Capstone believes several rulemakings and legislative proceedings designed to inject more competition in the animal processing industry will face continued delays, as consensus on how to best reform the industry eludes lawmakers. Over the last decade, large meatpacking corporations have come under scrutiny for anti-competitive behavior, collusion, and unfair treatment towards farmers, which has been further highlighted by all-time high retail protein prices buoying processors’ margins while farmers struggle to make a profit. Consolidation has put the animal processing industry under the control of a handful of companies—including Tyson Foods, Inc. (TSN) and JBS SA (JBSS3)—leaving farmers with few sales outlets for their livestock and poultry.

While regulators and lawmakers agree something needs to be done to help inject more competition into the industry and boost farmers’ income, there is little agreement on how to help. This means large processors are unlikely to face considerable regulatory or political headwind at a time when market dynamics for meat processors are favorable.

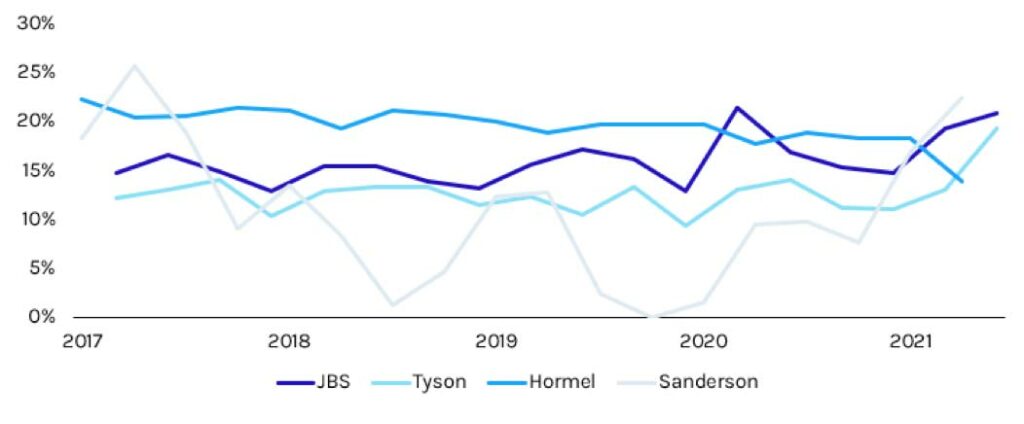

Historical Margins of Top Beef, Pork, and Poultry Processors