BACKGROUND:

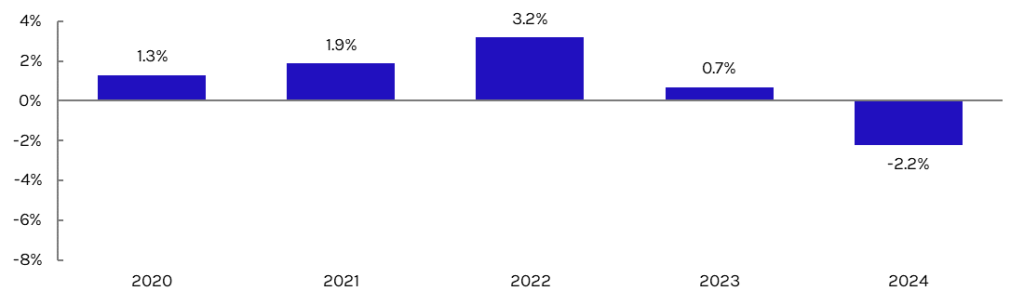

On June 30, CMS released its 2024 home health proposed rule, with a scheduled cut of 2.2% reflecting a 2.7% with a scheduled cut of 2.2% reflecting a 2.7% market basket, a 5.1% permanent cut for behavioral changes, and a 0.2% increase for technical changes. A permanent 1.6 percentage points in additional cuts due to a continued decline in home health visits per episode came as an unwelcome surprise and produced a more negative rule than we had expected. The agency did not propose beginning temporary clawbacks in 2024 and noted timing and methodology would arrive in future rulemaking. Investors reacted negatively to the proposed rule, which is the most negative payment update in recent years. Capstone previously predicted a negative update, albeit one closer to -1% vs -2%. In response to the rule, the National Association for Home Care & Hospice announced a suit against CMS seeking to block the 2024 rule’s implementation and reverse 2023 cuts.

The home health proposed rule will now enter the public comment period. Capstone will be tracking lobbying efforts and pushback from public companies to the forthcoming cut, and gauging Congressional traction for a potential legislative fix. A final rule from CMS is likely to arrive in the final weeks of October or early November, setting the stage for late-year drama as the industry pushes for relief before the final rule takes effect. Capstone will continue to monitor events on Capitol Hill and at CMS for signs of any policy evolution affecting support for the industry.

TRANSCRIPT:

Grace Totman

Welcome to our CMS Home Health Proposed Rule conference call. I’m joined today by Wylie Butler, vice president on the healthcare team here at Capstone, and head of our post-acute coverage, including all things home health. Wylie has been following all things home health incredibly closely in recent months and published a short reaction piece on Friday (June 30, 2023) following release of the 2024 proposed rule. If anyone on this call did not receive that piece or would like to receive additional capstone research, please reach out to your capstone sales representative or myself or Wylie. Today, Wylie will provide his thoughts and response to the proposed rule and an outlook for what comes next. The call will be conducted Q and A style of myself and Wylie. However, we will open it up for questions at the end of the call. With that, we can go ahead and get started. So, Wylie, we can start with the easy question. We saw the release of the rule Friday afternoon from CMS. High level, what happened, and how did this differ from market expectations?

Wylie Butler

Thanks, Grace, and great to be on. I think pre-release of the rule, there was a widespread expectation that this year would be relatively quiet, that you would get a market basket in line with what we’ve seen in hospice and other providers, which occurred, and that we would see mention of clawbacks and potentially a methodology, but that they wouldn’t start in 2024, and that also was correct.

But what was probably the key difference, and I think caught a lot of folks off guard, was the increased permanent cut that’s going to land for 2024. CMS had signaled this was possible in prior rulemaking, but they’ve continued to take a look at utilization and billing patterns. What they saw between 2021 and 2022, which was the most recent year of data available, was that you can see a continued decline in visits per episode for home health providers. And that’s really been the crux of all of the cuts in the patient-driven groupings model. You see that relative to the old system, which was all fee-for-service, that these patients on a case-by-case basis are essentially just receiving less visits per episode, and so in CMS’s eyes, they should be paying less for each of these total episodes. That was the major change. It led to an additional 1.6 percentage points in cuts. It does have some flow-through effects to clawbacks in the future. But I think for now, folks will just be very focused on what we can change administratively or through Congress this year.

Exhibit 1: Medicare Home Health Updates, 2020-2024, Proposed

Source: Capstone analysis of CMS rulemaking

Grace Totman

That’s a super helpful summary. You hinted at it at the end here, but what is industry asking for in the wake of relief? Are they asking for relief from CMS, relief from Congress, or bit of both?

Wylie Butler

I think it’s going to be a bit of both. You saw before the rule, while it was actually still at OMB, there was a push for home health to get some forecast error relief. So essentially, CMS is putting dollars back into the system to adjust for the fact that for home health, like many other payment systems during COVID, the market baskets have just been below true inflation. CMS has shown that after the fact, they can recognize their mistake, but it doesn’t actually go into the system. Maybe in the long term these even out, but for now, you are just essentially factoring in losses for home health because CMS underestimated inflation during the pandemic. That obviously did not come through in the proposed rule, and I think was always a bit of a long shot, even if it’s logical.

So now the push comes two-fold. First, on the regulatory front, we might see an attempt similar to what you saw last year, where the stakeholders come forward and ask CMS to spread this cut out over multiple years. I think it’s certainly possible, but I think it’s hopefully a lower likelihood than you saw last year just because of the size of the cut that’s coming through. They just got this relief. I think the issue is CMS is rather constrained on the type of relief they can provide. You can spread these cuts over time, but it’s not truly wiping the slate clean. And as they pointed out last year, it ends up inflating the market basket on the back end, so you’re just squeezing one end of the balloon.

The much bigger push, and the bill was just reintroduced into the Senate recently, is going to be for Congress to provide relief that could take many different forms. The push last year was initially for there just to be a delay in cuts but that…CMS is required to do them eventually. That way they were able to essentially design a bill that was budget neutral. It seems like the industry has given up on having CMS change their methodology for doing these cuts. That ship has essentially sailed, but there definitely will be arguments or asks for simple dollars in the system, whether that means erasing all the cuts that are currently on the board or providing an additional update to the current market basket.

But I think the fact that they lost out last year on even a budget-neutral bill signals how difficult the ask is for billions of dollars to flow into this system at this time, especially with a Congress that we spent so much time on just a couple of months ago discussing whether or not we would head to debt ceiling. So it’s certainly shaping up to be a difficult push these next six months ahead of this rule being implemented.

Grace Totman

When can we expect the final rule, and what are your early expectations for final and ultimate implementation versus proposed?

Wylie Butler

We’re in the public comment period, likely seeing a final rule in late October/early November. I think, unlike last year, you’re a lot less likely to see significant changes. So last year, the two major changes were: One, you got your cut spread out over two years. That was a great relief. But then also last year, we were (and are still) in a high inflationary environment, but inflation is now flat to declining. And so you’re not going to get this percentage point win on the market basket. I think you can go ahead and see the 2.2% cut as very similar to what the final is going to look like.

Ultimately, I think that from where we stand today, it’s highly unlikely that Congress intervenes. In the past, home health benefited from either being in line with many other providers asking for relief or it was tied to the pandemic, but it always has been when it comes to receiving relief, been more of a Democrat-funded exchange. Last year they weren’t able to get the Republicans support they needed in the House or Senate, and now you have a Republican-controlled House. It just feels even more unlikely relative to last year.

Grace Totman

Anything you’re watching for in the comment period as we see comments from industry come in over the next couple of months?

Wylie Butler

Yeah, there is the window for relief, and we talk about this a lot with any Medicare or Medicaid rule, is if CMS begins to believe that they’re restricting access to care, then you see a lot more potential for relief. This year, they showed that the decline in fee-for-service beneficiaries using home health was rather pronounced. I think it came out to about 5-6%. Keep in mind that the fee-for-service population as a whole is also declining because almost all new beneficiaries are going into Medicare Advantage, so you can attribute about half of that to just AMA population movement and CMS not having utilization data there. But there was a section where CMS essentially laid out a series of bullet points saying, “Okay, utilization is declining. Should we be concerned about this? Why is it declining? Are home health companies struggling to pay their aids compared to other settings?” It’s very low hanging fruit for a lobbying push. It doesn’t mean that the agency by any means has the power to wipe the board for these cuts or make significant changes.

But I do think that you’re going to see, in the wake of this proposed rule and then probably immediately following the final, a huge push using that section of the public comment period. Obviously, it’s difficult that with a final rule landing in early November, you have this two-month gap to shoot for a fix and you also have Congress trying to be home by Christmas, so there’s a narrow timeline. But it’s certainly possible, and it seems like the agency was extending an olive branch after these last few years of cuts, even if they have their hands relatively tied there.

Grace Totman

Obviously, this rule is primarily focused on 2024, but with the clawback still outstanding, how do you think that this is going to affect rulemaking in the future years to come?

Wylie Butler

We have been playing around with some of the estimates here a ton since the release of the proposed rule. I think our expectation is still that you ultimately see clawbacks come around in 2025 as long as there’s not another new permanent adjustment, and that they take a four-year phase in approach similar to what we’ve seen in other payment systems with major changes. But what’s interesting is that because there’s a new permanent adjustment, the size of the clawback balloon should be going up. But because the fee-for-service population and utilization are declining, it’s actually lower than my expectations ahead of the proposed rule.

The Catch-22 there is that while the total size of cuts to be made is marginally smaller, you’re also going to be taking it off of a significantly lower spending total for home health. So we now spend significantly less in home health as part of fee-for-service, and so in order to claw back $4 billion-$4.2 billion worth of cuts, we’re going to be taking a higher percentage than I would have expected ahead of the proposed rule. We’re still…trying to think about exactly how that’s going to play out, but it does appear to be in the 22-24% range, and I think that that’s going to be significant in years to come.

Because they are temporary adjustments, the math definitely gets interesting where you end up with a little bit of a slingshot at the end of the phase-in period. But whether they do the clawbacks as an even series and try to keep providers relatively net neutral, or if there is a a harder shot upfront, that is yet to be seen. But I think that as soon as we finish this year’s lobbying push on trying to get relief, if we do not receive any and the home health is staring down these clawbacks, you’re going to see a ton of focus in the industry on, “Okay, if we have to have these cuts, how do we want them to play out? Do we stretch this timeline out further than four years?” It’ll be a very interesting fight.

Grace Totman

Beyond the discussion on the clawbacks and the actual payment update for 2024, were there any other ancillary policies included in the proposed rule that you found interesting?

Wylie Butler

Yeah, I just wanted to call out that this is the first performance year for the nationalized version of the value-based purchasing model. So you won’t receive performance-based payments until 2025 off of 2023’s performance. But it’ll be interesting to see whether this ends up looking a lot like the MIPs program for physicians, where since it’s budget neutral, in order for anyone to be a winner, there has to be an equal loser. So the performance caps on payments is plus or minus 5%. In prior years, you really only saw about 20% of practices being worse than -2% or better than 2%, so I think we’re expecting a pretty narrow band. Even so, that is a win for a provider if they do very, very well and are able to offset some of these cuts. It won’t be year-over-year compounding, but they’re able to offset a cut from maybe clawbacks in 2025 because they performed well in 2023 relative to peers.

That said, it’s a little bit funny that the physician quality payment programs always are budget neutral, but MA star ratings were not. I think it’s going to be difficult in the industry for some of the smaller providers to compete with the national ones on this type of scale, but it is peer-based, so we’ll have much better insight by 2025 on how these statistics are shaking out and if the expectation that your national providers (Amedisys, Enhabit) are continuing to be the better performing practices or if there’s some mid to small providers that do very well in the system.

Grace Totman

Great. Wylie, I have a bit of a broader question for you. Consistently in recent months, we’ve heard sentiment from investors but also more broadly from industry that there’s a disconnect between the perceived bipartisan support for something like home health that I think all lawmakers would say that they support, the Biden administration would say that they support, and then the actual policymaking that we see. Can you talk a bit about that disconnect and whether that’s CMS being technocratic at the end of the day, or whether that’s a little bit of liking something on paper but struggling to really enact policy when it comes down to it.

Wylie Butler

I can start with the CMS point and then talk about the Biden administration and Congress together. But that’s exactly how I’ve been thinking about CMS the last few years. Very technocratic. They had their marching orders from Congress here, and they laid out this methodology and have essentially followed it since. But it’s otherwise been relatively quiet from them in terms of new innovative policy in this space.

On the legislative front, the last shot that we saw from Biden towards making progress or giving dollars to this system was in Build Back Better. He had $400 billion earmarked for home and community-based services broadly. We watched that get pared down to $150 billion and then sent all the way to $0. I think that signals that when it comes to home health, it’s an important issue for the Democrats, but when it comes to end of day getting a bill done on a bipartisan basis, it’s not at the top of their list. Drug negotiation was more important. Anything else that made it into the IRA was more important. I do think there’s still a possibility that you see more congressional bipartisan bills that get through and make improvements in this space, but it has to have a very low price tag. I think more and more we hear from folks on the Hill that they, post-pandemic, are tired of physicians or providers broadly saying that they need more dollars. Anyone will immediately point to the pandemic relief and say, “We’ve given you so many billions. You should still have more in the bank,” or, “you got your wish list.” Everything that providers needed during the pandemic was sent out. And now that we are 1-3 years removed, or if you look at the end of the public health emergency, we’re a couple of months removed, but there’s just not a lot of sympathy on the Hill to providers at the moment.

The last thing I’ll mention back to CMS, it feels more and more like CMS is viewing providers and how they pay for these systems on a siloed basis. So they don’t want to think that the total margin for these home health companies is in the mid-20s, but that home health payments for Medicare, the margin is in the mid-20s. And so they’ll say it’s a high value service, but Medicare as a payer is overpaying the Medicaid programs and the commercial Medicare Advantage Plans need to step up the payments, which I think we have been seeing a little bit on the MA front in the market. But it is interesting that the federal Medicare side of CMS is turning the tables back over to MA and saying, “You need to step up your payments,” or maybe there won’t be home health providers in that region, but it’s not going to be because Medicare is not paying enough. It’ll be because of other payers.

Grace Totman

It’s such an interesting argument, and we’ve seen it in other industries too, right? I think dialysis comes to mind in the complete opposite sense where CMS has a sense that they are vastly underpaying dialysis providers because Medicare margins are so slim, and that’s not taking into account commercial margins, obviously. So I think it’s an interesting point that at the end of the day, CMS takes a very, very siloed, limited view when it comes to payers and margins and calculating what they perceive as over- versus under-payment. So I think that makes a ton of sense.

And then I’d be remiss if I didn’t somehow bring up Medicare Advantage into this conversation. But we saw very, very different looking cuts, but cuts nonetheless, in the proposed Medicare Advantage Rule this year for 2024, and CMS did end up finalizing those over a three-year period. So I’m wondering if you think we could see something similar happen here for home health.

Wylie Butler

It’s certainly possible. It’s funny thinking through which years make the most sense, and it gets difficult, but whenever I’ve seen CMS make a phase-in on the provider front, it’s almost like they skip straight to four years for even more minor changes on the physician fee schedule. We’ve seen it in home health as well back in the earlier 2010s, where whenever there’s a major coding change or a cut that’s going to, for a specific group of providers, adversely affect them, they look to, “Okay, we propose to do this in one year. Let’s do it over four.”

Obviously, there’s been some variation, but I think there’s completely reasonable arguments for three or five years out there, but that ultimately it feels like almost like a default choice, CMS leans to four years. I think the most important piece is just that I don’t think in any world—and we see CMS keep hitting on this, they don’t want to combine the temporary clawbacks, even on maybe a phased-in basis with permanent cuts—I don’t think that there’s a world where we see CMS come out, even in just a proposal, and say that they want to claw all of this money back, this full $4 billion in a single year.

Whether they stretch out the timeline, whether it looks a little bit more like Medicare Advantage in three years instead of four, that feels possible, but certainly not a worst-case scenario here.

One note I’ll chime in on, on a timing point. Thinking about when Congress is going to act, we generally see them wait until the final rule, almost like Congress will wait and see what the administration is going to do before they would pass any bill. You saw this year-over-year with the physician fee schedule, where the grassroots lobbying efforts that gives a great indication of where a bill’s momentum is going will start now before the final rule. But I haven’t seen Congress act to prevent cuts or delay or spread them out over multiple years until after the final rule, which leaves us with that November to December gap between final rule and ultimate implementation.

Caller One

Hi, thanks for the discussion. Could you tell us a little bit about what actually happens in terms of the implementation here? In other words, these proposals by CMS seem like—they always seem like—starting negotiating lines in the sand. How does resolution actually occur? And when does industry get its best shot to talk about the negative impacts and the reasons why these things should not happen?

Wylie Butler

There’s a little bit of a discussion ahead of the proposed rules. So there were meetings between a couple of the stakeholders, the National Association of Home Care and Hospice, with CMS ahead of the proposed rule. I think you’re right that this is drawing the line in this sand from a negotiation standing point. But now I’ve typically seen folks use this moment as, “Okay, let’s introduce our bill in Congress directly before, and then use the release of the…rule…into the news cycle as a chance to get a ton of meetings on the Hill, make a starting push for this, start to build that momentum that you need heading into year end.”

I think in short to answer your question that the time is now for providers and lobbyists to start to make that push. When we speak to folks on the Hill and we’re asking how they’re thinking about certain industries, and if they say that someone reached out at Thanksgiving for inclusion in a year-end spending bill, there’s just not enough room in the budget for you.Everyone else has gotten in line and tried to take a space, and you’re just going to be at the back of the priority list. So I would say home health is probably pushing on the gas right now for a fix.

Caller One

You alluded to it in your discussion, but the Debbie Stabenow and Susan Collins bill, will that go anywhere? Is that something that is hackneyed or is that something that’s relatively new?

Wylie Butler

I think you just spoke to CMS drawing their line in the sand on negotiation. It almost seems like, “We put out a bill on home health or anyone else, physicians, asking for our biggest dream that all of these cuts totally go away.” But there’s so many places in between taking the full hit of this cut and getting all of the relief that you want where home health can start to negotiate too. So while I don’t think that a full wipe-the-slate-clean approach is anywhere near likely, as you start to whittle that down into smaller relief, it does start to feel—I don’t think I’d say possible, I probably still say it’s unlikely—but if you’re talking about very marginal help or spreading this cut, that’s where it certainly does feel more possible that they could get some help.

Caller One

Great. Thank you.

Caller 2

Hi, thanks for taking my question. So if you can just comment, is there any precedent for the clawback? And how do you imagine it’s implemented? Meaning, would we get a 6% cut every year for four years, or would it be some other way of doing that? Any comment would be helpful.

Wylie Butler

Yeah, absolutely. So there’s a few different ways we’ve been thinking about it. I think the first biggest question is on timeline. So we have been drawn to that four-year phase in, but we sketched out in our first publication back in April how it could look if you did in one or two years and so on. But there’s essentially two main pathways. All of these clawbacks are done on a temporary basis. So essentially, each year they’ll make the cut, and then the following year, if the cut was repeating, they would essentially be giving it back to you. So that’s what I think about it, like ripping the Band-Aid off. You’ll take a 6% hit off of your market basket in year one, and then for the remaining three years, you would not be receiving any cuts because each time you got relief, it would essentially be offsetting a new cut. And then at the end of that period, you would get your 6% back.

Another methodology here would be a little bit above 2.2%, where they make a repeating cut for the four-year period, but try to keep providers just above net-even.

And you’d probably be coming around half a percentage point positive each year, and that’s a more smooth phase in. It prevents providers from being negative, but still achieve the same result. Because since this is on a temporary basis, CMS really just thinks about it as, “Okay, in order to capture these payments for four years instead of paying you $100 an hour, we need to be paying you about $90 an hour and we’ll think about that spread as capturing our clawbacks. At the end of the phasing period, we’ll give you the boost, the $10 an hour back.” And so there’s a huge boost, I believe, that would be in 2029. But those are the two main ways that we were thinking about it at this time, but still playing around with how that could eventually shake out, obviously, as you change the number of years, the network is fluctuate a little bit.

Caller 2

Does it mean that the boost, everything that was clawed back would be repaid at year four or would it just mean that after the year four everything will come back to a normal rate?

Wylie Butler

So not returning the clawbacks themselves, but after year four, they return you back to the budget-neutral rate. So they’re no longer keeping you below that indexed $100.

Caller 2

And will they take into consideration, as you mentioned before, the fact that X amount of providers will simply exit the business?

Wylie Butler

They certainly will. And I think that’s where we saw the discussion going today, where they put in a few bullets that you could lobby on. Are there reasons for utilization declining outside of the fact that the fee-for-service enrollment is declining? Is there an access-to-care issue? And while I don’t think that CMS can necessarily stop that train, it’s definitely a better push for home health to make some relief with Congress. That’s going to be the argument is, maybe we get two years into this four-year phase and this will be a continued story and a bunch of home health agencies close. That conversation on the Hill that home health needs relief but it needs help gets much, much easier.

Caller 2

Okay, thanks so much.

Caller 3

Could you touch base on the home infusion therapy increases and CMS’s thoughts around that that might be a way to offset some of these declines in structure?

Wylie Butler

It’s admittedly a spot in the rule where I haven’t spent as much time yet. Happy to dig in a little bit more there. We’ve spent some time there from the pharmacy perspective, but I need to dig back into that piece of the rule.

Caller 3

Okay. Thank you.

Wylie Butler

Of course. I just want to say thank you again for everyone joining in and the thoughtful questions. We’re going to keep digging into this space, and we are just re-initiating conversations with some of the main lobbyists and stakeholders in this area, but also folks on the Hill trying to get a sense of their priorities ahead of any type of year and spending relief, getting an understanding of where home health sits in the priority list for who could potentially be getting dollars this year. We’ll continue to publish on this space, and if folks have any specific questions on the rule that they want us to dig into or just catch up one-on-one, happy to do so and look forward to speaking with everyone soon.