By Grace Totman

Introduction

Capstone believes Medicare Advantage (MA) insurers will face underappreciated pressure from all sides as a swath of reforms finalized in 2023, designed to crack down on various forms of overpayment, are implemented over the next few years.

Capstone believes that investors have falsely labeled Medicare Advantage rulemaking volatility as in the rearview mirror when associated headwinds have largely yet to begin. While the headlines from the 2023 rulemaking cycle have largely played out, paving the way for a benign 2024 rulemaking cycle, the underappreciated impact of 2023 changes will be lasting and painful as the implementation shoes begin to drop.

Pressure that began for insurers on star ratings earlier this year, will be compounded by hits related to risk-scoring reform that will begin in 2024, and risk adjustment data validation process (RADV) audit extrapolation starting in 2025 will present further risk.

Separately, we believe renewed campaign talks of repeal and replace, and a looming subsidy deadline in Congress may bring the Affordable Care Act (ACA) back into the limelight in 2024, but that enrollment should continue growing, keeping risk to headlines for now. The true test awaits in 2025, with potential Republican control challenging the future of enhanced subsidies.

More Pain Ahead for MA Insurers Who Have Yet to Feel ‘23 Rulemaking Hits

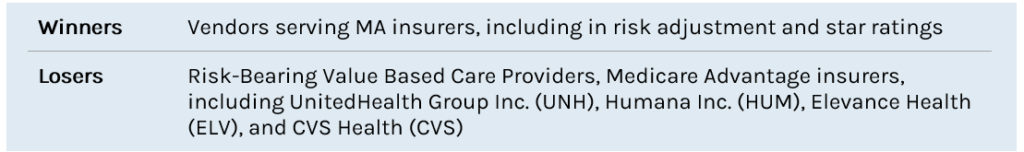

Capstone believes insurers are in for more pain as investors have falsely labeled Medicare Advantage rulemaking volatility as in the rearview mirror. We believe the associated stress of the implementation of that reform is just beginning. Insurers saw the beginning of star ratings pressure earlier this year, hits related to the ICD-10 (v28) risk-scoring reform will begin in 2024, and RADV audit extrapolation starting in 2025 will further pressure revenue. The aggressive 2023 rulemaking cycle can- and should- be viewed largely as a clearing event in terms of future regulation, with only one more confirmed shot on goal for the Biden administration before the 2024 election, but delayed implementation periods of many of the already finalized reforms mean the worst is yet to come.

Looking ahead, the prospect of Republican control post-2024 election would indicate the beginning of relief for the industry. Republicans have historically supported the MA program, and the negative changes the industry has weathered over the past two years could result in a compelling case for favorable rulemaking cycles for CY2026 and CY2027.

2024 Rulemaking (for the 2025 plan year) to be Relatively Benign

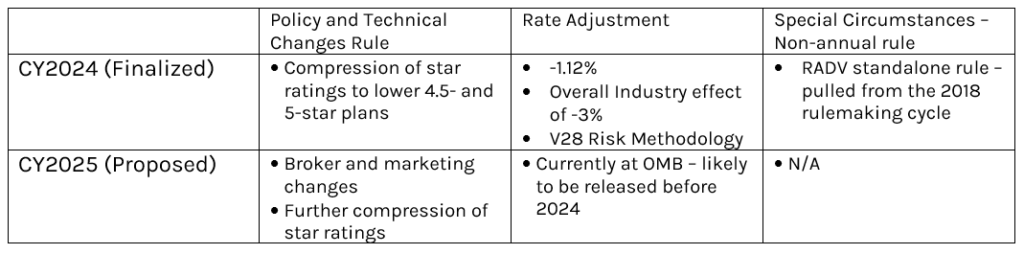

In 2024, MA plans will face two major rulemakings, a return to the more normal annual rulemaking approach. Notably:

- 2025 Policy and Technical Changes

- 2025 Rate Notice

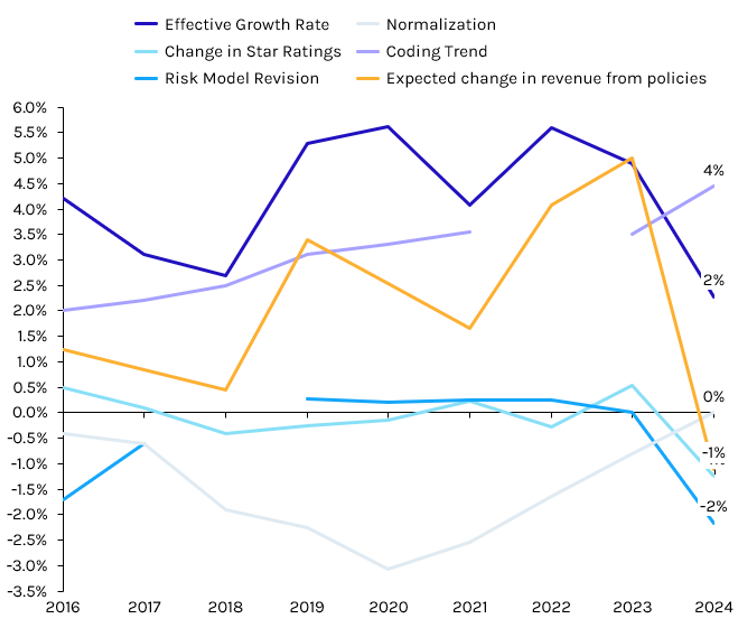

In 2024, MA investors primarily need to be concerned about the forthcoming 2025 Rate Notice. The proposed rate update is currently at the Office of Management and Budget (OMB) pending review. Once the review is completed, expected in the second half of December, the rule is typically released within 48-72 hours. Capstone believes the effective growth rate- the largest factor in overall rates- will return to pre-2023 generosity, given a boost in utilization of healthcare coming out of the COVID-19 pandemic. CMS reserves the ability to negatively modify the effective growth rate, such as via the coding intensity adjustment, risk model revision, or normalization factor, however Capstone believes this is unlikely, given the ongoing v28 implementation. A repeat of the negative star ratings adjustment from last year likely means an all-in rate update of low-to-mid single digits, which should be viewed as a win by the industry.

Exhibit 1: Rate Notice Components

Source: Capstone analysis, CMS

The 2025 Policy and Technical Changes rule was already released in proposed form and will likely be finalized largely as proposed in March 2024 after the comment period concludes on January 5, 2024. Along with some modest star ratings changes, the rule will primarily disrupt the marketing and MA broker industry by restricting the dollars flowing to brokers and changing how payors can pay for certain marketing expenses.

There is a possibility that the Biden administration may also look to propose the 2026 policy and technical changes rule or 2026 Rate Notice in 2024, to get ahead of a potential White House flip in 2025. The former is more likely than the latter, given the recent timing of rules release.

Exhibit 2: Medicare Advantaged-related Rulemakings, 2024 and 2025

Source: Capstone analysis, CMS

Underappreciated Pain: 2023 Rulemaking Review (largely for the 2024 plan year)

In 2023, Medicare Advantage plans faced three major rulemakings, one more than the typical rulemaking cycle.

Policy and Technical Changes Rule to Mean Continued Star Ratings Pressure, Bonus Payment Pressure

Capstone believes star ratings pressure is only just beginning for MA plans, as CMS looks to balance out a previously top-heavy star rating environment from 2021-2023. UnitedHealth and Humana continue to outperform on stars, while Centene, although improved, has remained at the bottom of the barrel. As CMS pushes more plans out of the 4.5 and 5-star buckets, MA plans will experience even further margin pressure as star ratings bonuses decline.

In April of 2023, CMS finalized the 2024 Policy and Technical Changes rule, which will primarily reduce star ratings performance, and therefore plan star ratings bonus payments. As we expect this star rating normalization to continue, MA plans that have concentrated numbers of individuals on a single plan or contract ID continue to face the largest risks. By concentrating beneficiaries in one plan, plans make a calculated risk, reaping bigger financial rewards if the plan is rewarded with a higher rating and experiencing bigger losses if the plan is downgraded. As we see continued pressure on star rating normalization by CMS, we expect to see new strategies from payors to attempt and mitigate losses due to downward rating pressure. These may include stratifying plan types to limit the number of beneficiaries on a given plan or investing in star ratings vendors more heavily.

2024 Rate Notice Risk Model Changes to Hit in 2024, Potentially Significantly Reducing Risk Scores for Certain Providers, Plans

Capstone believes the 2024 rate notice, and particularly the included v28 risk model revisions, will create significant disruption in the coming years. The v28 risk model changes go into effect for 2024, at least in part. CMS finalized a three-year phase-in of the model in response to aggressive lobbying by industry, meaning 2024 risk scores will be calculated using one-third of the new model and two-thirds of the old model. The full phase-in will be completed by 2026 and will mitigate near-term negative impacts while hopefully allowing behavioral shifts to offset losses. For example, plans can shift to attracting enrollees without conditions for which the risk score is now eliminated or lessened. Still, an existing reliance on diagnoses codes taking a hit under the new model will prove difficult for many payors and providers.

RADV Rule

Capstone believes that the RADV rule finalized in early 2023 presents the most significant risk to MA plans in the near-term, with extrapolated audits beginning in 2025 for the 2018 plan year. 2024 will bring renewed attention to the rule as the Humana lawsuit plays out and the potential for Republican control after the 2024 elections renews hope for a repeal. While it’s too soon to predict the prospects of the Humana suit- or the 2024 elections- even in the case of favorable outcomes, the RADV audit program is expected to present material risk to plans. Republican control after the 2024 elections opens the possibility of a roll-back of RADV, but this would require prioritization by a new administration and willingness to revisit a messy policy change, both of which we view as unlikely.

2025 RADV Extrapolation Significantly Increases Audit Risk

Once the long-awaited RADV rule was finalized by CMS, many investors breathed a sigh of relief. The RADV unknown that hung over industry for nearly 5 years was finally answerable. While this relief was warranted, Capstone believes it has clouded industry from appreciating the forthcoming headwinds associated with the rule. Beginning in 2025, for the 2018 plan year, CMS will extrapolate audit results to the entire plan size. To illustrate the magnitude of extrapolation, below are three case scenarios of different RADV audits.

RADV Before the Rule

Before the finalization of the final rule this year, RADV audits were a contained risk. If a plan was selected, 201 beneficiaries from that plan were selected at random coming from equal numbers low acuity, average acuity, and high acuity risk groups. CMS then audited those 201 selected beneficiaries and determined for each the level of upcoding present based on recorded diagnoses vs reported diagnoses. From there, CMS levies a financial penalty based on the audited 201 beneficiaries, and the plan is fined the overpayment amount for that population of 201 only Below is an example of the original RADV process, which will be in effect until 2025.

Example: Original RADV Audit Process

201 beneficiaries x (0.44% average risk miscalculation x $15,000 per member per year) = $13,266 clawback

As evidenced by the example above, the old RADV methodology was financially inconsequential for most plans.

RADV Audits With Extrapolation

Beginning in 2025, the RADV audit process will include extrapolation. Extrapolation, in simple terms, means that the average risk miscalculation now applies to the entirety of the audited plan, instead of the 201 selected beneficiaries. The dollar magnitude of the audit will now be directly correlated to the size of the plan audited, meaning that MA plans with many beneficiaries on a single plan run a high risk of significant RADV clawbacks if selected. To illustrate how large the dollar amount could be just on one plan, below is an example of one of the nation’s biggest plans, Aetna National PPO, CVS’s largest MA plan, with a RADV audit applied after 2025. By looking at CMS’s released example audit from plan year 2007, Capstone analysis determined an error rate of 0.44% for a large Aetna plan.

Example: RADV Audit Process with Extrapolation

2 million beneficiaries x (0.44% average risk miscalculation x $15,000 per member per year) = $132 million clawback

RADV Audit With Extrapolation: Diagnosis-Specific Audit

While the above scenario gives an example of extrapolation applied to a plan in its most standardized form, CMS has discussed a more nuanced RADV audit capability that could mean even more significant clawbacks. In this more selective audit process, CMS has the capability to apply RADV audit extrapolation to a specifically diagnosed population. For example, CMS could look at a plan’s error rate within reported diabetes, and use that sample diabetic population risk adjustment error rate to extrapolate to the plan’s entire diabetic population. Two factors make this kind of audit particularly concerning for MA plans. Firstly, because of upcoding in the risk adjustment space with higher acuity patients, there is likely to be a higher average error rate for that population. Secondly, the average PMPY for those chronically ill patients is higher than the average patient. These two factors together mean that when CMS selects a high-acuity population to audit within a plan, clawbacks may be significantly higher on a per-person basis.

RADV Repeal Hope: Republican Win or Court Order

Two avenues exist for plans to potentially avoid the worst of RADV extrapolation. The first course of action is to vacate the rule through the court system. Humana, currently the second-largest MA plan, has already taken concrete steps to initiate that process. Humana strategically decided to sue the HHS in the payor/private industry-friendly Northern District of Texas. Judge Reed O’Connor, who is famous for vacating the individual mandate provision and preventative care coverage mandates in the ACA, is presiding and will likely decide on behalf of the payors for one or many violations of the Administrative Procedures Act. Humana has asked for the rule to be stayed in its entirety, which would be viewed as a huge win, though may send the Biden administration back to the drawing board depending on timeline.

The second and less sure course of action is banking on Republican congressional and presidential control in 2024. While it is possible that Republicans could take a commanding position in both the congressional and executive branches, demonstrable effects of the audit process will not have materialized yet, making it an unlikely first candidate for reform.

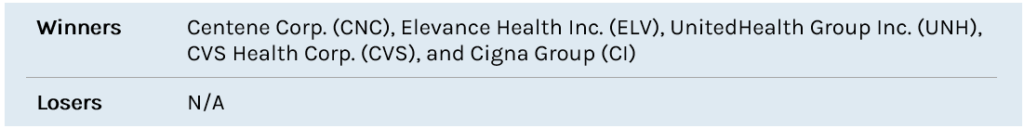

ACA Enrollment to Continue Swelling, Driven by Enhanced Subsidies, Redetermination, but Repeal and Replace Calls Means Headline Risk, Uncertain Subsidy Future

Capstone believes ACA enrollment will continue to grow in 2024, facilitated by ongoing enhanced subsidies for the program set to expire in 2026 that will likely be extended with modifications. However, the stability the ACA has enjoyed for the past three years is in jeopardy with the return of 2016 “Repeal and Replace” rhetoric from presidential candidate Trump. Capstone believes this will be more headline risk than anything else, but that investors should pay attention to conversations it may spur surrounding the future of the enhanced subsidies.

2024 to Follow Record-High Enrollment Trend

For the past three years, ACA enrollment has experienced an almost exponential growth rate as programs enhanced subsidies have increased the affordability of the program. From 2020 to 2023, the program grew by over 5 million participants due American Rescue Plan Act enhanced subsidies. As of Week Five (December 2nd) of the CY2024 open enrollment period, the ACA exchanges have already signed up 1.6 mm new beneficiaries. This is a notable increase over the 1.18 mm new beneficiaries who had signed up at the same time last year. Medicaid redeterminations will also contribute to enrollment boosts in 2024 as approximately 10% of individuals being disenrolled from the program find themselves on the ACA.

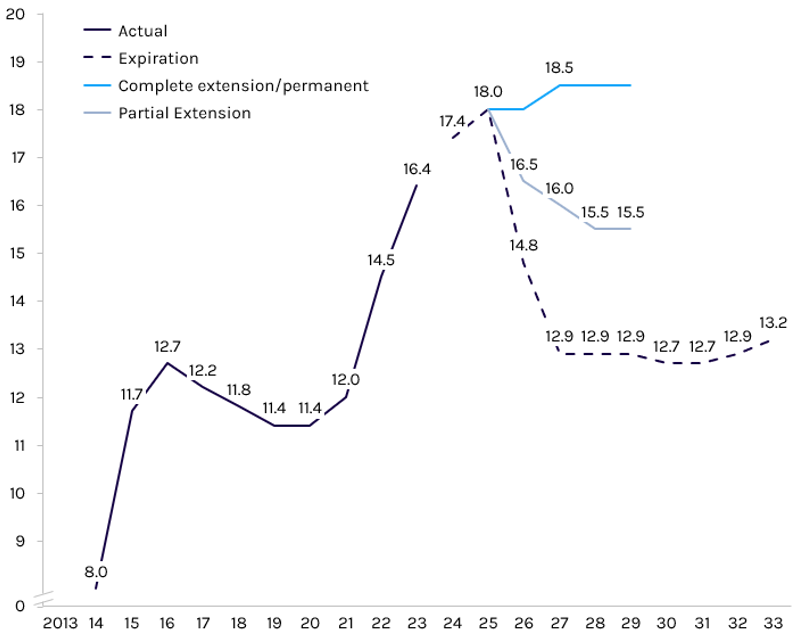

This near exponential growth trend will continue into 2024 and 2025, with enrollment projected to hit ~18.5 million by the end of 2025, and the expiration of the enhanced subsidies. While extension depends heavily on the outcome of the 2024 elections, Capstone believes partial extension in exchange for Republican tax cuts is the most likely.

Exhibit 3: National ACA Enrollment Projections Based on Various Subsidy Scenarios (millions)

Source: Capstone analysis, Congressional Budget Office

The Return of Repeal and Replace Rhetoric May Rain on The ACA’s Parade, Even If It Fails

Capstone believes that the reemergence of Repeal and Replace language tied to the 2024 election cycle will create volatility in the ACA exchange market. Former President and Republican Presidential nominee apparent Donald Trump recently expressed his continued interest in repealing Obamacare. Trump’s endorsement of the policy marks a return to the late 2010’s era Republican talking point, which was featured prominently in the 2016 election cycle and then less prominently in the following 2018 cycle. The former president did not offer a concrete methodology for stripping back the entitlement program, which raises question about the feasibility of actual implementation if elected. However, if rhetoric around Repeal and Replace becomes a focal point of the 2024 election cycle, it could have material effects without ever being implemented.

The ACA’s historic enrollment relies not only on affordability via enhanced subsidies, but also the public trust that has grown in the years since President Biden took office. Over the past three years, the exchanges have appeared for the first time to be competent and supported by the administration in power. The return of Repeal and Replace rhetoric threatens to unravel that public trust, and in turn, businesses and individuals that rely on ACA populations. As former President Trump teases Repeal and Replace rhetoric during his 2024 presidential campaign, Republican hopefuls in races across the country may emulate his talking points. Dissemination of Trump’s talking points throughout Republican campaigns may result in eligible beneficiaries believing the exchanges will be soon repealed, leading them to not enroll in the first place and hampering enrollment projections.