Capstone believes Q3 2021 earnings reports for consumer finance companies, when viewed as a whole, paint a picture of the gradual return to normal borrowing behavior for US non-prime consumers. As many COVID-19–related stimulus programs and policy protections expire, we see ongoing normalization across key metrics in the consumer lending industries—with a recovery in loan originations and a worsening of loan performance, as shown by higher delinquency rates and indications of pending charge-offs. One of the four key trends from earnings we think investors should monitor is rising delinquencies.

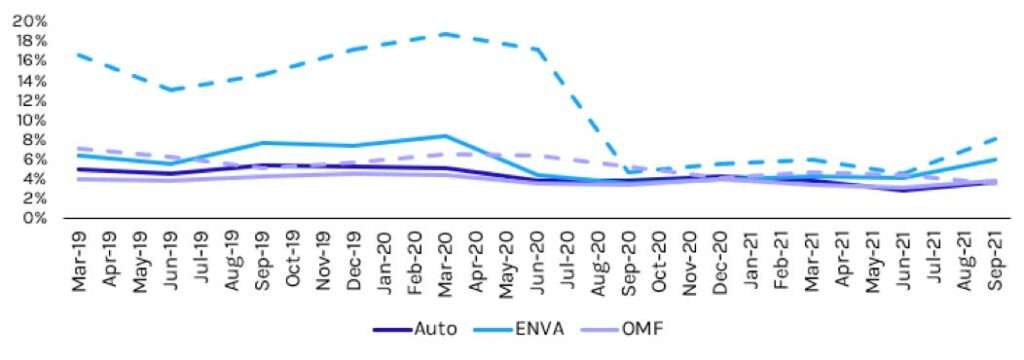

After benefiting from flexible loan accommodations, federal aid, and economic stimulus, a more “normal” number of consumers is now struggling to pay off debt. Third-quarter earnings indicate that 30+ day delinquency rates are increasing, although they have not yet transitioned to default. OneMain Financial (OMF) and Enova International Inc. (ENVA), both of which primarily offer installment loans, saw upticks in delinquencies in Q3 2021. This was consistent across the subprime auto loan industry as well. As consumer borrowing behavior gradually recovers, we anticipate that delinquencies will continue to rise and transition to defaults in the coming quarters.

Delinquency Rates March 2019-September 2021

Note: Solid lines represent delinquencies of 30+ days and dashed lines represent net charge-offs. The gray line shows monthly 60+ day subprime auto delinquencies.