to protect consumers by regulating earned wage access (EWA) products, including states regulating EWA providers as lenders under their state credit laws, the CFPB actively supervising providers, jointly affirming that “tips” on extensions of credit are attempts to disguise interest charges, and jointly regulate all fees charged to the consumer as credit.

- CFPB issues supervisory highlights identifying junk fees affecting consumers. The bureau released a special edition of its Supervisory Highlights on March 8th, focused on unlawful junk fees in deposit accounts and in loan servicing markets, including in mortgage, student, and payday lending. In particular, the report calls out surprise overdraft fees, multiple non-sufficient funds (NSF) fees for a single occurrence, inflated estimated repossession fees, fake or excessive late fees, pay-to-pay payment fees and kickback payments in auto loan servicing, fake private mortgage insurance (PMI) premium charges, fees for unnecessary property inspections, vehicle repossession and property retrieval fees, and late fee and interest charges after student loan payments were made on time. The report provides further insight into the CFPB’s priorities within its broader junk fee initiative.

- Bureau seeks public comment on mortgage loan originator rules. On March 10th, the CFPB issued a notice and request for comment, announcing that it is reviewing Regulation Z’s mortgage loan originator rules under the Regulatory Flexibility Act. Comments are due 45 days after publication in the Federal Register. In particular, the bureau is seeking comment on the economic impact of the loan originator rules on small entities to determine whether the rules should be continued without change or amended or rescinded to minimize any significant economic impact of the rules for small entities.

- CFPB requests information on data brokers ahead of FCRA reform. On March 15th, the bureau issued an RFI on the activity of data brokers and the potential impacts of their business practices on the daily lives of consumers. The CFPB is seeking information on the types of data that brokers collect and share; the sources they rely on for information; the types of entities that have relationships with data brokers and the nature of those relationships; and consumers’ experiences with data brokers, including potential benefits or harm, among other information. The press release notes that the feedback from this inquiry will better inform the bureau’s planned rulemaking to amend the Fair Credit Reporting Act (FCRA). Comments are due by June 13, 2023, which could signal that the CFPB will struggle to release a proposed change to the FCRA regulations by the end of the year.

Rulemaking

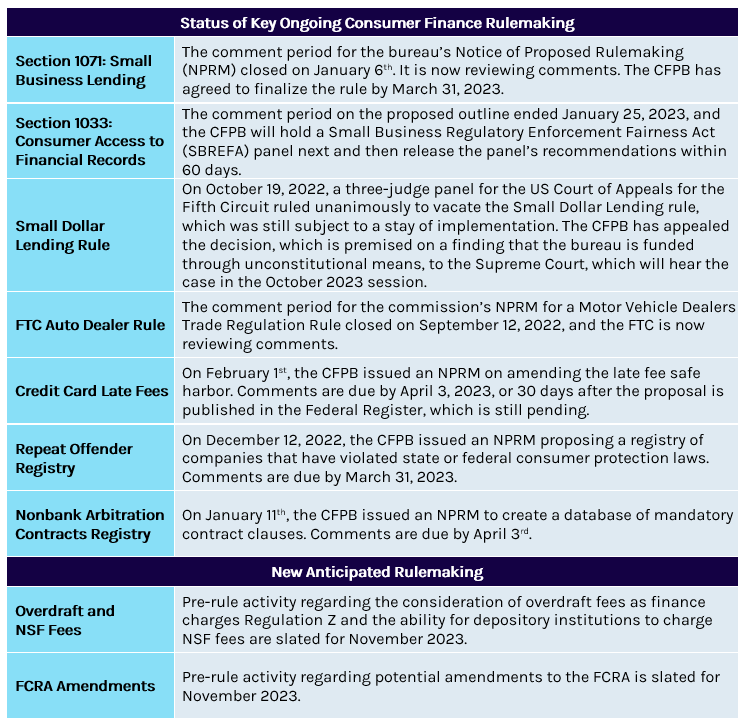

There were no significant changes in the CFPB’s rulemaking agenda in the past month. We are continuing to monitor the below processes:

Noteworthy Developments

Congressional Activity

- House Republican lawmakers push back on CFPB credit card late fee rulemaking. On March 1st, Republican representatives on the House Financial Services Committee sent a letter to CFPB Director Chopra criticizing the bureau for not adjusting the credit card late fee safe harbor for inflation in December 2022, as is required annually under Regulation Z.Furthermore, the lawmakers argued that the late fee safe harbor thresholds outlined in the bureau’s proposed rule will have negative consequences as credit provider will offset lost income by increasing interest rates for all borrowers or limiting extensions of unsecured credit to borrowers with low credit scores. Additionally, they argue that the bureau failed to fulfill its statutory obligation to comply with the SBREFA by not convening a Small Business Review Panel, contending that the rule will result in a significant economic impact on a substantial number of small banks and credit unions. The letter asks Director Chopra to respond to a series of questions about the bureau’s actions and rationale for proposed changes to the late fee safe harbor.

- Senate Democrats call for greater protections against Zelle fraud. Five Senate Banking Committee Democrats sent a letter on March 2nd to the leadership of the Federal Reserve, NCUA, FDIC, and OCC, voicing concern about the oversight of the Early Warning Services’ (EWS) Zelle payments network. They urged regulators to ensure that Zelle complies with the Electronic Fund Transfer Act (EFTA) and the Bank Secrecy Act (BSA) and suggested that Zelle poses safety and soundness risks since depository institutions take the position that they are not responsible for making customers whole through a reliance on ambiguity regarding the classification of transactions as “authorized,” “unauthorized,” or “error.” The senators urged the OCC and Federal Reserve Board to directly examine EWS to ensure compliance with consumer protection and anti-money laundering (AML) laws.

- House Financial Services Subcommittee holds hearing on CFPB reform. The House Financial Services Subcommittee on Financial Institutions held a hearing on March 9th to examine potential reforms to the CFPB. The hearing comes amid legal uncertainty ahead of the Supreme Court hearing a case next term on the constitutionality of the CFPB under its funding current structure through the Federal Reserve. Republicans advocated for subjecting the bureau to annual congressional appropriations and restructuring its leadership into a multi-member board rather than a single director. While Republicans condemned what they categorized as overreaches of authority in a host of actions taken under Director Chopra, Democrats defended the bureau’s recent work to further protect consumers. There was no support from Republicans to eliminate the bureau entirely, and the majority continued to make the distinction between the funding of the CFPB and that of other agencies not subject to direct appropriations, especially the prudential regulators.

Chart of the Month

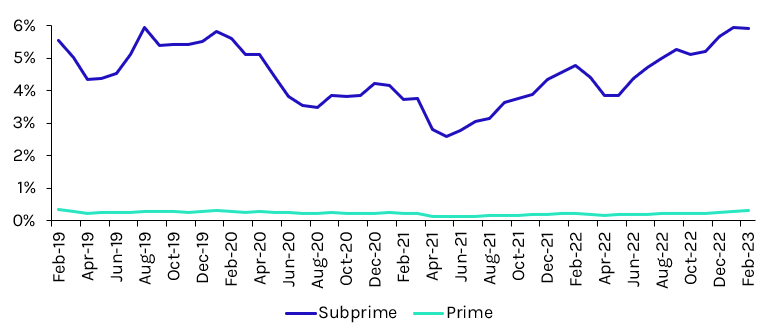

Auto Loan 60+ Subprime Delinquencies Reach Pre-Pandemic Levels

Auto loan performance has been deteriorating after delinquency rates dropped significantly during the COVID-19 pandemic. Sixty-day subprime delinquencies of 5.93% in January matched the highest level in recent years (recorded in August 2019) and were second only to the record peak of 5.96% in October 1996. Delinquencies fell slightly in February for subprime borrowers, in line with historical trends, although the figure ticked up to 0.32% for prime borrowers compared to 0.28% in January 2023 and 0.24% in January 2022.

Consumer Complaints Tracker

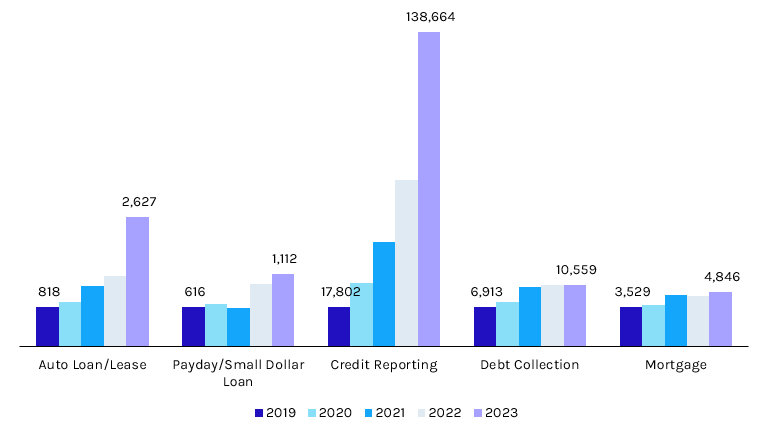

Note: scaled to show growth from 2019; data through February of each year

Consumer complaints to the CFPB continued to increase and were up 68.9% year over year (y/y), up 25.5% y/y excluding credit reporting, through February. Data for complaints related to auto financing and mortgages continue to be skewed by a high number of complaints about Wells Fargo after the CFPB encouraged submissions in its December 2022 enforcement action. Excluding the company, auto loan and lease complaints are still up 26.2% y/y compared to an 82.3% y/y headline increase while mortgage complaints would be down 21.7% y/y excluding Wells Fargo instead of up 9.5% y/y. Overall, we believe the increase in consumer complaints reflects increased strain on consumer finances as delinquency rates for auto loans and small dollar loans have returned to pre-pandemic levels and underwriting standards have tightened, making it more difficult for consumers to access credit at a favorable cost.

Looking Ahead

We expect the CFPB’s legal challenges will result in an increased shift of responsibility to state regulators—an area that has been largely overlooked since Democratic leadership took over at the bureau. As the CFPB will continue to pursue an aggressive agenda, it is likely to leverage state partnerships to provide it some legal insulation. For example, we anticipate the bureau will bring joint enforcement actions alongside state attorneys general who can pursue at least some of the claims independently if the Supreme Court severely limits the CFPB’s authority. Additionally, Director Chopra touted the White House’s effort to encourage states to crack down on “junk fees” earlier in March, which would include passing legislation and taking enforcement action by leveraging state or federal consumer protection laws.

States have been responsive to the CFPB’s efforts. The New York State attorney general joined the bureau’s complaints against MoneyGram and Credit Acceptance Corp. (CACC) while California passed legislation last year limiting the price of guaranteed asset protection (GAP) waivers for auto loans. The California Senate also introduced legislation (S.B. 478) that would prohibit “drip pricing,” although it has not advanced yet. The White House release lists eight other examples of state actions covering fees from hotels, food delivery, event ticketing, rental cars, installment lending, and debt settlement from regulators including Massachusetts, Nebraska, Maryland, and the District of Columbia. As we anticipate the CFPB will have little legal recourse for at least the next 12–15 months, we believe this state activity will accelerate and presents ongoing risks to the consumer finance industry even if a Republican president is elected in 2024.

What We’re Reading

A bumpy road ahead for credit union auto lending, American Banker

White House urges states to join crackdown on surprise consumer fees, Reuters

Nearly half of millennials, Gen Xers have more credit-card debt than savings, The Hill

Credit card debt soars as perks proliferate, AxiosLittle relief for US consumers as sticky rents keep inflation elevated, Reuters