Introduction

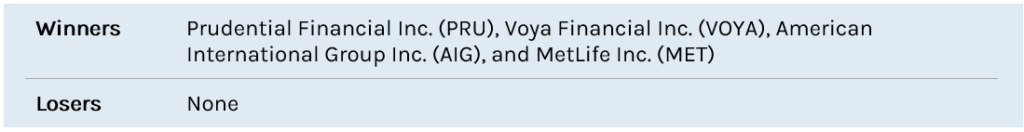

Capstone believes regulatory developments in 2024 will produce challenges for specific subsectors of the US insurance industry while unveiling underappreciated investment opportunities in others. We expect to see meaningful developments in the scrutiny of private equity-owned insurers, the California property and casualty insurance market, the fiduciary responsibilities of insurers and agents, government-sponsored enterprise (GSE) title insurance reform, and the Secure 2.0 Act of 2022.

In terms of risks, we predict private equity (PE) investment in the insurance market will likely face headwinds in 2024 as the National Association of Insurance Commissioners (NAIC) presses ahead with several reforms that will weigh on insurers’ investing strategies. Additionally, insurers face a new threat from the Department of Labor’s (DOL) recently proposed Retirement Security Rule—its newest attempt to reform its Fiduciary Rule to redefine who is considered a fiduciary under the Employee Retirement Income Security Act (ERISA) and what obligations that entails. The DOL could also direct retirement plan sponsors to further scrutinize the complex organizational structure associated with annuity providers for pension risk transfers.

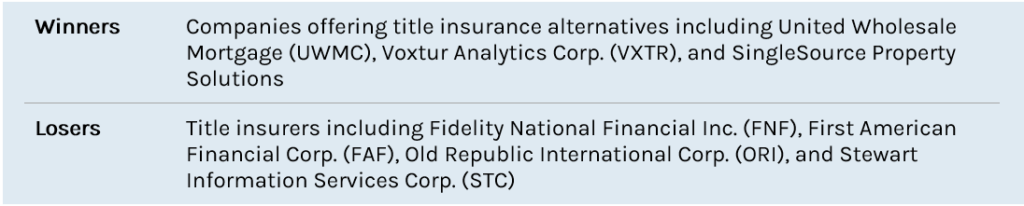

We also expect that the title insurance industry will continue to face emerging risks as housing regulators under the Biden administration look to push forward housing affordability initiatives—including the promotion of alternatives to title insurance products—in 2024.

In terms of opportunities, we believe that recent reforms proposed by the California Department of Insurance (CDI) are a win for the insurance industry with further concessions on the horizon that could ultimately bring the nation’s largest insurers back to the state. We also anticipate that annuity providers will benefit from an increased share of workplace retirement plans as increased investment has been enabled by SECURE 2.0.

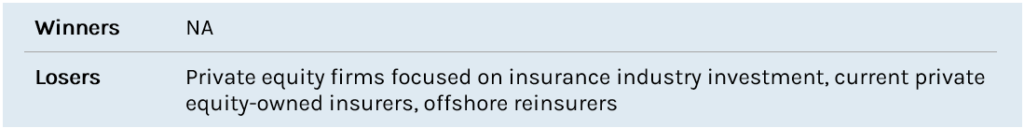

Insurance Regulators Closing in on Private Equity-Owned Insurer Investment Strategies

Capstone believes private equity (PE) investment in the insurance market is likely to face headwinds in 2024 as the NAIC presses ahead with several reforms that will weigh on insurers’ investing strategies. On December 7, 2021, the NAIC voted to expose a list of “regulatory considerations applicable (but not exclusive) to [PE] owned insurers” for a 30-day comment period. The report identifies 13 topics of consideration related to PE ownership of insurance companies. The list covers a wide range of topics, including investment management agreement structure, private equity owner investment horizon and affiliated investments, increased investments in less-liquid structured securities, use of offshore reinsurers, and pension risk transfers. To-date, the NAIC has made notable progress on several fronts, including revamping risk-based capital (RBC) requirements for residual tranches of structured securities; expanding the authorities of the Securities Valuation Office (SVO) to regulate ratings designations for non-bond securities; and creating additional compliance frameworks to help give regulators better visibility into offshore reinsurance structures.

Structured Securities Risk-Based Capital Regime

As a part of its broader efforts to better regulate PE-owned insurers, the NAIC has become acutely focused on enhancing regulation of insurers’ structured securities investments that could pose heightened risk to policyholders. According to a report published by the NAIC’s Capital Markets Bureau in August 2023, PE-owned insurers tend to have higher concentrations of asset-backed securities (ABS) and other structured securities (22% of total bonds) compared to the overall US insurance industry (11% of total bonds). A June 2023 report by the NAIC indicates that “PE firms and funds typically hold riskier investments than their counterparts in hopes of generating a higher return.” The NAIC is beginning to rein in some of the riskier investing strategies PE-owned insurers may engage in by 1) increasing scrutiny on the use of external credit ratings to quantify risk and assign RBC requirements to insurers, 2) bringing certain structured securities rating functions in-house, and 3) enhancing RBC requirements for the riskiest tranches of structured securities.

Historically, the SVO within the NAIC has served the function of assessing the credit quality of securities owned by insurance companies. In most instances, the SVO’s analysis relies on securities ratings assigned by nationally recognized statistical rating organizations (NRSROs) such as Standard and Poor’s (S&P), Kroll Bond Rating Agency (KBRA), Fitch Rating Agency, and Egan Jones. Insurers are required to regularly submit external ratings to the NAIC to be incorporated into the SVO’s analysis. NRSRO ratings correspond to internal NAIC designations, which determine an insurer’s RBC requirements (the amount of capital an insurer must hold against a given investment). The NAIC’s reliance on external ratings to determine NAIC designation has been scrutinized with insurers accused of “rate shopping” where overly favorable agency ratings are submitted to obfuscate portfolio risks and reduce RBC requirements. This is one of the 13 concerns included in the list of “regulatory considerations applicable (but not exclusive) to [PE] owned insurers.” The NAIC is currently in the process of expanding the SVO’s authority to override or modify NRSRO ratings in certain instances to reduce “blind reliance” on third-party rating designations of an insurer’s non-bond securities. As part of the initiative, the NAIC will be expanding the SVO’s staffing to allow for the Capital Adequacy Task Force to conduct these more in-depth ratings assessments. We believe the NAIC’s efforts to scrutinize and possibly override external NRSRO ratings could increase RBC charges ultimately borne by insurers.

In recent years, the NAIC has become concerned that regulators’ RBC approach is allowing for “regulatory arbitrage” in which RBC factors for structured securities are lower than those for the underlying collateral. In a May 2022 report, the NAIC states, “It is currently possible to materially (and artificially) reduce [capital requirements] just by securitizing a pool of assets.” The NAIC gives the example that a “B” rated pool of corporate loans (corresponding to an NAIC designation of NAIC 4.B) would receive an RBC risk factor of 9.535% while the same “B” rated corporate loans securitized into a collateralized loan obligation (CLO) would receive an overall RBC risk factor of 2.917%—resulting in regulatory arbitrage of +6.618%. To address this, the NAIC is in the process of bringing the ratings function for CLOs in-house rather than relying on NRSRO credit ratings for NAIC designation and RBC factor assignment.

In order to bring CLO RBC factors in line with underlying collateral RBC factors, the NAIC plans to increase the RBC factor for CLO residual tranches—typically the riskiest component of the security. Currently, the residual tranches of CLOs receive an RBC factor of 30%. The SVO has recommended creating three new NAIC designations to rachet up that factor for each new designation to 30%, 75%, and 100%. However, the NAIC has agreed that while analysis is ongoing, an interim 45% factor will apply beginning in 2024. Notably, in 2023 the NAIC expanded its review of residual tranche RBC factors to include all structured securities—not just CLOs. As a result, the new 45% RBC factor for residual tranches will apply across all structured securities. While residual tranches make up only 0.05% of the more than $8.5T of life insurance industry assets, the change (and future changes to RBC factors) could negatively impact the investing strategies of PE-backed insurers. Additionally, we believe there is a greater risk that the NAIC may bring rating designations in-house for other types of structured securities that could meaningfully affect associated RBC factors. Capstone will be following developments closely in 2024.

Offshore Reinsurers

Offshore reinsurance is a continuing area of interest for the NAIC. In 2023, the NAIC created additional measures to give commissioners more power to investigate and assess the risks posed to policyholders by non-US entities affiliated with US insurance companies. Reinsurance is an essential tool for insurance companies to manage the risk and the capital they are required to hold to support those risks. In a typical contract between a reinsurer and an insurer, the insurance company transfers risk to the reinsurance company, which assumes all or part of one or more insurance policies issued by the insurer. US insurers that cede business to authorized reinsurers—insurers licensed to accept reinsurance in a state or territory—can recognize a reduction in liabilities without a requirement for the reinsurer to post collateral to secure its payment of reinsured liabilities. Before 2011, reinsurers not licensed in a US state were required to post collateral equal to 100% of their reinsurance transaction. In 2011, the NAIC revised its Credit for Reinsurance Model Law and Credit or Reinsurance Model Regulation, which jointly establish rules under which reinsurance credit is allowed to be claimed by a US ceding insurer. The reforms allow reinsurers in qualified jurisdictions to become eligible for reduced reinsurance collateral requirements (on a sliding scale) based on the financial strength of the reinsurer and the rigor of the home jurisdiction’s regulatory regime. Seven jurisdictions have “qualified jurisdiction” status.

In 2019, the NAIC revised its reinsurance model laws to establish the concept of “reciprocal jurisdictions”—jurisdictions that have in-force agreements with the US (both the European Union and the UK have these in place), meet certain NAIC accreditation requirements, or are determined by state insurance commissioners to meet all applicable requirements to be a reciprocal jurisdiction. Only three jurisdictions outside the EU and the UK have reciprocal jurisdiction status (Bermuda, Japan, and Switzerland).

Insurers often look to non-US domiciled (“offshore”) reinsurers to conduct reinsurance transactions. These entities provide several benefits including more favorable tax treatment, more flexible regulatory requirements, and the ability to avoid punitive reserve requirements in the NAIC model law revisions. The NAIC included in its list of PE-related considerations “insurers’ use of offshore reinsurers (including captive insurers), and complex affiliated sidecar vehicles” to maximize capital efficiency and reduce reserves. The NAIC’s primary concern with offshore reinsurers is the potential for increased investment risk when 1) offshore reinsurers are not held to the same capital standards as the insurer, and 2) regulators have less visibility into arrangement structures than there is in domestic reinsurer deals.

This year, the NAIC adopted a new insurance comparison worksheet designed to allow regulators to look into offshore reinsurers with more transparency than they were previously able to. This allows regulators to essentially audit the level of risk taken on by these deals between insurance companies and offshore reinsurers. This new worksheet requires a top-to-bottom review of the reinsurer, including a close analysis of its financials and a review of the overall structure of the deal (most notably, the posted collateral for the policy). We expect the NAIC to remain focused on offshore reinsurance transactions in 2024 with regulators potentially making changes to reinsurance requirements and model laws to moderate the level of risk assumed in transactions by non-US entities and to provide more transparency to regulators on an ongoing basis.

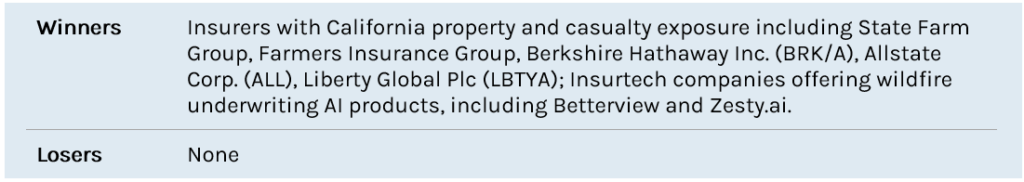

California Insurance Department Poised to Intervene to Bring Insurers Back to the State

We believe that recent reforms proposed by the California Department of Insurance (CDI) are a win for the insurance industry and could be enough to bring back some of the largest nationwide insurers who left the state in the last two years if further concessions are made. Insurers left the California market in recent years due to the growing risk of wildfires in the state and the associated costs of insuring, which are unique to California. Proposition 103 has dictated property and casualty (P&C) insurance policy in the state since 1988. The law does not allow catastrophe modeling and reinsurance costs to be factored into pricing policies. It also established a system for public intervention for all rate filings exceeding 6.9%. The new proposed reforms are designed to incentivize insurance carriers to resume writing policies by allowing them to charge higher rates—if they insure more homes in areas where wildfires are more prevalent. We believe the proposal demonstrates California’s willingness to compromise on issues to bring more insurers back into the state as housing costs and wildfire risks continue to rise. Insurers are likely to leverage this position to push for further concessions that would be crucial to their return to the state.

On September 21, 2023, California Governor Gavin Newsom issued an executive order highlighting the major P&C insurance issues caused by wildfires in the state and urged the Commissioner of Insurance to “take prompt regulatory action” to improve the overall efficiency of the rate approval process. Commissioner Lara later that day announced a proposal—which he had negotiated with insurance companies—to reform California insurance regulation by 1) expediting the state’s approval of forward-looking catastrophe modeling 2) scheduling public hearings to discuss factoring reinsurance costs into rate pricing 3) committing to streamlining the rate filing process to improve efficiency, timeliness, and oversight. The proposal also indicated that the CDI is considering enacting intervenor reform, which could help further streamline rate approvals. In exchange, the carriers have agreed to write no less than 85% of their statewide market share in high wildfire-risk communities.

A majority of policies in wildfire-prevalent areas have fallen under the jurisdiction of the state’s Fair Access to Insurance Requirements (FAIR) Plan—the state’s insurer of last resort which was created by the state legislature but is privately run and funded by the insurance companies. The FAIR plan has taken on a growing share of the overall market with carriers leaving, which has increased its risk of insolvency. The agreement still leaves concerns for the industry over what this streamlined process for rate approvals will look like and how/when reinsurance costs and catastrophe modeling will be used in pricing. We believe insurers are in a strong position to lobby the state to implement desired reforms given the state’s urgent need for insurers to reenter the market.

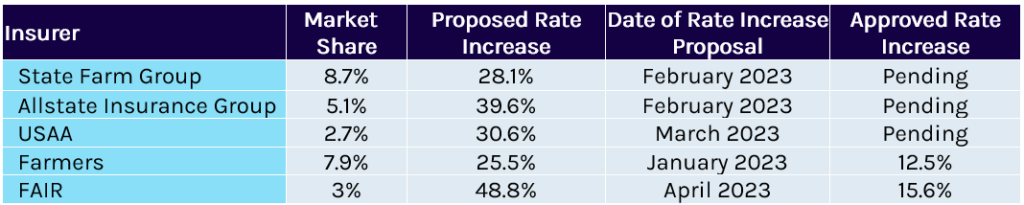

Insurer Rate Increases

The proposed reforms still leave concerns for the industry over the timeliness of rate approval. We expect insurers to push for clarity around streamlining rate approvals in a final regulation. Efficiency of the rate approval process has been one of the biggest issues that carriers have cited as a reason for leaving the state. The long timeline to approval paired with public intervention hearings, which are triggered for rate increases above 6.9%, have ultimately cut down on the large carriers’ bottom lines. Exhibit 1 below illustrates large California carriers’ rate proposals this year and their statuses.

Exhibit 1 Proposed Insurance Rate Increases

Source: California Department of Insurance, S&P Global

Opposition To Proposed Reforms

Consumer advocates have been vocal in opposing the agreement arguing that it represents a statewide sellout to the insurance industry. Californian citizens have seen increasing taxes across the board and face steady rate hikes in utilities to support wildfire prevention for decades. The state also currently has the highest median purchase price for a home in the US. We expect advocates to remain active in lobbying against a final regulation that supports insurers in the state, though we do not expect them to ultimately sideline a final regulation.

A Win for Insurtechs

We believe the agreement’s allowance for catastrophe modeling in rate-setting will be a boon for insurtech companies offering wildfire underwriting and catastrophe modeling AI products including Betterview and Zesty.ai (which was recently approved for use in FAIR’s pricing model). We believe the new regulation will foster more widespread utilization of the platforms among carriers returning to the state.

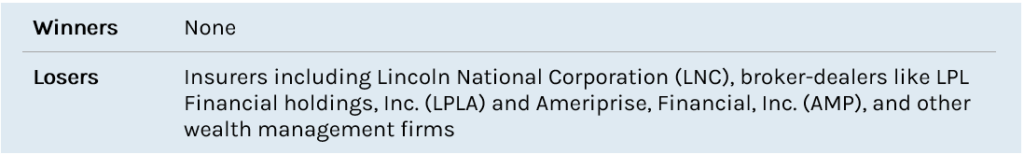

DOL Proposed Retirement Security Rule Poses Risk to Insurers, Annuity Providers

We believe that the DOL’s newly proposed Retirement Security rule will have far-reaching implications for the insurance industry, specifically the market for independent retirement account (IRA) rollovers and fixed index annuities. The proposed rule seeks to expand the definition of a fiduciary under ERISA with the intent of capturing IRA rollovers as fiduciary in nature. It also amends certain prohibited transaction exemptions (PTEs) used by investment advice fiduciaries to receive compensation that would otherwise be prohibited. We believe the DOL’s ultimate goal with the proposed rule is to pull under its purview transactions that have historically “slipped through the cracks” of federal regulation because they were not covered under the original 1975 DOL Fiduciary Rule or the Securities and Exchange Commission’s Regulation Best Interest—such as fixed index annuities.

New Fiduciary Definition

Since 1975, a five-part test has been used to define “investment advice” under ERISA. To be considered an investment advice fiduciary under the original five-part test, an individual must: 1) make recommendations on investing in, purchasing, or selling securities or other property, 2) on a regular basis, 3) pursuant to a mutual understanding, 4) that the advice will serve as a primary basis for investment decisions, and 5) will be individualized to the particular needs of the plan.

With the new ruling, the five-part test would be replaced with a conditional system that considers a person a fiduciary if:

- They provide investment advice or make an investment recommendation to a retirement investor (including IRA owners or beneficiaries);

- The advice or recommendation is provided “for a fee or other compensation, direct or indirect” (e.g., through or together with an affiliate); and

- The person makes a recommendation in one of the three following contexts: 1) an investment advice provider invests with discretionary authority, 2) if an investment advice provider offers paid advice to investors on a “regular basis” as a part of their business and the recommendation is provided under circumstances indicating it is tailored to the needs of the retirement investor, or 3) the person making the recommendation acknowledges they are doing so in a fiduciary capacity.

The proposal’s restructuring of the “regular basis” criteria is the most contentious revision in the new test as it would substantially expand the definition of a fiduciary and would explicitly capture rollover recommendations in the definition.

PTE 84-24

PTE 84-24 currently allows pension consultants, insurance agents, brokers, and mutual fund principal underwriters to receive otherwise conflicted compensation when making recommendations to plans or IRAs. The proposal would ultimately increase compliance requirements for insurance companies while also narrowing the scope of the exemption’s applicability. We also believe it overlooks a few key parts of the insurance business that will need to be rectified in a final rule. We expect to see the most pushback from the insurance industry on the following reforms to the PTE:

- Narrowed Scope: The proposed reforms to PTE 84-24 narrow the scope of coverage regarding both the type of fiduciary who can rely on the exemption and the products they sell. Relief would only be extended to investment advice fiduciaries who are independent insurance agents and sell products for at least two insurance companies. It is worth noting that this reform would not extend relief to captive insurance agents—an issue that has been raised by industry stakeholders as captive insurance agents would also be unable to rely on PTE 2020-02. Additionally, the exemption would only provide relief when independent insurance agents sell certain annuity products. Those who recommend investment products other than annuities, such as mutual funds, stocks, bonds, or certificates of deposit will be required to rely on the more stringent PTE 2020-02 when receiving otherwise conflicted compensation.

- Shifting Compliance Burdens: While the proposed reforms to the exemption would not require insurance companies to assume fiduciary status, it would require them to take on a new role of overseeing independent agent compliance with 84-24. This means that insurers are not provided relief from liability under the exemption as relief is strictly limited in scope to the independent agent’s receipt of fully disclosed compensation. An insurer is required to rely on PTE 2020-02 for relief if it is itself an investment advice fiduciary under ERISA and the new fiduciary status test.

- Impartial Conduct Standards: The proposed reforms to PTE 84-24 would also require those relying on the exemption to adhere to the Impartial Conduct Standards currently in place under PTE 2020-02—though the standards would be tailored to independent insurance agents. The impartial conduct standards include a best interest standard, a reasonable compensation standard, and a requirement to avoid misleading statements. This would be a substantial departure from current compliance requirements under PTE 84-24, which are considered lighter-touch compared to PTE 2020-02.

Industry Opposition

We believe industry stakeholders impacted by the proposal will likely challenge the proposed changes in court. The DOL has suffered significant legal setbacks in the past two years related to its interpretation of the 1975 Fiduciary Rule laid out in a preamble to PTE 2020-02 and guidance released in 2021. Opponents could use the legal losses to argue that the DOL is yet again overstepping its authority under ERISA. They could also point to the 2018 Fifth Circuit Court of Appeals decision in Chamber of Commerce v. United States Department of Labor which tossed the Obama-era version of the rule.

Timeline

The proposed rule was open for a 60-day open-comment period for concerned stakeholders, followed with a public hearing that was held by the DOL on December 12th and 13th. We believe the DOL will look to finalize its rule within President Biden’s current term to avoid the risk that a new Republican administration sidelines it. However, the rule could still become subject to the Congressional Review Act if it is not finalized by the middle of 2024 (May/June), which may expedite the DOL’s timeline for finalizing the rule.

Annuity Allocations in Workplace Retirement Plans to Accelerate in 2024 with DOL Clarity

Capstone believes that insurance products will represent an increased share of workplace retirement plan assets as provisions from SECURE 2.0, the sweeping retirement legislation passed at the end of 2022, come into effect and are better understood by plan advisors. According to survey data from Alight, a large recordkeeper, 12% of employers had annuities in their defined contribution (DC) plan in 2023, with another 38% demonstrating interest in offering annuities in the future, while the remaining half of employers indicated no interest.

Increasing retirement plan access to annuities was also a goal of the original SECURE Act in 2019, which shifted the legal liability to the insurer rather than the retirement plan sponsor if an annuity provider failed to make promised payments. Prior to the SECURE Act, only 7% of employers offered annuities in their DC plans according to the Society for Human Resource Management. We expect SECURE 2.0 to advance this trend further through three primary provisions.

Historically, actuarial tests in the minimum distribution regulations have limited the availability of life annuities in DC plans and prohibited the use of provisions such as increasing annuity payments over time or period-certain guarantees. SECURE 2.0 allows lifetime annuity benefits to increase at a constant percentage, no more than 5% per year, which lawmakers have described as being akin to a cost-of-living adjustment. The provision became effective on January 1, 2023. We expect it will provide increased flexibility for annuity providers and a sustained growth tailwind.

SECURE 2.0 also raised the limit for Qualified Longevity Annuity Contract (QLAC) holdings within a DC plan. QLACs commence payments to the individual at the end of their life expectancy. They may be used to reduce the risk that an individual outlives their retirement savings and to defer the timing for required minimum distributions (RMDs). Previously, QLACs had been limited to $125,000 or 25% of the account value, whichever was greater. SECURE 2.0 increased this threshold to $200,000, which is indexed to inflation for annual increases. The provision went into effect immediately, but we expect the IRS to provide updated regulations on the use of QLACs in the first half of 2024 which will enable greater utilization.

The law also adjusts the RMD calculation for annuities. Previously, the account holder had to evaluate RMD requirements for the portion of the account holding an annuity and the rest of the account separately, which resulted in higher minimum distributions than the account holder would have been required to take if they did not hold an annuity. SECURE 2.0 allows an account holder to evaluate RMD requirements for the account as a whole. We expect DOL regulations to provide further clarity into the calculation approach in the first half of 2024.

We believe that improved RMD treatment and lower regulatory burdens will drive increased allocation of workplace retirement plan assets to annuities. In particular, we expect that annuities will increasingly become embedded options within target date funds, which represent 42% of workplace retirement plan assets according to the Investment Company Institute. Asset managers including BlackRock Inc. (BLK) and JP Morgan Asset Management (JPM) have previously announced such offerings.

In addition to annuities representing a larger share of retirement plan assets, we expect continued increases in workplace retirement plan participation rates from the law. Several provisions that provide incremental tailwinds to plan access go into effect in 2024 in addition to continued momentum as plan sponsors and recordkeepers adjust to provisions put in place when the law was enacted. In 2024, employers will be permitted to match student loan payments, provide “side-car” emergency savings accounts, and account holders will be able to take more penalty-free withdrawals. This will also set the stage for the automatic enrollment requirements to apply beginning in 2025, which we believe will significantly increase the number of workers participating in available plans that are covered by the requirement.

At the same time, we are continuing to monitor potential DOL changes to IB 95-1, an interpretive bulletin related to fiduciary standards for the selection of an annuity provider for defined benefit plan distributions, or pension risk transfers. The current standard is to select the safest annuity available, unless it would be in the interest of participants and beneficiaries to do otherwise. In August 2023, the DOL Advisory Council offered mixed views on whether the department should update IB 95-1 to direct fiduciaries to consider additional risks from the ownership structure in assessing an annuity provider’s claims-paying ability and creditworthiness. Changes to this standard would present risks to insurers with complex ownership structures, such as Athene, which is owned by Apollo Global Management (APO). The DOL is required to provide a recommendation to Congress by December 29, 2023 (as directed by SECURE 2.0) and we expect any changes to be implemented in 2024.

GSEs Intend to Crack Down on Title Insurance Costs for Borrowers

We believe the title insurance industry will continue to face emerging risks as housing regulators under the Biden administration look to push forward housing affordability initiatives—including promotion of alternatives to title products—in 2024. Title insurance is designed to help provide home buyers and their mortgage lenders with the necessary protection against losses resulting from unknown defects to the title that occur prior to the closing of a real estate transaction. Unknown defects, for example, could include outstanding liens on the property or anything else that may hinder the owner’s right to ownership such as errors or omissions, fraud, or forgery. Title insurance policies will cover the insured party for certain covered losses and legal fees that may arise. The policies are usually paid for with a one-time premium at the closing of the real estate transaction. Today, most mortgage lenders require homebuyers to purchase a title insurance policy equal to the loan amount.

GSE Support for Title Alternatives

Until recently, the GSEs—Fannie Mae and Freddie Mac—also required title insurance on any loans they purchased. However, beginning in May 2020, Freddie Mac began permitting the use of alternatives to title insurance—specifically attorney opinion letters (AOLs)—that meet certain specifications to satisfy its requirements. In April 2022, Fannie Mae followed suit announcing that the GSE also would be accepting AOLs in lieu of title insurance as long as the letters meet specific criteria.

Since then, the GSEs—at the direction of the Federal Housing Finance Agency (FHFA)—have become increasingly focused on reducing closing costs for borrowers to make homeownership more attainable in an increasingly expensive market. They are looking to do this by further supporting alternatives to traditional title insurance—which can cost a borrower between 0.5% and 1% of a home sale price upon closing. On a $300,000 home, that would mean estimated title costs would be roughly $2,250. Title insurance industry advocates have until now been able to successfully communicate to regulators and lawmakers the importance of a true title product relative to alternatives—like AOLs. However, sentiment around the products has shifted under the Biden administration as home affordability issues persist.

While the adoption rate of AOLs remains low today, the GSEs have been exploring other ways to incentivize the use of title alternatives that could give title insurance companies reason for concern. In June 2022, FHFA announced its approval of the GSEs’ Equitable Housing Finance Plans—plans the GSEs adopted at the behest of FHFA designed to map out ways to advance equity in the housing finance system. Both Fannie Mae and Freddie Mac included in their plans various actions they plan to take over the next three years to reduce the cost of title insurance, including setting up pilot programs to promote the use of AOLs and exploring other title alternatives to lower closing costs. We expect the efforts to accelerate in 2024 as the administration looks to push forward initiatives that may be sidelined under a change to a Republican administration. We believe many of the initiatives included in the GSEs’ Equitable Housing Finance Plans fall into this category.

New Entrants a Risk to Traditional Title Insurers

New entrants have begun taking advantage of the GSEs’ acceptance of title alternatives by rolling out GSE-compliant AOL products. Immediately following Fannie Mae’s announcement that it will be accepting AOLs in lieu of title insurance, Voxtur Analytics Corp. announced that it now offers a fully compliant alternative to title insurance through its Attorney Opinion Letter Program. Voxtur’s AOL product provides an attorney’s opinion of title and is backed by a mortgage service provider errors and omissions liability insurance wrapper for the full amount of the loan for the life of the loan. The policy is issued by surplus lines carriers and covers Voxtur, the issuing law firm as a service provider, and the lender as a third-party beneficiary. Voxtur claims its policy is fully compliant with Fannie Mae and Freddie Mac guidelines and is available in all 50 states. According to the company’s management team, the product provides the same protections as traditional title insurance but can lead to savings of 20%–70% relative to traditional title products. On October 1, 2022, the largest US wholesale mortgage lender, United Wholesale Mortgage (UWM) announced its roll out of a new title review and closing (TRAC) product designed to streamline the closing experience and remove the need for a lender title policy. In its announcement of the new product, UWM claimed the product can save borrowers up to $1,100 on purchase loans and up to $800 on refinance closing costs.

Opposition to Title Alternatives

The title insurance industry—led by the American Land and Title Association (ALTA)—has pushed back fiercely on the GSEs’ efforts to reduce title insurance costs and support alternative products. In September 2022, ALTA sent a letter to Federal Housing Finance Agency (FHFA) Director, Sandra Thompson, raising concerns about the GSEs’ Equitable Housing Plan goals to reduce the cost of title insurance and support cheaper alternatives. In the letter, ALTA argued that title insurance alternatives do not typically provide the same level of coverage to lenders and borrowers, especially related to fraud or forgery of title documents, which ALTA pointed out is one of the largest sources of claims paid in the industry that has never been historically covered by AOL products.

Additionally, on October 3rd, Representatives Andrew Garbarino (R-NY) and Vicente Gonzalez (D-TX) introduced bipartisan legislation—the Protecting America’s Property Rights Act (H.R. 5837)—with a companion bill—S. 2687—introduced by Senator John Kennedy (R-LA) and Senator Katie Britt (R-AL). The legislation would require title insurance issued by a state-licensed or regulated title insurance company on all loans purchased by Fannie Mae and Freddie Mac. We believe continued pressure from Congress could stymie efforts by the Biden administration to reform the title insurance requirements.

We believe title insurance advocates will continue to push back on the use of alternatives in 2024 and the ultimate viability of title alternatives remains to be seen. However, GSE support for alternative products that lead to lower borrower closing costs has paved a potential path forward for disrupters to take market share away from the title insurance industry.