Introduction

Capstone expects banks to push back aggressively across several regulatory fronts in 2024, establishing a notable and underappreciated inflection point for regulation in the industry. But, we don’t expect regulators to go down without a fight.

Capstone believes the banking industry will challenge the ambitious response of prudential regulators to the turmoil that afflicted mid-sized banks, starting with the run on Silicon Valley Bank in the Spring of 2023. One target will be the increase in capital requirements for large banks, which will face multiple challenges in 2024. The industry and some lawmakers will continue to adopt an aggressive stance toward regulatory capital increases stemming from the Basel III Endgame proposal.

Multiple scenarios could significantly weaken or delay the Basel III proposal, which would be a significant victory for large banks facing a roughly 16% increase in Common Equity Tier 1 (CET1) capital under the current proposal.

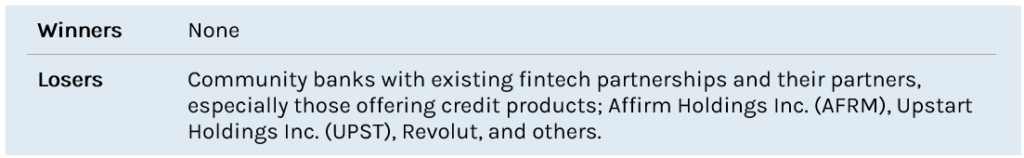

We expect prudential regulators to adopt a more aggressive supervisory posture on uninsured deposits and bank partnerships with third parties following recent bank failures that highlighted the risks of high volumes of uninsured deposits. Enforcement action against banks that fail to monitor third-party partner activities will continue after the finalization of new third-party risk management guidelines.

Financial regulators have also moved to address perceived systemic financial risk outside of the banking system. The Financial Stability Oversight Council (FSOC) finalized its framework for designating nonbank financial institutions as systemically important. Capstone believes, however, that FSOC will not formally apply that designation to any firm before the 2024 election.

Basel III Endgame Far From Settled, Multiple Potential Off-Ramps for Banks

The Basel III Endgame proposal casts a long shadow over the banking industry as the most meaningful revision of bank capital rules since the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Capstone believes the likelihood that the proposal, introduced in July by US financial regulators, will be significantly revised to dramatically lessen the capital impact, successfully challenged in court, or derailed through a change in administration is currently underappreciated. There are multiple paths to a softened final proposal that is less impactful to large banks, and any final rule that closely resembles the current proposal will face multiple potential challenges.

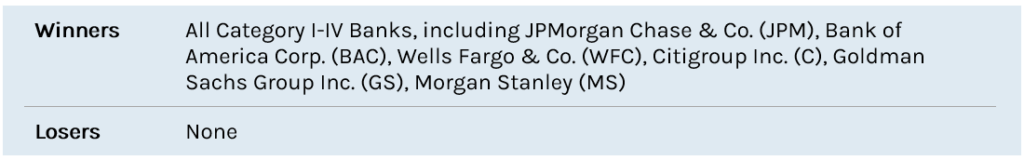

The US banking industry has been unsettled since early 2023 – first shaken by multiple large regional bank failures and, more recently, by the looming threat of increased regulatory capital requirements from prudential regulators’ Basel III Endgame proposal. The interagency proposal — composed by the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Board of Governors of the Federal Reserve System — would implement the Basel Committee on Banking Supervision’s (BCBS) remaining reforms to address the Global Financial Crisis and the BCBS’ revised market risk capital framework. Banking organizations with more than $100 billion in assets would be required to determine their capital requirements under a revised credit, operational, and market risk framework called the “Expanded Risk-Based Approach.” The regulators’ own analysis indicates that the proposal would increase risk-weighted assets (RWA) by 20% relative to the currently binding measure for RWA for impacted banks, with variations in the impact depending on bank size and activity. As a result of the increase in RWA, the proposal estimates that the binding CET1 capital requirement for impacted banks would increase by roughly 16%.

Exhibit 1: Estimated RWA Increase for Category I-IV Banks from Basel III Proposal

Source: Interagency Rulemaking Proposal

The banking industry and many legislators, particularly Republicans, have pushed back aggressively against the proposal, arguing that current bank capital requirements are sufficient, banks are historically well-capitalized, and any increase in capital requirements would have significant negative economic impacts. Fed Chair Jerome Powell and Fed Vice Chair Philip Jefferson, though they voted in favor of moving forward with the rulemaking, have expressed skepticism regarding specific aspects of the current proposal. In response to criticism, the banking agencies extended the original comment period deadline from November 30th, 2023, until January 16th, 2024. Capstone believes there are many scenarios in which implementation of Basel III Endgame reforms is significantly blunted or delayed, providing relief to large banks.

Significant Revisions to the Final Rule

Interagency leadership could, based on feedback through the end of the comment period, determine that the original proposal has over-calibrated capital requirements and choose to lessen the impact. Former Fed Vice Chair for Supervision, Randal Quarles, had previously pushed for a Basel proposal that was largely capital-neutral in aggregate. Federal regulators could moderate the proposal to closely align with Quarles’ perspective and adjust it to create muted capital impacts. Specifically, current Vice Chair for Supervision Michael Barr could heed wide-ranging calls to soften elements of the proposal related to mortgage risk weights, changes to tax equity financing, small business and corporate credit risk, the current securitization risk-weighting framework, and the underlying assumptions around calculation operational risk. Elements of the rulemaking proposal that are ‘gold-plated’ or super-equivalent to the Basel Committee’s initial framework could be eliminated to create better jurisdictional alignment between the US and other markets implementing Basel. Capstone believes, however, that Barr will be reluctant to soften the proposal. He has repeatedly supported the proposal and publicly argued for increases in capital requirements. Even in his earliest remarks as Vice Chair, he seemingly abandoned the notion that Basel III Endgame should be capital-neutral. More recently, during congressional hearings, Barr vowed to seek consensus on the proposal among fellow Fed members but seemingly left the door ajar to moving forward with the proposal over potential objections of fellow Board members.

Legal Challenges from Industry

If the proposal is not softened, leading trade organizations representing the banking industry are ready to challenge the legality of the Basel Endgame rulemaking process. In a comment letter to the agencies following the release of the proposal, the leading trade groups representing large banks, including the Bank Policy Institute, American Bankers Association, and the Financial Services Forum, argue that the rulemaking process is fundamentally flawed. The letter notes risk weights were chosen “arbitrarily,” the economic analysis presented is insufficient and violates the Administrative Procedures Act (APA) by relying on non-public information, and that the agencies must withdraw and repropose the rule after additional data analysis. The Bank Policy Institute’s chief executive officer, Greg Baer, testified in Congress regarding the Basel III Endgame proposal in September, and elements of his testimony were even more direct. He said the Federal Reserve never considered the interplay between stress tests and the Basel proposal, a failure that the footnotes to his testimony indicate “defines arbitrariness and caprice for the purposes of the Administrative Procedures Act.”

Capstone is also closely monitoring two related legal developments that could impact the success of a bank-led challenge to new capital requirements. First, bank industry groups released a letter earlier this summer requesting that the Federal Reserve engage in rulemaking to codify the models and formulas it uses to calculate stress capital buffer requirements. The letter came after Bank of America Corp. (BAC) and Citigroup Inc. (C) raised questions about discrepancies between their internal stress tests and those run by the Fed and argued that rulemaking would remedy the “serious existing legal defects” that undermine the Fed’s existing process for setting stress capital buffers (SCBs). A legal challenge to the Fed’s stress-testing regime would set a precedent for a broader challenge to the Basel III Endgame requirements. Second, Capstone is following the Supreme Court’s willingness to reconsider long-standing court deference to agencies in interpreting federal statutes in rulemaking where Congress has not spoken directly to the issue at hand – as long outlined following Chevron USA v. Natural Resources Defense Council (1984). SCOTUS has now agreed to hear two cases that challenge Chevron deference with oral arguments likely scheduled for January, and recent Court decisions have narrowed the scope of Chevron. Any decision to fully overturn Chevron deference could open the door to broader challenges of the banking agencies’ authority and latitude to impose far-reaching capital requirements on large banks, among other issues.

A New Administration Changing Regulatory Focus at FDIC and OCC

While some Democrats are skeptical about elements of the Basel III Endgame proposal, the overall concern with the rulemaking among Democratic legislators is relatively far more muted. Capstone believes a Republican victory in the 2024 presidential election could significantly alter the direction of bank agency rulemaking and stall or weaken the Fed’s efforts to implement the proposal. While regulators aim to finalize the proposal by mid-to-late summer, recent rulemaking history suggests the timeline to finalize the rule will be longer. Capstone reviewed the timeline for more than 50 Federal Reserve rulemakings since 2010 and found that the average time between the close of the comment period and the release of the final rule is approximately 313 days. Given the comment period closes on January 16th, and the 2024 general election will be November 5th, historical precedent suggests a final rule is unlikely to be released before the election. Should the Republican nominee win the 2024 presidential election before a rule is finalized, they could reshape the leadership at the FDIC and OCC and exert pressure on the Basel III Endgame implementation process.

A Republican president can immediately remove the Comptroller of the Currency, who heads the OCC, and nominate new leadership that could be more critical of the current Basel Endgame proposal. Additionally, a Republican president would almost certainly remove the Director of the Consumer Financial Protection Bureau (CFPB), Rohit Chopra, who also serves on the FDIC’s Board of Directors. While a Republican President would not have the ability to unilaterally change the leadership at the Fed, changes in leadership at the OCC and FDIC would almost certainly reduce those agencies’ willingness to support the current direction of the proposal and make it more difficult for Fed leadership to forge ahead unilaterally.

If the rule is finalized before the election, but a Republican is elected, Capstone believes that leadership changes at the OCC and FDIC could result in significant delays or attempts to amend and repropose any final Basel III Endgame rule. Finally, it is possible leadership changes at the FDIC occur prior to any election. The recent revelations of a toxic work environment at the FDIC have created a new controversy around FDIC Chair Martin Gruenberg. While calls for his resignation have been limited, and have not come from congressional Democrats, any widening of the controversy or implication of the Chair in misconduct related to the original story or more recent stories about his alleged treatment of employees could increase scrutiny and ultimately force him out.

Congressional Review Act or Other Legislative Challenge

As mentioned, Republicans have spoken out aggressively against the current Basel III Endgame proposal. Republican leadership on the House Financial Services Committee (HFSC) has been highly critical of the process and substance of the proposed rule. In the Senate, nearly 40 Republican senators sent a letter to the bank agencies requesting they withdraw and repropose the Basel III Endgame proposal. Capstone has spoken to multiple staff members within the Republican legislative caucus, and all are opposed to the proposal. While they remain focused on using their oversight function to encourage regulators to soften or withdraw the current proposal, they are ready to challenge any final rule through legislative means. Should Republicans sweep the 2024 elections and gain control of the White House and both chambers of Congress, they could use legislative tools to weaken or remove the Basel III Endgame rules.

A unified Republican-majority Congress could seek to alter or remove a final rule through simple legislative rescission – passing legislation that essentially guts or significantly amends the rule. Alternatively, Congress could employ the fast-track procedures authorized by the Congressional Review Act (CRA) which allows Congress to quickly nullify an agency rule. Under the CRA, rules submitted on or after the 60th day before sine die adjournment in at least one chamber of Congress will be subject to congressional review when Congress adjourns. In 2020, rules submitted on or after August 21st were subject to congressional review. That August date for the 2020 congressional review look-back period, however, is uncharacteristically late. For example, in 2016, rules finalized on or after June 13th were subject to congressional review. Going further back, Capstone finds that from 1996-2012, the CRA cutoff period has ranged from sometime in late May to early July. Barring atypically rapid finalization of the rule, something that seems unlikely given the expected volume of comments on the proposal, the magnitude of the rule, and the political sensitivity surrounding the proposal, Capstone believes any finalized version of Basel III Endgame will be subject to the CRA. Notably, the Trump administration and a Republican House and Senate utilized the CRA aggressively; during the 115th Congress (2017-2018), the CRA was used 16 times compared to only once before in its 20-year history.

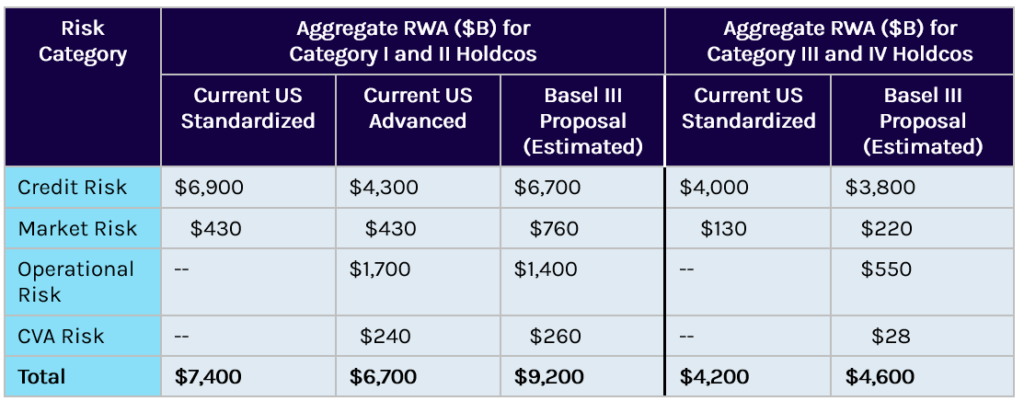

Capstone believes any significant softening of the Endgame proposal or outright withdrawal via agency or legislative action would be significant for Category I-IV banks. Increased capital requirements are expected to generate downward pressure on banks’ return on equity (ROE) and overall equity valuations. A muted or significantly delayed proposal forestalls that pressure.

Legislation Unlikely, but Ininsured Deposits a Continued Supervisory Focus

Capstone believes that while Congress has largely set aside concerns about uninsured deposits, bank supervisors have not. The role of uninsured deposits in the failure of Silicon Valley Bank (SVB) and, to a lesser extent, Signature Bank (SBNY), prompted policymakers to explore if and how the current $250,000 per depositor limit may be amended to protect banks and their depositors in the future. Amid that instability, the FDIC commissioned a report on possible options to reform the deposit insurance system. The report analyzed three primary courses of action – making no changes to the deposit insurance system, providing unlimited deposit insurance, or providing expanded protection to “business payment accounts.” The FDIC ultimately endorsed a targeted expansion of deposit insurance to cover “business payment accounts” at some higher threshold. Actual expansion of deposit insurance coverage, outside of an emergency scenario whereby financial regulators petition Congress to create a new deposit guarantee facility, would require an act of Congress.

At this stage, Congress appears reluctant to consider legislation to alter the deposit insurance system. Since the turmoil last spring and the release of the FDIC report, four separate bills have been introduced to reform the deposit insurance system. The two most recent, one introduced by Rep. Adam Schiff (D-CA) and the other by Sen. J.D. Vance (R-OH), center around expanding insurance coverage for commercial or non-interest-bearing transaction accounts. Neither bill has progressed, and Republicans in the House Financial Services Committee have opposed deposit insurance reform, likely killing any hopes for a bill in 2024.

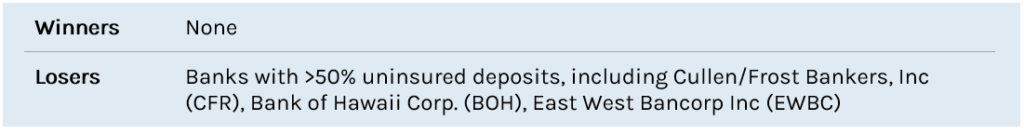

Meanwhile, regulators continue to express concerns about uninsured deposits and changes to the FDIC’s supervision manual and recent remarks suggest focus on the issue will persist through 2024. Recent updates to the FDIC’s supervision manual and the Fed’s recent semi-annual “Supervision and Regulation Report” all point towards a heightened supervisory focus on uninsured deposits. The FDIC’s new supervision manual will require examiners to provide written analysis evaluating institutional risk management practices where uninsured deposits represent more than 50% of total deposits. Similarly, the Fed has identified “liquidity coverage of uninsured deposits” as a key supervisory priority as it continues to intensify its supervisory regime and encourage examiners to push banks to assess their deposit concentrations and outflow assumptions. The banking agencies’ Long-Term Debt (LTD) Proposal is also intended to help alleviate concerns about uninsured deposits. The expanded LTD requirements that would be imposed on Category II-IV banks would structure debt requirements in a way that any losses to a financial institution would first be absorbed by long-term debt holders before uninsured depositors, with the goal of lowering their incentive to pull their deposits.

Beyond supervisory scrutiny, Capstone also expects that FDIC Chair Gruenberg will seek adjustments to deposit insurance pricing related to uninsured deposits. He specifically identified deposit insurance pricing as a priority during a speech last summer that examined recommended next steps to avoid subsequent bank failures. Other reforms Chair Gruenberg recommended in the speech, including capital requirement changes, resolution planning changes, and capital treatment for unrealized losses, are all areas of current rulemaking.

More intensive supervision of uninsured deposits may carry practical implications for banks. Greater scrutiny to banks’ reliance on uninsured deposits as a bank funding source may impact bank CAMELS ratings – supervisors use CAMELS (capital adequacy, assets, management capability, earnings, liquidity, sensitivity) ratings as a metric to confidentially rate banks on various metrics. For FDIC-regulated banks, poor CAMELS ratings can impact bank M&A activity or branch expansion, create heightened supervisory scrutiny, and increase deposit insurance assessment rates. Notably, banks appear to be reducing their overall volume of uninsured deposits. Among banks with more than $10 billion in total deposits, the overall percentage of uninsured deposits has declined on average to 35% at the end of Q3 2023, down from 40% in Q4 2022.

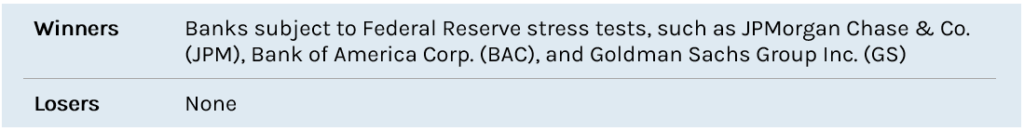

Big Banks Gearing up to Challenge Stress Testing Regime

Capstone believes the largest banks subject to the Federal Reserve’s annual supervisory stress testing regime are prepared to pursue litigation against the Fed to combat increasingly challenging stress testing scenarios that result in binding stress capital buffers. With steadily rising capital constraints and the specter of the Basel III Endgame on the horizon, we believe the industry will pursue a combative legal strategy to blunt the impact of stress testing on bank capital requirements. While the industry has pushed back against the stress testing regime, we believe the likelihood of legal challenges in the coming year is currently underappreciated. The industry views the combination of Basel III Endgame and stiffening stress testing as a high-water mark in bank regulation at a time when the industry sees itself as stable and well-capitalized – increasing its willingness to challenge regulators.

The industry believes that potential Basel III Endgame requirements and the existing stress testing methodology may be duplicative – specifically the Global Market Shock element of the stress testing regime is duplicated in the Basel framework’s “fundamental review of the trading book” reforms. Application of the current stress testing framework and imposition of new market risk capital requirements will result in double counting and require banks to over-capitalize for the same risks, according to industry. Further, Vice Chair Barr has promised to continue assessing banks against multiple exploratory scenarios in subsequent stress tests. While those exploratory scenarios will not be currently utilized to calculate binding stress capital buffers, there is some concern they could be in the future. The potential for future climate stress testing scenarios has also been broached.

In 2023, multiple banks were surprised by their supervisory stress test results. Citigroup’s stress capital buffer increased from 4.0% to 4.3%. And while Bank of America’s SCB declined, the company expressed concern about the discrepancies between the Fed’s stress testing results and its own internal models. In response to the SCB announcements this summer, banking trade groups petitioned the Fed to initiate formal rulemaking to explain the models and methodology for determining stress capital buffers. In the letter, the industry groups argue that rulemaking on the topic would “remedy the serious existing legal defects” with the stress testing process and allege the current process violates the Administrative Procedures Act (APA). The crux of the argument is that since the stress testing models used to determine binding capital constraints for banks are non-public, they are de facto in violation of the transparency provisions of the APA. We believe industry groups and participants may use this statement as a building block for a lawsuit against the Fed on grounds the tests violate the APA. The industry has previously alleged that the stress testing regime needs an overhaul and greater transparency, but petitioning for formal rulemaking is more combative than previous complaints. Former Vice Chair for Supervision, Randal Quarles, agrees with the industry, claiming in July that the supervisory tests are “illegal” in their current form.

In October, current Vice Chair Barr doubled down on the need for additional exploratory scenarios in stress testing and rebutted industry concerns that testing and forthcoming changes to market risk calculations are duplicative. Capstone believes that Barr’s stance, and the potential for challenging and far-reaching supervisory stress testing scenarios in 2024, as well as the potential for increased capital requirements through the Basel III Endgame, set the stage for a legal showdown over stress testing.

Sustained Regulatory Pressure on Banks and Third-Party Partners

Capstone believes federal banking regulators will continue to aggressively scrutinize third-party partnerships in 2024 and that an increase in enforcement actions against banks in the coming year is likely. Regulators this year have increased their focus on bank partnerships with fintech and technology providers. In addition to related enforcement actions, the OCC, FDIC, and Federal Reserve finalized third-party risk management guidance, establishing clearer guidelines for insured depository institutions (IDIs) and their nonbank partners. We expect a heightened risk of enforcement action for banks that fail to monitor the compliance capabilities of third-party partners throughout 2024. We believe the continued focus on partnerships and the threat that enforcement action presents to both fintechs and community banks is underappreciated.

Pressure on third-party partnerships from current FDIC and OCC leadership has been building slowly, with Acting Comptroller of the Currency Michael Hsu leading on the issue. Early in his tenure in 2021, Hsu spoke of his concern that by existing outside the traditional bank regulatory architecture, fintechs were taking advantage of regulatory arbitrage to skirt compliance rules. Understanding this aspect of his position is critical to interpreting the regulators’ approach. In 2022, Hsu said bank and fintech partnerships were growing at “exponential rates” and without proper oversight, that process “is likely to accelerate and expand until there is a severe problem or even a crisis.” In November 2023, Hsu spoke at a fintech conference and discussed how through these expanding partnerships banks can generate efficiencies and innovation, though there is the potential for “a huge diffusion of responsibility” regarding risk and who is responsible for monitoring it.

Third-party risk management guidelines, which have been in development since 2021, were finalized this year and are designed to address regulatory concerns about the build-up of risk through partnerships. The updated guidance includes some general principles of third-party risk management and highlights that banks are responsible for tailoring their risk management practices to the specific third-party relationship. However, the guidance does state that banks should have stronger oversight and management over relationships that support “critical activities,” which are defined as those that could cause the bank to face significant risk, impact customers, or the bank’s finances or operations. The guidance also states that risks related to third-party relationships follow a life cycle, including planning, due diligence and third-party selection, contract negotiation, ongoing monitoring, and termination, and that banks must follow steps to manage risks at each stage.

Recent enforcement actions by both the FDIC and OCC underscore the gravity of non-compliance for banks and key areas of focus for bank regulators.

OCC Enforcement

Over the past year, the OCC has entered into consent agreements with Blue Ridge Bankshares Inc. (BRBS) and Vast Bank to address their engaging in unsafe and unsound practices and risk management related to fintech partners. Blue Ridge Bank needs to submit plans to onboard new third-party fintech partners or offer new products or services through existing fintech partners and receive non-objection from the regulator. Vast Bank must submit to the OCC a “written plan for adding new, modifying existing, or expanding existing product and service offerings.” Vast Bank must also address any risks from its partnerships with third parties and share details about “how the Bank selects, assesses, and oversees third-party providers.”

FDIC Enforcement

Since March, the FDIC has entered into consent agreements with Cross River Bank and First Federal Bank regarding unsafe and unsound banking practices related to relationships with third-party partners. Cross River Bank must obtain FDIC approval before offering new credit products, entering into new third-party agreements, or allowing new third parties to offer credit products. First Federal Bank (a subsidiary of First Northwest Bancorp [FNWB]) must get approval before offering any new bank products or contracting with new third parties.

Potential Industry Impacts

The increased regulatory focus on these partnerships will impact banks and their partners.

Capstone believes that banks should largely view third-party partners as extensions of themselves. The banks’ partners are required to follow the same rules as they are, and it is up to the banks to monitor that compliance. Because fintech partners are often early in their life cycle and lack fully built-out compliance operations, banks may have to take a more proactive role in monitoring partners in this space.

For bank partners, the increased supervisory scrutiny will require a more rapid maturation of compliance functions to make them more closely resemble those operated by banks. Bank partners, particularly fintechs that may rely on a single partner, should also consider diversification or contingency planning in case their bank partner is limited by enforcement actions that delay rollout of new products. Affirm, for example, announced last February that it would transition most loan origination from Cross River to Celtic Bank. While there has been no formal indication that this transition was related to the forthcoming enforcement action or just fortuitous timing, it underscores the flexibility fintechs may need if bank partners face penalties or further scrutiny.

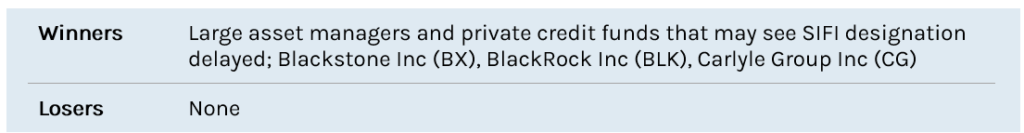

FSOC Unlikely to Designate Nonbank as Systemically Important in 2024

Capstone believes despite the finalization of two proposals to resuscitate an Obama-era authority to subject nonbank financial firms to increased regulatory oversight, there is a relatively low chance of any firm being targeted by the Financial Stability Oversight Council (FSOC) in 2024. In early November 2023, the FSOC unanimously voted to finalize two proposals initially released in April 2023 that resuscitate an Obama-era authority to designate nonbank financial institutions as systemically important financial institutions (SIFIs). One proposal focuses on how FSOC views financial stability risk at an institution and more broadly (the Risk Analytic Framework) and the other, the Designation Guidance, allows FSOC the authority to subject a nonbank firm to enhanced prudential standards (EPS), which would entail enhanced oversight by the Federal Reserve in conjunction with a firm’s relevant regulator.

When designating a firm, FSOC will lean on its Risk Analytic Framework, which codifies how the Council sees financial stability risk posed by a particular firm. Firm leverage, liquidity risk, and interconnectedness are metrics that FSOC uses to determine if a firm poses substantial financial stability risk. Notably, these proposals interpret financial stability risk far more broadly than the 2019 versions,.

If FSOC wishes to designate a nonbank SIFI, it can do so through a two-stage process: an initial stage where staff may flag a potential designee for a series of internal FSOC committees and a secondary, more senior, and longer stage. In the first stage, using publicly available and regulatory data, the internal FSOC committees will review and vote to move the firm to a second stage. If they vote to do so, the company must be informed within 60 days (the guidance also notes that the Council will alert the company’s primary regulator in tandem). The second stage is far more intensive and involves a robust and in-depth review of the company’s activity, as well as considerations as to whether the risk can be mitigated outside a designation. Should FSOC decide to designate after a second stage, a two-thirds vote of the Council is required to issue a proposed determination, which the company may request a hearing to contest. Another two-thirds vote is required for a final determination of designation.

During the Obama administration, four firms—three insurers and a banking subsidiary of a large US conglomerate—were designated as SIFIs. Of the four designations, three were rescinded and another, MetLife’s, was removed per the ruling in FSOC v. MetLife (2016), a case brought by MetLife against FSOC on grounds that the designation methodology was faulty. Based on recent statements from members of FSOC, which is comprised of the heads of US financial regulatory agencies and chaired by the Secretary of the Treasury, we initially believed that larger nonbank financial firms, such as private equity funds and mortgage servicers, were at risk for designation once these proposals become implemented. However, based on recent diligence, we believe mortgage servicers are less likely to receive a designation, considering they are relatively small compared to other nonbank financial firms and not nearly as concentrated. Top mortgage servicers are considerably smaller than companies that oversee large private equity funds, such as Blackstone Inc. (BX), Carlyle Group Inc. (CG), and BlackRock Inc. (BLK), which manages mutual funds and exchange-traded funds. These fund managers have asset bases in the hundreds of billions of dollars in comparison to large mortgage servicers, such as Mr. Cooper Group Inc. (COOP), which has an asset base of just under $15 billion. Considering these asset managers are not only bigger asset-wise but also more publicly recognizable, we believe it is more likely they would be potential targets for designation. Notably, because FSOC is comprised of the heads of US financial regulatory agencies, targeting private credit funds and asset managers for further regulation would comport with broader banking regulatory efforts and potentially address concerns that bank regulations may push risk into nonbank sectors. It would be a more palatable argument for FSOC to designate a large, recognizable private fund instead of a smaller mortgage servicer to claim a political win.

While we think large asset managers and private firms are more likely to be the target of any SIFI designation effort, we believe a designation is unlikely in 2024. Any designation would be the culmination of several months of work throughout both the staff and principals’ levels. For example, when Prudential was designated in 2013, it took three-and-a-half months for the proposed designation to become a final determination (cognizant that much more time not known to the public was involved in the decision). The initial proposed determination was made on June 3rd, 2013, a hearing was requested on July 2nd, 2013, and held on July 23rd, 2013, and the final determination was made on September 19th, 2013. The FSOC guidance rule had been finalized more than a year before. The timeline to designation under the recent proposals is lengthy and presents multiple opportunities for a designee to elongate the process through hearings.

Additionally, we believe competing priorities in the financial regulatory community, such as the finalization and implementation of Basel III Endgame rules or the finalization and implementation of climate disclosure rules at the Securities and Exchange Commission, will lessen the chance of a nonbank SIFI designation, which is an already long and resource-intensive process. Given competing priorities and an upcoming election, we do not believe there will be a nonbank designation before the 2024 general election.