Introduction

Capstone believes the Biden administration’s policy toward China in 2024 will double down on making necessary but underappreciated investments to confront China economically and militarily, all while seeking to carefully avoid ratcheting up tensions with Beijing in the process.

Capstone believes direct public US-China tensions will moderate in 2024, with both countries seeking to avoid intentional and accidental catalysts for conflict. That said, we don’t expect significant changes to the fundamental driver of the relationship—managed competition. We expect emerging US export controls in the run-up to the election to impact US-China competition in the year ahead.

Capstone believes 2024 will also be noteworthy for defense and tech sector investors, as US policymakers, private capital allocators, and key allied countries will increasingly focus on weakening Beijing’s supremacy in defense and critical materials supply chain and boosting allied military capabilities with an eye toward the Indo-Pacific.

Capstone believes that as economic competition plays out in the continued US-China Cold War, business leaders and investors will need to reimagine how global trade can and should be restructured—and how government intervention will restructure trade. Though investors and companies are coming to terms with the change in the US-China relationship, we believe many still do not fully appreciate the potential near- and long-term implications this dynamic has for their investments.

The Public Face of the US-China Relationship to be Carefully Managed

The November meeting between Presidents Xi and Biden underscored both parties’ intent to lower the temperature in the relationship. Make no mistake—China remains committed to displacing the US as the premier global superpower, and Beijing has a minimal appetite for concessions that would dramatically improve bilateral ties. However, neither side is particularly motivated in an election year to fundamentally change the contours of the relationship.

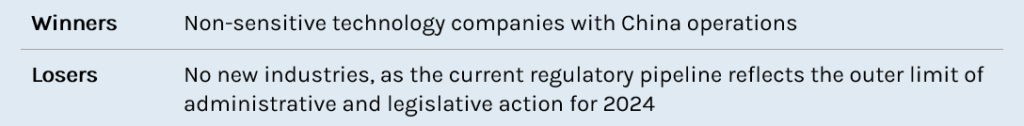

For example, we do not believe President Biden will enact new significant regulatory measures aimed at reducing commerce with China beyond what is already in the regulatory pipeline. The August 2023 Executive Order restricting outbound investment, combined with updated guidance on export controls of sensitive technologies, will likely constitute the outer limit of administration action in the year ahead. We likewise believe Congress, despite bipartisan concerns about China, will not enact further legislative restrictions on US businesses operating in China or on private sector capital allocation.

Biden’s commitment to maintain the status quo—at least publicly—will also likely translate into homeostasis on tariffs and trade generally. However, China trade is one of the few foreign policy issues that resonates in congressional campaigns, and we expect a lot of noise on this subject during the presidential campaigns.

We similarly do not expect a significant shift vis-à-vis Taiwan and cross-Strait relations. Specifically, we do not believe that the post-election Taiwanese government will unilaterally declare independence that would likely force China’s hand into a military reaction. We similarly do not believe that China will invade Taiwan on its own or take other steps that will materially upend the status quo in the region and the position of the United States. This view extends to US economic relations, as well.

This relatively sanguine view, however, should not provide too much comfort for compliance and risk management teams, which should remain focused on emerging export control regimes as a primary vector through which US-China competition will be managed in the year ahead. Both the Trump and Biden administrations relied on export controls – not sanctions – to curb US investment and export of goods in “sensitive” areas, particularly advanced semiconductors and related technologies. We envision further reliance on export controls to curb Chinese domination of key supply chains with national security implications for the US in 2024 and in the years to come.

Finally, the year will end with a US presidential election—which could markedly shift the tone heading in 2025 depending on its outcome. For example, an important factor to consider for many businesses is how tariff policy would shift as a result. Were Donald Trump to win the election, Capstone would expect aggressive use of executive authority to increase tariffs on a wide range of industries. Specifically, we believe as President, Trump would strongly consider increasing Section 301 tariffs on imports from China—a move that would be cast as being “tough” on Beijing.

Full Steam Ahead on the Acceleration of Allied Investment Strategies

Capstone expects to see enhanced coordination among US and allied investors in 2024 to address mutual concerns regarding defense and critical materials supply chain security. We also expect significant investment in advanced allied military capabilities, driven in large part by concerns about the need to enhance allied interoperability and boost allied capabilities to confront China.

The trilateral defense agreement between the United States, the United Kingdom and Australia, known as AUKUS, is an important case in point. The 2024 National Defense Authorization Agreement (NDAA) fully authorizes the agreement and—importantly for the defense sectors of these three countries—also establishes a Canada-level exemption to International Traffic in Arms Regulations (ITAR) for both countries pending the passage of US-equivalent export controls. From a policy perspective, it is viewed as a much-needed reform to US export control regulations to enable a more effective allied fighting force capable of meeting the threats posed by China and Russia. And from an investor perspective, it will enable better defense technology transfer among the three countries and greatly expand market opportunities for classified technologies geared toward the US market into these other countries.

AUKUS is already spurring meaningful activity among the defense investor community. For example, the AUKUS Defense Investor Network was launched in early December, which will bring together over 300 institutional investors from the US, the UK, and Australia to invest in solutions required to meet critical security challenges, including in artificial intelligence (AI), quantum, undersea capabilities, hypersonics, and others. Individual firms are executing on similar investment theses, including Cerberus Capital Management, which earlier this year announced a $2.5bn fund to invest in national security and supply chain-related businesses, driven specifically by the direction of US policy. Andreessen Horowitz this year also launched its American Dynamism practice, which is focused on investing in the US national interest, which it defines as aerospace, defense, public safety, supply chain, and others.

The US government is also looking to better leverage private capital to better compete with China in other ways, as well. For example, the May 2023 White House announcement of the Partnership for Global Infrastructure and Investment (PGI) at the G7 Summit not only made it clear that the US government plans to more directly compete with China’s Belt and Road Initiative, but that it also launched an annual investor forum intended to “more comprehensively de-risk capital” and “play a matchmaking role between investors and opportunities that advance PGI”. That first investor forum was held in September 2023, and was also followed by a PGI and Indo-Pacific-Economic Framework for Prosperity (IPEF) Forum in November focused on increasing private sector investment in the Indo-Pacific Region—a key aspect to successfully building economic resilience against China. Attendees included some of the world’s largest private equity investors, as well as leading corporates. That same month, the US and several allied countries launched the India-Middle East-Europe Economic Corridor (IMEC) which also seeks to spur investment in critical sectors across these countries. To be sure, there are some reforms that Capstone believes are necessary to further accelerate US investment in key industries and infrastructure in critical countries, but we see that these efforts and more are going to accelerate in the year ahead.

Given the well-understood challenges in the US defense industrial base and extensive reliance on China for critical supplies, the imperative—and the policy tailwinds—to build an economy more resistant to geopolitical risk is only growing. Finally, we see this trend enduring well past the 2024 US Presidential election. Indeed, a second Trump administration can be expected to continue strengthening US defense capabilities, including key tools of government to spur the investments necessary to meet the geopolitical challenges of today and in the coming years.