Introduction

Capstone believes pharmaceutical manufacturers will continue to face a rockier landscape in 2024 than the industry and its investors expect as Inflation Reduction Act (IRA) implementation uncertainties continue.

While pharmacy benefit managers (PBMs) face a high probability of reform in 2024, we expect Congress to water down the risks. Capstone believes that industries impacted by widespread weight loss will continue overestimating the uptake of GLP-1s by discounting barriers to widespread insurance coverage.

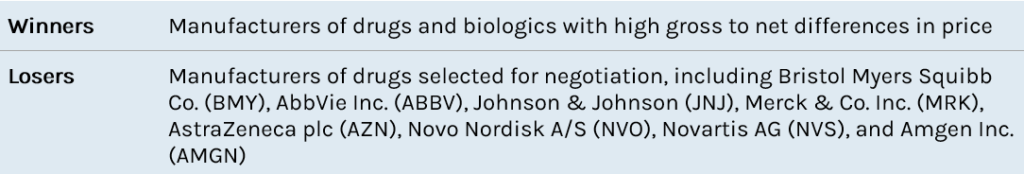

We believe pharmaceutical manufacturers will continue to face headwinds navigating IRA implementation as uncertainty in guidance and the impact of Medicare drug price negotiations persists. We are looking to the outcome of the initial round of negotiations to set expectations for future negotiations. If the government adheres to minimum price cuts, there would be potential upside for manufacturers of drugs with high gross to net differences. Litigation will continue through 2024, with the potential for the entire negotiation scheme to be undone.

We maintain a 65% probability that Congress will enact pharmacy benefit manager (PBM) reform by the end of 2024, however, we believe reform will create fewer risks for PBMs than many expect. Although pharmaceutical lobbies and Senate Democrats propose staunch reform, House Republicans oppose regulation in commercial markets—sparing a large portion of Big 3 PBM revenue. We believe that reform will be limited to an elimination of spread pricing in Medicaid markets, a delinking of PBM revenue from drug cost in Medicare markets, and mild transparency measures in commercial markets.

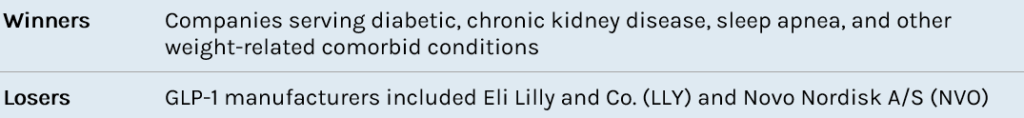

We believe industries impacted by widespread weight loss will continue to overestimate the usage of GLP-1 medication and the subsequent impact that GLP-1s will have on their business. We maintain a low probability that Medicare will cover the drugs and do not expect substantive commercial insurer coverage. As a result, we believe GLP-1 uptake will be slow as plan sponsors navigate uncertain long-term spending impacts and high GLP-1 price tags.

Implementation of the Inflation Reduction Act Creates Volatility for Manufacturers and Plans

Medicare Drug Price Negotiation

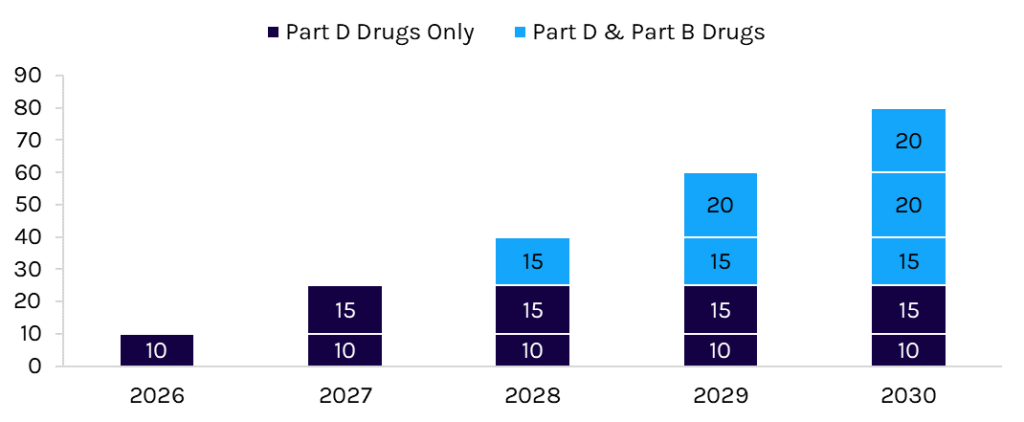

Congress passed the Inflation Reduction Act (IRA) in 2022, including a provision allowing the federal government through the Centers for Medicare and Medicaid Services (CMS) to negotiate the price of drugs in Medicare. Medicare negotiation is a long-term Democratic priority with broad popular support. CMS will select drugs that 1) Medicare spends the most on; 2) are on the market past original exclusivity; and 3) do not have generic or biosimilar competition. The number of drugs negotiated increases yearly and is cumulative (Exhibit 1). By 2030, the government will have negotiated the price of 80 drugs. Minimum price cuts depend on how many years the drug has been on the market and the net post-rebate cost of selected drugs.

Exhibit 1: Cumulative Number of Drugs Negotiated

Source: Capstone analysis of the IRA

In August 2023, CMS announced the first 10 drugs selected for negotiation. The drugs accounted for $50.5 billion in Medicare Part D expenditures between June 2022 and May 2023, roughly 20% of total Part D spending. Capstone analysis suggests that the government will save as much as $16 billion assuming negotiations adhere to minimum price cuts.

CMS will send an initial offer for each drug to manufacturers by no later than February 1, 2024. Manufacturers will have 30 days to respond to the initial offer by accepting or submitting a counteroffer. If an agreement is not reached initially, CMS will invite manufacturers for up to three negotiation meetings during the spring and summer of 2024. The negotiation period ends on August 1, 2024. Prices for the initially selected drugs take effect January 1, 2026.

We believe the impact of negotiation on manufacturers will depend on three factors: litigation, the government’s position on pricing, and the net price of products.

- Litigation: Lawsuits are ongoing challenging the constitutionality of the IRA’s negotiation provision in at least seven district courts. Because Congress explicitly prohibited judicial review of many of the negotiation provisions in the IRA, manufacturers are challenging the broader constitutional authority of the scheme. We expect at least several of the district court cases to be resolved in 2024, leading to likely circuit court appeals and, ultimately, US Supreme Court review.

- The Government’s Position: Asmanufacturers are quick to point out, Medicare negotiation is less “negotiation” and more price setting. Manufacturers must accept the price “negotiated” by the government or face steep and punitive taxes or the prospect of pulling of their drugs from the Medicare and Medicaid programs. The government must achieve minimum price cuts, which we believe may be limited depending on rebate dynamics. However, should the government pursue deeper price cuts, the impact of negotiation would increase, especially for drugs with significant Medicare exposure.

- Net Price: In addition to statutorily set discounts that the government must achieve in negotiation, CMS must ensure that prices reflect at least the enrollment-weighted net price for each selected product. For products with large gross-to-net differences, the government’s negotiated price may simply collapse the delta. Payers are required to place negotiated drugs on their formularies in Part D, so manufacturers will likely have to offer less in rebates to ensure formulary access. The end result for some products may be lower net prices, easier formulary access, and limited downside to Medicare revenue. This outcome depends on the government’s position and rebate dynamics.

We believe manufacturers with negotiated products will not want lower Medicare prices to bleed into the commercial market. Manufacturers must ensure that Medicare beneficiaries receive the negotiated price, so we expect manufacturers, distributors, and pharmacies to establish more robust chargeback regimes following negotiations. Chargebacks will enable manufacturers to maintain a constant, elevated list price while conforming with requirements in the IRA. For pharmacies, cash flow dynamics would likely change, as they would acquire drugs at the higher price, fill Medicare scripts at the negotiated price, and then rely on chargebacks to make them whole.

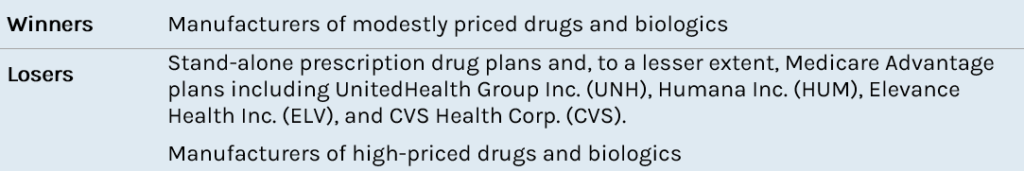

Medicare Part D Redesign

The IRA also included a substantial overhaul of the Medicare Part D benefit. Democrats and Republicans have considered redesigning the Part D benefit since at least 2018. Currently, the government provides reinsurance, and beneficiaries have coinsurance in the “catastrophic” phase of the benefit. The redesigned benefit would shift liability from the government to plans and manufacturers. Beneficiary coinsurance in the catastrophic phase would be eliminated, and out-of-pocket costs would be capped at $2,000 annually. The Part D redesign will take effect in 2025.

For manufacturers of high-priced products, the unlimited liability associated with the new manufacturer discount will weigh on Medicare revenue. Manufacturers of modestly priced products ($10,000-$25,000 annually) will likely see their discount obligations fall. For all manufacturers, the cap on beneficiary out-of-pocket costs will likely make drugs more affordable, increasing purchase volume.

Two important though undervalued impacts of the Part D redesign affect payers. Part D plans—including Medicare Advantage prescription drug plans (MA-PDs) and stand-alone prescription drug plans (PDPs)—will be unable to raise premiums more than 6% annually until 2029 even as their liability in the benefit increases. Given the competitive dynamics of Part D and the uncertainty of how the new design will impact payers and beneficiaries, we expect actuarial analysis and plan bids to be volatile. Plans will need to submit bids by June 2024 for the 2025 plan year. For MA-PDs, we believe the negative impact of the redesign can be subsidized through the medical benefit while keeping premiums low and stable. Stand-alone PDPs do not have the same flexibility (they do not offer medical benefit coverage), so we expect additional pressure. Over time, we expect the redesign to make stand-alone PDPs less profitable and thus continue the downward trend in participation of these plans.

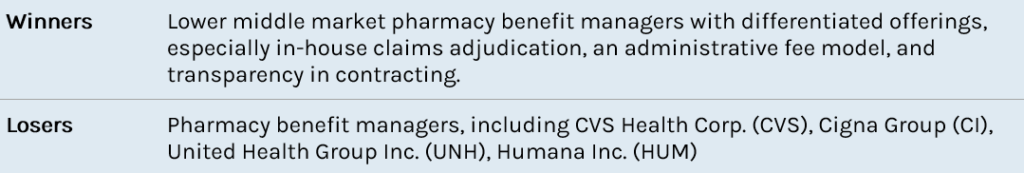

Pharmacy Benefits Stay in Congressional Crosshairs, but Republican Support Will Dull the Blow

We expect Congress to pass pharmacy benefit manager (PBM) reform in 2024. However, House Republicans oppose regulation in commercial markets—likely sparing a large portion of Big 3 PBM revenue. The PBM market is dominated by three PBMs, which are all owned by major insurers. The largest PBMs, which include Caremark (CVS), Express Scripts (CI), and OptumRx (UNH), control more than 80% of total adjusted scripts.

Congressional interest in PBM reform has grown significantly since 2017, with numerous hearings and reports addressing impacts on both patient affordability and clinical outcomes. Capstone maintains a 60% probability that Congress passes PBM reform, including transparency measures and/or prohibitions on certain business practices, by the end of 2024. We believe reform will include a provision requiring PBMs to disclose pricing, rebate, and formulary data to plan sponsors, prohibit spread pricing in Medicaid, and potentially “delink” PBM compensation in Medicare from the price of drugs. Collectively, we believe these reforms will be manageable for most PBMs.

We expect that PBM reform will be used to at least partially pay for expiring public health funding (referred to as health extenders). Previously, in 2018, Congress paid for a two-year health extender by sourcing funds from Medicare reform, including enacting changes in Medicare Part D, Medicare reimbursement, Medicare Part B premiums, and other saving policies. In 2020, Congress paid for an earlier three-year extension by passing the No Surprises Act. As Congress considers an additional funding extension, lawmakers have searched for savings within PBM reform, site-neutral reform, and by eliminating the Medicaid and Medicare Improvement Funds (MIFs).

While both parties are interested in PBM reform, they have different priorities.

Republicans have largely supported PBM reform since 2017. However, they are unwilling to implement reform that would impact the commercial market. Instead, Republican lawmakers are focused on implementing reforms for PBMs that operate in Medicaid and Medicare markets. Although Republicans would like to implement mandatory rebate pass-throughs, as the Trump administration intended in its rebate rule, they continue to face barriers to implementation, including premium increases and high federal costs.

Democrats have recently begun supporting PBM reform as they already addressed drug prices in the IRA. Previously, Democrats had been unwilling to engage seriously on PBMs, fearing that such a focus would distract from their more important goal of drug pricing reform and Medicare negotiation. Unlike Republicans, Democratic lawmakers are comfortable regulating both government and commercial markets. However, like Republicans, the high costs of implementation make substantive reforms difficult, reducing the likelihood a substantive bill can pass.

Health extender funding expires again in January 2024, so we expect Congress will either punt the extenders and PBM reform to later in the year or address the issue in the first quarter of 2024.

Substantive Uptake of Weight Loss Medications Will Continue to Be Overhyped

As demand for GLP-1s for weight loss continues to surge, investors are keenly focused on anticipating and projecting impacts of widespread GLP-1 usage on various healthcare and consumer securities. However, Capstone believes that many estimates of GLP-1 uptake are overestimated and fail to recognize the inherent barriers PBMs, plan sponsors, and the government pose to widespread access.

Medicare Coverage

Medicare statute prohibits coverage of medications that are used for weight loss. While drugs such as Ozempic, Mounjaro, Victoza, and Trulicity can be covered for their type II indication, other drugs such as Wegovy, Zepbound, and Saxenda are explicitly excluded from all Medicare formularies.

To expand Medicare coverage of GLP-1 medications, Congress would need to pass a law to modify existing Medicare statute. Capstone assigns a 15% probability that Congress will allow Medicare to cover GLP-1s for weight loss by the end of 2024. While manufacturers and advocacy groups tout the potential preventive health benefits, there is seldom research to support the claims that coverage decreases overall health spending.

The Treat and Reduce Obesity Act (H.R. 4818/S. 2407) has been proposed every year since 2013 to expand coverage of these medications, however it faces steep hurdles to passage with a projected $100 billion cost to the government over the next 10 years. At this price point, the bill competes with other significant priorities, such as extension of ACA subsidies, Trump-era tax cuts, and telehealth expansion capabilities—further limiting the probability of passage.

On December 14th, Senator Bernie Sanders (I-VT)—chair of the Senate Committee on Health, Education, Labor and Pensions (HELP)—held a hearing to discuss the diabetes epidemic and teased upcoming legislation that would align US pricing with international pricing (giving flashbacks of the Trump-era Most Favored Nation pricing model). While this legislation would likely both save the government money and indirectly encourage subsequent Treat and Reduce Obesity Act passage, the bill is likely to be strongly opposed by both the pharmaceutical and hospital lobbies that seek to preserve hefty margins.

Alternatively, Medicare Advantage and Medicare Part-D plans could choose, without accompanying legislation, to cover GLP-1s for weight loss as a supplemental benefit to entice enrollment. However, no plans thus far have chosen to do so. Capstone believes that plans will continue to avoid expanding supplemental coverage as they observe both significant demand and high cost of coverage.

Commercial Coverage

As employers and insurers witness the seemingly uninhibited demand of weight loss drugs, plans have begun tiering out or otherwise excluding coverage of GLP-1 medications.

In the commercial market, plan sponsors are uniquely focused on maximizing profit in a high-turnover environment. As with any preventive health benefit, plan sponsors must weigh the costs of product coverage with the potential benefits that are likely to be seen during an enrollee’s time in a plan. There is currently limited data available to suggest that the cost of GLP-1 coverage is substantially offset by reductions in future health spending.

As health expenditures increase rapidly, plans are unlikely to take on additional costs of weight loss drug coverage voluntarily. If Medicare were to cover medications for weight loss, commercial coverage would likely similarly expand. However, given the lack of substantive data supporting both short-term and long-term reductions in health spending that would overcome the high $1,000+/month cost of coverage, Capstone believes that uptake in employer health plans will continue to be slow.