Capstone believes data center developers are more likely to encounter local pushback in 2026, shaping the attractiveness of different areas for investors. Officials in mature geographic markets—those with high concentrations of existing data centers—are likely to put up soft barriers as mitigation measures rather than ban the facilities. Rural counties, by contrast, are more likely to impose moratoriums on new construction.

- A growing number of environmental and ratepayer advocates are resisting data center developments, presenting downside risk for current and future data center investments. Many city and county officials, however, remain willing to approve zoning ordinance amendments on a case-by-case basis after reviewing public comments and securing commitments from developers that are seen as beneficial to the community.

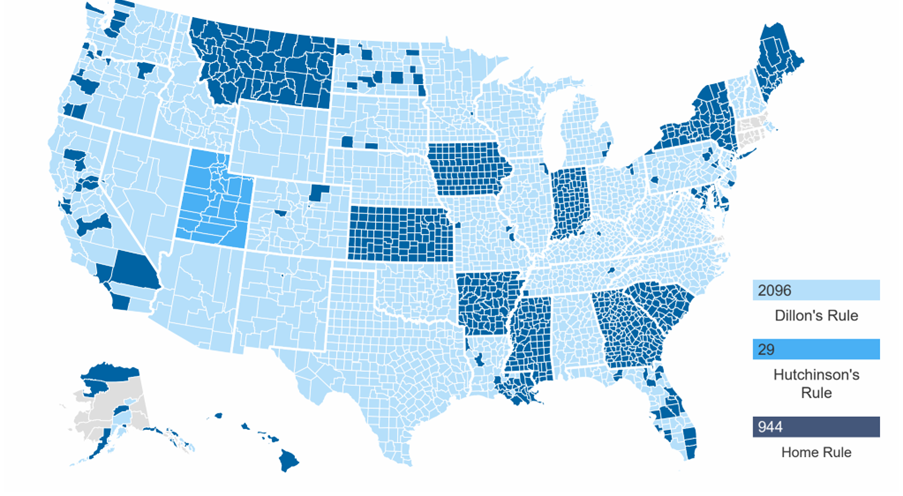

- Pushback proliferates faster in localities operating under Home Rule, in which local governments can legislate independently of the state. Data center moratoriums in Indiana and Georgia reflect a growing disconnect between Republican-majority local and state governments. On the other hand, counties operating under Dillon’s Rule (e.g., Virginia, Texas), which requires local governments to adhere to state law, are likely to follow the state government’s approach to data center development, providing regulatory clarity for investors.

- Hyperscalers, including Amazon.com Inc.’s Amazon Web Services (AMZN), Alphabet Inc.’s Google (GOOG), Microsoft Corp. (MSFT), and Meta Platforms Inc. (META), are more likely to encounter local-level pushback due to the size of their projects. However, these Big Tech companies have significant financial and political resources to circumvent project delays. Smaller companies specializing in co-location data centers, such as Equinix Inc. (EQIX) and Iron Mountain Inc. (IRM), are generally less vulnerable to local pushback.

- When evaluating whether to invest in a given project, developers should consider the key potential drivers of local pushback: (1) economic development (e.g., job creation, property tax revenue, community benefit plans, land value); (2) noise and air pollution from electricity infrastructure; (3) water usage; and (4) preservation of rural or suburban character.

Localities Are Expected to Have Significant Influence Over Data Center Policy in 2026

Virginia County’s Elimination of By-Right Zoning Indicative of More Stringent Policies to Come

Two regulatory entities important to data centers at the local level are planning commissions and boards of supervisors (also referred to as councils). Planning commissioners are responsible for recommending zoning ordinance changes and special-use exemptions to county supervisors, who have the final decision-making authority over applications.

Before 2025, most counties in mature data center markets operated under a form of “by-right zoning” policy, in which most special exemptions to existing ordinances were subject only to staff-level review by both planning commissions and county boards. However, in 2025, many prominent counties opted to repeal by-right zoning to slow data center proliferation and increase transparency in the siting process.

As Capstone highlighted at the time, the most notable example of this came in March 2025 when Loudoun County, Virginia, amended its zoning ordinance to prevent new data center proposals from being approved on a by-right basis. Since then, each application has been subject to public hearings and official votes.

We view Loudoun County’s decision as an inflection point in data center policy because it is home to the world’s highest concentration of data centers. Other counties in Virginia’s “Data Center Alley” have also recently contemplated changes to their zoning ordinances, including Fairfax, Prince William, and Fauquier.

We believe more stringent local zoning ordinances will negatively impact future data center proposals by increasing permitting costs and approval times. However, we also believe county boards, including Loudoun County’s, will generally approve applications but exercise more control over final project details. For instance, after amending its zoning ordinance, the Loudoun County Board of Supervisors approved an application after receiving concessions from the developer to reduce the project’s square footage.

Republican States and Localities in Emerging Markets Have Diverging Views on Data Centers

Outside the Northern Virginia market, at least eight Georgia towns and counties and four Indiana counties have banned the construction of new data centers. We view these as the worst-case scenario for project developers and expect the trend to continue in new, rural markets.

These examples reflect a growing disconnect between Republican-majority localities and state governments, the latter of which have broadly supported incentives for data center development. On the other hand, Loudoun County notes that its Board of Supervisors “does not have the legal authority to implement a moratorium on new data center applications [because] Virginia law requires it to consider each rezoning or special exemption application on its merits.”

This difference in authority systems reflects Virginia’s widespread adoption of Dillon’s Rule, while Indiana, Georgia, and other states operate under Home Rule (see Exhibit 1). According to the National Association of Counties:

- Counties under Home Rule have the authority to legislate independently from the state;

- Counties under Dillon’s Rule can only operate within areas explicitly outlined by state law.

We believe most counties operating under Dillon’s Rule will follow the state government’s policy direction, whether for or against data center development. We view this as slightly positive for project developers, as it provides greater regulatory certainty. Conversely, we view counties operating under Home Rule as riskier sites for future investments, given that greater local autonomy creates uncertainty and makes it easier to implement moratoriums.

Exhibit 1: Authority System by Country

Source: National Association of Counties

Note: Utah is the only state that operates under Hutchinson’s Rule, which is essentially a unique variant of Home Rule.

Hyperscalers Face More Risk Than Co-location Facilities, But Have Resources to Circumvent

As localities continue to erect barriers to entry, we believe hyperscalers (i.e., Big Tech companies that own and operate large campuses) will face a higher risk of project delays and cancellations than smaller co-location data centers (e.g., Equinix, Iron Mountain). Hyperscale projects are often more high-profile due to their size, making them the primary targets of a growing “Not In My Backyard” (NIMBY) movement. However, in many cases, these developers have enough financial and legal resources to stave off local pushback. In Appendix 1, we use three case studies to illustrate this risk and how different authority systems can precipitate local pushback.

Key Siting and Permitting Considerations Across Geographies

Economic Development and Tax Revenue Are Primary Motivations for Attracting Data Centers

Localities are interested in exploring data center development because the industry generates substantial property tax revenue, which helps officials fund public infrastructure projects and reduce rates for other taxpayers. In Virginia, nearly half of Loudoun County’s property tax revenue is derived from data centers, allowing the local government to improve public education services, maintain low real property tax rates for residents, and lower the vehicle tax rate by 67% in FY26.

Economic development considerations still entice many other communities to allow new construction outside of Virginia’s Data Center Alley. In Quincy, Washington, which has seen increased hyperscaler development since 2007, some residents support the projects as they have accounted for 75% of property tax revenue and financed the construction or renovation of hospitals, high schools, and other public infrastructure.

While these localities have benefited from substantial property tax revenue from data centers, many data center owners are likely to face political opposition from NIMBY activists at the state level to maintain existing sales and use tax exemptions, posing headwinds for local governments in mature geographic markets.

For example, Virginia’s exemptions account for 53% of the state’s incentive spending across FY15-FY24, a historically strong market signal to developers seeking to build new sites. However, in light of public scrutiny, a Republican state senator introduced legislation last year that would sunset the sales and use tax exemption immediately and distribute any subsequent revenue to public infrastructure. We expect state legislators, particularly in Virginia, to continue considering changes to such exemptions as energy affordability remains a salient voting issue. In the most extreme cases, these exemptions may be tied to broader clean energy transition goals.

Noise and Air Pollution from Electricity Infrastructure Stir Most Opposition

Most local pushback against data centers stems from complaints about noise and air pollution associated with on- and off-site electricity infrastructure. In Loudoun County, local and state Democrats have repeatedly called on Dominion Energy Inc. (D) to install underground transmission lines to mitigate the number of lines running through residential communities.

As Capstone previously highlighted, Talen Energy Corp. (TLN) is facing major local opposition to its request to rezone land in Montour County, Pennsylvania, for industrial use. The independent power producer is reportedly requesting to rezone 1,300 acres of agricultural and semi-public land to potentially serve as the location of a data center campus and on-site generation. While it remains unclear how the county commission will vote, there is significant community pressure to reject the plan. We will be monitoring the January 23rd hearing for any readthroughs beyond Montour County.

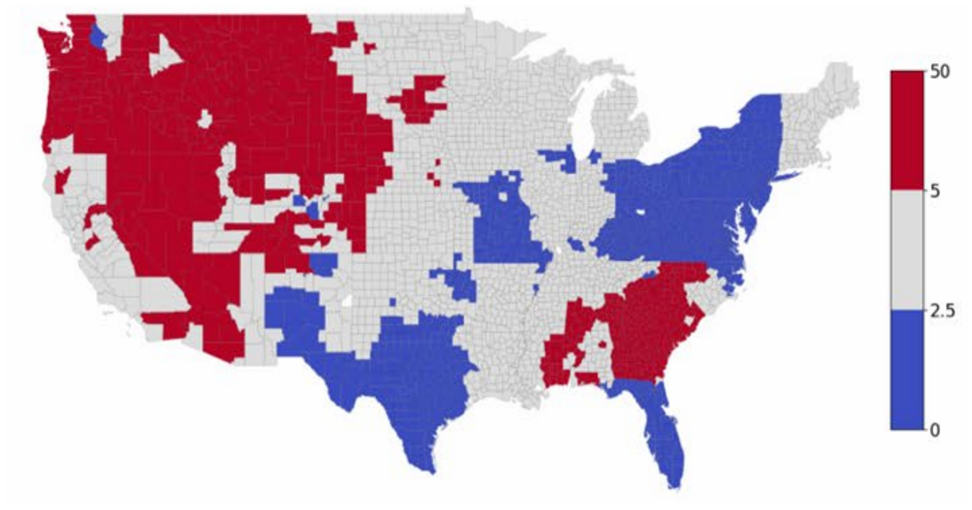

Water Usage Concerns Arise in Drought-Stricken Communities Across the West

Beyond electricity, many Western communities are also highly sensitive to data centers’ high water usage (see Exhibit 2). Without immediate technological solutions to this problem (e.g., closed-loop systems or other efficient cooling mechanisms), data center developers are likely to face pushback from nearby communities. In December 2025, the Pima County Board of Supervisors in Arizona approved an agreement with Beale Infrastructure that would require the data center developer to use air cooling and obtain water from a Department of Water Resources-approved source for “Project Blue.” This project has encountered considerable opposition from residents, who are particularly concerned about disruptions to the public water supply.

Exhibit 2: Water Consumption Intensity (in liters/kilowatt-hour) by County, 2024

Source: Lawrence Berkeley National Laboratory

Communities Want to Preserve Their Rural or Suburban Character

Data centers in rural and suburban areas are often viewed by nearby residents as being too conspicuous. In response to these criticisms, localities have begun considering measures to strengthen siting regulations. For example, Stafford County, Virginia, approved significant setback and buffer requirements, including the following rules:

- Data centers must be at least 750 feet from residential buildings and schools (previously was at least 500 feet);

- Vegetative buffers are required to be grown between 50-200 feet from data centers;

- Equipment is capped at a noise limitation of 55 decibels;

- Projects should be within half a mile of existing transmission lines; and

- Substations and other accessory infrastructure must sit at least 300 feet from property lines.

We expect other jurisdictions to consider imposing similar measures, including in areas subject to Dillon’s Rule. Additionally, we expect state legislators to seek to codify such measures during the 2026 legislative sessions. Virginia Democrats are likely to reintroduce and pass a bill requiring localities to conduct site assessments before approving new data centers. The measure was vetoed by outgoing Governor Glenn Youngkin (R) despite its bipartisan support in the General Assembly. Youngkin will be replaced by Abigail Spanberger (D) on January 17th.

Overall, we believe the ideal county to site a data center: (1) operates under Dillon’s Rule; (2) is located in a state that has provided favorable clarity either through legislation or regulation; and (3) has access to abundant water resources.

What’s Next

Capstone will continue monitoring local and state data center policies throughout 2026. In Q1 2026, we expect state legislators, particularly in Dillon’s Rule states, to continue proposing legislation that would increase the siting and permitting requirements for data center developers.

Appendix 1: Case Studies of Local Pushback to Hyperscale Data Centers

| Case Studies | Capstone’s Takeaways |

|---|---|

| #1: The Barn Saline Township, MI Oracle Corp. (ORCL), Related Digital, DTE Energy Co. (DTE) | Local Pushback: Residents are concerned about the developer’s lack of transparency and the facility potentially undermining the state’s 2023 clean energy law. State regulators received more than 5,000 online comments opposing the proposed special contracts, and more than 800 people protested at a virtual hearing.Outcome: In December 2025, the Michigan Public Service Commission (PSC) approved DTE’s two proposed special contracts to serve the new ~1.4 gigawatt data center. However, the PSC imposed ratepayer protections in the contracts to ensure that nearby residents are not required to pay for additional infrastructure.Capstone’s Takeaway: We believe The Barn is likely to continue facing local opposition, but state officials have demonstrated robust support for the project. In Dillon Rule counties, such as Washtenaw County, state regulators and legislators are likely to be more impactful decision-makers than local officials, who can only operate within the state’s mandate. |

| #2: PW Digital Gateway Manassas, VA QTS, Compass Datacenters, Dominion Energy Inc. (D) | Local Pushback: The project’s application was initially slated to rezone nearly 2,100 acres, but it would sit directly next to Manassas National Battlefield Park. Opponents argue that it would desecrate hallowed ground, ruin the county’s rural “Crescent,” and threaten the local water supply.Outcome: In August 2025, a Circuit Court judge ruled that developers and the county did not advertise their zoning changes properly before amending the zoning ordinances. However, the Virginia Court of Appeals temporarily stayed the ruling in October, allowing the developers to resume pre-construction work. The court will hear oral arguments in February 2026. The Prince William County Board of Supervisors approved an additional $400,000 to fund litigation efforts against key opposition groups, including the Oak Valley Homeowners Association, American Battlefield Trust, and Coalition to Protect Prince William County.Capstone’s Takeaway: Similar to The Barn, this project benefits from being located in a Dillon’s Rule county that has to operate within favorable state law. However, local opposition groups can still disrupt projects by delaying construction through procedural means. In such cases, projects will either eventually circumvent these challenges by relenting to public demands or relocating to a more amenable area. |

| #3: Project Flo Franklin Township, IN Deep Meadow Ventures LLC (a shell company of Google), AES Indiana (AES) | Local Pushback: Residents are concerned about the developer’s lack of transparency and the data center’s potential water and energy consumption.Outcome: While the Metropolitan Development Commission voted 8-1 to recommend approving the rezoning request, at least 17 of 25 councilmembers publicly opposed the project. Google withdrew its application minutes before the city council’s final vote. Google can refile a new proposal, but has indicated only that it looks forward “to continued opportunities for growth in the state.”Capstone’s Takeaway: We believe the delays to Project Flo reflect a near worst-case scenario for developers in Home Rule counties. While state Republicans remain committed to attracting data centers, local opposition can still disrupt projects and force in- and out-of-state relocation. We view this as a more material risk for hyperscalers than for smaller, co-location data centers, which are generally more inconspicuous. |

Source: Michigan PSC, Prince William Times, Data Center Dynamics, WTHR Indianapolis

Read more of Capstone’s research on power and utilities:

Data Center Squeeze: The Coming Political Debate Over Data Center Development

One Simple Trick to Lower Electricity Prices in PJM

Data Centers’ Collision Course with the Ballot Box