By JB Ferguson

Introduction

Capstone believes Grayscale’s victory against the Securities and Exchange Commission (SEC) in August has begun to open the floodgates for crypto issuers, as the commission will approve a spot bitcoin exchange-traded fund (ETF) by July 2024, kickstarting an underappreciated resurgence for the beleaguered asset class.

The crypto sector is rebounding from a catastrophic 2022 that saw a meltdown in digital asset prices as well as the demise of FTX. The increased investor access and liquidity provided by these funds will improve prices and give a lifeline to a distressed industry. Coinbase Global Inc. (COIN) will be an outsized beneficiary as the preferred custodian for nine of the 12 pending ETF applications.

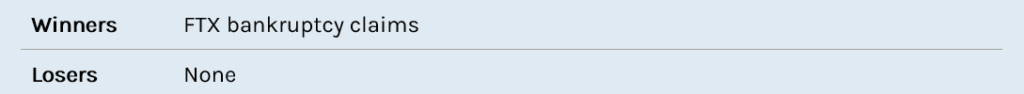

The flood of interest—and investments—in artificial intelligence also presents strong upsides for FTX bankruptcy claims. The now-defunct exchange was a major investor in AI startup Anthropic, whose valuation has skyrocketed in 2023 on investments from Alphabet Inc. (GOOGL) and Amazon.com Inc. (AMZN). The claims are currently trading above our predicted range, and we believe the current state of AI funding supports an even higher trajectory for FTX claims.

However, regulatory headwinds persist. While legal clashes with the SEC have siphoned attention from other developments, the US Department of the Treasury’s proposed reporting rule has been little noticed. The rule would expand tax liabilities for crypto trading and impose new reporting requirements on firms, though it is unclear whether it is even possible for firms to comply.

Bitcoin ETFs an Imminent Reality

A rising tide will lift all crypto boats as spot bitcoin exchange-traded funds (ETF) are likely to become a reality in 2024. Coinbase will benefit as the preferred custodian.

The SEC is effectively powerless to stop an ETF for spot bitcoin from coming to market following the commission’s loss in Grayscale v. SEC. After the US Court of Appeals for the District of Columbia ruled the SEC was wrong in refusing to allow Grayscale to convert its bitcoin trust to an ETF, there has been an influx of applications for new ETFs from the world’s largest asset managers, including BlackRock Inc. (BLK) and Fidelity Investments.

The market’s optimism is most clearly reflected in Grayscale Bitcoin Trust’s (GBTC) reversal of fortune. The trust’s discount to net asset value (NAV) shrank from nearly 50% at the start of the year to its current 10% as the trust inches forward to converting into an ETF. The SEC is reportedly in late-stage discussions with applicants, and attorneys we spoke with said that the commission tends to approve multiple applicants at once to increase competition in the space. As a result, we believe GBTC and others are likely to be approved on January 10th, which is the final deadline for the SEC to make a decision about Ark Invest’s bitcoin ETF application. (However, because the appeals court did not give the SEC a date by which it must finishing reconsidering Grayscale’s application, under the commission’s typical process, it could delay a decision on GBTC until July 2024.) A regulated fund for investing in bitcoin and greater access for large money managers could significantly increase trading volumes.

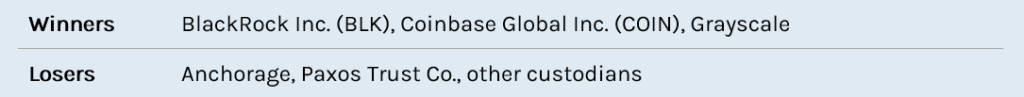

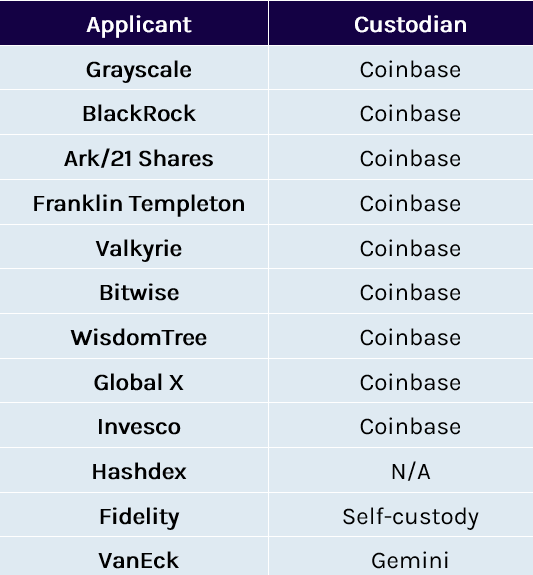

Another aspect of the wave of ETF applications that investors are underappreciating is the question of custody. Of the twelve pending ETF applications, nine of the issuers have selected Coinbase to hold the keys for the underlying bitcoins (see Exhibit 1)

Exhibit 1: Pending Spot Bitcoin ETFs and Proposed Custodian

Coinbase would claim the lion’s share of custody fees as bitcoin takes another step toward the financial mainstream, while competitors—such as Anchorage and Paxos Trust Co.—will be left in the lurch. While custody fees made up just 2% of Coinbase’s total revenue in Q3 2023, ETF launches could significantly expand this figure and allow the company to diversify its revenue stream away from trading.

FTX Claims Pose Underappreciated Upside

Claims have exceeded our predicted recovery rate as the continued growth in the valuation of FTX’s investment in AI firm Anthropic could provide a path to full recovery for creditors.

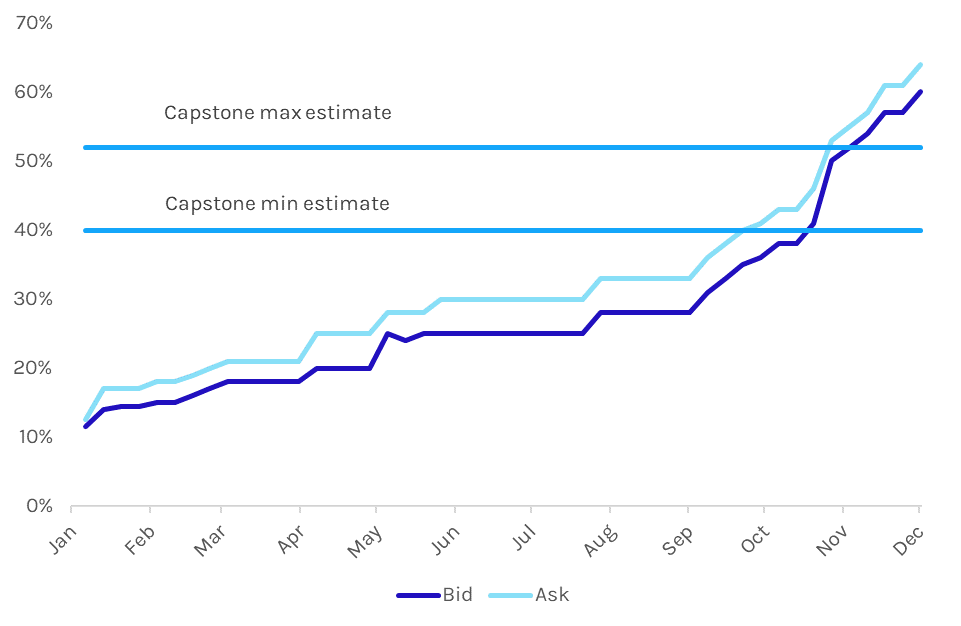

FTX bankruptcy claims initially traded for just pennies on the dollar, given the difficulty of tracing assets and the uncertainty as to whether creditors even legally owned their assets. However, the recovery of over $7 billion in customer deposits, a rebound in digital asset prices, and other updates from the bankruptcy estate have caused claims prices to climb over the past year (see Exhibit 2).

Exhibit 2: Price of FTX Bankruptcy Claims Year-to-date

Source: Cherokee Acquisition

We initially predicted that the bankruptcy estate would be able to recover between 40% and 52% of account holdings (see “FTX Claims Undervalued as Creditors Likely to Recover at least 40-52% With Further Upside Potential, Legal Outlook Favorable for Creditors,” February 3, 2023). In particular, we highlighted FTX’s investment in Anthropic as a potential tailwind. The defunct exchange had invested $500 million in Anthropic as part of a Series B round in the AI startup, which released its generative AI chatbot, Claude, in March 2023.

The sudden surge in FTX claims prices was largely driven by this investment as tech giants Google and Amazon have begun pouring money into Anthropic, hoping to create their answer to Microsoft Corp. (MSFT) and its OpenAI. Anhropic’s precise valuation is unknown, though reports cite figures between $20 billion and $30 billion. Given FTX invested in Anthropic’s Series B, this stake has likely increased significantly and could continue growing as the AI frenzy draws more investments.

In addition, there was concern that FTX customers would not have legal ownership over their deposits and would be treated as unsecured creditors, as happened in the Celsius bankruptcy. This uncertainty led to several customer lawsuits. However, the bankruptcy estate proposed a settlement in October 2023 that would give FTX customers priority to recovered assets and allow them to receive 90% of the distributable value. The proposal will be filed on December 16th, 2023, and will require approval from the bankruptcy court.

FTX claim bids are currently at 61%. However, we believe the legal environment and sustained investor interest in AI could make a full recovery possible. While it could still take years for FTX to fully liquidate its Anthropic stake, we believe these bankruptcy claims hold additional upside.

Treasury Tax Reporting Rule Pose Underappreciated Risks

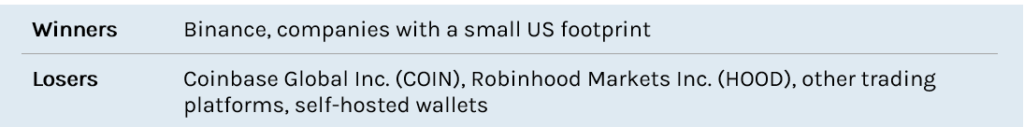

The Treasury Department is expanding reporting requirements for exchanges and wallets. However, these obligations could be unworkable and lead to substantial capital flight.

We believe the US Department of the Treasury’s proposed rule, in its current form, presents underappreciated risks for crypto. The proposal, published in August, would expand the reporting requirements for brokers adopted as part of the 2021 Infrastructure Investment and Jobs Act (IIJA). Specifically, the rule aims to treat entities that execute the sale of digital assets as brokers with reporting duties. Affected parties include centralized exchanges, decentralized finance (DeFi) entities, and self-hosted wallets.

These entities would have to report the gross proceeds of transactions and cost basis to the Internal Revenue Service via Form 1099. However, complying could be impossible, given the decentralized nature of digital assets. For instance, decentralized exchanges would need to collect this transaction data directly from users’ wallets, even though self-hosted wallets are unlikely to allow this, likely citing privacy concerns.

The proposal received pushback in comments from Coinbase and industry groups that raised concerns over the administrative burden and potential privacy violations. Other comments requested an explicit exemption for stablecoins, while tax reform groups also questioned whether courts would find this rule is constitutional, given the Supreme Court’s recent application of the so-called Major Questions Doctrine, which holds that courts should presume Congress has not empowered administrative agencies to make rulings of significant political or economic importance. Treasury had originally closed the public consultation period on October 30th, but later extended the deadline to November 13th due to the strong feedback.

While we anticipate changes to the proposed rule in light of the comments, we believe the regulations pose an underappreciated risk for the industry. If the final rule imposes a significant or ultimately unworkable compliance responsibility on companies, we believe customers could move deposits to overseas exchanges, prolonging crypto winter.