Three years ago, Winter Storm Elliott rattled electric grids from the Midwest to the East Coast, leading to blackouts for millions of utility customers. In PJM Interconnection—the largest Regional Transmission Organization (RTO) in the US, responsible for ensuring grid reliability across parts of 13 states—real-time electricity prices reached over $3,700/MWh—over 100 times the average wholesale energy price in 2024. The day before Christmas saw nearly a quarter of PJM’s generation capacity on forced outage, failing to deliver power when called on by the grid operator. Seventy percent of this capacity was gas. When the dust settled, PJM’s grid operators managed to avoid blackouts, and non-performing generators were penalized $1.25 billion under PJM’s capacity performance framework.

Roughly a year after the storm, the Federal Energy Regulatory Commission (FERC) approved a package of fast-tracked proposals from PJM to adjust market rules incorporating lessons learned from the storm. One big finding: natural gas generators were not as reliable as PJM thought. This led to a reduction in accredited capacity for both combined cycle and combustion turbines, meaning a smaller portion of power generators’ nameplate capacity “counts” for reliability modeling.

Just like that, a technical fix became a political fault line, and what looked like market plumbing became a national, multidimensional issue. Back then, few could have predicted the massive ripple effect this change would have across state capitals, Fortune 50 boardrooms, kitchen tables of everyday people across the 13 PJM states, and, very likely, the 2028 presidential election, by sparking the widespread electric rate affordability debate in the largest US grid.

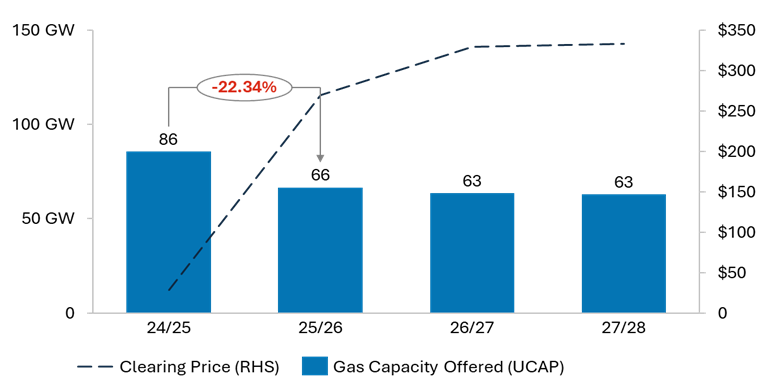

This tweak functionally reduced the amount of gas generation capacity in PJM by over 22% overnight, or 20 GW, in terms of eligible supply for the capacity auction. This reduction in supply on paper, coupled with data center load growth projections, was largely responsible for the 800% increase in capacity prices from the 2024/2025 auction to the 2025/2026 auction, resulting in a record-high price for the third auction in a row.

Figure 1. Gas Capacity Offered and Auction Clearing Prices Following Accreditation Change

Source: PJM

The spike in clearing prices in the 2025/2026 auction started a maelstrom in PJM, with governors threatening to leave the market, a push to re-regulate generation by investor-owned utilities, and a two-year price collar to control consumer costs. Some utility analysts have suggested that the most recent $333/MW-Day record clearly necessitates drastic, structural changes to the capacity market, such as bifurcating the auction for new and existing generators or mandating curtailment for new data centers during grid stress.

Capstone does not expect such fundamental reforms to materialize due to the hurdles they face. Given the Trump administration’s clear focus on providing speed to market for AI data centers and supporting existing thermal generators, as evidenced by FERC’s recent order on data center co-location in PJM and ongoing proceeding over large load interconnection, we do not think FERC would support major reforms that only prioritize new power generation while causing years-long uncertainty over market rules.

Instead, we expect FERC to step in and mandate new accreditation standards that boost the reliability value of thermal resources while further eroding the already meager accreditation for renewables, in line with the Department of Energy’s (DOE) July 2025 resource adequacy study and the all-of-government approach toward conventional energy at the expense of renewables. Adding 10-15 GW of capacity back to the supply stack through accreditation changes—in addition to new supply additions and emergency plant retentions by the DOE—would make the 30 GW of projected data center load growth by 2030 significantly less daunting.

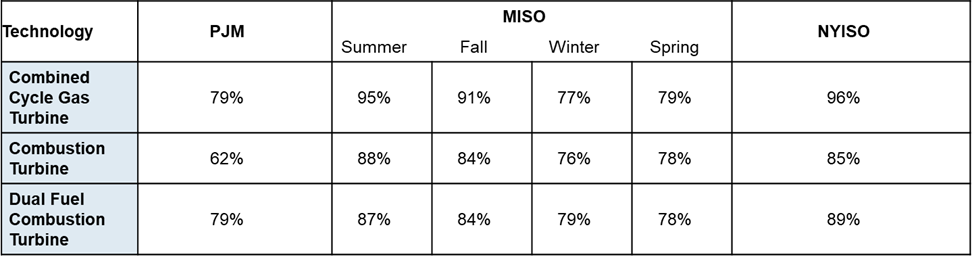

FERC could point to the fact that natural gas has higher accreditation in PJM’s neighboring regions—the Midcontinent Independent System Operator (MISO) and New York Independent System Operator (NYISO)—which use different methodologies for rating capacity, as a model. A new top-down mandate from FERC would also align with President Trump’s April 2025 executive order—which led to the July 2025 DOE study—directing the agency to “accredit generation resources in such conditions and scenarios based on historical performance of each specific generation resource type in the real-time conditions and operating scenarios of each grid scenario.” In fact, PJM is already contemplating more minor changes to accreditation to better account for seasonal performance.

Figure 2. Capacity Accreditation Examples for Different Gas Generation Types in PJM, MISO, and NYISO*

Source: PJM DY 25/26 ELCC Classes, MISO Planning Year 2025-2026 Indicative Direct Loss of Load Results, *NYISO Review of Class Average EFORd Assumption in Margin Assessments, Using State-Wide Derates for Resource Types based on NYISO’s 100% Summer Capacity Accreditation Factor for DY 25/26

FERC moving in this direction would certainly carry potential downsides. Overcorrecting the post-Elliot accreditation changes for thermal power generation would increase the risk of blackouts for 67 million consumers across PJM at a time when hundreds of billions of dollars in AI and data center investment are at stake. However, we believe finding the right balance between reliability and affordability could score a relatively easy victory for the Trump administration without requiring time-consuming, fundamental changes to the market that run counter to FERC’s policy objectives.

Beyond upsizing the reliability contribution of thermal generation, we believe FERC will also explore methods to shift costs away from ratepayers to renewable generators, potentially adopting policies such as the recently finalized “firming” requirements in Texas. This would align with the Administration’s rhetoric that it’s green energy and irresponsible Democratic politics, not data centers, that are responsible for any affordability issues.

While there are no short cuts or “simple tricks” when it comes to balancing affordability, reliability, and economic growth, we believe pressure from the White House to drive down electricity prices ahead of the 2026 and 2028 elections, coupled with the potential benefits for thermal generation and findings from the DOE’s grid analysis, suggest changes to accreditation will likely be on FERC’s agenda in the new year.