Introduction

Capstone believes federal agencies will make significant progress in 2024 to push forward their agenda to improve educational affordability and empower K-12 schools with additional spending flexibility. Despite that focus on affordability, we expect agency action to face legal challenges or to be softened relative to reformer demands as the administration balances student costs with industry concerns.

In the K-12 education sector, Capstone believes that although the US Department of Education (ED) extended the liquidation timeline for American Rescue Plan Act (ARPA) education stimulus funds, most schools will not utilize the extra time due to an onerous application process. As a result, we believe the extended spending timeline, which many educational service providers hoped for, is unlikely to materialize, resulting in a pullback in stimulus-supported K-12 investments in areas like tutoring, social and emotional health, and supplemental instruction.

In the child care sector, we expect the US Department of Health and Human Services (HHS) will soften its proposed rulemaking to cap parent co-pays and change the payment structure for state-run Child Care and Development Fund programs, alleviating a risk for child care providers. Without modification, the proposed changes would likely lead to a reduction in states’ subsidy slots or cuts to reimbursement rates.

In the higher education sector, Capstone believes that ED’s final student debt forgiveness rulemaking will face legal challenge despite the department’s attempt to narrow its scope. In addition, we expect ED to take further steps to mitigate perceived drivers of student debt burdens, including releasing new guidance that tightens the parameters around revenue sharing between online program managers (OPMs) and universities. While ED will likely stop short of fully rescinding guidance that enables revenue sharing, the new restrictions will still be negative for OPMs.

HHS Likely to Soften Proposed Rules Changing Childcare Subsidies, Mitigating Risk for Childcare Providers that Serve Subsidy-eligible Students

Capstone believes recently proposed rules from the US Department of Health and Human Services (HHS), intended to improve childcare affordability and modernize payment practices within state-run Child Care and Development Fund (CCDF) programs, are likely to be softened from their original form, alleviating risks for child care providers serving subsidy-eligible students. As proposed, the rules would move from retroactive to prospective payment—requiring states to pay childcare providers up front for serving subsidy eligible children rather than weeks after care is provided—and capping family co-payments at 7% of a family’s income.

Changes to payment practices, particularly up-front payment to providers, are intended to align HHS and state-led agency payment practices with the private sector. Currently, processes vary significantly by state, with providers waiting up to multiple weeks after providing care to subsidy-eligible students before receiving a reimbursement. This delay in payment can present cash-flow challenges for providers and complicates their willingness to accept subsidy students into their programs. Caps on family co-pays are intended to increase the overall affordability of childcare and limit states from setting co-pay rates that are too burdensome for families.

While childcare advocates and providers are universally supportive of increased affordability and modernized payment practices, there is broad concern that the proposed rules, without additional program funding, will reduce low and middle-income families’ access to childcare. Notably, many commenters have indicated that a hard cap on family co-payment without additional funding for states could result in a reduction in the number of available subsidy slots in a given state or cuts to reimbursement rates by states to ensure that the same number of students are served. Industry commenters expect that states will react to the proposal by:

- Increasing overall funding for childcare to keep reimbursement rates steady;

- Decreasing eligibility thresholds for families and re-allocating funds to help providers serve the lowest income families so they are not faced with co-pays exceeding 7% of income; or

- Leaving eligibility thresholds and reimbursement rates unchanged while capping co-pays.

In both scenarios 2 and 3, providers would be negatively impacted by having to reduce the number of overall subsidy slots they can serve or receiving a smaller reimbursement from subsidy-eligible families (inclusive of state and family reimbursements).

Advocates are also concerned that prospective payment, though long a goal of the industry, could negatively impact the number of subsidy students served. Advance payment, based on enrollment, does provide greater stability in payment to providers. However, the common practice of paying based on attendance, and reducing payments for significant absences, allows states to stretch limited CCDF funds across additional families. Some states have expressed concern that a universal move towards prospective payment based on enrollment presents operational challenges for existing payment systems and may result in some reductions in the overall number of children served.

While the industry and advocates both support the proposed changes, Capstone expects that the timeline for implementation and elements of the rule will be adjusted to assuage commenter concerns, particularly amid broader market uncertainty around childcare provider closures and family loss of access to care. Specifically, Capstone believes that language around a 7% co-pay cap will likely be softened or HHS will strengthen language prohibiting state cuts to provider reimbursement or eligibility thresholds. Those changes would place the onus for additional funding on states, placing a greater emphasis on state legislative funding support for low-to-moderate income (LMI) family child care support.

Despite Extension, K-12 Education Agencies Will Spend the Majority of Stimulus Funds by the Initial Deadline, Foreboding Reduced Spending on Non-Core Services

Capstone believes that local education agencies (LEAs) will primarily spend remaining education stimulus funds within the statutorily defined obligation and liquidation periods and are unlikely to significantly utilize the liquidation extension period recently granted by ED. As a result, Capstone expects school spending to normalize and for vendors in the industry to see drawdowns in spending on non-core services—a negative for providers of mental and emotional health, supplemental curriculum, and tutoring activities.

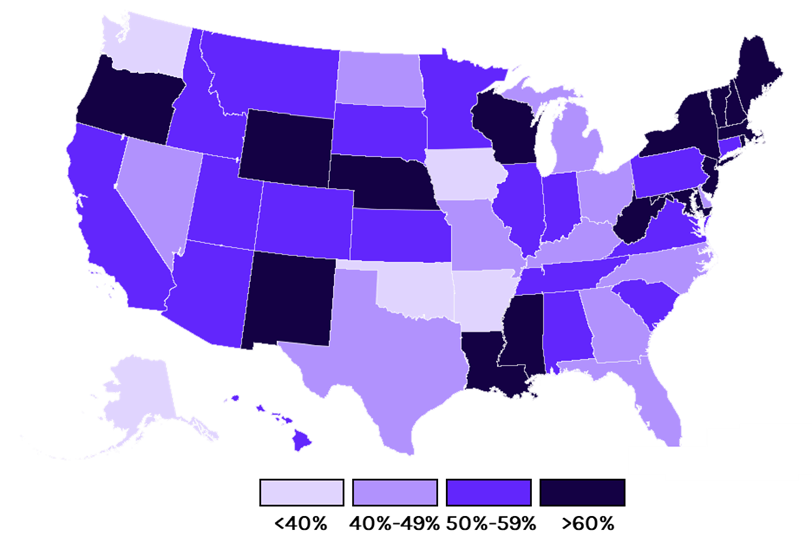

State and local education agencies nationwide have already exhausted funds from the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act and the 2020 Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA), but they still can spend the largest allotment of relief funds from the American Rescue Plan Act (ARPA). ARPA funds must be obligated by September 30, 2024.

Department of Education data, which is reported on a multi-month delay, indicates that nearly $64 billion in ARPA funds are unspent. Considering the lag in reporting, Capstone estimates that the accurate volume of unspent funds is closer to $50 billion. Further, ED’s reporting only captures funds that are spent but does not capture funds that have already been committed for spending or that LEAs have budgeted for use. Leadership at The Superintendent’s Association (AASA) estimates that only 15% of the unspent funds are uncommitted, which we would estimate at $7.5 billion.

Exhibit 1: % of ARPA Education Funds Remaining by State

Source: Department of Education

LEAs will have additional time between the obligation and spending deadline to utilize remaining ARPA funds. Initially, ED gave LEAs 120 days between the obligation deadline and the formal liquidation deadline for funds. However, advocacy from LEAs and state education agencies (SEAs) convinced ED to provide a 14-month extension to the original liquidation deadline for ARPA funds. ED granted similar extensions for CRRSA and CARES funding. Despite the liquidation extension, Capstone expects most funds to be spent within the original liquidation timeframe due to the complicated nature of seeking and receiving extension approval.

According to the industry, ED’s process for granting liquidation extensions is confusing, complicated, and potentially fraught with risk for school districts. Interested districts are required to apply for an extension through their SEA. In turn, the state aggregates applications and submits them to ED for final approval. While most states have shown a willingness to seek extensions on behalf of their districts, local education officials must carefully monitor their SEA’s posture on extension and the types of activities they are willing to support for extension. There is no guarantee ED approves an extension—some industry participants have suggested that guidance on allowable uses of funds during a liquidation extension is unclear, which makes districts reluctant to seek extensions. Finally, the actual application process is onerous. Districts are required to provide near line-item spending information in any application submitted to their state and then onward—a level of detail challenging to achieve, particularly with the larger ARPA funding allocation. Any denial of an extension request increases the likelihood that districts will have difficulty spending funds and that the federal government will reclaim the remaining funds. While education advocates are pushing for greater flexibility in the extension process, Capstone believes ED is unlikely to change its course.

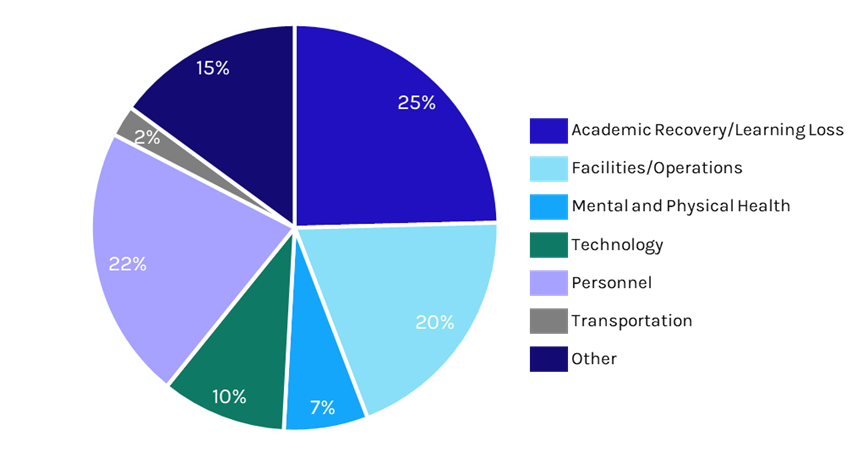

As those additional funds are drawn down, Capstone expects LEAs to begin reducing spending on services and offerings largely enabled by stimulus funds. Survey data from the AASA indicates that school leaders have been focused on utilizing additional funding to support summer and extended learning opportunities; improve facilities; add support, intervention, and mental health staff; and purchase additional curriculum materials. Capstone’s analysis of ARPA spending plans reveals similar themes.

Exhibit 2: Average Planned Spending of ARPA Education Stimulus Funds

Source: Capstone Analysis, Burbio

As funds are exhausted and schools face an uncertain state funding outlook amid broader recession fears, Capstone expects that spending on mental health support (specifically for children without special education designations), extended learning opportunities, and supplemental educational tools intended to drive academic acceleration will be reduced.

Notably, we believe districts have little flexibility to reallocate traditional budgets toward pandemic-era spending priorities. The majority of school budgets, ranging from roughly 60-80%, are dedicated to administrative, educational, and support staff salaries. To the extent that districts can preserve investments primarily funded through stimulus, we expect a significant focus on retaining services and solutions that have proven successful in rapidly remediating student learning loss.

We expect the reduction in spending to be felt most acutely in districts that receive a high percentage of funding from Title I, as stimulus dollars were distributed proportionally based on previous Title I allocations. We expect significantly less drawdown in school expenditures related to core curriculum, special education services, and enterprise and administrative software and technology offerings.

Additional States to Kick-Off K-12 Student Assessment Innovation Programs, Creating Opportunities for Assessment Vendors with Strong Data Analytics Capabilities

Capstone expects that additional states will apply to participate in the Department of Education’s newly widened Innovation Assessment Demonstration Authority (IADA) program as ED expands eligibility to all 50 states, promoting a shift to “through-year” assessments to measure student achievement and away from year-end assessments. We believe ED is increasingly willing to allow states to experiment with new methods of assessment to improve the link between assessment and classroom instruction, and to accelerate student performance. This expansion creates opportunities for existing formative and interim assessment providers to scale, particularly if they have strong data analytics capabilities.

Under the Every Student Succeeds Act (ESSA), states must conduct annual accountability assessments in grades 3-8 for math and English language arts (ELA) and conduct more intermittent assessments for science. Assessments for the same subjects must also be administered once in high school. These year-end summative assessments are required for continued eligibility for federal Title I education funding. ESSA did, however, create a small innovation program to allow a select number of states to experiment with assessment formats. The IADA program, as initially envisioned under ESSA, allowed up to seven states to initiate formal assessment pilot programs aimed at eventually replacing a standard summative assessment.

The experience of states that participated in IADA was mixed and significantly complicated by the COVID-19 pandemic. While the pandemic made the delivery of IADA programs more difficult, it amplified concerns about the utility of the summative assessment system. In an attempt to more closely link assessments to classroom instructions and empower teachers to alter lessons to address demonstrated learning gaps, multiple states began experimenting with so-called “through-year” assessments. These through-year assessments, typically three assessments offered in the fall, winter, and spring, measure student achievement throughout the year and provide real-time feedback to educators. Proponents believe this real-time feedback allows teachers to target student learning gaps and improve student performance more effectively.

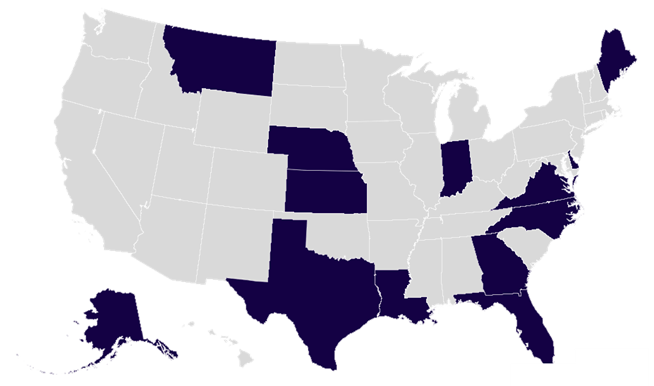

Currently, at least 13 states are experimenting with some form of alternative, through-year assessment model. In May, ED will open up the IADA program and make all states eligible for participation. Capstone expects that multiple states will formally apply to participate and take steps to experiment with assessment delivery. There is no guarantee, however, that these assessment experiments satisfy ESSA requirements. For an alternative to successfully replace an existing summative assessment, federal reviewers have to determine that the new regime is valid, comparable, and reliable—that the new regime produces consistent valid scores that are comparable across the state and to the existing summative test.

Exhibit 3: States with “Through Year” Assessment Programs

Source: Education First

While many statewide assessment providers are helping states experiment, Capstone believes the potential for expanded innovation provides opportunities for existing formative and interim assessment providers to scale, particularly if they have strong data analytics capabilities. Capstone has consistently heard from district officials that the value of interim assessments for teachers heavily depends on the extent to which those assessments produce usable classroom insights. Assessment providers that can develop interim assessments that provide granular, standards-linked information for teachers in easily usable formats are better positioned to offer assessment solutions that fulfill the promise of assessment innovation.

Narrow Student Loan Forgiveness Proposal Would Still Face Legal Challenge, and a Plaintiff with Standing Would Likely Succeed

On December 4th, the Department of Education released proposed regulatory text outlining the scope of its student debt forgiveness plan. As Capstone expected, based on previous ED guidance and conversations with the negotiated rulemaking committee, the proposed scope of debt forgiveness is far narrower than the administration’s previous attempt at broad, income-based debt forgiveness. The regulatory text outlines four classes of borrowers that would receive forgiveness:

- All borrowers with student loan balances that exceed their initial balance would be eligible for the lesser of $10,000 or the amount by which their current balance exceeds the initial balance in forgiveness. That amount of potential forgiveness would climb to $20,000 for borrowers with loan balances that exceed their initial balance and earn less than 225% of the federal poverty line or are enrolled in existing repayment plans.

- Borrowers that entered repayment on undergraduate loans on or before July 1, 2005, could see the full remaining balance of their loans forgiven. All other types of loans that entered repayment on or before July 1, 2000, would also be eligible for forgiveness.

- Borrowers eligible for existing loan forgiveness plans but have not yet applied would be eligible for full loan forgiveness.

- Former students of institutions closed due to misconduct are eligible for full forgiveness. Additionally, students who attended institutions that fail the ED’s new gainful employment metrics may also be eligible for full student debt forgiveness.

Capstone expects ED to release a proposed debt forgiveness rule in the first quarter of 2024 to finalize the rule well in advance of the November 1st deadline to allow rules to be effective by the July 2025. We believe that the narrower tailoring of the current debt forgiveness rule, as well as the inclusion of multiple severability clauses, is an attempt to insulate any future debt forgiveness rule against legal challenge.

Despite the administration’s efforts, Capstone still expects any final debt forgiveness plan to face legal challenges. Capstone expects taxpayer groups, state attorneys general, and potentially loan servicers to challenge the legality of any finalized debt forgiveness rulemaking.

The Biden administration’s current debt forgiveness effort leans heavily on statutory authority ED alleges it possesses under the Higher Education Act (HEA) to “compromise” or “waive” collection of student loan debt. The Trump administration published a memo in 2020 that came to the opposite conclusion, arguing that the HEA and congressional intent around student loans assumes that “loans would be repaid except in very specific circumstances.” The recent Supreme Court ruling on the previous debt forgiveness plan seemingly sides with the Trump administration’s interpretation, stating that HEA only identifies “a few narrowly delineated situations that could qualify a borrower for loan discharge.”

While the specifics of the final rule and the language of the legal challenge will have bearing on any legal outcome, we believe a plaintiff with standing would lean heavily on the Trump administration’s legal memo and the Supreme Court’s previous decision as legal precedent. In this case, we expect plaintiffs would successfully challenge the final rule.

Short-Term Pell Grant Legislation to Pass in 2024; An Underappreciated Opportunity for Credentialing Providers and For-profit Universities

Capstone believes bipartisan short-term Pell Grant legislation will pass in 2024. In December 2023, federal lawmakers introduced H.R. 6585, the Bipartisan Workforce Pell Act, which would establish short-term Pell Grant programs. The legislation is sponsored by a combination of Republicans and Democrats and would, for the first time, make students participating in short-term workforce training programs eligible for Pell Grants.

Democrats and Republicans have long agreed that the Pell Grant program should be expanded to provide additional funding to support workforce development programs, but they have often disagreed on the extent to which for-profit providers should be allowed to participate, the stringency of program accountability measures, and online program participation. Capstone believes that this latest bill represents a bipartisan compromise on the issue that is likely to pass in 2024.

We believe potential passage of short-term Pell Grant legislation, an area of long-time disagreement, is underappreciated and a rare area of political compromise in the current Congress. As currently constructed, the legislation would provide tailwinds for for-profit universities and trade schools offering short-term certification and workforce training programs. Further, the potential for increased enrollment in training programs and the emphasis on stackable credentials may drive increased demand for digital credentialing and badging solutions, like Credly (owned by Pearson PLC) or Instructure’s Canvas Credentials (INST).

The legislation would make short-term training programs that offer 150-600 clock hours of instruction over 8-15 weeks, regardless of tax status, eligible for Pell Grant participation. Notably, the bill would allow for-profit providers to participate so long as they satisfy the multiple quality assurance provisions included in the bill. Quality assurance elements include approval for state workforce boards that the program provides education aligned with high-skill, high-wage, or in-demand industry sectors, satisfies educational prerequisite requirements for professional licensing, approval from an appropriate accrediting body, and meets ED-established completion, earnings, and job placement thresholds. Other interesting bill elements include requirements to make transcripts available to students free of charge and regulations requiring that available credentials be stackable with other programs unless there is only one relevant license/certification in a given field.

ED Guidance on OPMs Coming in 2024, Likely to Narrow Bundled Services Exemption

Capstone expects the Department of Education to finally make changes to the bundled services exemption in 2024 that narrow its applicability, but the department will not completely rescind the exemption. Under the Higher Education Act, colleges that participate in federal student aid programs must not compensate individuals or organizations based on their success in recruiting and enrolling students. In 2011, ED published a Dear Colleague Letter that explained that it did not consider tuition sharing agreements that include a bundle of services, including recruiting activities, to violate the ban on incentive compensation.

That 2011 Dear Colleague Letter provided a significant boon to the online program manager (OPM) industry, providing a legal basis for tuition-sharing agreements that provide a bundle of services—including recruiting—to universities. Progressives have long decried the bundled services exemption, arguing that it violates the statutory text of the Higher Education Act and ultimately produces negative outcomes for students. Opponents argue that OPMs engage in deceptive marketing, capture too large a percentage of revenue, and often deliver low-value programs for students. The GAO, in a recent report reviewing the industry, concluded that ED oversight over OPM relationships with institutes of higher education was insufficient. Partially in response to that GAO report, ED hosted a listening session on the bundled services exemption in March 2023.

Capstone expects that ED will provide long anticipated adjustments to the bundled services exemption in 2024. We believe that the Department of Education has been aggressive during the Biden administration in addressing issues that drive high student debt burdens, and we expect that the administration will narrow the scope of the bundled services exemption as part of that broader effort. Notably, Capstone does not anticipate full recission of the 2011 Dear Colleague Letter. During spring listening sessions representatives from a number of public and private, non-profit institutions spoke in favor of preserving the existing exemption and the GAO report found that 90% of OPM partnerships are with public or non-profit institutions.

Instead, Capstone believes that ED will take steps to narrow the exemption and place new guardrails around OPM and university partnerships. Specifically, Capstone believes that ED may try and provide new guidelines around the specific activities that are eligible for the exemption or make recommendations around revenue sharing thresholds. Notably, the industry appears to be preemptively moving away from a revenue-sharing model. 2U, for example, debuted a more traditional fee-for-service model earlier this year, with the careful caveat that it expects most university partners to continue to prefer a revenue-sharing model. Changes to allowable bundled service arrangements will inevitably place revenue pressure on OPMs and may force adjustments to existing contracts and service offerings. While we expect ED to stop short of full recission, even new guidelines will be disruptive for the providers in the space.