June 10, 2023 – Capstone believes French wealth managers and other distributors and managers of investment and savings products, including insurance-wrapped products, will have to lower product pricing following forthcoming requirements to offer “value for money” and a ban on “undue” costs as part of the EU Commission’s retail investor strategy (RIS).

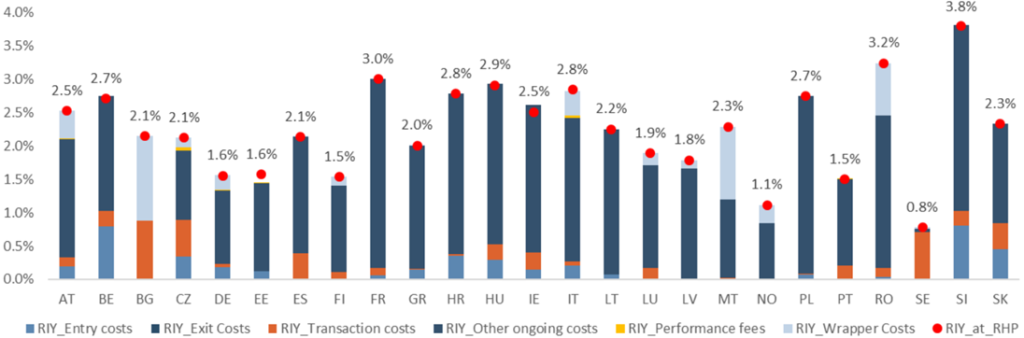

In the European savings and unit-linked market, France is among the most expensive on a weighted average cost basis and, therefore, more likely to have to adjust product pricing downward. However, even in countries with lower average pricing, we anticipate a regulatory crackdown on product pricing as evidenced by the German regulator BaFin setting strict requirements in terms of value for money.

Unlike price caps, value for money requirements are anticipated to focus on outliers compared to products with a similar risk/return profile. Regulators across the European Union, including those in France, continuously stress the cost difference between actively managed funds and index funds such as exchange-traded funds (ETFs), in particular when the latter achieve higher returns with significantly lower costs.

Data gathered by the French Senate Finance Committee in 2019 show that the French market is characterized by high management fees that are among the highest in Europe. However, the costs reflect only part of the total cost borne by the savers and additional costs apply.

Unit-Linked Weighted Average Cost by Member State (2021)

Source: EIOPA 2022 Consumer Trends Report