The Great Healthcare Insurance Shift

January 31, 2022

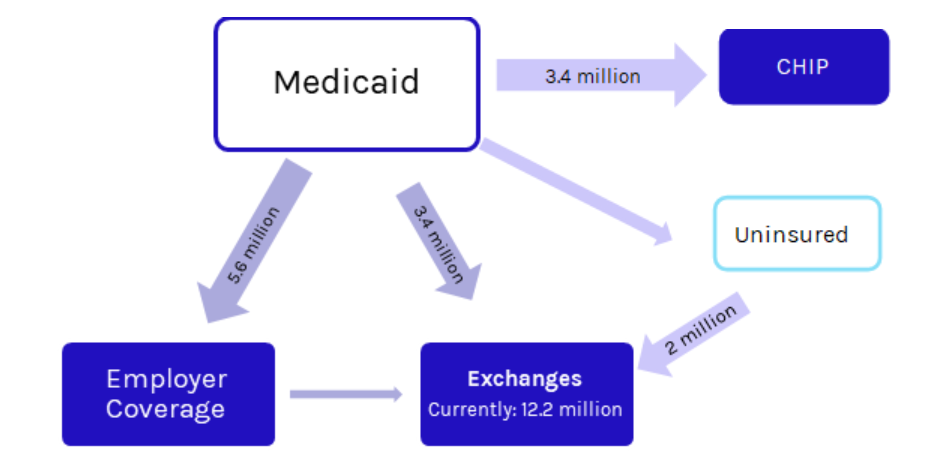

There will be a significant shift in healthcare coverage enrollment in 2022 from Medicaid to commercial coverage. The shift will produce significant tailwinds for hospitals, namely Tenet Healthcare Corp. (THC) and Community Health Systems Inc. (CYH). Managed care organizations (MCOs) with greater exposure to employer-sponsored insurance and the Affordable Care Act (ACA) exchanges will also benefit from increased membership. MCOs that primarily rely on Medicaid membership, namely Molina Healthcare Inc. (MOH) and Centene Corp. (CNC), will face headwinds as they see reduced membership. Catalysts include states restarting Medicaid beneficiary eligibility redeterminations—which will kick 18% of Medicaid enrollees off the program—a solution to the Medicaid gap, and the extension of ACA subsidies.

Major Theme

We expect three major catalysts to cause a significant shift in healthcare coverage enrollment (known as the payer mix shift) in 2022:

- Medicaid redetermination following the Public Health Emergency (PHE).

- Extension of Affordable Care Act (ACA) subsidies in the reconciliation bill.

- Medicaid gap fix in the reconciliation bill.

The payer mix shift will largely benefit hospitals, particularly those with significant footprints in non-expansion states, as individuals move from uncompensated care to commercial rates. The Medicaid gap fix alone, without any shift from Medicaid rates to commercial rates, will create a windfall for hospitals in 2022, including Tenet, HCA Healthcare Inc., and Universal Health Services Inc.

However, their gains will be offset slightly by a portion of redetermined Medicaid enrollees losing their insurance.

While hospitals will benefit from the payer mix shift in any scenario, the impact for insurers is much more nuanced (see Exhibit 4). At first glance, shifting away from capitated Medicaid rates to higher ACA exchange rates is a positive for payers. However, recent managed Medicaid enrollees have been low utilizers of healthcare, resulting in insurers overearning on these individuals. For MCO’s that rely heavily on Medicaid, the downturn will produce headwinds. MCO’s with diversified membership would be able to offset the enrollment loss by a bump in exchange membership from the redetermination process, extended ACA subsidies, and Medicaid gap fix.

The result: MCOs with greater ACA exposure are set to benefit from the potential Medicaid gap fix and ACA subsidy extension (both of which Capstone remains constructive on), while MCOs with greater Medicaid exposure will see significant enrollment reductions.

Exhibit 1: Projected Shift in Healthcare Enrollment (Payer Mix Shift)

Source: Capstone

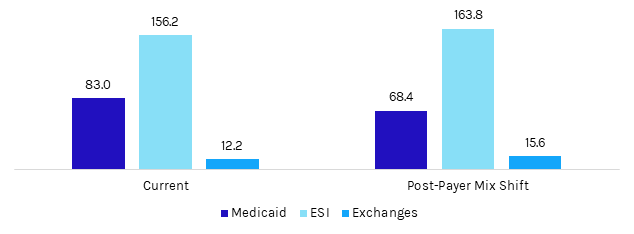

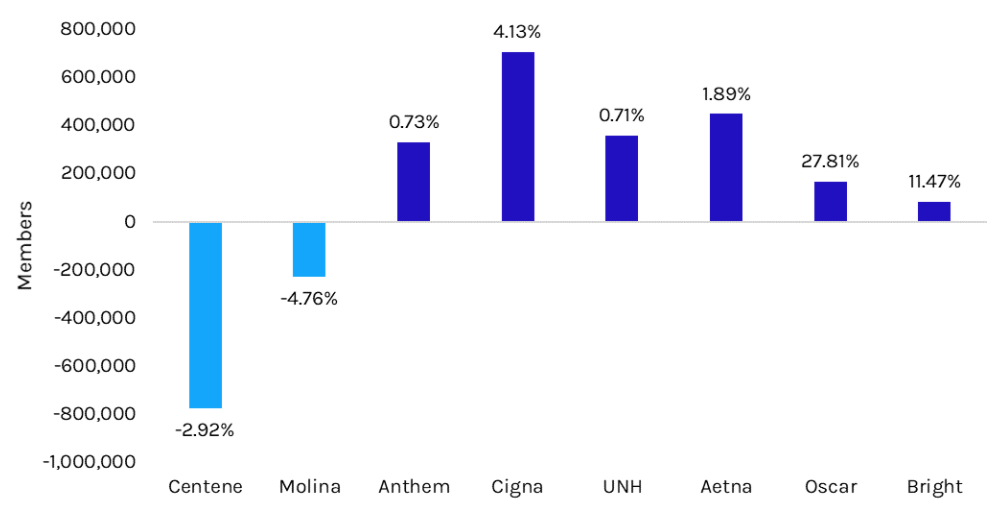

Exhibit 2: Payer Mix Shift Net National Impact

Source: Capstone

Healthcare Insurance Risks

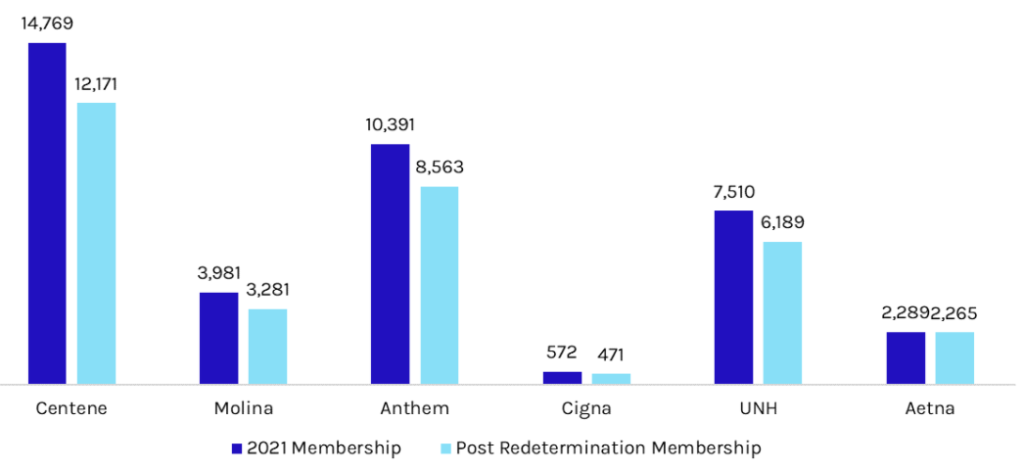

The Medicaid redetermination process will produce headwinds for managed care companies that have high enrollment of low utilizers, namely Centene and Molina.

The Families First Coronavirus Response Act included a 6.2% bump in the federal matching assistance percentage (FMAP) for state Medicaid programs so long as they halted the redetermination process for the duration of the PHE. TThe Families First Coronavirus Response Act included a 6.2% bump in the federal matching assistance percentage (FMAP) for state Medicaid programs so long as they halted the redetermination process for the duration of the PHE. The policy has led to a surge in Medicaid enrollment of 16.2% from the beginning of the pandemic to May 2021. Though data has lagged, experts estimate that up to 15–17 million enrollees will enroll in the program by the end of the PHE, at which point states will essentially dump the new enrollees. At present, Democrats are attempting to fix this via the Build Back Better legislation which—in both the most recent House and Senate versions—would decouple the FMAP bump from the PHE and set a schedule for states to begin redeterminations. States would be limited to redetermining 1/12th or 1/9th (House vs. Senate) of enrollees each month from March 2022 to September 2022. Though Biden administration changes will slow the redetermination process, enrollment will eventually be reduced by 19.58%, returning total program enrollment to the projected baseline it would have been at without the redetermination pause.

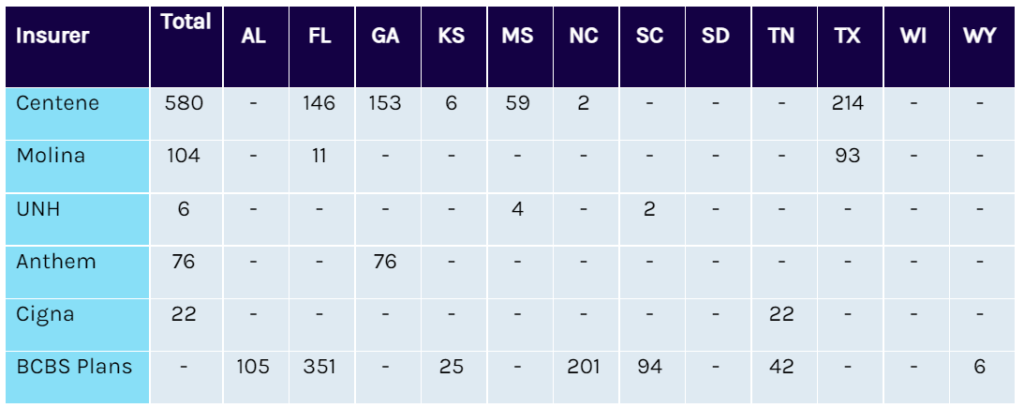

Exhibit 3: Projected Medicaid Membership Post-Redetermination for Major Insurers (figures in thousands)

Source: Capstone

The risk will be most impactful for insurers that rely heavily on Medicaid, namely Molina, which holds 82% of its membership in Medicaid, and Centene, which holds 56% of its membership in Medicaid.

The redetermination process will be less impactful for more diversified insurers—namely UNH, Aetna, Anthem, and Cigna—which hold just 15%, 24%, 23%, and <5% of their membership in Medicaid, respectively, as they offset the loss with membership increases to their other business lines.

Healthcare Insurance Opportunities

Medicaid redetermination will drive enrollment in the exchanges, a boost for MCOs with significant exchange exposure

Assuming that 15 million individuals disenroll from Medicaid by the end of 2022, approximately 9 million will be adults. Academics estimate that at least one-third of these adults would qualify for subsidized ACA marketplace coverage, producing new ACA enrollment of at least 3 million. In addition, roughly 2 million separate individuals are anticipated to gain ACA coverage via a Medicaid gap fix.

Based on our analysis, Oscar Health is best positioned, as its total membership would grow by 27.81%. Of the larger MCOs, Cigna is best positioned, as its total membership would grow by 4.13%.

Exhibit 4: Net Impact to MCOs from the Payer Shift

Source: Capstone

Note: See appendix for company-specific impacts

Exhibit 5: Projected New Exchange Enrollees via Gap Fix (figures in thousands)

Source: Capstone

Hospitals will benefit in all scenarios as they see increased reimbursement rates from a shift toward commercial enrollment.

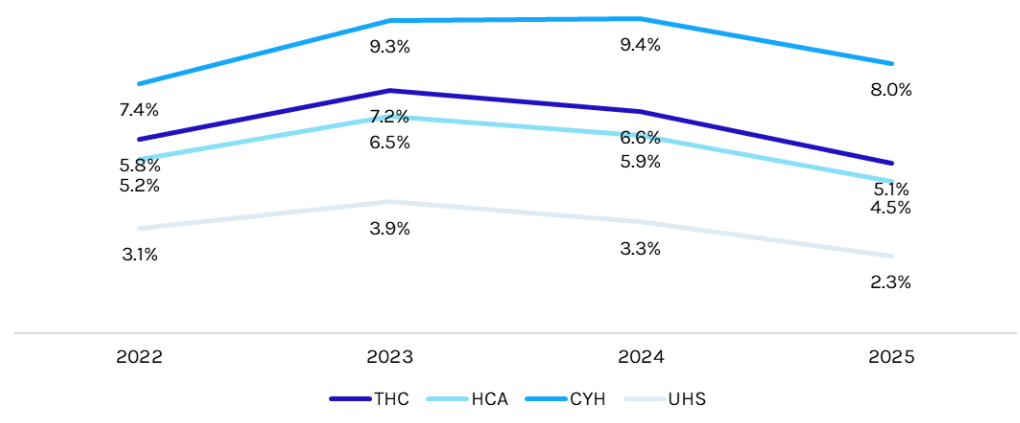

Hospitals will benefit in all payer mix shift scenarios as they see reimbursement rates go from uncompensated or Medicaid to commercial. The Medicaid gap fix alone is expected to boost hospital EBITDA significantly (see Exhibit 1). Notably, the redetermination process will result in a portion of enrollees returning to being uninsured, which will offset the upside for hospitals. However, Capstone does not expect this uptick in uncompensated care to offset the benefits of new commercially reimbursed exchange enrollees. The EBITDA boosts below do not include the impact of new exchange enrollees via the redetermination process and the subsidy extension.

Exhibit 6: Projected EBITDA Change for Hospital Systems via Gap Fix with Uncompensated Care Cuts Delayed and Reduced

Source: Capstone

ABOUT THE AUTHOR

Grace Totman is a vice president on Capstone’s healthcare team.