Capstone’s European Energy 2023 Preview: Electricity Reform to Bolster Renewables; Energy Security Focus to Boost Hydrogen; Recycling Push a Risk for Waste-to-Energy

December 20, 2022

Capstone believes the European Union will remain hyper-focused on stabilising its wholesale electricity and gas markets in 2023 amid its ongoing energy crisis, implementing several short- and long-term reforms to EU energy market rules that will provide tailwinds to the renewables sector. We also expect increased regulator focus on the reuse and recycling of waste. This bodes positively for the waste management and recycling industries and poses headwinds for non-recyclable packaging producers and landfill and incinerator operators, including waste-to-energy (WtE) plants—an underappreciated aspect given the lack of regulatory scrutiny on WtE thus far.

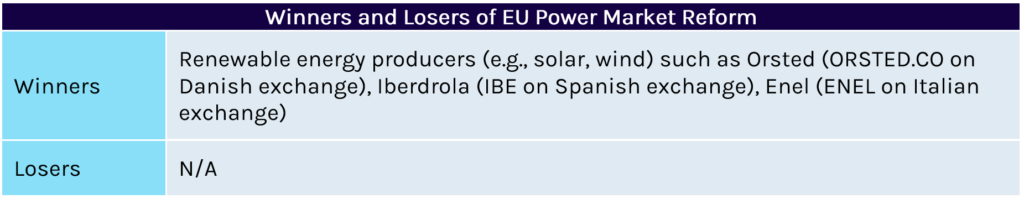

Traditional renewables such as solar and wind will benefit from greater regulatory certainty owing to the upcoming reform of the EU electricity market, which will reduce the risk of further government intervention in wholesale markets (e.g., inframarginal, or non-gas, price caps). We expect policymaker caution and timing constraints to limit the extent of the reform, which will primarily focus on providing greater certainty and revenues for renewable operators.

The EU’s focus on implementing targets set in 2022 to reduce dependency on Russian fossil gas will also pose significant tailwinds for producers of renewable natural gases, including hydrogen and biomethane. We believe the rules will be relaxed, making it easier, cheaper, and faster to produce these gases, which will benefit both domestic producers and companies exporting to the EU.

We expect policymaker caution and timing constraints to limit the extent of the reform, which will primarily focus on providing greater certainty and revenues for renewable operators.

We also expect a push to implement revisions to key pieces of legislation on the EU waste hierarchy. The waste hierarchy, which ranks reuse and recycling at the top and disposal at the bottom, is expected to be reinforced by the introduction of several restrictions both at the product level (e.g., non-recyclable packaging) and at the waste management treatment level (landfilling, incineration), boding poorly for companies in these sectors and benefitting those offering recyclable products and processes.

EU Power Market Reform to Increase Stability and Bolster Revenues for Renewable Players

The European Commission is planning to introduce a legislative proposal to reform the EU’s electricity market in Q1 2023, as announced by Commission President Ursula von der Leyen in August, benefitting renewable energy producers such as Orsted (ORSTED.CO on Danish exchange), Iberdrola (IBE on Spanish exchange), and Enel (ENEL on Italian exchange). The reform will focus on decoupling the price of gas from that of electricity to reduce the impact of higher gas prices on electricity. Several options are under consideration by the European Commission, the most widely discussed involving a switch from the current pay-as-clear model to a pay-as-bid one.

Pay-as-clear to pay-as-bid: In the current pay-as-clear electricity market, all generators receive the price of the most expensive accepted bid (i.e., gas) and bilateral trades tend to converge with the marginal cost. This means the price represents the cost of procuring an additional unit of electricity and reflects the current balance of supply and demand in the market. In a pay-as-bid market, participants receive the price they provide to the market and each party receives its own price, allowing different resources to be priced differently. This could enable a decoupling of electricity prices from gas prices, leading to a reduction in wholesale electricity prices, as, under this system, the most expensive feedstock for producing electricity (gas) would not be used to price all electricity production pathways.

However, a reduction in the wholesale electricity price is not guaranteed in pay-as-bid market due to participants bidding strategically at the price of the most expensive offer that is expected to be accepted. There is an incentive to bid above the marginal cost to obtain a higher payment, meaning reductions in wholesale electricity prices may not materialise unless technology-specific price limits are introduced in conjunction.

Caution and timing constraints to reduce scope: Several countries have expressed concerns about further disrupting the electricity market’s functioning during a period of high volatility. Following discussions with the European Commission, Parliament, and Council during Capstone’s Energy Policy Summit in Brussels, we expect the reform to be phased and reduced in scope in the short-to-medium term, reflecting pushback from several Member States and time constrains. After the proposal’s publication in Q1 2023, it will undergo the regular legislative procedure through the Parliament and Council before the new rules are adopted, which could take 12 to 18 months. As policymakers are keen to legislate the reform before the parliamentary elections in May 2024, it was suggested that the proposal would have a more limited scope to ensure rapid approval.

We believe a compromise in the short-to-medium term could involve an EU platform for standardised long-term contracts, such as power purchase agreements (PPAs) that are de-linked from spot prices. The role of contracts for difference (CfDs) also could be expanded to promote renewables deployment. CfDs have proved very successful in incentivising low-carbon technologies across the EU. Under a CfD, generators are offered a fixed price over a specific term by paying them the difference between the CfD’s strike price and a market reference price. If the market price is below the CfD strike price, then the generator is paid the difference, and if it is above the CfD strike price, the generator pays the difference. CfDs are awarded through an auction process, which rewards the least-expensive projects. We expect the move toward fixed-term contracts to benefit renewable operators, which typically have earned better revenues when under a CfD or PPA compared to in the wholesale markets.

Drive to Reduce Reliance on Fossil Gas Will Spur Hydrogen Deployment

In 2022, EU regulators continued consolidating the regulatory framework for hydrogen to deliver on the ambitions set out in the Green Deal, which was turbocharged by the war in Ukraine and the need to quickly replace Russian fossil gas.

Reduced regulatory red tape: To reach the EU target of 10 million tonnes (Mt) of domestically produced green hydrogen by 2030, a minimum of 40 gigawatts (GW) of electrolyser capacity will be needed. In May, the Commission called for companies to increase combined EU manufacturing capacity to 17.5 GW by 2025, up from the existing 1.75 GW, and to further increase that through to 2030 in line with demand.

To address the high costs that project developers face, the EU is reducing the regulatory red tape around the qualification requirements for green hydrogen. To ensure that renewable energy used for hydrogen production is not diverted from decarbonising the electricity grids, the EU typically requires that new renewable plants be built for hydrogen production. These ‘additionality’ requirements have been criticised for increasing the costs of hydrogen production and slowing deployment.

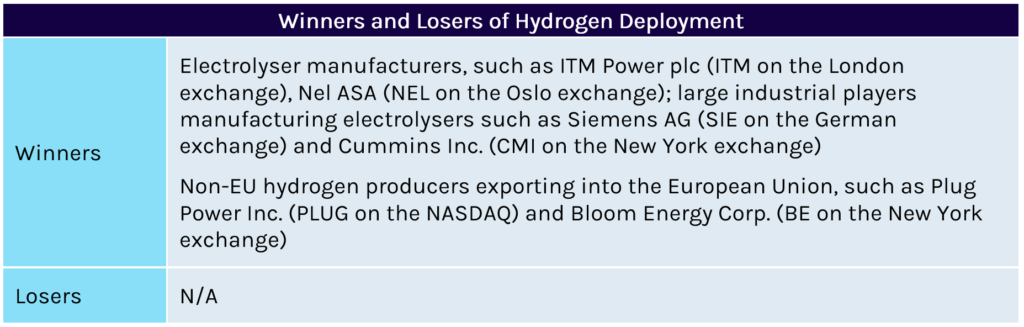

To address the urgency of deploying electrolysers, the Commission relaxed the requirements in December, providing a derogation for hydrogen plants to use existing renewable capacity until 1 December 2036 for installations coming into operation before 1 January 2027. We expect the derogation to accelerate deployment in the next five years and benefit electrolyser manufacturers such as as ITM Power plc (ITM on the London exchange), Nel ASA (NEL on the Oslo exchange), as well as large industrial players manufacturing electrolysers such as Siemens AG (SIE on the German exchange) and Cummins Inc. (CMI on the New York exchange).

We expect non-EU hydrogen manufacturers… to benefit from increasing demand and financial support from the EU.

Focus on imports: In recognition of the difficulty of reaching the EU target of 40 GW of electrolyser capacity by 2030, a large focus is placed on imports in the REPowerEU strategy to phase out Russian gas. According to the strategy, which was published in May, the EU will aim to secure 10 Mt of green hydrogen imports annually by 2030 (on top of the 10 Mt of annual domestic production already planned).

Moreover, exporters into the EU will be able to bid for support under upcoming EU subsidy schemes for hydrogen. In addition, President Von der Leyen has announced a new European Hydrogen Bank to guarantee the purchase of hydrogen and bridge the investment gap, with €3 billion already committed. According to the Commission Work Programme 2023, the initiative will be published in Q3 2023, paving the way for increased imports of hydrogen into the EU. We expect non-EU hydrogen manufacturers, particularly those manufacturing green hydrogen, to benefit from increasing demand and financial support from the EU.

Revision of Key EU Packaging Legislation to Benefit Recycling Industry

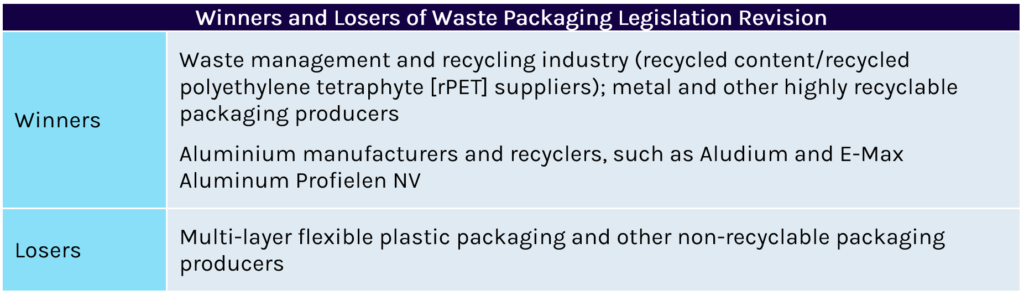

On 30 November 2022, the European Commission proposed new EU-wide rules on packaging to address growing packaging waste. Packaging is one of the main uses of virgin materials—40% of plastics and 50% of paper used in the EU is destined for packaging. Moreover, packaging accounts for 36% of municipal solid waste.

The following are the key features of the proposed revision of the Packaging and Packaging Waste Directive (PPWD):

Regulatory harmonisation: In line with Capstone’s prediction, the Commission has proposed moving from a directive to a binding regulation (Packaging and Packaging Waste Regulation—PPWR) to promote better harmonisation and enforcement across the 27 Member States.

Packaging waste reduction and minimisation: According to the Commission, without further policy action, the EU is likely to see a 19% increase in total packaging waste by 2030 and a 46% increase in plastic packaging waste specifically. As such, the proposed PPWR requires each Member State to progressively reduce the packaging waste generated per capita (from a 2018 baseline) by 5% by 2030, 10% by 2035, and 15% by 2040.

Packaging recyclability: A key target within the revision is to ensure that all packaging is reusable or recyclable by 2030. This includes: setting Design for Recycling (DfR) criteria for packaging to be designed for recycling from 2030 and be recycled at scale from 2035, creating mandatory deposit return systems for plastic bottles and aluminium cans, and making it clear which very limited types of packaging must be compostable so that consumers can dispose of these as biowaste. We expect the DfR criteria (including the methodology to assess whether packaging is recycled at scale) to be established via subsequent delegated acts (secondary legislation).

Recycled content requirements: Each unit of packaging that contains a plastic part would be required to include a certain percentage of recycled content recovered from post-consumer plastic waste (PCR). From 2030, recycled content would have to make up 30% of contact sensitive packaging made from polyethylene terephthalate (PET) as the major component; 10% of contact sensitive packaging made from plastic materials other than PET, except single use plastic beverage bottles; 30% of single use plastic beverage bottles; and 35% of all other packaging. From 2040, recycled content would need to make up 50% of contact sensitive plastic packaging, except single use plastic beverage bottles, and 65% of single use plastic beverage bottles and other plastic packaging. Derogations for immediate packaging of medicinal products and contact sensitive plastic packaging of medical devices and in vitro diagnostic medical devices are foreseen until 31 December 2034.

From 2030, reuse and refill targets would apply to various food and beverage packaging, such as cold and hot beverages filled at the point of sale (20%), take-away ready-prepared food intended for immediate consumption (10%), alcoholic beverages excluding wine (10%), wine (5%), and non-alcoholic beverages (10%).

Compostable packaging: The PPWR defines conditions for packaging to be considered compostable and prescribes that filter coffee pods, sticky labels attached to fruit and vegetables, and very lightweight plastic carrier bags shall be compostable by 24 months after the entry into force of the PPWR.

Next Steps

The PPWR will now be considered and potentially revised by the European Parliament and the Council in the ordinary legislative procedure, which can take 12–18 months. Capstone will continue to follow developments closely in 2023.

Reuse and Recycling Focus Spells Headwinds for Landfills and Incinerators

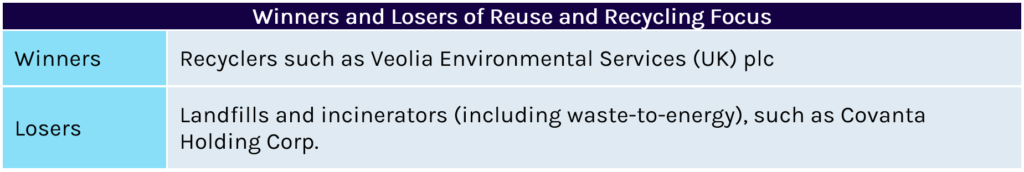

We believe the Waste Framework Directive (WFD)—the overarching EU legislation setting the basis for the management of different waste streams—is likely to be revised in 2023 to tackle inefficient waste-collection and encourage recycling. The revision is expected to support the implementation of the five-step “waste hierarchy” that ranks waste management in the following order of preference: 1) prevention, 2) preparation for reuse, 3) recycling, 4) recovery, and 5) disposal.

Municipal waste focus: The WFD sets “preparing for reuse” targets for municipal waste and recycling targets for municipal biowaste. We expect the minimum targets for both reuse and recycling to be increased to 55%, 60%, and 65% by weight by 2025, 2030, and 2035, respectively. We expect a mix of price signals and restrictions on recovery and disposal operations to be implemented at both the EU and Member State level to ensure waste moves up the hierarchy.

Landfilling restrictions take priority: The Landfill Directive, a complementary directive to the WFD, already includes provisions that ban recyclable/recoverable waste from being landfilled starting in 2030, ban the landfilling of separately collected waste, and limit the share of municipal waste landfilled to ≤10% by 2035. The European Commission will review the directive by Q4 2024 to decide whether to maintain, or potentially expand, its goals. We note that the directive’s targets are binding, with European Commission pursuing infringement proceedings against 12 Member States for failing to reach the target of 35% maximum landfilling by 2018.

We believe the Waste Framework Directive is likely to be revised in 2023 to tackle inefficient waste-collection and encourage recycling.

Incineration restrictions a long-term risk: In 2022, the European Parliament and Council said they would support the inclusion of municipal waste incineration in the EU Emissions Trading Scheme (ETS), increasing costs for incineration and WtE plants. Parliament supports an inclusion from 2026 and Council from 2031, pending an impact assessment to check the second-order impact of including incineration in the ETS (the main concern being that it could increase landfilling). We also note that in some regions, such as the south of Italy, a lack of WtE capacity has been linked to a flourishing waste crime scene, leading regulators to err on the side of caution. Against this backdrop, the EU is more likely to adopt the Council’s position of including municipal waste incineration in the ETS from 2031, posing a longer-term risk to waste-to-energy incineration plants. Under the ETS, we expect installations will have to pay only for the non-biogenic (or fossil waste) components, which account for about 50% of the volume of municipal waste.