Capstone believes that Texas’ broadly favorable regulatory framework will continue to face increased lawmaker scrutiny over rising insurance rates. In California, we believe that P&C insurers will benefit from the reforms enacted in the recently concluded legislative session, while the Trump administration’s reduction in funding for the Federal Emergency Management Agency (FEMA) threatens federal mitigation funding in disaster-prone areas.

- In Texas, the second-largest US property-and-casualty (P&C) market, homeowners’ rates rose by an average of 19% in 2024 and 21% in 2023, enabled by the state’s “file-and-use” system and driven by increasing incidents of severe weather. With SB 1643, lawmakers proposed a rival prior approval system for rate changes over 10%, and while the bill failed, we anticipate that continued legislative scrutiny is highly likely.

- We view a package of bills signed by California Governor Gavin Newsom (D) on October 10th as favorable for P&C insurers, as is ongoing implementation of the Sustainable Insurance Strategy (SIS). As the state continues to take steps to improve the environment for carriers, we anticipate gradual increases in underwriting over the next two years, provided there are no major wildfires.

- The Trump administration recently eliminated the Building Resilient Infrastructure and Communities (BRIC) program, a key disaster mitigation funding initiative intended to reduce property damage caused by natural disasters. While the administration’s move faces litigation, shifting the funds away from BRIC would reduce the potential benefits of mitigation for P&C insurers in disaster-prone states.

- The National Flood Insurance Program (NFIP) lapsed on October 1st, temporarily disrupting mortgage markets and supporting demand for private flood insurance. Congress continues to weigh reform of the program, with debates centering on affordability and actuarial soundness.

Texas Homeowners’ Insurance Market Overview

Texas accounts for more than 11% of homeowners’ insurance premiums written in the US, making the state the second-largest property and casualty (P&C) insurance market nationwide behind California. In recent years, increasingly prevalent and severe weather events have threatened carrier balance sheets and resulted in rising premium costs for consumers. While the market remains generally attractive to investors and carriers, enabled by a favorable regulatory environment, the state’s growing climate risk, increasing reliance on the state insurer of last resort, and rising consumer costs have attracted legislative scrutiny.

Between 1980 and 2024, Texas experienced 190 confirmed weather events with losses exceeding $1 billion (inflation-adjusted). The National Oceanic and Atmospheric Administration (NOAA) reported that 68 of these billion-dollar events occurred in the last five years alone, compared to the 62 events that occurred from 2010 to 2019. Notable events include Hurricane Harvey (2017), which caused an estimated $125 billion in damage, and a winter storm in 2021 that caused an estimated $26 billion in damage. The pattern continued in 2024, with Hurricane Beryl, a greater-than-typical wildfire season, and extensive flooding in Hill Country further straining the state’s P&C market.

Texas’ file-and-use rate-setting system enables insurers to adjust rates to reflect risks without prior regulatory approval. Generally, once an insurer files its rates, it can use them on its effective date provided that the rates are: 1) adequate, 2) not excessive, 3) actuarially sound, 4) reasonably related to costs, and 5) non-discriminatory. Relative to a prior approval regime (such as in California), a file-and-use framework generally permits carriers to more quickly adjust rates in response to real market conditions and changing risks (though the Texas Department of Insurance may challenge rates post-filing). As a result, increasing risk generally results in higher insurance premiums for the insured. Those increasing premium rates have prompted heightened scrutiny from the Texas state legislature.

Like other catastrophe-prone geographies, Texas provides for state-backed insurers of last resort: the Texas FAIR Plan and the Texas Wind Insurance Association (TWIA). To be eligible for coverage from the Texas FAIR Plan, applicants must receive coverage declinations from at least two admitted insurers and are required to seek coverage in the admitted market every two years. The number of FAIR Plan applicants has grown from 66,512 in 2021 to 121,658 in Q1 of 2025. TWIA operates as a non-profit insurance company, exclusively offering windstorm and hail coverage for residents along the Gulf Coast. It has a significant presence in 14 coastal counties, reporting over 280,000 policies (6.7% y/y growth) and $121 billion in exposure (14.8% y/y growth).

Some Legacy Carriers Weigh Retreat, Smaller Insurers with Thin Balance Sheets Have Suffered

The Texas homeowners’ insurance market remains concentrated, with legacy carriers such as State Farm, Allstate Corp. (ALL), and Farmers Insurance, a subsidiary of Zurich Insurance Group AG (ZURN on the Swiss exchange), collectively holding about three-quarters of market share. While heightened catastrophe risk in Texas has driven smaller insurance carriers to stop underwriting new homeowners’ policies in the state, voluntarily or otherwise, the underwriting posture of legacy carriers has remained relatively stable. Although most legacy carriers have not signaled efforts to reduce their underwriting in Texas, some carriers, such as Progressive Corp. (PGR)—which accounts for 3% of total homeowners’ insurance premiums written in the state—have sought to reduce their exposure. Progressive CEO Tricia Griffith wrote that natural disasters in Texas caused nearly 40% of storm losses nationwide, resulting in the firm deciding to “temporarily restrict new homeowners’ business” in the state. Griffith wrote that “shifting [the company’s] geographic mix continues to be a top priority,” signaling a potential downsize in the carrier’s relative exposure in Texas. While other legacy players have not publicized similar moves, smaller carriers have been forced to reconsider their underwriting posture.

Exhibit 1: Extreme Weather Decimates Some Small Carriers, Forces Legacy Carriers to Re-assess

| Company | Year | Action |

|---|---|---|

| New Century Insurance Co. | 2025 | Placed into receivership and ordered into liquidation by the Travis County District Court. All policies with New Century will be canceled. |

| Lemonade Insurance | 2025 | Lemonade sent letters to policyholders saying that it must follow guidelines that prevent the company from “covering areas with significant exposure to weather-related catastrophes,” reducing their underwriting in high-risk areas. |

| Progressive | 2024 | One month after Hurricane Beryl, Progressive announced that they were “temporarily restricting new homeowner business” in Texas. |

| Foremost Insurance | 2023-2024 | Foremost, a subsidiary of Farmers, announced its intent to non-renew certain homeowners’ policies in areas with significant wind and hail exposure. |

| Germania Insurance | 2023 | In July 2023, Germania informed its agents that it would cease writing new residential property business in Texas due to financial losses from severe weather events. |

| FedNat Insurance Co. | 2022 | In September 2022, FedNat was ordered into liquidation, canceling insurance policies for nearly 4,000 residents. |

| Weston | 2022 | In August 2022, Weston was ordered into liquidation, canceling insurance policies for more than 30,000 policyholders in Texas. TWIA then announced a rule extending application timelines and a special payment plan in response to Weston’s insolvency. |

Source: Company press releases, TDI, Insurify, Houston Chronicle, The Insurer

Homeowners’ Insurance Rates Have Grown Significantly in Recent Years

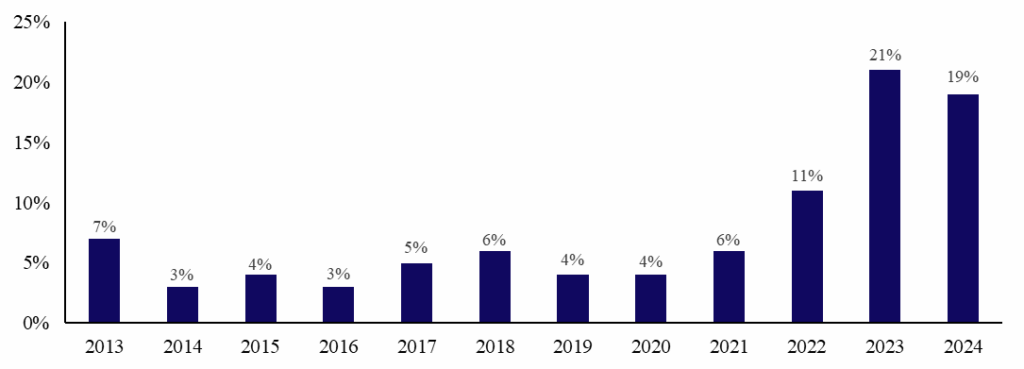

Extreme weather disasters have driven carriers to rapidly increase premium rates to ensure rate adequacy. According to filings from the Texas Department of Insurance (TDI), the average rate change for homeowners’ insurance hovered around 3% from 2014 to 2016. Recent rate increases have been more dramatic, averaging 11% in 2022, 21% in 2023, and 19% in 2024. Insurify estimates that Texas will be the fifth-most expensive state for home insurance in 2025, with homeowners paying an average annual premium of $6,522. Increasing premiums have raised scrutiny in the Texas legislature and at TDI, which we expect to continue in the near term.

Exhibit 2: Homeowners’ Premiums, Average Rate Change

Source: Texas Department of Insurance

Legislative Scrutiny Grows amid Increasing Insurance Costs

In 2025, Texas lawmakers filed over 600 bills related to P&C insurance, some of which focused on addressing rapidly increasing rates for policyholders. Three key bills introduced in the most recent session suggest the legislature will continue to be active on this subject. While only SB 213 was signed by Governor Greg Abbott (R) on June 20, 2025, and insurers avoided the implementation of a prior approval regime for certain large rate increases, we believe policymakers in Texas are highly likely to continue weighing administrative and legislative changes aiming to balance the tension between insurance affordability and availability.

Exhibit 3: Texas Legislative Reforms Targeting High Premium Prices

| Bill | Status | Description | Impact |

|---|---|---|---|

| SB 1643 (2025) | Passed Senate, Stalled in House Committee | Requires insurance companies to obtain prior authorization from TDI for rate adjustments greater than 10% (either increase or decrease) for residential and commercial property and auto. | While the failure of the bill suggests the durability of the state’s file-and-use system, its progress suggests legislators’ acute awareness of rising premium costs. Such a change would constitute a dramatic shift that could pose risks for carriers aiming to maintain rate adequacy amid increasing risk. |

| SB 1006 (2025) | Passed Senate, Stalled in House Committee | Requires insurers to issue quarterly reports summarizing their reasons for declining, canceling, or non-renewing policies. | From 2020 to 2023, non-renewal rates nearly doubled from 0.46% to 0.83%. While insurers would have retained the right to cancel policies under the bill, the proposal reinforces legislative scrutiny on carrier underwriting behavior and growing consumer protection interests. |

| SB 213 (2025) | Signed by Governor Abbott, Effective September 1, 2025 | Prohibits insurance companies from requiring customers to bundle their home and auto insurance policies with the same provider as a condition for coverage | Enactment of SB 213 with nearly unanimous support in the state legislature suggests policymakers’ willingness to incrementally promote consumer choice and flexibility, to the potential detriment of carriers. |

Source: Texas Senate

Legislative Scrutiny Unlikely to Abate

As Texas continues to face a worsening insurance affordability crisis amid more prevalent extreme weather events and increasing premium costs, Capstone expects near-term regulatory and legislative stability, backgrounded by sustained scrutiny of P&C carriers in the state.

As Texas continues to face a worsening insurance affordability crisis amid more prevalent extreme weather events and increasing premium costs, Capstone expects near-term regulatory and legislative stability.

The Texas legislature meets every two years, with the most recent session concluding on June 2, 2025, and the next session set to begin in January 2027, supporting our thesis of short-term stability. That said, we expect legislation aimed at insurance affordability to be introduced in the next session, potentially including a reintroduction of SB 1643 or some iteration of it. While the policy commitment to ensuring the availability of insurance, via maintaining carriers’ ability to quickly adjust rates and a file-and-use regime, defeated these concerns in the most recent session, we believe pressure on policymakers to act to ensure insurance is affordable will continue to metastasize in the years to come.

California Update: Significant Regulatory Changes Take Effect

California’s homeowners’ insurance market has experienced significant regulatory change over the past year (see California’s P&C Insurance Strategy Likely Finalized by June 2025; Reforms to Gradually Coax Allstate, Travelers, Chubb, Others Back into the State, November 13, 2024). Finalized in December 2024, the Sustainable Insurance Strategy (SIS) is the largest insurance reform in the state since the enactment of Proposition 103 in 1988. SIS consists of four main components: enabling carriers to incorporate 1) forward-looking catastrophe models and 2) reinsurance costs in rate filings, 3) rate review timeline reform, and 4) FAIR Plan modernization. We view these reforms as favorable for admitted insurers operating in the state.

Before the finalization of the SIS, California was the only state to prohibit the inclusion of forward-looking catastrophe models and reinsurance costs in homeowners’ insurance rates. Now, insurers can incorporate CAT models and reinsurance costs, provided they increase their underwriting in high-risk areas (a carrot-and-stick model aimed at incentivizing underwriting in high-risk areas). To date, at least three insurers have sought rate increases that incorporate the use of forward-looking models and reinsurance costs.

Exhibit 4: Insurance Carriers Incorporate CAT Models and Reinsurance in Rate Filings

| Company | Date | Action |

|---|---|---|

| CSAA | August 2025 | In August 2025, CSAA announced that it had requested a 6.9% increase in homeowners’ rates, incorporating reinsurance costs and catastrophe models. |

| Mercury Insurance | August 2025 | In August 2025, Mercury announced that it had requested a 6.9% homeowners’ rate increase based on the use of Verisk’s approved catastrophe model. |

| Pacific Specialty | September 2025 | In September 2025, Pacific Insurance Group requested a 6.8% rate increase for homeowners, incorporating reinsurance costs and catastrophe models. |

Source: SERFF

Under SIS, improving rate review processes remains a priority for Commissioner Ricardo Lara and the California Department of Insurance (CDI), as California’s rate approval timelines are the longest in the nation. As of July 2025, review timelines averaged 259 days when not challenged by an intervenor, while challenged filings typically took more than 500 days to be approved. Rate approval timelines continue to be prolonged by the public intervenor system under Proposition 103, which empowers consumer advocates to challenge homeowners’ and commercial rate increases above 6.9% and 14.9%, respectively. Commissioner Lara has increasingly scrutinized the role of the intervenor and has since taken steps to mitigate its impact on rate filings.

Because the public intervenor was established through a constitutional amendment, overhauling it would require a citizen-led ballot initiative. As a result, CDI has sought to tactically leverage administrative authority to limit delays driven by the public intervenor process. On September 19, 2025, CDI announced reforms to the intervenor process aimed at enhancing transparency and accountability in rate reviews, including 1) clarifying the “substantial contribution” standard for intervenor compensation, and 2) requiring public reporting on intervenor activity and compensation, among other changes. We believe these reforms, paired with CDI’s commitment to shortening rate approval timelines, are generally positive for the industry as it continues to grapple with heightened wildfire risk. Shortened rate timelines will enable carriers to receive timely rate decisions, a key component to driving increased underwriting in the state by legacy carriers.

Legislative Reforms Await Governor Newsom’s Signature

Following the Los Angeles wildfires in January 2025, legislators and Commissioner Lara introduced a package of reforms called the “Golden State Commitment.” The reforms aimed to strengthen wildfire mitigation, market stabilization, and consumer protection. On October 9th, Governor Newsom signed bipartisan legislation aimed at enhancing the state’s FAIR Plan. Effective immediately, Assembly Bill 226 (The FAIR Plan Stability Act) authorizes the state to issue bonds to finance the plan’s claim-paying capacity. Governor Newsom also signed AB 1 (The Insurance and Wildfire Safety Act), requiring CDI to assess and update regulations based on new fire science every five years.

On October 10th, Governor Newsom signed additional P&C insurance-related bills, including the Safe Homes Act (AB 888), the Public Wildfire Model Act (SB 429), the Eliminate the List Act (SB 495), the Business Insurance Protection Act (SB 547), and the Community Fire Hardening Commission Act (SB 616). We believe that these legislative reforms, paired with the insurer-friendly provisions of the SIS, will continue to help stabilize the California homeowners’ insurance market.

Disaster and Mitigation Funding Outlook Amid FEMA Complications

Trump Administration’s Efforts to Scale Down FEMA

President Trump has sought to reduce the role of the Federal Emergency Management Agency (FEMA), repeatedly suggesting that disaster relief responsibilities should fall entirely to the states. The president signed an Executive Order (EO) on January 24, 2025, establishing a FEMA Review Council to advise the administration on possible reforms to better “serve the national interest.” According to the EO, a key focus area of the council is to evaluate whether FEMA can be transformed to play a supporting, rather than a leading, role in disaster relief. A second EO on March 19, 2025 declared that state and local governments must be more actively involved in disaster mitigation and relief.

During the first six months of the second Trump Administration, FEMA’s headcount decreased by approximately 2,500 employees, an estimated half of its staff, including 24 senior leaders with experience responding to natural disasters. Recent reforms within FEMA have also sought to reduce the agency’s spending. In June, Department of Homeland Security Secretary Kristi Noem, who oversees FEMA, mandated that all the department’s proposed expenditures in excess of $100,000 receive her personal approval, a policy that has been criticized for causing delays in disaster response expenditures.

More critically for carriers, in April 2025, FEMA announced that it would eliminate the Building Resilient Infrastructure and Communities (BRIC) grant program in a move that would reallocate $4 billion in federal funds away from disaster mitigation projects. The program has provided state and local governments with funding to strengthen infrastructure and promote resilience to natural disasters. Mitigation funding is critical to reducing property damage and limiting the costs to insurers in the aftermath of disasters. A 2020 study conducted by the National Institute of Building Sciences found that federal mitigation funding grants across several agencies, including FEMA, save $6 for every $1 spent. We generally view mitigation funding as favorable for insurers, as it reduces underlying balance sheet risk when deployed at scale to make communities more resilient. Elimination of that funding perpetuates that risk.

Challenges to the Trump Administration’s Approach

The administration is limited in its ability to scale down FEMA, at least with respect to the agency’s statutorily mandated disaster relief responsibilities outlined in the Homeland Security Act of 2002 and the Stafford Act of 1988. FEMA also remains highly popular with the American public, especially in disaster-prone states, posing political risks to significant reductions in the agency’s capabilities.

A legal challenge has also been mounted against the administration’s elimination of BRIC funding. In July 2025, 20 states filed a lawsuit against FEMA and DHS in the U.S. District Court for the District of Massachusetts, arguing that the agencies overstepped their statutory authority. While the case remains ongoing, Judge Richard Stearns granted the plaintiffs a preliminary injunction on the reallocation of BRIC program funding on August 5, 2025. Judge Stearns noted that the court was “not convinced that Congress vested in the agency any discretion to relocate [BRIC] funds,” suggesting BRIC funding may ultimately be deployed.

Efforts to Curtail Mitigation Funding Increase Risks for P&C Carriers

The Trump Administration’s efforts to eliminate mitigation funding programs, to the extent successful, would increase or at least stabilize the risk exposure facing P&C insurers. FEMA’s staffing decrease could result in fewer personnel to administer federal disaster relief and less experienced staff holding leadership roles in disaster responses. A less-prepared FEMA with reduced resources has the potential to lead to more disaster-related damage, ultimately leading to greater claims volumes and insured losses for carriers. If successful, the attempted elimination of the BRIC program would leave states less able to take smart steps to improve their resilience to growing extreme weather risks. As previously mentioned, more resilient infrastructure ultimately means lower balance sheet risk for carriers.

Capstone believes large-scale reductions in FEMA’s role are unlikely to survive legal challenges.

Capstone believes large-scale reductions in FEMA’s role are unlikely to survive legal challenges, as FEMA and many of its programs are statutorily mandated under the Homeland Security Act of 2002 and the Stafford Act of 1988. Further, we believe it would be politically unpopular for the administration to dramatically cut funding, as federal relief programs are highly popular, especially in disaster-prone states. However, future administrative reforms will likely continue, with the ultimate success of these reforms likely contingent on litigation outcomes. Losing such funding would carry meaningful, albeit indirect, risks for carriers.

National Flood Insurance Program, Reauthorization, and Reform Prospects

National Flood Insurance Program Overview

On September 30, 2025, the National Flood Insurance Program’s (NFIP) authorization expired with the lapse of the Continuing Appropriations and Extensions Act of 2025. As Capstone has previously covered, the NFIP, which provides coverage to 4.7 million policyholders across the country, has faced financial distress in recent years, drawing down $22.5 billion in debt from the Department of the Treasury to cover losses. The program’s insolvency has led to widespread recognition that meaningful reform to the NFIP is necessary, although elected officials have been unable to reach consensus. While Congress members from flood-prone states, such as Senator Bill Cassidy (R-LA), have advocated for policies that enhance the affordability and stability of the NFIP, other members of Congress have pushed back, countering that the program’s lack of actuarial soundness is unsustainable. This impasse, in addition to the NFIP’s critical role in the flood insurance market, has led to 33 short-term extensions of the program in recent years.

NFIP Reauthorization in the Continuing Resolution

Following the failure of Congress to pass a continuing resolution (CR) to keep the government open, the NFIP’s authorization lapsed on October 1, 2025. During a program lapse, new policies cannot be written, and the program’s capacity to borrow funds from Treasury is limited to $1 billion, an amount substantially lower than the current remaining limit of $7.9 billion. Such a lapse typically impacts the mortgage market, as homes located within Special Flood Hazard Areas designated by FEMA are required to have flood insurance. However, several federal agencies issued a joint press release on October 1, 2025, informing mortgage lenders that they are still able to originate mortgage loans that would generally require flood insurance without requiring its purchase during the NFIP lapse.

Recent reporting suggests that the costliness of private flood insurance relative to NFIP coverage has still driven a decrease in daily home closings. Several members of Congress have since introduced standalone bills to reauthorize the NFIP. However, these proposals have struggled to advance due to the Republican leadership’s reluctance to reduce any leverage in spending bill negotiations. In this temporary period of program unavailability, homebuyers actively seeking to purchase flood insurance could turn to the private market if they are willing and able to afford the generally more expensive and broader coverage offered in the private market, potentially creating a short-term tailwind for private flood insurers.

Recent Reform Efforts Indicate Challenge of Reform: Affordability or Actuarial Soundness?

In recent months, Congress members have pushed for administrative and legislative reforms to the NFIP, citing affordability concerns. Legislative proposals to extend the program through December 31, 2026, have also been introduced in both the House and the Senate; however, neither has gained significant traction outside of committee. At the core of debates around program reform is the question of whether NFIP should act as a subsidized flood insurance program (thereby displacing the private market) or a more expensive but actuarially sound option (which would enable greater private market activity). Fiscal hawks such as Senator Rand Paul (R-KY) have continued to oppose reforms that increase the program’s affordability, although they have recently garnered interest from more lawmakers.

In a July 9 letter to FEMA Acting Administrator David Richardson, nine senators requested the agency terminate Risk Rating 2.0’s pricing methodology, enhance transparency around the decision-making for premium increases, and reinstate policies that ensure affordability for “coastal, low-income and historically underinsured communities.” Risk Rating 2.0, implemented in 2021 under the Biden administration, is an initiative to more accurately assess the underlying flood risk associated with properties insured by the NFIP. We generally view Risk Rating 2.0 as positive for private flood insurers as it reduces price distortions resulting from the NFIP, which historically has functioned as a subsidy regime.

Separately, on August 15, 2025, Senators Cassidy and Booker (D-NJ) issued a request for public comment on the National Flood Insurance Reauthorization and Reform Act of 2023 to better understand the most important and problematic provisions of the bill. The bill, which would extend the authorization of the NFIP through September 2028 and adjust various components of the program, did not gain traction out of the committee and has not been reintroduced in the 119th Congress.

Short-Term Reauthorization Essentially Automatic, but Obstacles Remain

The implementation of Risk Rating 2.0 has enabled policies issued by private flood insurance providers to better compete with those issued under the NFIP, creating opportunities for carriers in the flood insurance space. However, any legislative or administrative reforms to terminate the initiative or increase the affordability of NFIP policies could result in the program again undercutting the private market, significantly reducing opportunities for private flood insurers.

Reform discussions are continuing to gain traction in Congress, and providing constituents with price relief has been a core objective of the second Trump administration. While FEMA has not indicated any intention of terminating Risk Rating 2.0, a catalyst-driven overhaul of the NFIP appears increasingly likely, though the tension between affordability and actuarial soundness is unlikely to abate. Capstone continues to believe that NFIP will remain in its current form through short-term reauthorizations, beginning with the CR that reopens the federal government.

Read more from Trace:

The CFPB Pendulum Swings Back: Regulatory Retreat Under Trump