Capstone believes clean fuel margins will expand, driven by the likely release of 45Z proposed rules and the finalization of the 2026-27 Renewable Fuel Standard (RFS). We expect incentives from state-level programs to benefit credit prices, starting with the January 31st release of market performance data under the new California Low Carbon Fuel Standard (LCFS). Clean jet fuel will gain momentum in states amid federal uncertainty.

Outlook at a Glance

- Finalized RFS rules will install high annual volume requirements and resolve small refiner exemption worries, sparking a surge in biofuels orders and clean fuels investment

- OBBBA changes to 45Z will take effect, boosting crop-based biofuel and dairy RNG credit values; expect regulations in Q1, providing clarity on key issues

- California LCFS credit prices to rise in H1 as data on credit and deficit generation under the new rules are released; states’ momentum on CFS bills to continue

- State action on production incentives and targeted project support will drive sustainable aviation fuel as cost concerns and federal uncertainty weigh on the sector

- Changes to Canada’s clean fuel regulations likely to take a year from the consultation’s start date, indicating challenges for companies in the interim

Finalized RFS Rules Will Install High Annual Volume Requirements and Resolve Small Refiner Exemption Worries, Sparking a Surge in Biofuels Orders, Clean Fuels Investment

| Winners | Companies receiving small refinery exemptions (SRE) or producing renewable diesel such as HF Sinclair Corp. (DINO) and Valero Energy Corp. (VLO) |

| Losers | Large integrated refiners without significant biofuels production. |

Expect higher biofuel margins and RIN prices despite a delay in 2026-27 rules

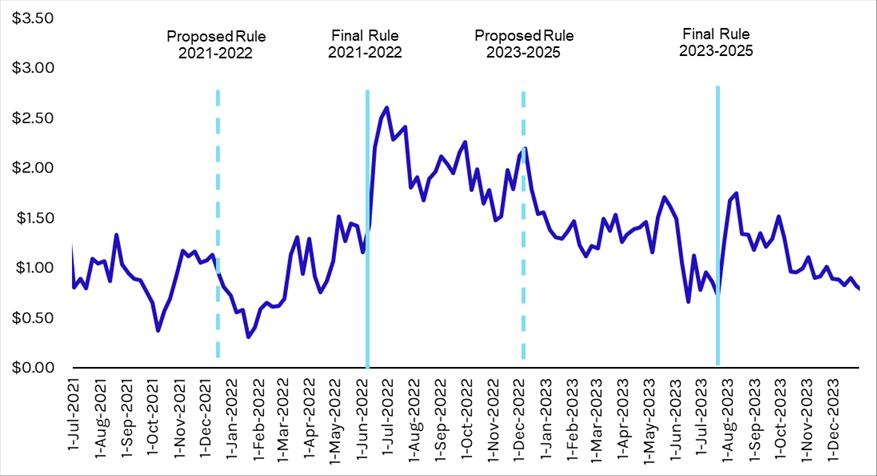

Capstone expects increased orders and widening margins on renewable diesel, biodiesel, and sustainable aviation fuel (SAF), along with the release of the final RFS rules for 2026-2027 rules, likely in Q1 2026. Our research shows the market is currently confident that the rules will set high volumetric requirements for biofuels and eliminate potential negative effects of SREs. However, margin improvement and large orders are yet to start as participants have historically been unwilling to act on RFS policies until they are finalized (see Exhibit 1). There is also significant uncertainty about which policies will be finalized and when.

Exhibit 1: Biodiesel Margin Reaction to Release of RFS Proposed Rules vs Final Rules

Source: Fastmarkets, EPA

The Environmental Protection Agency (EPA) must respond to the October 2025 comments on the proposed supplementary rules before finalizing the total RFS proposal. Capstone expects the rules to be finalized in January at the earliest, as work processes at the agency return to normal after getting disrupted by a record-breaking government shutdown. We expect the final rules to stipulate a large volumetric requirement that accounts for the reallocation of SREs for 2023-2024 and estimates for 2025. However, the decisions on other rules may be affected by a delayed release.

Capstone expects eventual finalization of the proposed rule to cut 50% of the Renewable Identification Numbers (RIN) for foreign biofuels, along with the proposed reduction to 1.6 D4 RINs per gallon of RD from the current 1.7 D4 RINs. However, the EPA is usually wary of implementing rules within the year, especially for fuels with high timing sensitivity (reporting of batches often trails generation) and when biofuel loads are in transit. A delay would push these rules to 2027. Capstone had already forecasted in July that the proposed 50% reduction in RINs generation for the use of foreign feedstocks would require significant changes to traceability requirements in the RFS process, likely pushing the implementation of these rules to 2027. Despite the missing changes on RINs generation, we expect the total implied volumetric requirement proposed in June to remain relatively untouched in the final rules, with the exception of some adjustments to account for market data on reductions of biofuels imports seen in 2025.

A delay in the RFS release may end up increasing the eventual 2025 cellulosic volumes vs those seen in the June cellulosic waiver proposal. This is because each monthly data release indicates that D3 generation for 2025, primarily from renewable natural gas (RNG), has been up to 10% higher than the volumes in EPA’s cellulosic waiver proposal for 2025. Delays could increase the amount of 2025 data supporting a higher requirement for both decisions on revisions for 2025 as well as 2026-2027, for which 2025 serves as a baseline for estimates. This will be generally positive for the outlook of D3 RIN prices and companies with RNG portfolios such as Montauk Renewables Inc. (MNTK).

Capstone continues to expect SREs for 2026 and 2027 and re-emphasizes that they will transform the US refinery landscape. By removing the compliance cost for approximately 10% of domestic petroleum refining capacity, the SREs may create a 2x differential in net crack margins and product costs. This has already boosted the value for companies with small refiners in their portfolio. Combined with the expected additional margins from RD operations, companies such as HF Sinclair and Valero will have a very healthy year.

OBBBA Changes to 45Z Will Take Effect, Boosting Crop-based Biofuel and Dairy RNG Credit Values; Expect Regulations in Q1, Providing Clarity on Key Issues

| Winners | Crop-based fuel producers such as Green Plains Inc. (GPRE), Valero, and Archer-Daniels-Midland Co. (ADM) Dairy RNG producers such as DTE Energy Co. (DTE) and Dominion Energy Inc. (D) |

| Losers | Fuel importers such as Neste Oyj (NESTE on the NASDAQ Helsinki), non-North American feedstock importers, and SAF producers such as Gevo Inc. (GEVO) |

OBBBA changes to be in full force in 2026

The One Big Beautiful Bill Act (OBBBA) includes several favorable changes for all clean fuels tied to the Section 45Z credit, including an extension of the credit by two years through 2029. Other changes to the credit are specifically beneficial to crop-based fuel producers and animal manure RNG producers. These fuel types will receive higher credit values starting in 2026, following major changes approved by Congress in 2025:

- Removal of Indirect Land Use Change (ILUC) Penalties: Although generic corn ethanol did not qualify for the 45Z credit in 2025, we expect it to receive roughly $0.10 per gallon from 2026-2029 due to the removal of ILUC. Similarly, we anticipate generic soybean oil for RD production will more than double the credit value per gallon to $0.50 from $0.21.

- Delineation of Animal Manure Pathways: In 2025, generic animal manure RNG production received a -31 carbon intensity (CI) score, translating to roughly $14/MMBtu of credit value. The OBBBA requires specific animal manure pathways and allows negative emission rates for these pathways, meaning dairy and swine RNG should get their own bespoke CI calculations. The credit scores are likely to be significantly more negative than -31.

Other changes that will take effect in 2026 include the reduction of the SAF base rate per gallon to $1.00 from $1.75, in line with ground transportation values. Importantly, the restriction on foreign feedstocks, except in Mexico and Canada, will be implemented. Feedstock industry trade flows will likely be rerouted, particularly related to foreign used cooking oil, Argentinian soybeans, and Australian tallow, as domestic producers look to capture 45Z credit value from feedstocks sourced in the US, Canada, and Mexico.

Regulatory clarity likely to resolve outstanding key issues

The Treasury Department is yet to issue formal regulations for the Section 45Z credit following initial guidance published by the Biden administration in January 2025. We expect formal proposed regulations to be issued in Q1 2026, although year-end is still possible. Several key items remain unresolved, including:

- Qualifying sale clarity to allow sales to third-party intermediaries;

- Rules surrounding renewable energy certificates;

- Potential inclusion of climate-smart agriculture practices into the 45Z emissions model;

- Ability to use proposed rules for 2025 tax purposes (e.g., safe harbor);

- Ability to book-and-claim RNG used as a feedstock or process fuel.

In addition, the Department of Energy will likely publish an updated 45Z emissions model for 2026 production, which should provide clarity on the credit values attributable to crop-based fuels and animal manure RNG following changes made by the OBBBA.

California LCFS Credit Prices to Rise in H1 as Data on Credit and Deficit Generation under the New Rules are Released; States’ Momentum on CFS Bills to Continue

| Winners | Low-CI clean fuel producers such as Darling Ingredients Inc. (DAR), Clean Energy Fuels Corp. (CLNE), and Aemetis Inc. (AMTX) |

| Losers | Refiners without significant clean fuels production |

California credit prices to increase gradually due to data release lag

Capstone expects California’s LCFS credit prices to increase gradually in H1 2026 as the effects of the new rules are reflected in data releases. Credit generation data for LCFS programs are released with a four-month lag. So, any impact of the stricter CI targets under the new LCFS rules, which took effect in July 2025, will not be visible to the market until January 31, 2026, when the Q3 2025 data will be released, and then April 30, 2026 for the Q4 2025 data. The program does have a significant bank of excess credits, which we expect will weigh on market sentiment and temper any significant boost in credit prices.

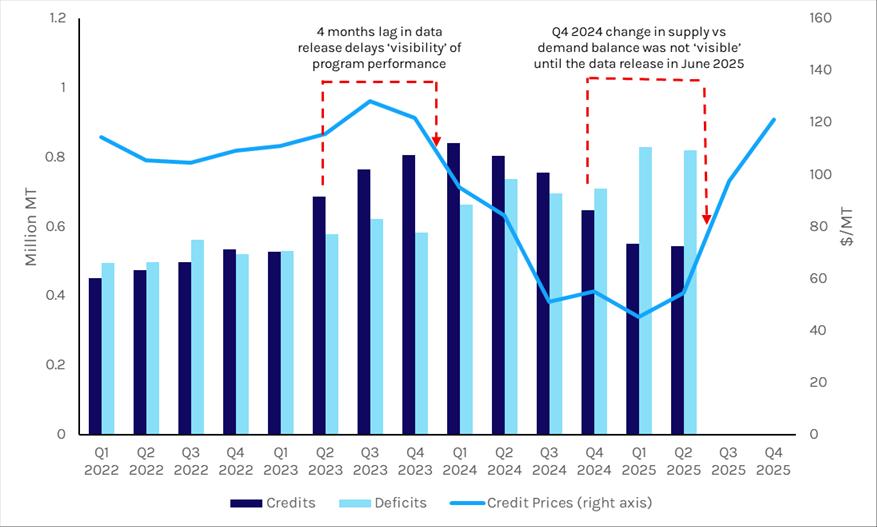

We saw this “delayed” price impact from the data release timeline in Oregon’s CFP market in 2025 (see Exhibit 2): The credit price did not reflect the switch from an oversupplied to an undersupplied market until June, when the program data for Q4 2024 was released, which showed a 15% drop in credit generation, mostly driven by a reduction in RD consumption. Then, prices soared 150% over the next few months. We expect storage limitations to continue restricting RD uptake in Oregon, benefiting credit prices in 2026.

Exhibit 2: Oregon Clean Fuels Program Credit Generation and Prices

Source: Oregon Department of Environmental Quality

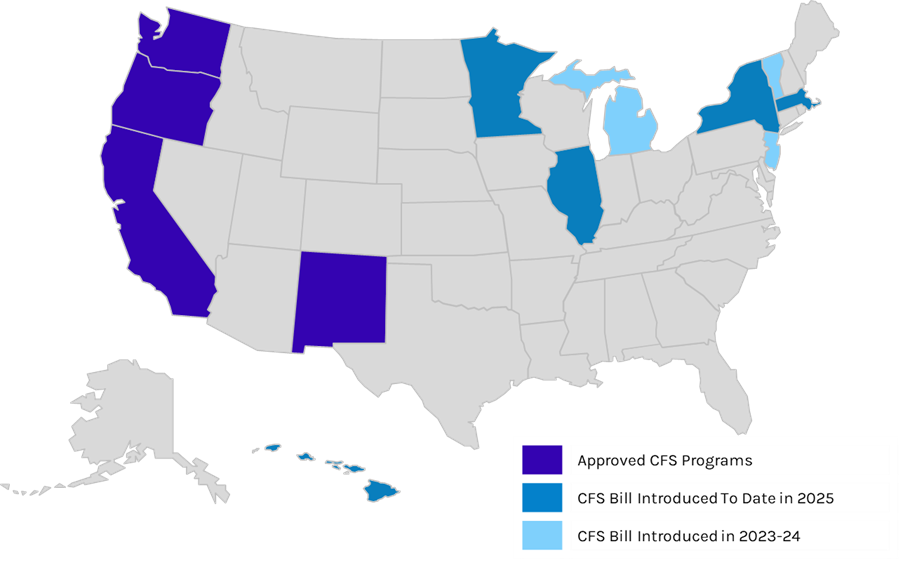

CFS legislation momentum to continue in states that introduced bills in 2023-25

Capstone expects CFS legislation momentum will continue in states that introduced such bills during 2023-25, with passage likely in Hawaii and increased progress in New York, Minnesota, Illinois, and Michigan (see Exhibit 3). Although competing legislative priorities and specific stakeholder opposition stalled progress on bills in 2025, we expect increased bipartisan support and continued backing from biofuels, agriculture, and environmental groups to support passage for the rest of President Donald Trump’s term. Additionally, with the expiration of federal electric vehicle (EV) tax credits and the revocation of state EV mandates, CFS remains one of the few policy mechanisms through which action on transportation emission can be supported. We expect this dynamic to temper opposition from progressive Democrats, who have viewed CFS as an insufficient tool for transportation electrification, a factor that stalled CFS bills in states such as New York and Michigan in recent years.

Separately, we expect final rules for New Mexico’s CFS to be in place before July 2026.

Exhibit 3: Status of Recent State CFS Legislation

Source: Capstone analysis

State Action on Production Incentives and Targeted Project Support Will Drive Sustainable Aviation Fuel as Cost Concerns and Federal Uncertainty Weigh on the Sector

| Winners | SAF producers such as Gevo, biofuel blenders like Archer-Daniels-Midland, and airlines including Delta Air Lines Inc. (DAL) |

| Losers | Biodiesel and RD producers competing for feedstocks; companies operating in states with no incentives or interest |

SAF incentive to gain momentum in states

Capstone believes uncertainty over federal incentives and grants, following the passage of the OBBBA and several instances of funding rescissions, will continue to spur states to develop their own SAF tax credits and pursue opportunities for targeted support. Under the Biden administration, four states enacted SAF tax credits: Washington, Illinois, Minnesota, and Nebraska. This sparked a trend of interest at the state level that has gained momentum amid the Trump administration’s uncertain approach to SAF. Overall, additional state incentives will enhance the incentive stack on top of 45Z and the RFS and capitalize on global interest in SAF mandates.

In 2025, states with strong biofuels, farming, and aviation sectors tested the political viability of such incentives, with Iowa and Arkansas establishing their own tax credits, and tailwinds supporting bills in Michigan, New York, and Wisconsin. Michigan came very close to creating a SAF credit in 2024 before introducing an entire SAF legislative plan in May 2025. This sets up 2026 as a significant year for deliberations. In New York, interest has grown in a state-level clean fuels program, with SAF applications rising as the state is a major SAF logistics and production hub. Wisconsin has seen multiple efforts to create a credit and provide targeted project support to take advantage of the state’s existing industry. Especially given the focus on farmers and local industry, SAF will likely be a significant point of interest.

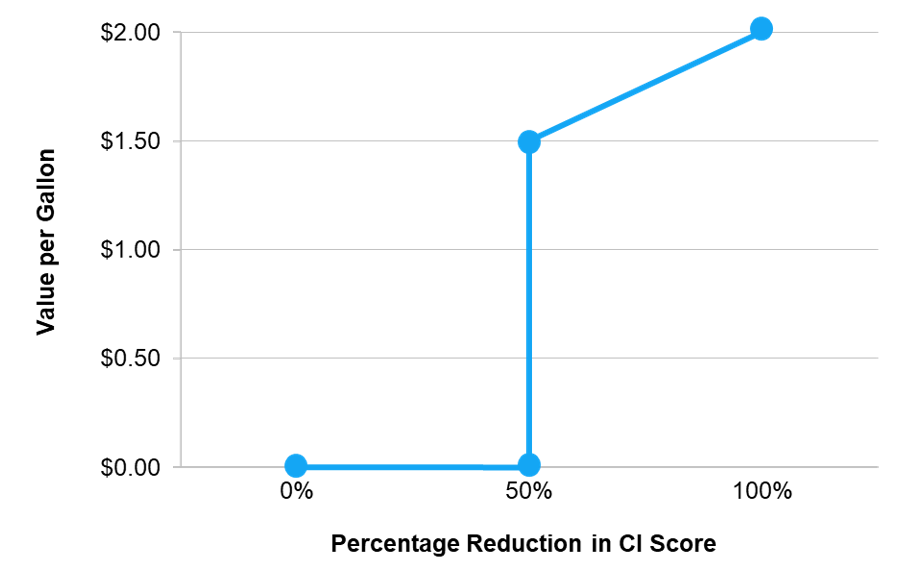

We believe Michigan is most likely the next state to implement a credit and expect the structure to be used by other states. This includes credit prices ranging from $1.50 per gallon to $2 per gallon. There is a $0.02 increase for every CI percentage point increase above 50%. The structure will include an annual cap of $4.5 million for year one and $9 million for each year thereafter.

Exhibit 4: Proposed Structure of the Michigan SAF Tax Credit

Source: Michigan legislature

We see two key interconnected limiting factors for SAF legislation. The first is budgetary constraints as states deal with competing priorities. Even in states where SAF is the main industry, lawmakers have chosen to put off allocating funds to SAF use cases. Lawmakers in Minnesota and Nebraska put on hold considerations to enhance existing credits — either raising the annual allocation amount or the duration — pending clearer demand signals from industry. This pattern also emerged in Hawaii, Kentucky, and Nebraska, as they were all evaluating the creation of a subsidy framework when other priorities took up capacity, leading these efforts to die in committee.

The second factor is energy affordability concerns that have caused leading lawmakers and regulators to claw back investments in low-carbon technology pathways to provide immediate support to voters and consumers. The 2026 midterm elections will be critical to watch for areas where support may emerge. Democrats will likely see tailwinds as midterm elections generally favor the party outside the White House. Should Democrat majorities emerge from the elections across several states, low-carbon industries will benefit.

Changes to Canada’s Clean Fuel Regulations Likely to Take a Year from the Consultation’s Start Date, Indicating Challenges for Companies in the Interim

| Winners | Canada-domiciled liquid renewable fuel producers such as Imperial Oil Ltd (IMO on the Toronto stock exchange, or IMO on the NASDAQ) and Tidewater Renewables Ltd (LCFS on the Toronto stock exchange) |

| Losers | US-domiciled producers of clean fuels such as Darling Ingredients |

CFR amendments will likely take effect in late Q4 2026 or early Q1 2027

Amendments designed to protect domestic producers under the Clean Fuel Regulations (CFR) will likely take at least 12 months to complete, which would incorporate a consultation period by Environment and Climate Change Canada (ECCC). These changes would be in response to the implementation of 45Z, fraught trade relations with the US, and restrictions imposed by China on Canada’s canola exports. The amendments will likely provide economic incentives for Canada-produced fuel, instead of penalizing foreign feedstocks and fuels. These changes would benefit Canadian-domiciled renewable fuel producers once fully implemented, dissuading US-produced fuels from entering the market.

- Under the Canadian Environmental Protection Act, the country’s primary environmental protection statute and legal foundation for the CFR, amendments to regulations through the rulemaking process require environmental justification, unless considered or approved by the full House of Commons. We believe this makes amendments to CFR more likely to reward Canadian producers rather than penalize US producers. If ECCC introduces restrictive measures for the CFR on foreign feedstocks, legal challenges will likely ensue.

- Feedstock and clean fuel producers say the Canadian government did not do enough in the past to support their key policy initiatives and funding priorities. Canada-based biofuel producers say that without immediate action under these CFR amendments or through an additional support mechanism, they will face increased going-concern risk due to the uneven playing field with US producers. The Canadian government has attempted to make some amends, announcing a C$372 million temporary production tax credit (PTC) in the most recent budget. We expect these PTC funds will not be distributed until Q1 2026.

Capstone foresees a challenging business environment for clean fuel producers without additional government support for domestic products. A key catalyst to watch will be the ECCC’s initiation of a consultation for targeted CFR amendments. We believe this will take at least 12 months, indicating an implementation date in late Q4 2026 or Q1 2027.