January 24, 2025

By Eric Scheriff, Capstone’s Global Energy Policy Head

Capstone believes the Trump administration will lean heavily on executive action to implement its energy agenda. Looking at Congress, with slim majorities and a host of priorities outside of energy, we believe Republican lawmakers will shy away from major action on energy. On balance, we believe the result of this dynamic will be a world that is moderately friendlier to fossil fuels.

Outlook at a Glance:

- IRA Tax Credits Largely Safe Under Trump, Limiting Risk for Clean Fuels; Congress to Target Chinese Firms’ Credit Access; Grants and Loans to Benefit Baseload Generation

- Permitting Reform to Remain a Priority in Next Congress But Still Unlikely to Pass in 2025, Presenting Continued Challenges for Transmission and Pipeline Developers

- Trump to Prioritize Oil & Gas by Removing LNG Export Barriers, Reducing Permitting Constraints, and Easing Environmental Requirements

- Trump EPA to Deemphasize Environmental Justice and Reduce Enforcement Actions, Spelling Tailwinds for Oil and Gas Producers and LNG Exporters

- Awareness of Power Market Tightening Likely to Grow; Trump Administration to Incentivize Natural Gas, Power Generation, and Transmission to Support Data Center Buildout

IRA Tax Credits Largely Safe Under Trump, Limiting Risk for Clean Fuels; Congress to Target Chinese Firms’ Credit Access; Grants and Loans to Benefit Baseload Generation

| Winners | Vistra Corp. (VST), Darling Ingredients Inc. (DAR), Air Products and Chemicals Inc. (APD), First Solar Inc. (FSLR), Occidental Petroleum Corp. (OXY), CNX Resources Corp. (CNX), Clean Energy Fuels Corp. (CLNE) |

| Losers | Sunrun Inc. (RUN), Enphase Energy Inc. (ENPH), Sunnova Energy International Inc. (NOVA), Tesla Inc. (TSLA), Contemporary Amperex Technology Co. Ltd. (300750 on the Shenzhen exchange), Gotion High-Tech Co. Ltd. (002074 on the Shenzhen exchange), JinkoSolar Holding Co. Ltd. (JKS) |

IRA Credits Largely Safe Under Trump, Grant, and Loan Funding Reallocations to Benefit All-of-the-Above Baseload Generation

Capstone believes Congress will not be able to fully repeal key Inflation Reduction Act (IRA) tax credits, given their largely bipartisan support. Instead, the Trump administration will likely adjust regulations to provide more favorable treatment for fuels with higher emission profiles and to restrict Chinese companies’ ability to claim credits.

We believe the Trump administration will, where possible, reallocate IRA grant and loan funding to support key sectors traditionally favored by Republicans, including carbon management, advanced fossil, advanced nuclear, biofuels, methane-based hydrogen, and critical materials. Where this is not possible, we expect the administration to rescind unspent funds and leave other funding uncommitted until the programs’ sunset dates.

Duration of Clean Electricity Tax Credits Likely to Be Scrutinized to Offset Cost of Trump Tax Cuts

We expect the IRA’s technology-neutral clean electricity credits and credits for existing nuclear plants to remain durable under the Republican administration, as such credits have historically enjoyed bipartisan support. However, Republicans may target the duration of the tech-neutral tax credits to help offset the cost of extending the 2017 Tax Cuts and Jobs Act.

Republicans Likely to Attempt to Restrict Chinese Companies’ Access to Tax Credits

IRA tax credits that support domestic manufacturing of batteries, solar components, wind components, and critical minerals will be difficult to repeal, given the widespread investments they have generated in Republican-controlled districts. However, we believe Congress will consider adding provisions that restrict the eligibility of Chinese companies to claim these tax credits, in an effort to bolster domestic supply chains and enhance national security.

Electric Vehicle Tax Credit Most at Risk of Repeal, But Likely to Maintain Necessary Margins of Republican Backing

The electric vehicle IRA tax credit is most at risk of repeal under the Republican administration. However, given that electric vehicle battery manufacturing facilities are increasingly located in Republican districts, providing jobs and promoting economic development, we believe it is possible that there will be sufficient congressional Republican support to keep the credit in place.

Permitting Reform to Remain a Priority in Next Congress but Still Unlikely to Pass in 2025, Presenting Continued Challenges for Transmission and Pipeline Developers

| Potential Winners | NextDecade Corp. (NEXT), Williams Companies Inc. (WMB) |

| Losers | N/A |

Permitting Reform Negotiations to Continue in 2025

Congress failed to pass permitting reform legislation in the 2024 lame-duck session, largely due to disagreements over whether to include more significant changes to the National Environmental Policy Act (NEPA) and a lack of consensus on the Energy Permitting Reform Act of 2024 proposed by Sen. Joe Manchin (I-WV) and Sen. John Barrasso (R-WY).

In the next Congress, we expect permitting reform to remain a priority. However, issues such as border security, national security, and passing a tax bill will be higher on the Republican leadership’s priority list.

Despite Being a Policymaker Priority, Permitting Reform Remains Unlikely to Pass in 2025

Given the Senate filibuster’s 60-vote threshold, any permitting reform bill passed through regular order will require substantial compromise, posing a hurdle for passage next session.

Capstone believes that reconciliation could be used to pass only limited energy permitting reform measures such as energy leasing, as seen with the opening of the Arctic National Wildlife Refuge to oil and gas leasing through the Tax Cuts and Jobs Act of 2017.

Based on these considerations, Capstone believes that permitting reform bills considered by the next Congress will likely still be limited to compromise measures, with sweeping changes to NEPA and other environmental laws likely off the table. Developers of large infrastructure projects like power transmission and pipelines stand to see the greatest benefits from any permitting reform, as even compromise legislation would likely help to speed up project timelines. However, we believe permitting reform is unlikely to pass in the new Congress, as the challenges that prevented passage during the lame duck will persist.

Trump to Prioritize Oil & Gas Development by Removing LNG Export Barriers, Reducing Permitting Constraints, and Easing Environmental Requirements

| Winners | NextDecade Corp. (NEXT), Williams Companies Inc. (WMB), Energy Transfer LP (ET), Kinder Morgan Inc. (KMI) |

| Losers | N/A |

Tailwinds Ahead for US LNG Exporters as US Department of Energy to End Permit Pause on Exports to Non-Free Trade Agreement Countries

Capstone expects President Trump to issue an executive order upon taking office to end the US Department of Energy’s (DOE) pause on new permits for LNG exports to non-free trade agreement (non-FTA) counties. This will rescind the April 2023 policy statement on non-FTA extension requests and expedite the processing of liquefied natural gas (LNG) export applications at both the Federal Energy Regulatory Commission (FERC) and DOE. While the Biden administration recently finalized its public interest study of LNG exports to non-FTA countries, we do not believe it will have any impact on the Trump DOE’s LNG policy. Additionally, we expect the US Department of Justice (DOJ) under Trump to support projects currently facing litigation, such as NextDecade Corp.’s (NEXT) Rio Grande project.

FERC Likely to Expedite Pipeline Permitting

Under Trump, we expect FERC to expedite the environmental review process for natural gas infrastructure by de-prioritizing environmental justice and climate change considerations, which are not explicitly required under environmental statutes. We believe this could lead to an increase in the number of natural gas certificates issued and will encourage more market participants to submit applications for new pipelines. For example, we expect to see more interest in projects like Williams’ Southeast Supply Enhancement to service data center-driven gas demand and potentially more projects increasing offtake from the Marcellus Shale.

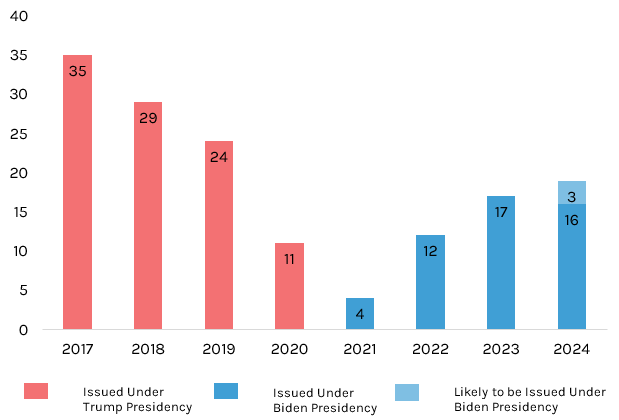

In recent years, FERC has attempted to revisit the process for issuing certificates for natural gas infrastructure, both in terms of assessing market needs and climate impacts. This has largely been driven by adverse rulings by the US Court of Appeals for the DC Circuit, which has vacated or remanded FERC pipeline certificates. Williams’ Regional Energy Access Expansion project is a recent example. Additionally, there is a notable difference in the number of gas certificates issued by FERC under Republican and Democratic administrations. From 2017 to 2020, during Trump’s first presidency, FERC issued nearly 100 certificates. Since Biden has taken office, the commission has thus far issued just under 50 (see Exhibit 1).

Exhibit 1: Number of FERC Gas Certificates Issued Under Trump and Biden Administrations

Source: FERC, Capstone analysis

Federal Methane Regulations Likely to be Weakened

Capstone expects the Trump administration to roll back Biden-era methane regulations—referred to as the Quad-O standards—for upstream producers. The US Environmental Protection Agency (EPA) finalized the regulations in December 2023, imposing strict compliance obligations for the measurement, reporting, and verification of methane emissions from upstream operations.

Relatedly, we also expect Congress to repeal the Waste Emissions Charge (WEC). This was enacted via the IRA and fines midstream and upstream facilities for having methane emissions that exceed congressionally-established thresholds. Importantly, compliance with the Quad-O standards can exempt facilities from the WEC.

Broadly, repeal of the WEC has been a goal of the oil and gas lobby and Republicans alike. A cohort of House and Senate Republicans, including Vice President-elect JD Vance, has already introduced legislation—the Natural Gas Tax Repeal Act—that would repeal the WEC. Similarly, incoming EPA Administrator Lee Zeldin has historically voted against the EPA’s ability to impose methane regulations while in Congress, and he will likely follow through on Trump’s campaign promise to roll back oil and gas regulations, including the Quad-O standards.

Stringent Power Plant Regulations Set to be Rolled Back

Capstone expects the incoming Trump administration to issue an executive order to reverse several power plant regulations promulgated by the Biden administration, such as the rule on carbon emissions from new gas and existing coal-fired power plants and the Cross-State Air Pollution Rule (also known as the Good Neighbor Rule) and replace them with less stringent alternatives. We expect this to be carried out in a similar manner to how the first Trump administration reversed environmental rules, such as the Clean Power Plan, which was replaced with the less-stringent Affordable Clean Energy (ACE) Rule.

Both the rule on carbon emissions from new gas and existing coal-fired power plants and the Cross-State Air Pollution Rule are currently facing legal challenges. We expect these challenges to essentially become irrelevant once the Trump administration takes office.

Trump EPA to Deemphasize Environmental Justice and Reduce Enforcement Actions, Spelling Tailwinds for Oil and Gas Producers and LNG Exporters

| Winners | Oil and gas producers, LNG exporters |

| Losers | N/A |

Trump To Target Biden-Era Environmental Justice Executive Orders and Defang Office of Environmental Justice and External Civil Rights

The Trump 2.0 EPA is likely to pull back heavily on environmental justice by rolling back Biden-era reforms. The administration is likely to target Biden’s Executive Order (EO) 14096, Revitalizing Our Nation’s Commitment to Environmental Justice for All, and may also seek to revise or revoke Bill Clinton’s EO 12898, Federal Actions To Address Environmental Justice in Minority Populations and Low-Income Populations (which set the groundwork for environmental justice at the federal level).

Project 2025 calls for the newly-created EPA Office of Environmental Justice and External Civil Rights (OEJECR) to be folded into the Administrator’s Office and the Office of General Counsel (OGC). It also calls for the OGC to review the EPA’s environmental justice policies and authority, stating that the Biden administration had pushed the doctrine “beyond long-standing understandings of the legal limits of that authority.” Although Trump spurned Project 2025 on the campaign trail, he recently appointed several people with ties to it to his administration, including Russell Vought (tapped to head the Office of Management and Budget), who wrote the chapter on the Executive Office of the President. Trump’s criticism of Project 2025 seems primarily to have been a campaign tactic, and we believe he is likely to proceed with some of the major changes proposed in the document, given that Republicans will hold both Congress and the White House.

EPA Enforcement Likely to Decline as Agency to Adopt More Industry-Friendly Posture and See Budget Cuts Under Trump

We expect EPA enforcement actions to decline under Trump. The agency’s civil enforcement actions peaked in 2016, before trending lower from 2017 and reaching a nadir in 2020 and 2021. Since then, enforcement actions have started to tick higher, reaching similar levels to those seen between 2014 and 2017. Enforcement actions are likely to begin trending lower again under the Trump 2.0 EPA, especially as the agency seeks to promote oil and gas development—in contrast to the Biden EPA, which levied a $64.5 million civil penalty against Marathon Oil Corp. in September 2024.

Trump Administration to Incentivize Natural Gas, Power Generation, and Transmission to Support Data Center Buildout

| Winners | Vistra Corp. (VST), Talen Energy Corp. (TLN), NRG Energy Inc. (NRG), EQT Corp. (EQT), Williams Companies Inc. (WMB), Exelon Corp. (EXC), PPL Corp. (PPL) |

| Losers | N/A |

FERC Likely to Provide Guidance on Co-Located Behind-the-Meter (BTM) Load in Mid-to-Late 2025

Capstone believes FERC will provide guidance for large loads seeking to co-locate behind-the-meter (BTM) at existing power plants by the end of 2025, likely through a policy statement that allows BTM arrangements to serve as a bridge to full network service. This presents opportunities for independent power producers like Vistra and Talen Energy.

We believe a policy statement informed by feedback from its November 1, 2024, technical conference on co-located load is the fastest route for FERC to issue guidance. If it chooses this route, we expect FERC to issue a Notice of Inquiry (NOI) in Q1 2025, laying the groundwork for a draft policy statement or proposed rulemaking on BTM load and data center co-location. Following public comments, a finalized policy statement could emerge in late Q2 or Q3 2025.

In early December, FERC came under significant pressure from external stakeholders (including Republican members of Congress and the co-chair of the congressional Artificial Intelligence Task Force) to expedite rules for data center co-location to address concerns over security and the competition for global artificial intelligence (AI) dominance. If FERC continues to face significant external pressure, the timeline to official guidance could accelerate, but we believe that even in this case, substantial regulatory action before mid-2025 is unlikely.

FERC to Defer to RTO/ISO Approaches to Interconnection Reform and Likely to Approve PJM’s Reliability Resource Initiative in Q1 2025

Capstone anticipates that FERC will favor regional transmission organization (RTO)- and independent system operator (ISO)-led approaches to interconnection reform, with PJM Interconnection LLC’s (PJM) Reliability Resource Initiative (RRI) likely to be approved in Q1 2025.

Following FERC’s finalization of Order 2023 (the Interconnection Final Rule) and its September workshop on interconnection queue reform, stakeholders have been advocating for a bottom-up, RTO/ISO-led approach alongside the implementation of Order 2023. Various RTOs and ISOs are leading interconnection reform efforts to reduce bottlenecks and curb lengthening queue wait times.

The California Independent System Operator (CAISO), for instance, received FERC approval in October for its queue prioritization process to fast-track requests in areas with existing or planned transmission. Similarly, PJM plans to file its RRI queue prioritization process with FERC in December. We believe players such as EQT and Williams Companies are well-positioned to benefit from PJM’s RRI, as natural gas is poised to score high on reliability and commercial viability relative to renewables in the queue. Despite opposition from renewable developers, we expect FERC to approve PJM’s RRI in Q1 2025, driven by concerns over growing interconnection delays and tightening supply-demand dynamics.

PJM Proposes Capacity Market Revisions Amid Surging Prices; FERC Approval Likely in Q1 2025

Capstone believes that FERC will approve PJM’s proposed capacity market revisions in Q1 2025. While we expect the revisions to lead to lower clearing prices, we do not expect them to fall below the 2025/2026 Base Residual Auction (BRA) clearing prices. Nevertheless, given the sustained upward pressure on capacity prices, independent power producers (IPPs) stand to continue to gain.

PJM Interconnection is facing challenges in ensuring sufficient electricity supply as retiring dispatchable generation outpaces new capacity additions, driving a tenfold surge in capacity prices at the 2025/2026 BRA in July. This price spike, coupled with public interest complaints, prompted PJM to delay the 2026/2027 auction from December 2024 to July 2025. Before January 1, 2025, PJM plans to file proposed capacity market design revisions with FERC to address these issues.

Adding to the concerns over supply, data center-driven electricity demand is accelerating, with PJM utilities forecasting 70 gigawatts (GW) of additional load by 2045, significantly exceeding prior projections. In response, PJM member states are exploring strategies such as delaying natural gas plant retirements, developing utility-owned storage and generation, and offering low-interest loans to incentivize new capacity.

Recent Initiatives and Policymaker Priorities Present Tailwinds for ERCOT Thermal Power Generators

Capstone believes recent market reform initiatives and current legislative priorities present a favorable outlook for natural gas power plant operators in Texas. We believe recent extreme weather events and forecasted load growth are encouraging policymakers and regulators to prioritize incentives for dispatchable generation to improve grid reliability and address resource adequacy concerns. S.B. 2627 (2023) allows the Texas Energy Fund to financially support up to 10,000 megawatts (MW) of new generation capacity using a budget of $10 billion, including specific funding caps for each program. However, the Texas legislature only approved $5 billion in its most recent biannual budget. We expect the additional $5 billion to be approved in the state’s 2025 budget.

H.B. 1500 (2023) requires the Public Utility Commission of Texas (PUCT) to implement a new ancillary services product called the Dispatchable Reliability Reserve Service (DRRS). Eligible sources must be able to ramp within two hours and operate for at least four. The PUCT and Electric Reliability Council of Texas (ERCOT) must still define eligibility for DRRS, but the statutory language in H.B. 1500 suggests that thermal generators, such as Vistra and NRG Energy, will be the main target benefactors of the service.

Eric Scheriff, Capstone’s Global Energy Policy Head

Read more from Eric:

The Energy Transition Wave, the Election, and Why the Details Matter

How a Harris Admin Would Impact Energy & Industrials

The Unstoppable IRA Wave: Why the Clean Energy Bill Will Withstand Repeal Efforts and other Challenges