By Ian Tang

Introduction

Capstone believes US-China tensions pose notable underappreciated risks in the upcoming election year for microelectronics manufacturers and platforms selling consumer goods made in China, despite a more stable US-China relationship materializing in recent months.

We believe the Biden administration aims to pursue a measured approach to US-China technology policy issues broadly, including semiconductor export controls. However, the US Congress and Republican presidential candidates will remain a source of pressure and a potential driver for course adjustments towards a more hawkish stance on China. This poses a risk that existing export controls will be interpreted more strictly amid an expected greater focus on enforcement and more frequent updates to restrictions.

We expect the US Department of Commerce to earmark funding for more companies in 2024 under the US CHIPS and Science Act, which is designed to spur reshoring and domestic manufacturing and production capabilities. However, we believe there remains key uncertainty around the timing of subsidy distribution to companies and the intensity of the company-by-company negotiations.

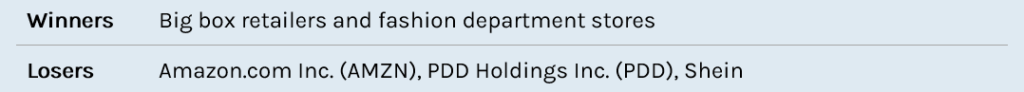

We believe Congress will ramp up deliberations on how to regulate fast fashion digital storefronts and other companies that source textiles from China, adding underappreciated risks for companies including Amazon.com Inc. (AMZN), PDD Holdings Inc. (PDD), and Shein.

The Chinese Communist Party has reacted in a reciprocal manner to changes from the US in the past and will likely respond in kind to US actions going forward.

Commerce to Turn up Heat on Targeted Export Controls, Increasing Review Frequency and Enforcement

China-Related Export Control Updates To Become More Frequent

In conjunction with the carrots offering domestic manufacturing incentives through the CHIPS Act, the US has strengthened the sticks, its semiconductor-related export controls, as it seeks to support and rebuild its position as a global leader in semiconductor manufacturing. The executive branch is sharply focused on leading-edge, advanced computing chips for applications such as artificial intelligence and supercomputing. Regulators are hoping to mitigate the threat of the Chinese Communist Party’s Military-Civil Fusion development strategy, which has shifted how the Commerce Department’s Bureau of Industry and Security (BIS) will levy restrictions moving forward. For example, while the BIS’ October 2023 interim final export control rules close gaps and workarounds developed over the last year, they also relax licensing requirements for consumer electronics, reflecting the administration’s desire to take a measured and targeted approach.

During a fireside chat at the annual Reagan National Defense Forum (RNDF) in early December, US Secretary of Commerce Gina Raimondo affirmed the agency’s tough stance on enforcing existing export controls. Still, her remarks were consistent with the Biden administration’s overall strategy and recent actions that have underscored its pursuit of “managed competition,” stating that the US must “meet the moment… the world needs us [the US] to manage our relationship with China responsibly to avoid escalation.”

Secretary Raimondo showed restraint in answering questions about how the US will update export controls in the future and ensuring that the US does not go “too far.” Some of the tools that the US has relied on (for example, the Entity List, which specifies entities subject to controls) will likely become less important as regulators look to establish a more extensive approach. In advocating for country-wide controls, Secretary Raimondo acknowledged that enforcement is otherwise “whack-a-mole” in nature, given that new businesses/subsidiaries pop up daily.

Secretary Raimondo identified some areas where the US might extend export controls due to national security risks, including artificial intelligence and cloud computing, as it looks to make the overall program more “muscular.”

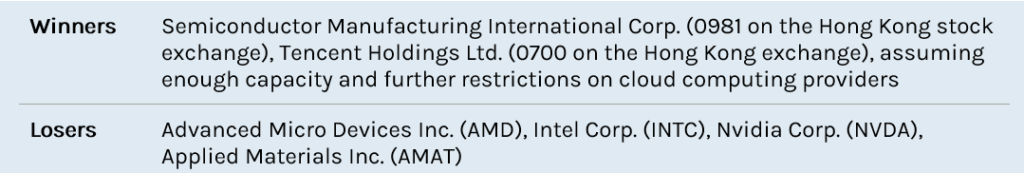

The BIS has promised more routine updates to its China-related export controls, which will create more unpredictability and revenue risk for leading-edge chip manufacturers in the US exporting to China. This poses an opportunity for Chinese manufacturers, such as Semiconductor Manufacturing International Corp. (SMIC, 0981 on the Hong Kong stock exchange) and Tencent Holdings Ltd. (0700 on the Hong Kong stock exchange), which could fill any resulting chip supply gap in China. This could force the Commerce Department to continuously reassess how restrictive US export controls are. For now, BIS has suggested at least an annual review. Additional clarifications are likely to come in January 2024.

Chinese regulators have seemingly improved their relations with Micron Technology Inc. (MU) in recent months, while the Biden administration is also seeking to minimize the potential for miscalculation from either side.

The US is working to develop a more permanent forum to work routinely with allies on refreshing export controls on a more regular cadence. Although Japan and the Netherlands implemented restrictions matching those in the US Commerce Department’s October 2022 final rule, they have appeared reluctant to further tighten them thereafter.

Overall, while we believe the US is seeking to take a tailored and measured approach to export controls, we believe pressure from Republicans, such as recent calls by members of Congress to revoke some of the licenses granted to shipments bound for Semiconductor Manufacturing International Corporation (SMIC, 0981 on the Hong Kong stock exchange), poses a risk that the Biden administration could take a more hawkish stance on China ahead of the 2024 presidential election. These calls could result in the Commerce Department turning the dial up on a stricter interpretation of export controls in demonstrating President Biden’s toughness on China, including through decreased granting of licenses, more expansive controls, and more robust enforcement.

Enforcement Program to Ramp Up

We expect the Commerce Department and the US Department of Justice (DOJ) to ramp up enforcement of export controls in 2024, a development that we believe is underappreciated. BIS and the DOJ spent much of 2023 building out their capacities and technical expertise, such as through the launch of the Disruptive Technology Strike Force (co-led by the Commerce Department and DOJ). They have also adopted a more aggressive approach in calculating penalties. For example, the agencies levied a $300 million fine against Seagate Technology Holdings Plc. (STX) in April 2023 in what was widely seen as a bellwether for the government’s tougher enforcement posture. In mid-November, public reporting revealed that Applied Materials Inc. (AMAT) was under investigation for shipments made to SMIC.

Congressional committees are also targeting a revamping of export controls. The bipartisan House Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party’s latest report outlines policy recommendations for the coming year, including the authorization of additional resources and a greater focus on multilateralism. Meanwhile, the US-China Economic and Security Review Commission has requested that the Government Accountability Office study the effectiveness of export controls and the extent of circumvention.

CHIPS Subsidies to be Rolled Out for More Companies, Semiconductor Industry Frontrunners Poised to Receive Bulk of Funding

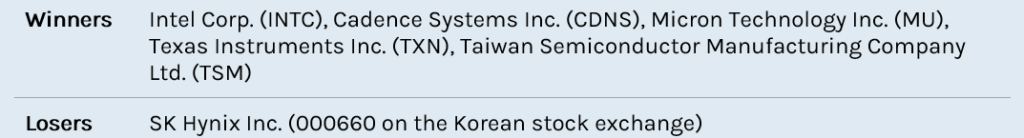

In 2024, we expect the US Department of Commerce to earmark funding for more companies through the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Fund. We expect industry frontrunners, such as Intel Corp. (INTC), to receive the lion’s share of the incentives.

On December 11th, the Commerce Department’s CHIPS Program Office (CPO) announced its first grant under the fund, consisting of $35 million to BAE Systems plc (BA on the London stock exchange) for the buildout and modernization of its Microelectronics Center in Nashua, New Hampshire. The facility, which is US Department of Defense-accredited, will produce mature node chips for the F-35 fighter jet program. The initial award is in line with our expectation that the Commerce Department will issue smaller awards upfront to emphasize the diversity of award recipients while affirming national security priorities.

While news of the first CHIPS Act award is a significant milestone for the program—the original bill for which was signed into law in December 2022—distribution of funds remains months away.

The BAE Systems subsidy agreement involved signing a non-binding preliminary memorandum of terms (PMT), which allows the agency to begin a comprehensive due diligence process and work with the recipient on establishing a final contract, which could lengthen the timeline for subsidy distribution. We believe the Commerce Department will focus on a range of smaller awards before moving to larger grants, in part because the latter group likely requires more complex negotiations. This aligns with the case-by-case review approach outlined in the Final Rule establishing guardrails for the program.

The complexities of the process could deter firms that have conveyed uneasiness about the bureaucracy involved. Though Korean semiconductor manufacturers like Samsung Electronics Co. Ltd. (005930 on the Korean stock exchange) and SK Hynix Inc. (000660 on the Korean stock exchange) have walked back statements to this effect in light of the more moderate final rule on guardrails, the Commerce Department may still impose tough conditions that make the incentives ultimately unappealing.

Secretary Raimondo expects additional announcements between January and July 2024. To date, the CPO and the National Institute of Standards and Technology (NIST) have received over 500 statements of interest. The selection of BAE Systems also demonstrates the criteria previously outlined as key priorities and potential positive factors weighed by the CPO: state and local government matching commitments and tuition assistance/incentives for semiconductor workforce training.

The Commerce Department has also dialed the notch up on conveying the primary objectives of the CHIPS Act funding, emphasizing that the money must be used to bolster defense missions. It is leaning into framing the efforts as a national security initiative first and foremost, which covers the continued development of domestic leading-edge chips, advanced packaging, and current mature chips.

E-Commerce and Apps Affiliated with Chinese-Based Companies Under Renewed Scrutiny, Legislators Will Look Closer at the De Minimis Vulnerability

We believe Congress will ramp up deliberations on how to regulate fast fashion digital storefronts and other companies that source textiles from China, causing underappreciated risks for companies like Amazon.com Inc. (AMZN), PDD Holdings Inc. (PDD), and Shein. Additionally, scrutiny over TikTok’s ownership structure will continue to re-emerge, spotlighting risks that the US government sweeps in other apps owned by Chinese-based companies to its review.

Shein’s filing for an initial public offering and better-than-expected sales data from PDD Holdings Inc.’s Temu over the last year (especially relative to its competitors) are making lawmakers take another look at the goods available on both platforms. In fact, Temu ended 2023 as the most downloaded app on the Apple iPhone. Despite other issues have taken precedence recently, Congress remains highly united in its approach to better understanding the labor processes behind the goods sold on both platforms. One loophole that legislators have viewed as a human rights and supply chain transparency vulnerability is the de minimis exemption. They believe the high $800 threshold allows low-dollar consumer shipments to bypass US Customs and Border Protection (CBP) inspection and thus permits the importation of goods into the US that otherwise would be detained.

The House Select Committee’s 2023 report identified lowering the de minimis exception threshold as one of the top items for its first recommendation to “aggressively counter the People Republic of China’s economic and trade strategy and the harm it inflicts on the United States and the global economy.” Action is unlikely during the last few days of this calendar year, but Shein and Temu’s continued popularity will draw attention back to this issue in 2024. Although legislation to amend the Tariff Act of 1930 (by either removing the de minimis entry exemption for some countries like China altogether or lowering the threshold, as well as requiring additional disclosure requirements and prohibitions for transport via the United States Postal Service) has received bipartisan support, a wide array of stakeholders are likely to continue to mount fierce opposition.

Though concerns with TikTok are somewhat different, Shein and Temu will likely continue to be swept into the conversation regarding user privacy. ByteDance’s ownership of TikTok has resurfaced as a critical national security risk, even as lawmakers remain divided on how to address those concerns. Though Congress started 2023 with intense interest in TikTok and other digital platforms owned by entities headquartered in China, momentum fell off in the second half of the year. Initial enthusiasm for the Restricting the Emergence of Security Threats that Risk Information and Communications Technology (RESTRICT) Act (S. 686) was met with skepticism that it was overly broad and too vague.

Despite continued reporting on potential data security gaps and parent company influence, this has not been sufficient to catalyze legislative action. In a further sign that Democrats are divided over these issues, the campaign for President Biden’s re-election is actively weighing using TikTok for its marketing efforts. TikTok has already received considerable airtime in recent Republican presidential candidate debates. A more risk-based framework for the Department of Commerce, as contemplated in the RESTRICT Act, would open up pathways for the agency to review other consumer apps.

The risk of federal app bans has diminished, easing regulatory headwinds for Shein, Temu, and TikTok. In the absence of federal action, states—especially those with conservative legislatures and/or governors—have tried to get out ahead. In addition to banning TikTok on government-owned devices, Montana and Indiana have attempted to block TikTok’s operations for consumers more broadly. However, courts have viewed these legislative and regulatory actions skeptically.

In November 2023, TikTok prevailed in a lawsuit (case no. CV 23-56-M-DWM) challenging a Montana bill (S.B. 419) that would have effectively banned usage of the app within its borders. The court denied the state attorney general (AG) a preliminary injunction, finding that the bill unduly limits constitutionally-protected First Amendment speech. Also in November, TikTok defeated a complaint in state court by the Indiana AG over user privacy concerns.

Federal courts’ hesitation to uphold a targeted ban will likely slow additional activity from states, while the Commerce Department seems unwilling to move forward with enforcement of its information and communications technology and services (ICTS) rule absent an act from Congress affirming its authorities. The lack of jurisdiction for the Committee on Foreign Investment in the United States (CFIUS) to investigate Shein and Temu insulates them from the most legally sound avenue to ban or force divestiture of a consumer-facing app.