January 22, 2024

By Hunter Hammond, Capstone lead Congressional analyst

Despite the chaos, gridlock, brinksmanship, and general weirdness demonstrated by this Congress in the past year, we contend that at its core, the Congress is operating normally by recent standards. Yes, for the first time in US history a Speaker of the House was ousted, but them’s the breaks when you control the majority by a thread, empower your most dogmatic, vocal faction, and won’t cut a deal with the minority party to keep your job. Aside from that (a big aside), everything else is relatively normal in a divided government:

- Legislators avoided a default on US debt by signing a two-year budget deal. Ahead of the June 2023 deal, Capstone assigned a 99% probability that the US would not default.

- Following the debt limit deal, Congress faced the prospect of a government shutdown on October 1, 2023. Ahead of that deadline, we predicted a 55% probability of a shutdown. Congress ultimately passed a continuing resolution (CR) until November 17 on a 65-35 Senate vote and a 254-175 House vote.

- Following the first CR, Congress acted again to prevent a shutdown, passing a two-tiered (CR) until January 19, 2024, and February 2, 2024. The CR was even more bipartisan than the first, with an 87-11 vote in the Senate and a 336-95 vote (under suspension of the rules) in the House.

- On January 18, the Senate passed a third CR on a bipartisan 77-18 vote, and the House swiftly concurred in a 314-108 vote, extending funding until March 1 and March 8. In November, we assigned a 40% probability of a shutdown the third time around and were proven correct.

At this point, Congress has avoided defaulting on the debt (normal), passed a budget caps deal (normal), punted funding three times (normal), and ousted the sitting Speaker (not normal). So, what’s next?

Capstone’s Call

- Appropriations: By the end of March 2024, we assign a 70% probability that Congress will pass one or more regular-order appropriations packages (likely in the form of two multi-bill minibuses), a 20% probability that Congress will pass only a continuing resolution (CR) for all appropriations bills, and a 10% probability that there is a government shutdown. A short-term CR may be needed in early March before full-year appropriations, hence our forecast timing.

- Tax Extenders: We assign a 65% probability that Congress will enact a tax extenders package by the end of March 2024, including R&D, bonus depreciation, child tax credit, and an end to the employee retention tax credit (ERTC). We believe Congress will enact this package on a stand-alone basis, though it is possible that it could ride with appropriations bills.

Government Funding Path Forward

Government funding expires again on March 1 and March 8. The tiered system places four of the 12 funding bills on one track and the eight remaining bills on a one-week delayed track. The March deadline is important as four of the last 23 appropriations cycles (17%) have ended with funding finally completed in March. Aside from December (43%), March is the second most popular month for legislators to finally appropriate funds for the year. Moreover, since 2000, after the third CR, Congress has passed regular-order appropriations bills 29% of the time, with another CR happening 59% of the time. However, those odds increase dramatically in the fiscal year before an election. In those five years, Congress has passed regular order appropriations bills 100% of the time.

Considering the past 23 appropriations cycles, we believe our 70% probability of regular order appropriations by the end of March is appropriate.

Speaker Mike Johnson (R-LA) agreed to a top-line spending figure in January, a positive sign for our call. Next, we will be watching for congressional leaders to finally assign subcommittee allocations. If the first four-bill tranche of spending bills—commonly referred to as a “minibus”—needs to be enacted by March 1, then the Senate likely needs to put the bill on the floor by the week of February 26. That means Congress likely needs to finish writing and reviewing the bill by February 15. As such, if Congress does not have subcommittee allocations by February 1, we will likely reevaluate our call.

Notably, this round of funding negotiations is especially important. Whatever is decided now will likely be what is in effect until after the election, as Congress is likely to pass a CR come the new fiscal year (October 1, 2024) so lawmakers can campaign.

Tax Extenders Path Forward

On January 16, 2024 the top Republican on the House Ways and Means Committee Rep. Jason Smith (R-MO) and the top Democrat on the Senate Finance Committee Sen. Ron Wyden (D-OR) announced an agreement on a tax framework. The deal—titled the Tax Relief for American Families and Workers Act of 2024 (Exhibit 1)—would:

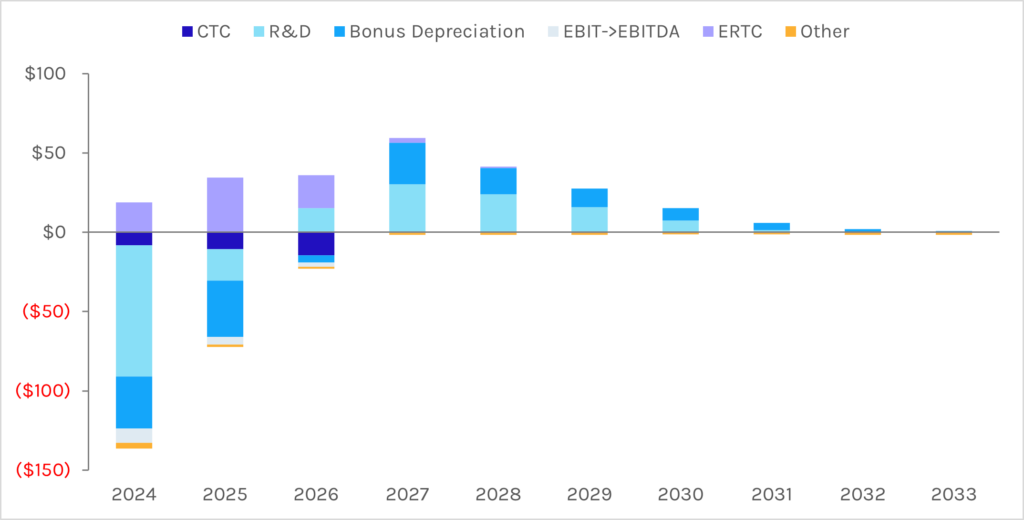

- R&D: Restore full expensing for domestic research and development until the end of 2025. The provision is retroactive for the 2022 and 2023 tax years. The provisions costs $102.6 billion in the first two years but ultimately saves $8.5 billion by reversing itself in 2026-2031, a budget gimmick that sets up a fight in 2025.

- Bonus Depreciation: Restore 100% bonus depreciation until the end of 2025. The provision applies to investments made since the end of 2022. The provisions costs $72.7 billion in the first three years, but—like R&D—ultimately saves $3 billion by reversing itself in 2027-2033.

- EBIT to EBITDA: Restore the use of EBITDA (instead of EBIT) for net interest expense deductions until the end of 2025. The provision is retroactive for the 2022 and 2023 tax years. The provisions costs $18.8 billion over 10 years.

- Child Tax Credit: Enhance the child tax credit by making it more generous, indexing it to inflation, and reducing work requirements for tax years 2024 and 2025. The provision is estimated to benefit some 16 million children in families not currently receiving the full credit, lifting more than half a million children above the poverty line. The provisions costs $33.5 billion.

- Employee Retention Tax Credit (ERTC): Thebill is paid for initially by ending the ability for employers to claim the ERTC after January 31, 2024. The ERTC was initially expected to cost $77 billion, but by September 2023, it had ballooned to cost more than $230 billion amid accusations of fraud. Ending the ERTC early is expected to save $77.1 billion.

Exhibit 1. Estimated Revenue Effects of the Tax Relief for American Families and Workers Act ($, billions)

Note: Years are Fiscal Years

Source: Joint Committee on Taxation

We are constructive on the outlook for enactment, as there is bipartisan, bicameral buy-in from key leaders, including Senate Majority Leader Chuck Schumer (D-NY). Moreover, the House Ways and Means Committee advanced the bill on January 19 on a 40-3 vote. We believe the House will likely pass the bill under suspension of the rules (requiring a 2/3 vote), but it could also potentially be passed as an amendment to one of the appropriations bills. We lean towards a standalone vote because tax season opens on January 29, and we believe lawmakers will want to enact legislation before that date.

We believe it will be vital to watch the Senate on this deal. The top Republican tax writer in the Senate, Sen. Mike Crapo (R-ID), says that he has unspecified issues with the bill, and his buy-in will be important to secure broader Republican support in the chamber. Equally important to Sen. Crapo, we will be watching the “three Johns,” Sens. John Thune (R-SD), John Cornyn (R-TX), and John Barrasso (R-WY). These senators are the next most likely to replace Senate Minority Leader Mitch McConnell (R-KY), so their stances on the bill will be a key driver of broader Republican support. Sen. Thune has already raised questions about the bill, including its impact on inflation and the work requirements related to the child tax credit. However, none of the comments from Sens. Crapo nor Thune are terribly pessimistic.

Ultimately, the tax deal is just that—a deal. It gives Democrats something on child tax credit, gives Republicans something on business taxes, and contains a bipartisan pay-for in the form of the ERTC. Progressives may want more and conservatives less, but we believe this is a deal that gets done ahead of primary races.