Capstone and Holland & Knight hosted a breakfast for private equity (PE) investors on December 9th in New York City, recapping state legislation impacting PE ownership in healthcare. Capstone has been closely tracking state-level regulations and legislation throughout 2025, which saw a record number of states introduce healthcare transaction notice/approval laws and stricter CPOM legislation.

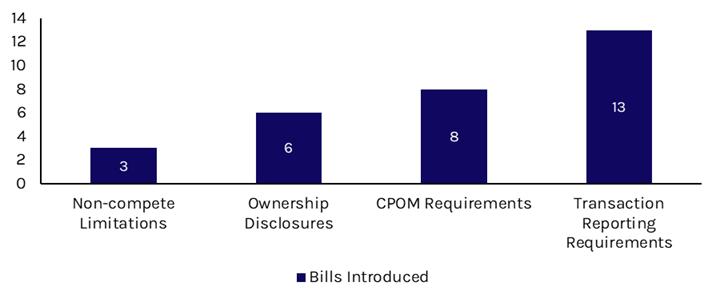

- 2025 saw a surge in new PE ownership bills across several states, with a renewed focus on transaction notice and approval laws as well as corporate practice of medicine (CPOM) laws.

A record number of states introduced healthcare transaction notice and approval laws in 2025, a trend we expect to continue as states assume a larger role under new leadership at the Federal Trade Commission, which has shifted the spotlight away from PE investment in healthcare. In addition to healthcare transaction bills, states also began considering more onerous CPOM laws, with Oregon and California both passing relevant legislation earlier this year (SB 951 and SB 351, respectively).

Exhibit 1: 2025 Legislative Activity

Source: Holland & Knight analysis

- As a major financial hub, New York naturally stands out when it comes to legislative efforts affecting investments. The state has distinguished itself in the current landscape surrounding PE ownership in healthcare, with its material transaction disclosure law and strict CPOM framework, as well as the introduction of a veterinary clinic bill earlier this year.

New York has remained at the forefront of the current PE ownership legislative landscape, having enacted a “material transaction disclosure” law in 2023 that requires healthcare entities, including physician practices and management service organizations, to submit notice and supporting documentation to the State Department of Health at least 30 days prior to closing.

Building on this framework, earlier this year, New York introduced AB 9042, which, if passed, would require entities acquiring veterinary clinics to notify and submit documentation to the state Department of Agriculture and Markets of any transaction involving a “material change” 14 days prior to closing. Unlike the Disclosure of Material Transaction law, AB 9042 empowers the attorney general to block veterinary transactions it deems to be contrary to the public interest.

These developments are underpinned by New York’s well-earned reputation as one of the strictest CPOM states. New York has long been the barometer for CPOM enforcement, which is firmly established through a combination of laws (e.g., education law, business corporation law, public health law) that have been further reinforced and defined through agency guidance and case law.

- The first few weeks of January will be key in assessing how the legislative landscape for 2026 will shape up, as state legislative sessions commence.

We believe that state-led efforts to regulate private equity ownership in healthcare will continue into 2026. With most states beginning their legislative sessions in January, additional bills will likely be introduced.

- While future developments remain uncertain, current legislative efforts appear to be aimed at increasing visibility and transparency around healthcare transactions and studying their effect on the cost, quality, and access of care, rather than seeking to prohibit them outright.

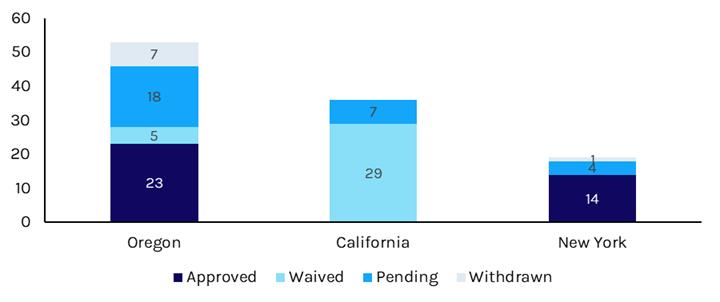

We believe states are prioritizing the collection of transaction records to ensure transparency and awareness, aiming to better understand their impact on healthcare costs, quality, and financial stability, rather than to block deals outright. Since the implementation of their respective transaction laws, our analysis shows that transaction reviews in Oregon, California, and New York most often result in approvals or are waived.

These efforts also help capture information on transactions that may fall below federal reporting thresholds.

It remains to be seen whether more transactions will ultimately be blocked, or if any of these laws will evolve to require prior approval where such requirements do not already exist.

Exhibit #2: Transaction Review Outcomes by State

Source: Oregon Health Authority, California Department of Health Care Access and Information, New York Department of Health

- We will continue monitoring any new catalysts, such as stakeholder engagement and health provider financial distress, that shape state trends with transaction notice/approval and CPOM laws.

Capstone and Holland & Knight will continue tracking newly introduced bills, emerging stakeholder engagement, and closures of PE-owned healthcare entities in states where these developments may influence legislation. You can find updated information about all private equity scrutiny legislation on Capstone’s tracker here, Holland & Knight’s tracker here, and Holland & Knight’s year-end report here.