Capstone expects Europe’s energy transition agenda in 2026 to be shaped by tighter grid capacity, mounting fiscal constraints, and increasingly complex regulatory trade-offs. As the EU seeks to balance climate leadership with industrial competitiveness—against a backdrop of US protectionism and low-cost Chinese cleantech exports—we expect priorities to shift away from headline renewable build-out toward assets with secure grid access, system flexibility, and strong regulatory alignment.

Outlook at a Glance

- Grid congestion and data centre demand will reward connected assets and storage while leaving unsecured renewable projects stalled in permitting queues

- The Net Zero Industry Act (NZIA) circularity mandates will favour EU manufacturers with recycling capacity while raising costs for import-dependent and PFAS-exposed producers

- Divergent Member State energy-pricing schemes will fragment the EU market and shift industrial investment toward jurisdictions with stable, favourable tariffs

- The 2035 ICE 2035 ban review expected to broaden compliance options for EU CO2 emission standards to include hybrids and e-fuels, benefitting diversified automakers

- CCUS will emerge as the most credible industrial decarbonisation option as fragmented hydrogen and biofuels rules raise project risk

- ETS tightening and stricter CBAM enforcement will raise compliance costs for carbon-intensive industries and boost demand for high-quality carbon-removal credits

- In the UK, offshore wind delays and grid constraints will strengthen the case for storage and flexible generation

Grid Congestion and Data Centre Demand Will Reward Connected Assets and Storage While Leaving Unsecured Renewable Projects Stalled in Permitting Queues

| Winners | Grid equipment suppliers, battery storage operators, flexibility operators (including fast-ramping gas peakers), data centre developers, infrastructure providers (power and cooling systems, back-up generation, on-site grid connections), industrial users with firm grid access |

| Losers | Merchant renewables (projects relying on wholesale revenue) in grid-constrained areas, renewable developers without secured grid capacity |

Capstone expects data centre demand to outpace grid capacity in 2026, favouring grid-connected assets such as storage, fast-ramping flexible generation, and well-sited industrial load, while limiting the ability of new renewable projects to secure connections. Grid-access reforms across several EU Member States are expected to shift capacity allocation away from queue position toward flexible generation, or projects that can deliver power reliably. Grid equipment suppliers, battery storage operators, and flexibility providers that can adjust output on demand stand to gain from surging data centre requirements, while renewable developers lacking secured grid connections face prolonged connection delays and revenue uncertainty.

Data Centre Load Outpaces Grid Reinforcement

Europe approaches 2026 with more than 1 TW of renewable projects stuck in permitting or grid-connection queues, while hyperscale data centres (driven by AI clusters, cloud expansion, and sovereign cloud requirements) request multi-GW volumes of firm capacity in already congested nodes. Regions including North Rhine–Westphalia, Amsterdam, Dublin, and parts of Sweden face constraints as digital expansion competes with electrification demand.

Grid Access Reforms Favor System Value Over Queue Position

Regulators are considering shifting from first-come, first-served allocation toward models that prioritize system value – rewarding projects based on location, flexibility contribution, and security-of-supply rather than queue position alone.

However, these reforms will not fully shield industrial electrification, EV-charging networks, or heat-pump deployment from being deprioritized when digital demand grows faster than reinforcement capacity. Throughout 2026, competitive advantage will depend on firm capacity, locational quality, and the ability to monetize local constraints through storage or demand-side response.

Geographic Fragmentation Creates Location-Specific Winners

Grid capacity constraints vary widely across Europe. France retains short-term headroom due to slower electrification (or adoption of electric vehicles and heat pumps), combined with high nuclear baseload capacity. Germany, the Netherlands, Ireland, and the Nordics face tighter constraints as industrial and transport electricity demand grows faster than grid expansion.

In constrained markets, developers with projects outside congestion zones or those offering flexibility capabilities gain negotiating power.

Net Zero Industry Act’s Circularity Focus Will Favor EU Manufacturers with Recycling Capacity, While Raising Costs for Import-Dependent, PFAS-Exposed Producers

| Winners | Advanced mechanical and chemical recycling providers (e.g., PET/PL recycling, solvent-based or depolymerisation technologies), waste-sorting and materials-recovery technology providers, chemical manufacturers with PFAS-free portfolios, EU clean-tech component manufacturers (batteries, solar, wind) |

| Losers | PFAS-exposed chemicals producers, import-dependent manufacturers, energy-intensive legacy industrials |

Capstone expects the Net Zero Industry Act to accelerate investment in EU-based manufacturing and recycling infrastructure in 2026, as local content requirements and circular economy mandates move from policy to implementation. Battery, wind, and solar component makers with EU supply chains and recycling capabilities will gain market access advantages and subsidies, while manufacturers reliant on imported materials or PFAS-exposed chemical inputs face rising compliance costs and potential market exclusion.

Member States Begin NZIA Implementation

Member States begin implementing the Net Zero Industry Act in 2026. Strategic project designations, accelerated permitting, local content requirements, and flexible state aid regimes shift from planning to execution. The Clean Industrial Deal adds emphasis on competitiveness and reshoring critical supply chains to Europe.

Circular Economy Requirements Become Market Access Gatekeepers

The Ecodesign for Sustainable Products Regulation mandates recyclability and traceability standards, packaging waste reform increases producer responsibility, and the near-universal PFAS restriction forces rapid substitution across chemical and polymer inputs.

Compliance may become a prerequisite for market access. Non-compliant products risk being restricted or withdrawn from the EU market for the relevant product categories and may be excluded from public tenders or support mechanisms.

Compliant Producers Gain Advantage Over Legacy Supply Chains

Industrial supply chains will be split between compliant and legacy producers. Manufacturers using recycled materials, low-toxicity materials, and compliance-friendly feedstocks enjoy regulatory tailwinds and clearer growth pipelines. Conversely, PFAS-exposed chemical producers and energy-intensive legacy industries face rising costs, forced portfolio transitions, and increased scrutiny from customers, regulators, and financiers.

Divergent Member States’ Energy-Pricing Schemes Will Fragment the EU Market and Shift Industrial Investment Toward Jurisdictions with Favourable, Stable Tariffs

| Winners | Energy-intensive users in stable-tariff markets, low-carbon producers in supportive regulatory environments |

| Losers | Firms exposed to volatile wholesale power prices (e.g., paper, glass, and fertiliser producers without long-term power contracts), industrial users in reactive-policy jurisdictions (e.g., manufacturers in Italy or Spain facing frequent tariff interventions), generators reliant on ad-hoc government interventions (e.g., utilities depending on revenue caps or emergency market measures) |

Capstone expects Member States to abandon EU-wide energy market harmonization in 2026, prioritising industrial competitiveness by implementing divergent national industrial energy schemes through fixed tariff contracts and targeted state aid. Energy-intensive manufacturers and low-carbon producers in stable tariff jurisdictions (for example France (long-term regulated tariffs replacing the former ARENH [Regulated Access to Historic Nuclear Electricity] scheme) or Sweden and Finland (low-volatility Nordic power prices) gain cost certainty, while firms exposed to volatile wholesale markets or to ad-hoc government interventions (such as sudden tariff freezes, windfall taxes, or emergency market caps) face heightened cost uncertainty and reduced competitiveness

Member States Turn to Domestic Strategies to Protect Industry

Member States are adopting differentiated industrial energy schemes, including long-term fixed tariff contracts, compensation for energy-intensive sectors, dedicated support for strategic manufacturing, and expanded state aid frameworks. This reverses a decade-long trend toward price convergence within the EU power market.

Investment Decisions Prioritize Regulatory and Price Certainty

Industries now benchmark locations not only on labour, logistics, and taxation, but increasingly on regulatory certainty and long-term electricity price visibility. Jurisdictions that offer durable industrial power contracting (often linked to national industrial strategies) are increasingly preferred by investors. By contrast, countries relying on political interventions or tariff freezes amplify risk and deter capital.

Competitiveness vs. Climate Consistency Becomes the Core Trade-Off

The core political tension for 2026 is increasingly explicit: the EU must balance industrial competitiveness with uniform climate enforcement across markets with vastly different cost structures. As the US accelerates subsidy-driven reshoring and China expands low-cost cleantech capacity, Europe faces growing asymmetries in both pricing and policy.

Member States are therefore more willing to diverge at the margins (via compensation schemes, tailored state aid, or softer national implementation of EU rules) to shield strategic industries from rising energy and compliance costs. This creates a widening gap between the EU’s harmonised EU climate objectives and the practical need for differentiated, country-specific industrial support.

In 2026, managing this tension becomes central to the EU’s ability to sustain both climate leadership and global competitiveness.

The 2035 ICE Ban Review Expected to Broaden Compliance Options for EU CO2 Emission Standards to Include Hybrids and E-Fuels, Benefitting Diversified Automakers

| Winners | Hybrid/internal combustion engine (ICE) powertrain automobile manufacturers, e-fuel technology OEMs, diversified OEMs |

| Losers | Pure-play EV producers, battery-value-chain suppliers reliant solely on EV demand (e.g., cathode suppliers, cell manufacturers, or component producers without hybrid/e-fuel exposure) |

Capstone expects the review of EU CO₂ emission standards for cars and vans (proposal due in Q1 2026) to relax the 2035 internal combustion engine (ICE) ban by expanding compliance options beyond battery-electric vehicles to include plug-in hybrids and e-fuel-compatible engines. Political pressure from Germany and Italy, combined with weak EV uptake among lower-income consumers and affordability constraints, has prompted the EU Commission to prioritise technology neutrality in its review. Diversified original equipment manufacturers (OEMs) and e-fuel/hybrid suppliers stand to gain from reduced regulatory risk, while pure play electric vehicle (EV) makers and undiversified battery value chain suppliers face softer demand and reduced policy support.

Political Pressure Drives Technology-Neutral Compliance Options

Weak EV uptake among lower-income consumers, affordability concerns, and intense lobbying from Germany and Italy have pushed the Commission to consider expanding compliance options beyond battery electric vehicles. Expanded hybrid flexibilities, dedicated e-fuel credits, and recalibrated fleet targets are all under active discussion.

Diversified OEMs Benefit from Reduced Technology Risk

This policy shift will reduce regulatory exposure for OEMs with mixed portfolios and weaken the privileged status of battery-electric vehicles. Pure-play EV manufacturers face the prospect of slower structural demand and reduced policy support.

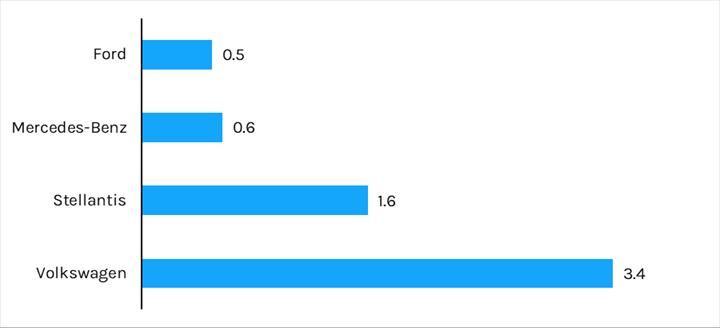

Exhibit 1: Penalty exposure of select automakers on passenger car fleets before review (€bn)

Source: ICCT, Capstone analysis

Broader Transport Sector Shows Similar Flexibility

Aviation mirrors this trend: sustainable aviation fuel (SAF) mandates face pressure from carriers citing cost and limited supply. The EU’s long-term climate trajectory remains intact, but its compliance instruments become more flexible, signalling a broader recalibration.

CCUS to Emerge as the Most Credible Industrial Decarbonisation Option as Fragmented Hydrogen and Biofuels Rules Raise Project Risk

| Winners | CO₂ transport and storage operators, second-generation or advanced low-cost biofuels producers, industrial emitters deploying CCUS (e.g., cement, steel, refining, and chemicals plants integrating capture into compliance plans) |

| Losers | Electrolyser OEMs, hydrogen developers without secured offtake agreements (i.e., projects with no committed buyers for their hydrogen), biofuel producers (e.g., biodiesel and ethanol plants) exposed to unfair foreign competition and regulatory uncertainty. |

Capstone expects carbon capture, utilization, and storage (CCUS) to emerge as the primary decarbonization pathway for heavy industry in 2026, as fragmented regulations for hydrogen and biofuels increase project delivery risk. CCUS benefits from clearer regulatory frameworks, cross-border infrastructure projects (Porthos, Northern Lights), and NZIA-mandated storage capacity targets that drive industrial adoption.

CCUS Gains Regulatory Clarity

CCUS begins to scale in 2026, as the Porthos and Northern Lights projects anchor Europe’s first cross-border CO₂ transport backbone, and NZIA-linked storage capacity obligations pull the technology into the mainstream of industrial compliance planning. Meanwhile, biofuels remain shaped by uneven national transpositions of the Renewable Energy Directive III (RED III), particularly around feedstock eligibility and sustainability criteria. Low-carbon hydrogen faces persistently high costs, weak demand visibility, and divergent Member State strategies, despite strong EU-level ambition.

Fragmented Certification and Corridor Planning Integration Risk

As these trajectories diverge, multi-country coordination becomes increasingly challenging: Guarantees of Origin systems, hydrogen and CO₂ corridor planning, and sustainability certification frameworks evolve unevenly across Member States. This fragmentation elevates integration risk across the “molecules” segment. CCUS is emerging as a more tangible near-term decarbonisation tool for certain hard-to-abate industries where alternatives are limited, while hydrogen and biofuels remain constrained by policy variability and uneven national implementation.

ETS Tightening, Stricter CBAM Enforcement to Raise Compliance Costs for Carbon-Intensive Industries and Boost Demand for High-Quality Carbon Removal Credits

| Winners | Bioenergy with Carbon Capture and Storage (BECCS) developers, Direct Air Carbon Capture and Storage (DACCS) developers, high-integrity carbon removal credit suppliers, industrial emitters with hedged carbon positions (e.g., steel and chemicals firms with long-term EU ETS forward contracts such as ArcelorMittal SA (MT on the Amsterdam stock exchange) and BASF SE (BAS on the Frankfurt stock exchange)) |

| Losers | Carbon-intensive sectors without hedged carbon positions, industrials reliant on low-quality carbon offsets, importers of CBAM goods |

Capstone expects Emissions Trading System (ETS) allowance tightening, stricter Carbon Border Adjustment Mechanism (CBAM) enforcement, and new high-integrity removal standards to lift compliance costs for carbon-intensive industries while boosting demand for Bioenergy with Carbon Capture and Storage (BECCS)- and Direct Air Carbon Capture and Storage (DACCS)-backed credits. High integrity credit suppliers and hedged emitters benefit from clearer price signals, whereas unhedged industrials relying on low-quality offsets face rising exposure and regulatory scrutiny.

ETS Tightening Increases Compliance Costs

Europe’s ETS is entering a tightening phase. Faster allowance reductions and strict enforcement of CBAM increase compliance costs for carbon-intensive industries. The delayed launch of ETS 2 until 2028, which would have covered buildings and road transport, shifts near-term pressure on governments to come up with incentive schemes to promote decarbonisation investments, with the risks of being delayed.

High-Quality Carbon Removals Credits Gain Market Share

The EU and UK are moving to integrate domestic carbon removal credits into compliance frameworks. The Carbon Removal Certification Framework (CRCF) categorises removal credits by quality, effectively sidelining legacy offset types. This elevates high integrity removal credits – often backed by BECCS or DACCS – above lower value avoidance offsets.

Unhedged Emitters Face Rising Scrutiny

Emitters reliant on low-quality credits or lacking hedging strategies face rising price volatility and intensified regulatory scrutiny, particularly aviation, heavy industry, and freight.

In the UK, Offshore Wind Delays and Grid Constraints Will Strengthen the Case for Storage and Flexible Generation

| Winners | Storage operators, flexibility providers (e.g., demand-side response aggregators such as Enel X (part of Enel SpA (ENEL on the Milan stock exchange)), grid-connected generation, power projects located near data centres, transmission and distribution (T&D) operators |

| Losers | Offshore wind developers, merchant renewables (wholesale-exposed wind/solar without long-term contracts), energy-intensive industries in grid-constrained regions (e.g., steel, chemicals, data centre operators) |

Capstone expects UK grid and planning constraints (including slow permitting, local opposition, and lengthy environmental reviews) to persist through 2026, despite Strategic Spatial Energy Planning and Allocation Round 7 (AR7) outcomes. Storage operators, flexible generation, and well-connected sites will continue to command a premium, while offshore wind developers, merchant renewables, and electrification-dependent industries face elevated execution risk in congested regions.

Offshore Wind Faces Economic and Planning Headwinds

Allocation Round 7, the next round of the UK’s offshore wind auction, will test whether developer confidence can recover after recent offshore-wind auction failures driven by rising capex, supply chain constraints, and higher financing costs. Strategic Spatial Energy Planning aims to clarify priority development zones, but the UK grid reinforcement timeline remains misaligned with deployment ambitions and industrial demand.

Policy Uncertainty Compounds Execution Challenges Across Decarbonisation Sectors

Political debates over EV mandates, building heat rules, and interim sectoral targets add uncertainty. Planning timelines remain long, judicial reviews frequent, and local opposition increasingly organised.

Storage and Flexible Assets Gain Structural Advantage

Against this backdrop, flexible generation, storage, and well-connected sites maintain a structural advantage. Offshore wind and merchant renewable developers face higher execution risk due to grid access constraints, planning delays, and evolving market design.