By Monica Chen, Capstone Energy Analyst

In the next decade, we expect to see a fundamental shift in how gas utilities will have to strategize their resource mix based on near-term regulatory and policy changes—developments we believe are underappreciated. Gas utilities are facing an existential threat as states increasingly pass policies to convert homes and businesses from using gas infrastructure to electric sources to meet milestone decarbonization goals. A confluence of regulatory trends are playing out on the state and federal levels that companies and investors should be paying attention to.

Top of mind for industry right now is the potential for more statewide gas bans. This month, New York became the first US state to pass a gas ban, which effectively requires all new construction to be electric instead of gas, beginning in 2026. Momentum for gas bans has picked up since Berkley, California passed the first gas ban in 2019. Gas utilities now are facing the same environmental pressures that electric utilities have and, just like the state renewable portfolio standard (RPS), we are seeing so-called clean heat standards pop up across different states.

A confluence of regulatory trends are playing out on the state and federal levels that companies and investors should be paying attention to.

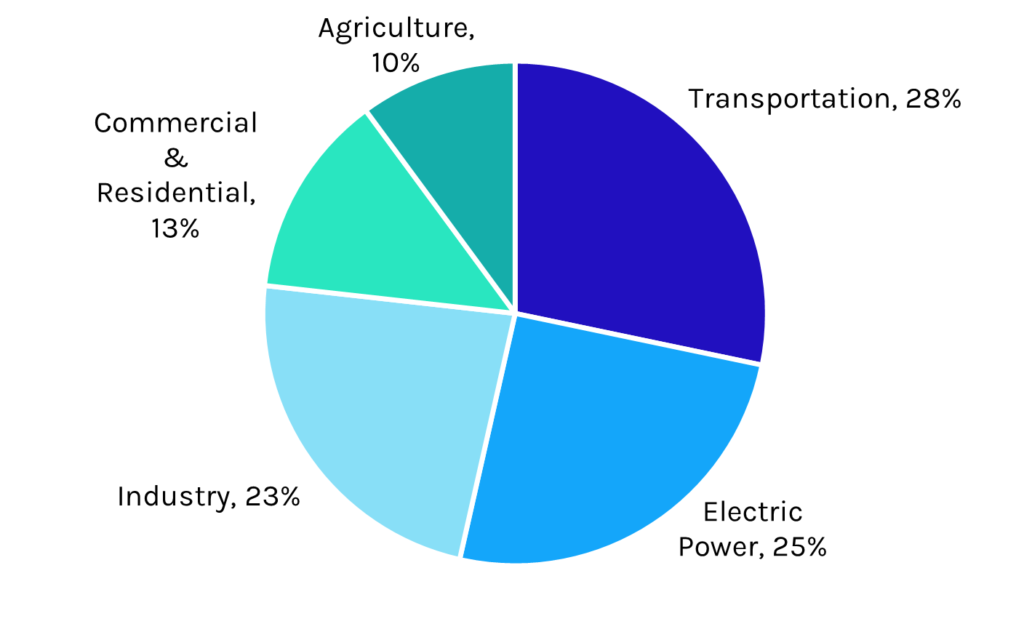

According to the Environmental Protection Agency (EPA), all the natural gas used in homes and businesses accounted for 13% of the US greenhouse gas (GHG) emissions in 2021 (see Exhibit 1).

Exhibit 1: Total US Greenhouse Gas Emissions by Economic Sector in 2021

Source: EPA; Note: May not add up to 100% due to rounding.

Methane Abatement

Methane also is a growing point of contention, ushering in the new gas utility conversion. We believe state policy to set up clean energy incentives and compliance programs will continue to proliferate in the US to counter concerns about methane emissions. Methane abatement is a national policy interest and is prioritized at the state level. Global warming potential (GWP) standardizes the amount of energy absorbed during the lifetime of a given gas. Higher GWPs indicate greater warming impacts. Carbon dioxide has a GWP of 1, while methane has a GWP of 28‒36. Due to methane’s impact, it has become the focal point for environmental groups and regulators. Several states, including California, Colorado, and Oregon, have enacted policies to incentivize gas utilities to curtail methane emissions by applying underutilized strategies such as blending renewable natural gas (RNG) or green hydrogen into their gas supply.

The Role of States

States are also becoming more proactive, as evidenced by Colorado’s passage of the nation’s first Clean Heat Standard (CHS) in 2021, which requires its gas distribution utilities to reduce GHG emissions by 4% by 2025 compared to 2015 levels and steps up to a 22% reduction in 2030. The US Department of Energy defines CHS as performance standards, requiring heat providers to deliver a gradually increasing percentage of low-emission heating services to customers. Clean heat choices usually include heat pumps, electrification, and sometimes low-carbon fuels. Last week, Vermont became the next state to pass legislation to set up a CHS. Both Colorado and Vermont encourage blending RNG and green hydrogen as part of their frameworks. Massachusetts is in the process of setting one up, but policymakers and regulators are reluctant to allow clean fuels to play a role as a heating source. We are seeing similar political environments in New York and Maryland.

We think the experience of electric utilities with the RPS provides a valuable framework for the road ahead. They have come a long way as states endeavor to reduce GHG emissions, and efforts to place a significant amount of capital to interconnect them with solar and wind projects. According to the Energy Information Administration (EIA), renewables made up nearly 20% of utility-scale US electricity generation in 2021 compared to 12.5% in 2011. For regulated gas utilities, it is important to take a proactive approach in starting dialogues with state regulators and policymakers to help them think through the cost-benefit considerations and use an all-of-the-above approach. A key issue that policymakers must contend with is finding the right solution for adapting climate-friendly thermal sources while being mindful that energy costs for constituents will go up.

The recent wave of federal and state legislation, which has driven the costs of renewable energy down, means significant change is coming to local gas distribution networks.

Changes to the Status Quo

Taken together, we believe the recent wave of federal and state legislation, which has driven the costs of renewable energy down, means significant change is coming to local gas distribution networks. Several gas utilities have already started taking aggressive measures to champion legislation that will protect the longevity of the natural gas industry. For instance, CenterPoint Energy and Liberty Utilities championed cost recovery legislation to pass along the incremental costs to purchase RNG down to ratepayers in Minnesota and New Hampshire, respectively. Tennessee will allow utilities to recover incremental costs to procure responsibly sourced gas (RSG), but costs cannot exceed three percent of the annual cost of gas. Twenty-three Republic-led states have passed laws prohibiting localities from restricting natural gas or associated infrastructure in buildings.

We believe the status quo for long-term resource planning is transforming, keeping state regulators at the center of the discussion. Regulators are learning about newer asset classes and technologies for the first time and will have to decide on timely statutory deadlines. All the while, they still will be responsible for ensuring that incremental energy costs to consumers are prudent and reasonable.

From a technological standpoint, there are many challenges ahead that will make resource planning more difficult. The California Public Utilities Commission (CPUC) believes clean hydrogen has a lot of potential in decarbonizing hard-to-electrify industries, such as cement, chemicals, and shipping. Generally, there are concerns about metal embrittlement of pipelines and leakage when gas utilities are considering blending hydrogen into the gas network. California continues to stand at the forefront of the US clean energy transition. At the end of 2022, the CPUC adopted two decisions to assess the feasibility and safety implications of using clean, renewable hydrogen as a decarbonization strategy for the natural gas system. We expect other states to follow suit in pilot programs and adopt policy at a record rate to move us into the next great conversion of our thermal energy network.

As always, companies and investors should pay close attention to both the wide forest and the dense trees of the great conversion—something Capstone prides itself on helping our clients understand and leverage.

Monica Chen, Capstone Energy Analyst

Read more from Monica:

Energy & Industrials 2022 Policy Preview

Read Monica’s bio here.