We expect risk from antitrust lawsuits relating to algorithmic pricing to broaden beyond real estate and hospitality, posing headwinds for pricing software firms and their customers across multiple industries. Risk is driven by accelerating private litigation, state legislative changes, and federal regulatory scrutiny. Providers and their customers face potential treble damages, with providers also at risk of material business model changes.

- Federal antitrust enforcers, state attorneys general, and private plaintiffs are increasingly targeting algorithmic pricing tools, most notably RealPage’s revenue management software, alleging they violate antitrust law by enabling anticompetitive conduct.

- Pricing software firms and their customers across a growing number of industries, including construction and healthcare, face increasing antitrust risk. The plaintiffs’ bar is already filing similar algorithmic collusion cases across multiple industries, and we expect this trend to accelerate due to California’s new Cartwright Act amendments. Meanwhile, the DOJ has signaled it will pursue additional cases beyond RealPage.

- Revenue management and benchmarking and data analytics providers face the most risk, with exposure to treble damages and injunctive relief requiring business model changes. Customers may also face liability for knowingly participating in coordinated pricing behavior. The ~$73 billion in estimated private damages in the RealPage case depicts the scale of risk.

Overview

Capstone expects antitrust scrutiny of pricing recommendation algorithms to expand meaningfully in the coming years, increasing enforcement and private litigation risk for a broad range of algorithmic pricing intermediaries and customers beyond the real estate and hospitality sectors, where attention has been most concentrated to date.

While the DOJ has long maintained antitrust guidelines on information exchanges, enforcement attention towards shared pricing algorithms first emerged under the Biden administration, which opened a civil antitrust investigation into RealPage in 2022 amid allegations that its pricing software facilitated coordinated rent increases among multifamily property managers. The DOJ later filed suit based on these findings and ultimately settled the matter, while parallel actions by state attorneys general and multiple private class action cases asserting similar theories remain pending.

The core theory of harm in the RealPage matter—algorithmic collusion—is that RealPage and participating property managers violated federal antitrust law by unlawfully exchanging non-public, competitively sensitive information via RealPage’s revenue management platform. The claims allege a hub-and-spoke conspiracy in which RealPage acted as the central intermediary (hub), aggregating and disseminating competing property managers’ (spokes) competitively sensitive pricing and occupancy data in a manner that reduced independent decision-making and stabilized and inflated rents across participating properties.

Following the DOJ’s initial probe into RealPage, parallel theories of algorithmic collusion began to surface in the hospitality sector, and a series of class action lawsuits advancing similar hub-and-spoke allegations were filed against casino-hotel operators in Las Vegas, Nevada, Atlantic City, and New Jersey. Luxury hotel brands, including Marriott International Inc. (MAR), Hilton Worldwide Holdings Inc. (HLT), and Hyatt Hotels Corp. (H), have likewise faced class action litigation for alleged similar conduct, with mixed results thus far.

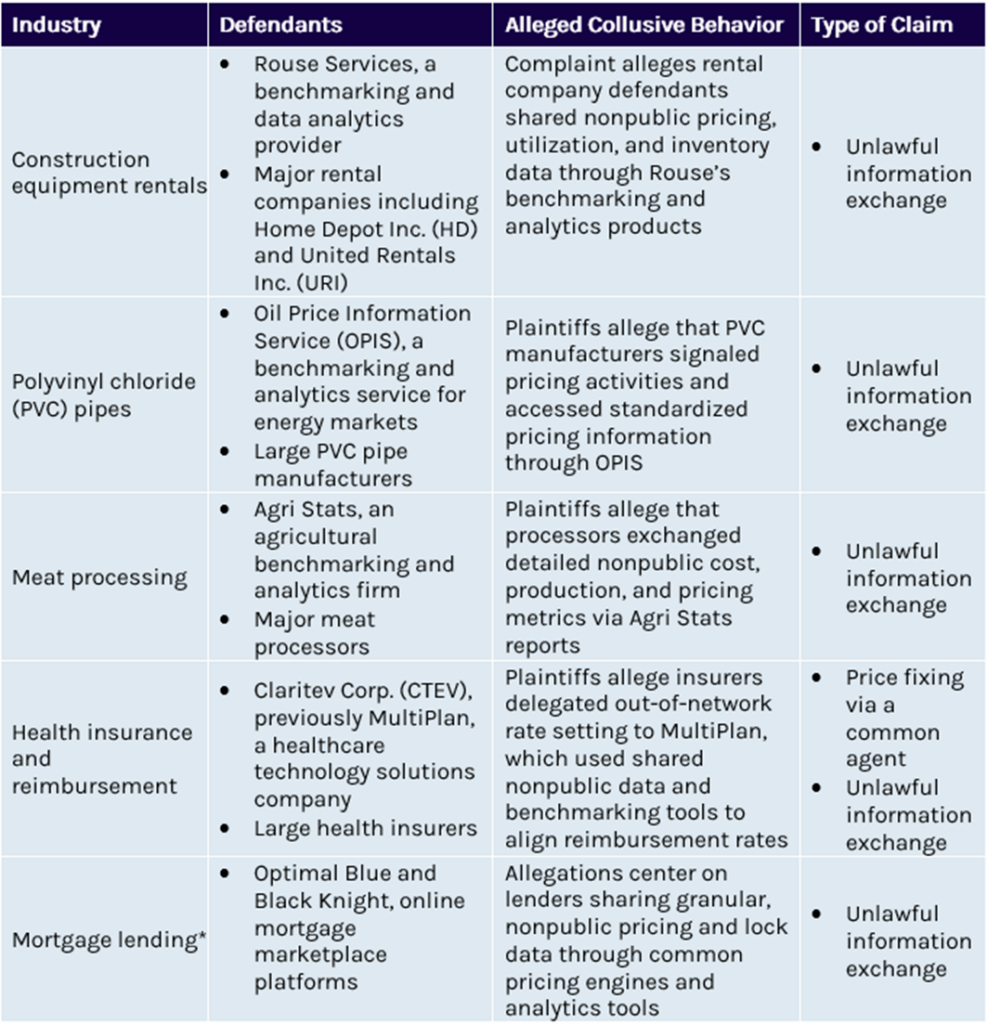

Outside of real estate and hospitality industries, private plaintiffs have begun advancing analogous claims against a wider range of defendants (see Exhibit 1). Based on recent public reporting, we believe pricing recommendation tools in sectors including airlines, business-to-business (B2B) sales, higher education, and short-term rentals are potential targets for future litigation.

Exhibit 1: Ongoing Private Class Action Antitrust Cases Involving Algorithmic Collusion Claims Outside of the Real Estate and Hospitality Industries

Source: Capstone analysis

*Note: While the price-fixing case against Optimal Blue is adjacent to the real estate industry, we view it as part of a second wave of litigation that extends beyond the early focus on RealPage and casino-hotel/luxury hotel operators.

Expect More Private Litigation Alleging Tacit Collusion Across Industries

Over the next two years, we expect a marked increase in private class action lawsuits based on theories of algorithmic collusion targeting pricing intermediaries and their customers across a range of industries. Several developments are likely to drive this surge in litigation activity:

- California Cartwright Act amendments: Amendments to California’s Cartwright Act (AB 325), effective January 1st, establish the first statutory regime to expressly treat algorithmic collusion as unlawful anticompetitive conduct. Critically, the law lowers the pleading burden for conspiracy claims by eliminating the requirement that plaintiffs prove companies are not simply engaging in independent, parallel conduct. Whereas prior California precedent largely tracked the federal pleading standard articulated in Bell Atlantic Corp. v Twombly (2007)—requiring “plus factors” to distinguish collusion from lawful parallelism—the amended statute requires only factual allegations that plausibly support the existence of a conspiracy. As a result, algorithmic pricing claims are more likely to survive motions to dismiss, increasing the attractiveness of California state courts as a venue for these cases.

- Affordability-driven legislative momentum: Rising political pressure regarding affordability—particularly ahead of the midterm elections—is likely to spur additional state and local legislative activity targeting algorithmic pricing tools. While the more than 50 affordability-related bills introduced last session were largely focused on rent-setting, we expect some states to consider broader, industry-agnostic legislation modeled on California’s approach. This environment may embolden state attorneys general, as well as private actors, to pursue enforcement actions targeting pricing intermediaries outside of the real estate context.

- A motivated antitrust plaintiffs’ bar: A well-resourced and increasingly specialized plaintiffs’ bar, attracted by the availability of treble damages and associated attorneys’ fees, will continue to fuel private litigation. A key example is plaintiffs’ success in recouping ~$150M in settlements with property managers in the RealPage private litigation more than two years before the case was slated to proceed to trial. Federal enforcers’ public support for plaintiffs’ theories in algorithmic collusion cases further lowers the perceived risk of bringing these suits.

Trump Administration Regulators Likely to Broaden Scrutiny of Third-Party Pricing Algorithms

Although the cases against RealPage and Agri Stats were initiated under the Biden administration, we expect federal antitrust enforcers to remain focused on theories of algorithmic collusion, especially given the Trump administration’s affordability priorities. Assistant Attorney General (AAG) Abigail Slater has noted that “[a]s pricing algorithm systems become more prevalent across our economy, we anticipate that the number of investigations involving these shared algorithms will grow.”

We see strong signals that the current administration will continue to scrutinize third-party pricing algorithms. Most notably, the DOJ’s March 2025 statement of interest filing in the MultiPlan case in support of the plaintiff’s claims suggests continued scrutiny of anticompetitive conduct, including amongst current Antitrust Division leadership. Similarly, the DOJ moved to participate in the Ninth Circuit oral argument in support of the plaintiffs in an appeal involving alleged algorithmic price-fixing by casino-hotel operators. Publicly, DOJ officials have emphasized that labeling conduct as a mere “information exchange” should not be viewed as a means of insulating businesses from potential antitrust liability.

We also expect the Trump administration DOJ and Federal Trade Commission (FTC) to continue weighing in on private litigation, as the Biden administration frequently did, which could further catalyze plaintiffs’ bar activity. The FTC’s recent probe into Instacart’s (Maplebear Inc. (CART)) surveillance-pricing practices underscores that algorithmic pricing is a priority for federal regulators, even where the conduct at issue does not constitute price-fixing per se.

Readthrough to Pricing Software Providers

We believe antitrust risk associated with algorithmic pricing products will rise materially, even as the underlying legal theories remain largely untested in court. Across industries, the applications most exposed to litigation tend to share several common features, including but not limited to:

- Pooling of competitively sensitive information: Requiring customers to submit competitively sensitive information (CSI) as a condition of using pricing software was central to the DOJ’s case against RealPage. Importantly, California’s amended Cartwright Act does not distinguish between public and non-public CSI, meaning liability can attach even where the information is publicly available, so long as it relates to core competitive variables such as price or output. The RealPage consent decree’s requirement that input data be at least 12 months old suggests that reliance on more recent information is increasingly viewed by enforcers as an antitrust red flag.

- Highly concentrated end markets: Pricing intermediaries with significant penetration in concentrated markets are more susceptible to allegations that their products facilitate coordinated outcomes. In enforcement actions, agencies typically advance the narrowest legally defensible market definition, making it easier to establish market power and anticompetitive effects.

- Coercion or inducement factors: Product features that encourage or effectively require adherence to algorithmic recommendations—such as automatic acceptance of pricing outputs—can be characterized as coercive conduct under the Cartwright Act. These features also heighten federal antitrust exposure under Section 1 of the Sherman Antitrust Act by diminishing independent decision-making and strengthening theories of joint delegation to a common agent.

Beyond the business-model risk associated with potential injunctive relief, exposure to treble damages and civil penalties arising from private federal and state actions presents substantial financial risk. While an upper-bound estimate, the roughly $73 billion in estimated potential private damages stemming from litigation against RealPage illustrates the scale of risk that firms accused of algorithmic price fixing may face.

What’s Next

The proposed consent decree in the RealPage case still requires federal court approval under the Tunney Act. Separately, in the private multi-district litigation (MDL), the key milestones to watch are the quarterly settlement-status reports, where the next filing could offer insight into whether additional settlements are imminent.

Progress across other private class actions varies significantly, but most remain in the motion-to-dismiss stage. If a case survives dismissal, the typical next steps are discovery, class certification, summary judgment, and potentially a jury trial. If fully litigated, these matters could extend for several years.

Read more from Capstone’s TMT team:

Too Big to Hide: Why Big Tech Platforms Will Face Continued Scrutiny

The Great Chip Chase: Implications of the Trump Administration’s Strategy to Win the AI Chip Race with China

The Banks Strike Back: Traditional Finance Muscles into Crypto