Uncovering Risks for State and Local Governments: Why Risks Abound in the Year Ahead, Despite a Facade of Financial Optimism

Introduction

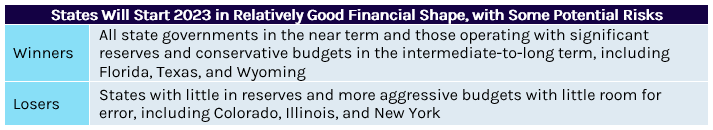

Capstone believes 2023 will be a volatile period for the finances of some states and their local government instrumentalities, despite being past the worst of the COVID-19 pandemic. Generally, states are entering the 2023 calendar year in financially good shape, which gives them a degree of breathing room, but also masks looming financial risks that could adversely impact their budgets during the next few years.

Post-pandemic tax collections and economic activity has been mixed at the local government instrumentality level, with some fully recovering from the impact of the pandemic as others continue to struggle. While the worst of this volatility appears to be over, state and local governments (SLGs) still face inflation and recession risks that could impact both state and local governments and investors.

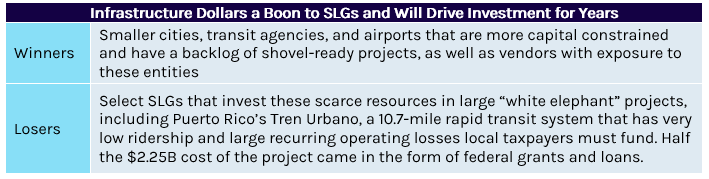

We believe the passage of the $1.1 trillion Infrastructure, Investment, and Jobs Act (IIJA) will be a boon to infrastructure investment and a significant driver of economic activity for most of the next decade. These funds should benefit SLGs, particularly those with access to nonfederal sources of capital, including local tax revenues and bonding, to complement the federal funding.

2023 will be a volatile period for the finances of some states and their local government instrumentalities, despite being past the worst of the COVID-19 pandemic.

During the past three years, SLGs have experienced significant uncertainty and financial volatility between the anticipated implosion of tax collections caused by pandemic-related disruptions to tax collections in 2020 and 2021 and the subsequent passage of several major pieces of legislation that provide more than $6 trillion to help cover pandemic-related costs, stimulate the economy, and invest in long-neglected infrastructure programs.

Capstone notes that it is important to remember that the financial situation that SLGs currently face is highly complex and requires investors to take a deep dive into a specific state and local governments to understand these risks. The inherent risks for a particular state, city, or transit agency could also have broad implications for governmental entities nationally.

Therefore, we believe investors should not make financial decisions based on a high-level review of macro data from public sources because this data will portray state and local budgets in aggregate as relatively stable, and nothing could be further from the truth. Capstone believes historical data looking in aggregate at SLG at revenues and expenditures ignore the variability across SLGs, the impact of accrued liabilities and the deferral of expenses on budgets, and how policymakers use tools such as tax increases and reserves to manage in times of financial stress. Macro data also do not convey how using short-term fiscal tools to manage government finances can have long-term impacts on the ability of SLGs to fund essential services, invest in infrastructure, and even cover long-term liabilities such as pensions and healthcare.

There also are a handful of SLG instrumentalities that Capstone monitors that face very specific and unique issues that matter a great deal to investors and that will continue to be topical in 2023. A few examples we highlight are:

- The ongoing economic recovery of Puerto Rico and the US Virgin Islands from Hurricane Maria, as well as Puerto Rico’s highly complex debt restructuring process, which has been ongoing since 2015, when the territory started defaulting on its various debt obligations.

- The substantial increase in federal and state funding now available to help cover the cost of wildfire detection, suppression, and prevention, as well as ongoing attempts at both the federal and state levels to reform how policymakers at all levels of government coordinate their efforts to deal with the increasing risk of wildfires more efficiently.

- How the expiration of certain federal tax code provisions, including the phaseout of accelerated depreciation or the rum tax cover-over program, impacts specific state and local government instrumentalities and industries. For example, phaseout of accelerated depreciation starting in 2023 and a recent tax code change making federal grant funding available to for-profits for subsidizing the cost of rural broadband deployments in unserved communities.

- How IIJA funding will flow to large transit agencies and airports, the impact of rules on how these funds can be used, and the specific projects that will likely be funded with the tens of billions of dollars being distributed annually for airport improvements, mass transit infrastructure, and intercity rail expansions, and upgrades.

Strong Financial Shape Masks Risks

Most states operate on fiscal years that align with school years, so we now are six months into the 2023 fiscal year that ends June 30, 3030. According to data from the National Association of Budget Officers (NASBO), 33 states are reporting that tax collections for FY23 are slightly outperforming budget forecasts even though revenues appear to be down slightly on a year-over-year basis. This outperformance in FY23 comes on the heels of states outperforming budgetary forecasts by more than 20% in FY22, largely because 2022 forecasts assumed a massive decline in revenues because of widespread disruptions in the economy caused by COVID-19. Revenues also increased on a year-over-year basis both in 2021 and 2022 by 16.6% and 14.5%, respectively.

We expect state tax collections will be driven by macroeconomic factors.

All this outperformance during the past few years through H1 FY23 can be attributed to the massive amount of pandemic-related and stimulus funds the federal government injected into the US economy through multiple pieces of legislation in 2020 and 2021. We view the impact of the more than $5 trillion in federal stimulus and pandemic-related funding as transitory in nature and believe it will have filtered through state and local budgets by the end of the current fiscal year.

We expect state tax collections will be driven primarily by more macroeconomic factors. This means that tax collections will be based more on how the economy performs than by how much stimulus funding is appropriated by Congress and filters throughout the economy. Should the US enter into a recession, as many economists are predicting for late 2023, we would expect tax collections to decline modestly. We will be monitoring how much will tax collections decline by, for how long they will be under pressure, and whether state and local governments will be forced to adjust their budgets to compensate for the loss in revenues.

COVID Recovery Still Uneven

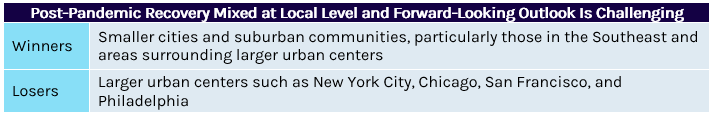

The US economy is has largely recovered from COVID-19, based on national data and unemployment statistics, estimated growth in the gross domestic product (GDP), and personal income. However, data collected at the national level are deceptive because the recovery has not been uniform and a significant number of cities and local government instrumentalities are far from a full recovery. A few examples of localized data that highlight these local disparities in the post-pandemic recovery include:

- Office vacancy rates in several major cities have increased meaningfully, with much of this increase being attributed to a shift to a work-from-home model or employers moving jobs outside major cities. Only 25% of cities have a lower vacancy rate than what they had before the pandemic, according to a July 2022 blog post from the National Association of Realtors®.

- Ridership on major mass transit systems has dropped significantly. New York City’s subway system, for example, is transporting only two-thirds of pre-pandemic ridership while automobile traffic into the city has fully recovered. This loss of ridership has led to significant erosion in farebox collections at most major mass transit systems.

- Higher office vacancy rates and lower transit ridership are reliable indicators that economic activity in some major cities could be in decline, suggesting sources of local tax revenues tied to economic activity also will likely be under pressure.

- Longer term, property tax collections in cities that have seen a significant decline in commercial occupancy could face significant pressure. Property taxes are tied to the value of a property, and there is likely to be an erosion in its value if there has been a substantial increase in vacancy rates. This is particularly true in cities where employers have disproportionately adopted a work-from-home or hybrid model, or moved workers’ office locations outside major urban centers to communities with lower leasing costs and more space for workers to social distance.

While cities such as San Francisco; Washington DC; New York; and Chicago are far from a full recovery, others, including Austin, Wilmington, Atlanta, Nashville, and Miami, have experienced very strong recoveries and their local economies are performing better than they were pre-pandemic.

Economic weakness in cities such as Washington, DC, and New York has been a boon for surrounding suburban communities as many of the people who used to commute daily into these major cities from the suburbs and spend their hard-earned dollars on dining and entertainment in the city now spend those same dollars on dining and entertainment in their suburban communities if they are working from home.There also has been a modest outmigration of residents and jobs from large urban centers in the Northeast and Midwest to Southern states like Florida and Texas.

Infrastructure Boon

The $1.2 trillion IIJA increases the amount of federal funding available for infrastructure-related investments by $550 billion during the next five years. Most of this funding will be funneled through state governments, local governments, and government instrumentalities such as airports, transit agencies, and port authorities. The funds will largely be distributed during the next five years, but recipients typically will have a few years to spend the money on a project once they are allocated funding. Specific rules for each infrastructure funding program are highly complex, and Capstone continues to assess developments to help clients better understand the dynamics of specific infrastructure programs.

Most large infrastructure projects are funded with a mix of federal, state, and local funding, as well as proceeds from municipal bond issuances. While IIJA effectively doubles the amount of federal infrastructure funding available during the next year, we believe how much of an increase in infrastructure projects we see in the coming years will depend on the availability and attractiveness of non-federal sources of funding, which will vary from situation to situation.

The increase infrastructure projects in the coming years will depend on the availability and attractiveness of non-federal funding.

In addition, the federal government typically requires recipients of federal infrastructure funding to provide local matching funds to cover a portion of the cost of any federally funded projects undertaken to make sure the recipient of the funds has “skin in the game.” For example, broadband projects have a 25% local matching fund requirement, and most highway projects require a 20% local match. If no local funding is available for a project, federal funds cannot be spent on that project.

The influx of federal funding in some circumstances will pull forward investments in infrastructure years earlier than these investments might otherwise happen because the recipients are faced with a “use-it-or-lose-it” situation. A perfect example is small to midsize airports that may consider pulling forward major terminal expansion projects they might not have to undertake right now but likely will have to complete in the next decade or so and could not afford to undertake had IIJA not made $125 billion in funding available to airports over the next five years.

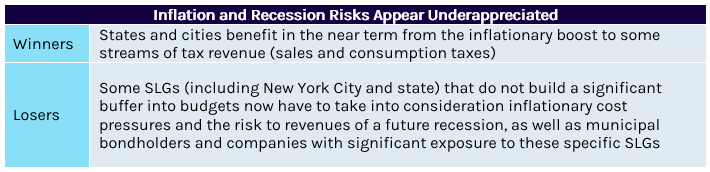

Inflationary and Recession Risks Loom

Capstone is particularly concerned with the impact of inflation on SLGs and a potential recession in H2 2023. According to a number of the monthly operating reports we have reviewed from state governments, it appears that inflation has helped to modestly boost both income and consumption tax collections. This inflationary boost to tax collections can be credited to federal stimulus dollars directed into the economy during the past couple of years, which helped push up wages, prices, and consumption. These stimulus dollars are a major reason states consistently reported income and sales tax collections coming in above expectations for the past couple of years, with wage gains and the inflationary effect on prices often specifically cited as contributing to tax collection outperformance. Even the Congressional Budget Office has cited inflation as a contributing factor in the projected 19% increase in federal tax collections that are expected in FY22.

However, this inflationary boost to tax collections is transitory and will wane. We already are seeing state tax collections start to level out as stimulus spending tapers off, which poses at least two potential risks to state and local government budgets. The first risk is to revenues and related to the very real possibility of tax collections falling in H2 2023 because of a recession. The second budgetary risk is the costs related to unionized government workers seeking large cost-of-living adjustments when their collective bargaining agreements come up for renewal.

There is a disconnect with respect to the timing of when inflation impacts revenues versus expenses.

Capstone reminds that there is a disconnect with respect to the timing of when inflation impacts revenues compared to expenses. Right now, state and local governments are benefiting from an inflationary boost to revenues, but this is quickly trailing off. During the next couple of years, wages for workers covered by collective bargaining agreements (CBAs) will likely start rising because these new labor contracts will likely include large raises well above those granted in prior contracts because of the level of inflation experienced during the past couple of years. With the cost of labor making up roughly 44% of SLG budgets per the Center for Policy Priorities, when these new CBAs with inflationary adjustments start to take effect, we believe SLG budgets could take a significant budgetary hit right at the same time when they start to experience weaker revenues because of a softening US economy.