June 28, 2024

The Bottom Line:

Capstone believes the most likely outcome of the snap French legislative elections – a victory for either the far-right (leading with 36% votes according to latest polls) or far-left (27%) – would result in adverse regulatory impact for oil and gas companies like TotalEnergies and motorway companies like Vinci. A win for the far-left is also likely to result in stricter PFAS regulations, impacting cooking utensil manufacturers like SEB.

- Legislative Elections: In two rounds on 30th June and 7th July, French voters will elect the 577 deputies of the National Assembly for a three-year term, before the Presidential and legislative elections in 2027. President Macron called for snap legislative elections following the collapse of his coalition in the European legislative elections, in hopes of achieving better domestic results. However, the gamble may prove unsuccessful as the latest IFOP poll suggests the far-right National Rally (36%) is leading the race for round one, ahead of far-left New Popular Front (27%). The President is expected to appoint a new Prime Minister from the majority-winning party and make some policy concessions.

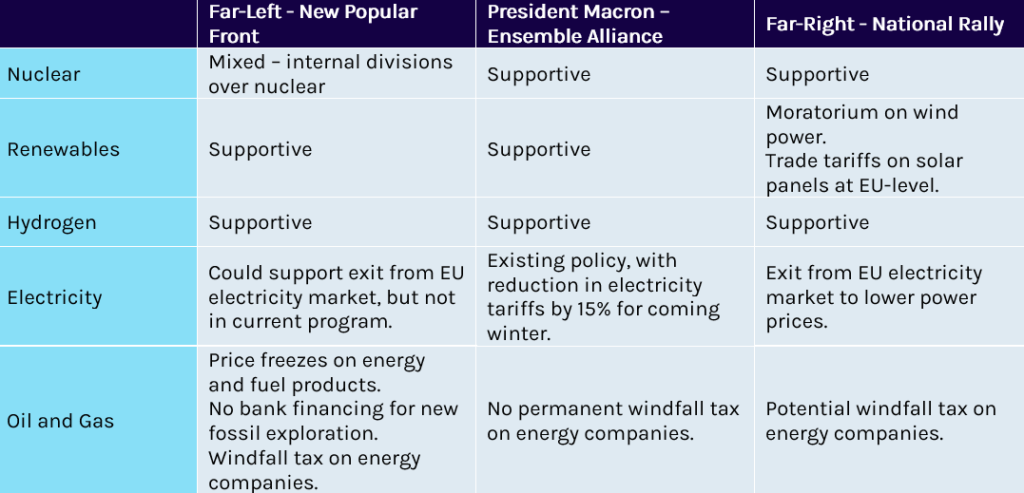

- Energy: The far-left party supports renewable energy broadly while targeting windfall profits of oil and gas companies, posing risks to TotalEnergies (TTE on the Paris exchange). The far-right’s manifesto supports renewables except for new wind power developments. Like the New Popular Front, the far-right has also been vocal about taxing superprofits but has yet to provide clear details.

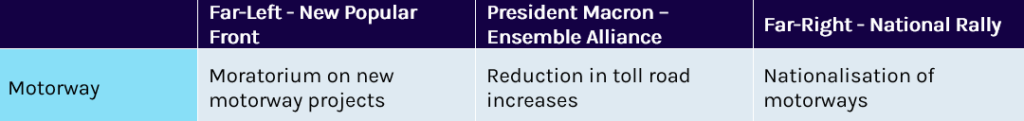

- Infrastructure: Both the far-left and far-right manifestos include policies regarding motorways. The far-left proposes a pause on new motorway construction, raising questions about ongoing projects. The far-right suggests the government take control of motorways by terminating existing concession contracts. However, we do not expect this plan to be implemented due to the high associated costs, estimated at €50 billion. Nevertheless, tougher policies on toll road prices are likely, with negative repercussions for groups like Vinci (DG on the Paris exchange) and Eiffage (FGR on the Paris exchange).

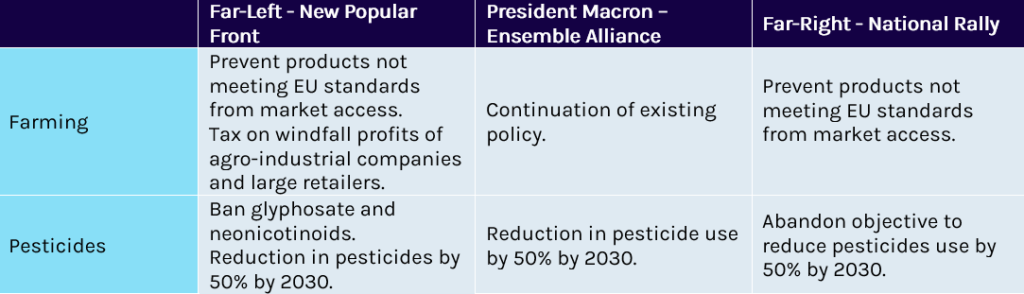

- Agriculture: The far-left supports taxes on windfall profits of agro-industrial companies and large retailers, negatively impacting brands like Carrefour (CA.PA on the Paris exchange). Pesticide producers may also face stricter regulations, particularly affecting Bayer (BAYN on the German exchange) due to its exposure to glyphosate sales in France. Conversely, a far-right victory would likely lead to a more lenient approach.

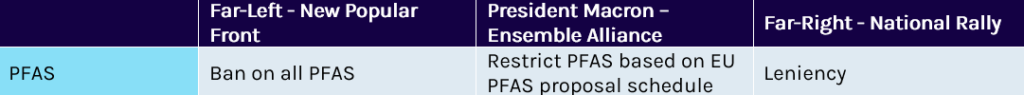

- Chemicals: A far-left win would likely lead to stringent PFAS regulations, particularly for segments excluded from the ban voted earlier this year. Companies directly impacted include cooking utensil manufacturer SEB (SK on the Paris exchange). Alternatively, a win for the far-right would likely result in leniency, including for PFAS.

A DEEPER LOOK

Background

On 9th June, President Macron called for snap legislative elections following a large defeat for his party in the European elections, where the far-right National Rally obtained 31% of the votes. The legislative elections will serve to re-elect the National Assembly’s 577 deputies via direct universal suffrage, which means every French adult registered to vote can cast a ballot. In each district, the vote takes place in two rounds one week apart, on 30 June and 7 July, with the second round being a duel between the two candidates with the highest scores.

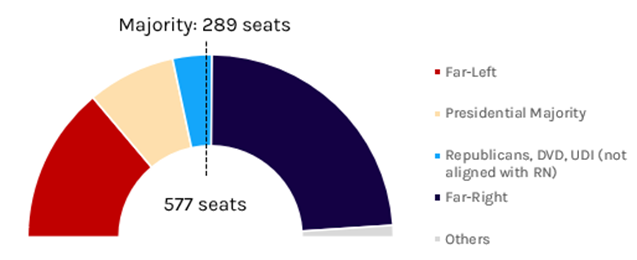

Currently, President Macron’s Ensemble coalition is underperforming (see Exhibit 1) its previous legislative score, when it had obtained 245 seats, or was 44 seats away from an absolute majority. The latest polls suggest a win by the National Rally, which may fall just short of winning a full majority. If either party wins a simple majority, they will need to reach agreements to pass legislation, which requires majority voting in Parliament. Legislative blockage is likely until the next elections in 2027.

Exhibit 1: Voting Intentions for the First Round, 19-21 June

Source: Elabe

The French system is heavily weighted towards the President. When the President lacks a majority in the Assembly, it is customary but not mandatory to appoint a Prime Minister from the majority party. This is because appointing a Prime Minister from outside the majority would lead to a hostile Assembly likely to reject the President’s bills. However, the President may still pass some laws without a vote using Article 49.3 of the Constitution, though this risks a motion of censure from deputies, potentially overthrowing the government. Additionally, the President has the right to request a new deliberation of the law or certain articles by Parliament, delaying the approval of laws. Finally, if government action is blocked, the President may dissolve the National Assembly, triggering new elections. This is risky as the new majority may still oppose the President’s agenda, and the President can only dissolve the Assembly once a year.

Nevertheless, we expect the President to appoint a Prime Minister from the Assembly majority and compromise on some of their policy proposals. Blocking all laws would likely lead to negative outcomes in the upcoming presidential elections in 2027, as both extremes would blame the President for uncooperative behavior with the Assembly.

In this note, we review the main policy proposals pertaining to energy, industrials, and infrastructure, and assess their likelihood of passage and companies impacted.

Energy Policy Proposals

Our Take

If the New Popular Front (Nouveau Front Populaire ) is victorious, we foresee potential risks for oil and gas companies in the event of possible price freezes on energy and fuel products. TotalEnergies has proactively implemented a voluntary cap on fuel prices at €2 per liter of petrol for 2023 and 2024, with most competitors following suit. Although the New Popular Front has not specified a level for the price freeze, a freeze at €2 per liter could have significant implications during commodity price fluctuations. We believe such measures could gain broader parliamentary support, especially as there is a push coming from the French Senate to impose larger taxes on the windfall profits of TotalEnergies and other energy companies. Currently, a tax is imposed on the inframarginal revenues of electricity producers which runs until 2025. A win for the Nouveau Front Populaire will likely result in an expansion in the scope of this measure.

If the New Popular Front (Nouveau Front Populaire ) is victorious, we foresee potential risks for oil and gas companies in the event of possible price freezes on energy and fuel products.

In the event of a National Rally (Rassemblement National) victory, wind power will face challenges. Its Prime Minister candidate Jordan Bardella could call for a moratorium on wind power, similar to the 2010 moratorium on solar photovoltaic by then-Prime Minister Francois Fillon, which had aimed to manage the surge in applications and determine a long-term trajectory for the sector. When a moratorium is issued, it is reviewed by the Superior Council of Energy, which suggests amendments that the government may or may not adopt, leaving ample decision-making power to the governing party. For solar energy, the National Rally’s presidential election manifesto included a similar measure, although it has since been removed. The current objective for solar is to promote local manufacturing and protect the industry from foreign imports through EU-level tariffs. With regards to the EU electricity market, we do not see France’s exit as a tangible risk. There are two legal avenues for withdrawing from the market: convincing the European Parliament and a sufficient majority of states to reform the existing system, which is unlikely due to the need for substantial EU support, or France withdrawing from the European Union, which is not part of the National Rally’s agenda. A third option would be for France to knowingly violate European law, which could lead to financial sanctions amounting to tens of millions of euros.

Finally, the National Rally has historically been vocal about taxes on superprofits. Specifically, they criticized the existing mechanism, which was expected to generate €3 billion for the government in 2023 but only brought in €600 million. We expect the National Rally’s first step will be to tighten the existing mechanism to prevent circumvention, with a potential follow-up instrument whose details remain to be defined.

Companies Impacted

Proposals from the New Popular Front would impact TotalEnergies, France’s largest fuel distributor, which has been at the center of controversy due to its windfall profits. Proposals from the National Rally would negatively affect companies developing wind projects in France, notably ERG (ERG on the Italian stock exchange), ABO Wind (ABO on the German stock exchange), and BayWa r.e. (BYW6 on the German stock exchange). We note that existing projects will not be affected.

Agriculture Policy Proposals

Our Take

Both the far-right and far-left propose protecting farmers by shielding the domestic market from foreign products not meeting the same environmental standards. This measure is feasible under World Trade Organization (WTO) rules, which allow countries to block imports on environmental or health grounds. The WTO’s focus on non-discrimination means that if France applies the same standards domestically, import restrictions are permissible. With regards to the EU, Member States are allowed to impose stricter environmental and health restriction than EU norms.

Specific to the New Popular Front program, we see imposing taxes on windfall profits of agro-industrial groups and large retailers as legally viable. This debate emerged following significant profits in 2023 due to inflation. Manuel Bompard, a prominent figure in the New Popular Front and a potential Prime Minister candidate, is championing a law currently under review in Parliament that aims to increase oversight on margins made by agro-industrial groups and retailers. Regarding pesticides and glyphosate, France has led in restricting glyphosate and neonicotinoids. While the EU has reapproved glyphosate, France has banned it for private use and limited its use for professionals. Although a complete ban is possible, anticipated farmer protests reduce the likelihood of such a measure.

We expect companies like Carrefour, France’s largest listed retailer, to be potentially impacted by windfall taxes. The group, with profits averaging €403 million between 2018 and 2020, achieved a record profit of €1.66 billion in 2023.

For the National Rally, a key proposal is to withdraw the new Ecophyto plan, set by the government in April 2024, which aims to reduce pesticide use by 50%. The new plan, criticised for prioritizing toxicity weights over total volumes, already faced delays to appease farmers, with a pause in implementation occurring in February 2024 before the updated version was adopted in April 2024.

Companies Impacted

We expect companies like Carrefour, France’s largest listed retailer, to be potentially impacted by windfall taxes. The group, with profits averaging €403 million between 2018 and 2020, achieved a record profit of €1.66 billion in 2023.

In the event of a victory for the New Popular Front, pesticide manufacturers’ sales in France could be at risk. France is notably the largest consumer of herbicides in Europe, accounting for 27% of total consumption, according to European Commission data. In 2023, Bayer’s Crop Science division achieved sales of approximately €23.27 billion, with around €3 billion attributed to glyphosate, based on the company’s annual report. Bayer’s total exposure to the MENA region (primarily Europe) is at 26.9%. Assuming a similar exposure in the herbicides segment, Bayer’s glyphosate revenue exposure in Europe is around €800 million, with France representing over €200 million of that revenue (27% of EU herbicide consumption).

Chemicals Policy Proposals

Our Take

If the New Popular Front wins, we anticipate even stricter policies on per- and poly-fluoroalkyl substances (PFAS) than the current legislature, which has already adopted measures that exceed EU-level requirements. Currently, an EU-wide PFAS restriction proposal is progressing through various legislative stages. If adopted, it will establish a harmonized restriction framework across EU Member States, with only rare exemptions granted for limited time periods. In anticipation of these EU-level restrictions, the French General Assembly passed a law in April 2024, limiting the production, sale, and distribution of certain products containing PFAS. The first measures, targeting cosmetics and wax, will take effect in 2026. The legislation also increases liability for PFAS manufacturers. However, the original bill was diluted, notably by dropping the proposed ban on PFAS in cooking utensils, largely due to lobbying efforts by industry players such as Groupe SEB (SK on the Paris exchange), which owns brands like Tefal that produce PFAS-containing frying pans. A victory for the New Popular Front would expand the PFAS restriction to currently excluded items like cooking utensils and food packaging.

Conversely, a win for the National Rally would likely result in lenient chemical restrictions, including on PFAS. During the Senate vote on PFAS restrictions, National Rally members abstained, indicating a potential preference for less stringent regulations.

Companies Impacted

Companies impacted by these potential changes include Groupe SEB, which is at risk of being prevented from selling PFAS-containing products in the French market. France accounts for 10% of SEB’s total revenue of €8 billion, making this a significant concern.

PFAS manufacturers with operations in France, such as Solvay (SOLB on the Brussels exchange) and Arkema (AKE on the Paris exchange), are also at risk. Solvay’s chemicals segment, which includes PFAS manufacturing and use, represented 33.5% (or €4.5 billion) of the group’s 2022 net revenue of €13.4 billion. Using the share of total revenue from Europe (27%) as a proxy for chemical sales in the EU, of which 14% is generated in France, we estimate that 1.2% of Solvay’s revenue could be affected by potential future restrictions, equating to €170 million. However, this estimate is conservative, as the potential closure of Solvay’s two French sites (out of four in Europe) could significantly impact its ability to serve customers.

Main Infrastructure Proposals

Our Take

Motorways have been a sensitive topic in French politics in recent years, largely due to protests from local environmental groups surrounding new projects. If the Nouveau Front Populaire wins, a moratorium on new motorway projects could be enacted. However, there is uncertainty regarding the treatment of existing projects, notably the A69 motorway currently under construction between Toulouse and Castres. Although the Socialist Party, part of the coalition, defends the A69, all other coalition parties criticize it. In light of this, we see a low likelihood of the project being permanently delayed, as halting it would exacerbate internal divisions and expose the government to legal action.

On the other hand, the National Rally criticises the high cost of motorways in France – in fact the most expensive in Europe at €7 per 100 km – and advocates for the nationalisation of motorways to reduce tolls by 15%. However, the term “nationalisation” is incorrectly used in this context, as motorways are currently publicly owned. Instead, taking control of motorways and their pricing would involve breaking existing contracts and compensating the companies responsible for building, maintaining, and operating motorways at an estimated cost of €50 billion. As such, we do not foresee this measure to be implemented given the country’s current financial situation, especially since concession contracts are set to expire in the next ten years, between 2031 and 2036. Nationalization could also raise issues with EU state aid laws for motorway operators, further complicating the process.

While we do not see substantial risks from the National Rally breaking existing contracts with motorway operators, there are risks of regulatory intervention to fix motorway prices.

Regardless, we anticipate adverse regulatory action toward current operators. Recent government reports indicate that companies like Vinci, Eiffage, and Albertis achieved their required returns on investment over ten years before the end of the concessions. A 2013 Court of Auditors had also warned of the imbalance between the contracting parties, which favored the operators, and criticized the “questionable” toll price increases. In 2015, the State imposed a toll price freeze until 2022 to protect French consumers’ purchasing power, but prices have risen again since 2023. Some experts have recommended a 60% reduction in toll rates, which indicates the scale of potential regulatory actions.

Companies Impacted

As highlighted above, while we do not see substantial risks from the National Rally breaking existing contracts with motorway operators, there are risks of regulatory intervention to fix motorway prices, which could have significant consequences for large operators. Vinci Autoroutes, the leading French motorway operator, manages 4,443 km in France and generated €6.32 billion in revenue in 2023, accounting for 9% of its total revenue. Vinci is followed by Eiffage, which reported €2.97 billion in revenue from its motorway operations, representing 13% of its total revenue in 2023. Sanef, the French subsidiary of the Spanish company Abertis, generated €1.99 billion in revenue from its motorway operations, making up 36% of its total revenue in 2023.

What’s Next

The legislative elections will be held in two rounds, on 30th June and 7th July. A candidate wins the seat if they win a majority of votes in the first round, provided a voter turnout of 25%. If not, the top two candidates, and others who won support from more than 12.5% of the registered voters, move on to the second round of the elections.