October 7, 2024

By Angela Lamari and Hunter Hammond, healthcare analysts

The Inflation Reduction Act made two significant healthcare promises to seniors: the government will 1) negotiate your drug costs lower and 2) cap your prescription spending. Democrats pulled every trick in the book to ensure their landmark legislation passed, burning political capital and weathering the reconciliation storm along the way. However, two years in, the reality is clear: plans and pharmaceutical companies continue to be fine, and the only real loser on this front has been the government.

Two years in, the reality is clear: plans and pharmaceutical companies continue to be fine, and the only real loser on this front has been the government.

To understand the changes the IRA made, it’s simplest to follow the journey from the doctor’s office to the pharmacy counter. When you—as a Medicare beneficiary—bring your prescription to the pharmacy, the pharmacist will ask for your insurance to check whether your drug is covered and what your cost-sharing responsibility is. If the drug is covered, the pharmacist will charge you for your portion and charge the remainder to your insurance company.

In the background, there are two major deals that are made:

- The Government Subsidy Deal: The insurance company does not pay for your drugs out of the goodness of their hearts. Instead, the government contracts and gives the plan a large pile of money—called the direct subsidy—to cover most of your expenses for the year. Then the plan will charge you a small premium for the remainder. If you spend too much money on your prescriptions, the government will step back in and provide “reinsurance” payments to the insurance company to cover the difference.

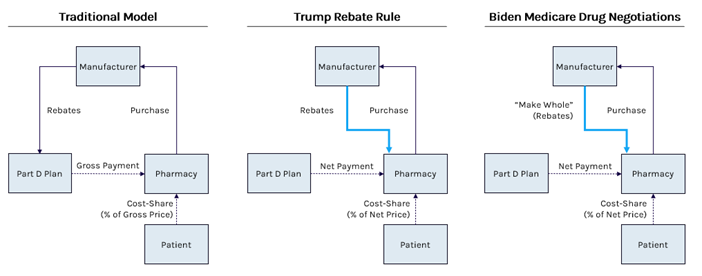

- The Manufacturer Rebate Deal: The insurance company does not pay for drugs at whatever price the pharmaceutical company asks for. Instead, the insurance company will ask manufacturers to offer their best “rebate,” or kickback, in exchange for being included on the covered drug list. The plan compares the offerings and picks the deals that maximize the rebates and results in the lowest net cost. If the plan chooses your drug’s deal, the plan pays the full price at the pharmacy counter, and they’ll hold their hand out to the manufacturer for the discounts.

On its face, the Medicare Drug Negotiation program seems successful: CMS reported negotiated discounts between 38% and 79% off of the 10 negotiated drug prices. However, in reality, these cuts were fairly in line with the discounts the government was already getting through rebates negotiated between the insurance company and manufacturer—resulting in no real savings. If anything, negotiations might be positive for manufacturers as they ensure patient access and relieve them of additional discount responsibility for the restructured drug benefit.

The other ironic truth of negotiations is that because the cut was only from the “list” to the “net” prices, not only did the government not significantly harm manufacturers or generate savings, but the Democratic party unintentionally codified President Trump’s Rebate Rule—the same rule that was delayed to pay for the Inflation Reduction Act itself to pass.

At the end of his administration, President Trump finalized a rule requiring the “rebates” negotiated by insurance companies to flow directly to the patients at the point of sale rather than to the plan. Patients would pay lower costs off of a lower price, and plans would pay the net payment upfront. This was estimated to significantly increase premiums as rebates could no longer subsidize the entire plan’s costs, therefore delay of the rule “generates” savings to fund other legislation.

The negotiation program will replace back-end rebates with front-end discounts. However, to keep pharmacies from suffering, manufacturers will keep their “list” prices the same, the government will pay only the net price, and manufacturers will pay pharmacies the difference. In other words, rebates will go directly to the pharmacies at the point of sale. Congress used the funds from delaying Trump’s rule to pass the equivalent of Trump’s Rule under Biden’s name.

The Medicare Part D redesign similarly, on its face, seems successful: the Biden administration has touted their role in capping patient cost-sharing to $2,000. However, this cap comes at a significant additional cost of higher premiums for both beneficiaries and the government. Policymakers underestimated the significant increase in the direct subsidy they would have to pay plans at the start of the year to cover this increased responsibility.

Following a higher-than-ever bid cycle, the Congressional Budget Office admitted that their projections were wrong and that the redesign will cost $10 to $20 billion more than expected. As the entire plan would be more expensive, patients would also have to pay higher premiums to participate. The administration recognized this fundamental flaw (unthinkable during an election year) and scrambled to use a loophole to cap patient premiums by giving plans even more upfront funds in exchange for their promise not to raise patient costs. The plan worked at the expense of an additional $5 billion per year.

So far, plans and manufacturers continue to be the winners as they have dodged the consequences Congress envisioned and will continue to derive profit from the Medicare program.

So far, plans and manufacturers continue to be the winners as they have dodged the consequences Congress envisioned and will continue to derive profit from the Medicare program. Seniors are neutral as their lowered out-of-pocket costs are offset by the decreased benefits they will have as plans maximize their margins in the new environment. The only real loser is the government—which is left with a nearly incontestable legislation that will continue to inevitably increase costs to the Medicare program.

Angela Lamari, Healthcare Analyst

Hunter Hammond, Co-Head of Capstone’s Healthcare Practice

Read more from Capstone’s Healthcare team:

Signals from Harris’ Healthcare Platform

The New Front in the Private Equity Healthcare Battle: State AGs

How Harris Diverges from Biden on Healthcare Policy