Capstone believes that tariffs on China and Section 232 tariffs on heavy industrial products and vehicles will lead to significant long-term import slowdowns across US ports due to the magnitude of the tariffs and their ability to withstand legal challenges, making it possible they stay in place beyond the remainder of President Trump’s term. Imports at port districts in Los Angeles, California, and Laredo, Texas, are most exposed to these tariffs.

- US ports, which facilitated more than $5.3 trillion in trade last year, face dramatic slowdowns due to Trump’s tariffs and the retaliatory tariffs imposed by the US’s trading partners. The agreement with China that led the US to reduce tariffs on Chinese products by 115 percentage points will generate a surge in Chinese imports over the next 90 days as companies seek to benefit from temporary tariff relief. However, we believe significant tariffs on China will be structural under Trump, impacting long-term trade volume.

- The ports of Los Angeles and Long Beach will see the most volatility due to changes in US-China trade dynamics, importing more than $129 billion of Chinese products in 2024. The port of Laredo is most at risk to product-specific Section 232 tariffs.

- Capstone believes that if they are maintained, automobile and truck tariffs will impact Laredo the most; steel and aluminum tariffs will impact Detroit the most; lumber and aircraft tariffs will impact Seattle the most; copper tariffs will impact Tampa the most, and semiconductor manufacturing equipment tariffs will impact Los Angeles the most.

- Capstone believes the retaliatory tariffs on US agriculture, such as China’s levies on pork, soybeans, and chicken, will significantly reduce exports from US ports. The port of New Orleans is likely to be hardest hit by foreign trade barriers affecting US agriculture.

Impact of Trade Policy on US Ports

Overview of US Port Trade Activity

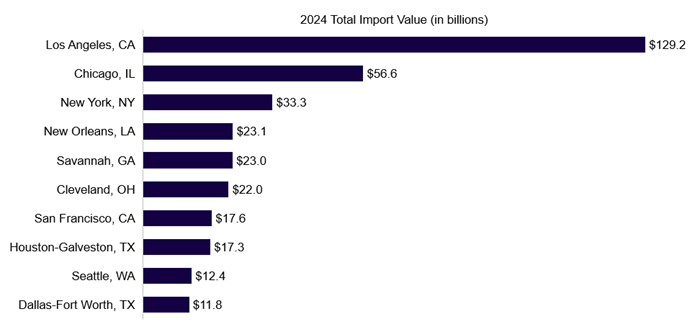

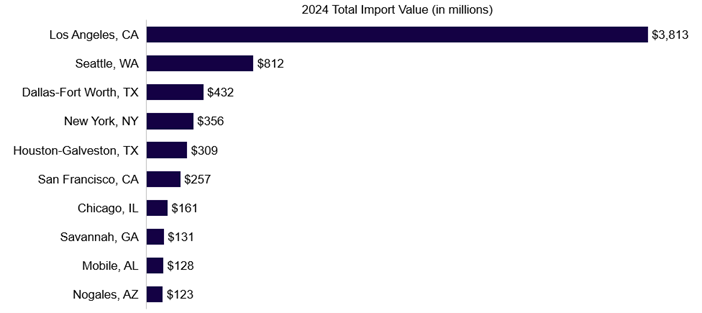

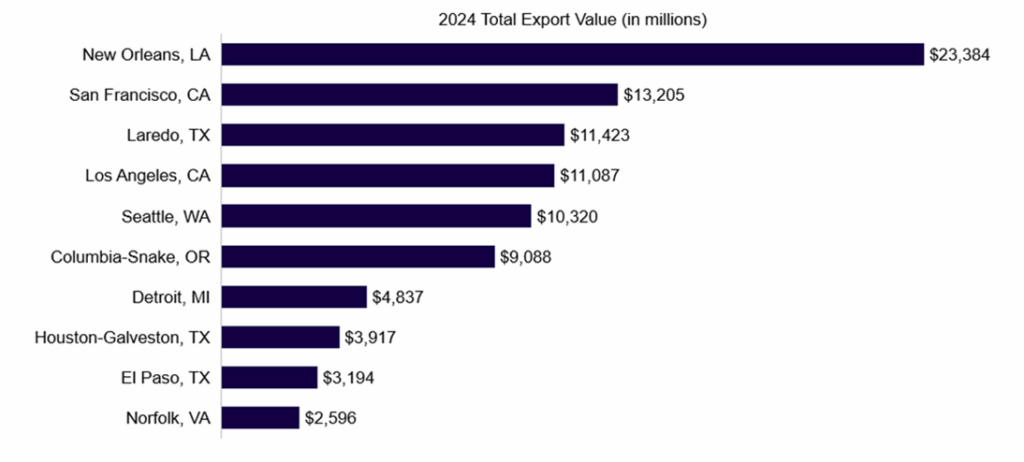

In 2024, US ports facilitated $3.2 trillion in imports and $2.1 trillion in exports. Capstone expects product-specific Section 232 tariffs, reciprocal tariffs, and port fees to result in slowdowns across US ports. While periods of temporary tariff relief, such as the de-escalation between the US and China earlier this month, will generate surges in port activity, the continual shifts in trade policies have created instability and uncertainty for US ports. On May 2nd, before the rollback of reciprocal tariffs on China, Port of Seattle Commissioner Ryan Calkins predicted a 40% reduction in cargo due to increased tariffs. The top 10 US ports, which accounted for more than 65% of imports in 2024, are the most exposed to tariff risks (see Exhibit 1).

Exhibit 1: Top 10 US Ports for Imports and Exports by Customs Value

| Rank | Port Ranking by Import Value | Port Ranking by Export Value |

|---|---|---|

| 1 | Los Angeles, CA | Houston-Galveston, TX |

| 2 | New York, NY | Laredo, TX |

| 3 | Chicago, IL | New York, NY |

| 4 | Laredo, TX | Detroit, MI |

| 5 | Savannah, GA | New Orleans, LA |

| 6 | Detroit, MI | Los Angeles, CA |

| 7 | Cleveland, OH | Chicago, IL |

| 8 | New Orleans, LA | Miami, FL |

| 9 | Houston-Galveston, TX | Savannah, GA |

| 10 | San Francisco, CA | Cleveland, OH |

Source: United States International Trade Commission

Reciprocal Tariffs and Their Impact on US Ports

We believe that Trump’s 10% universal tariffs represent a baseline for US levies, on top of which exists the potential for increases. We believe Trump’s reciprocal tariffs will have a lesser impact on ports than other tariffs and trade barriers, because countries can strike deals with the US to bring rates closer to 10%, and because litigation could undo some of those levies. Also, countries that impose retaliatory tariffs on the US will have a substantial impact on exports at US ports.

Chinese products, which accounted for 13.3% of US imports in 2024, are currently subject to tariff rates of between 37.5% and 70%, depending on the product. On May 12th, the Trump administration announced a 90-day pause on some tariff increases during which both sides would de-escalate. When Trump’s 145% blanket tariff on Chinese products was in effect, many US businesses paused shipments or canceled orders and had inventory waiting to be shipped to the US. Capstone believes that the temporary tariff relief will result in a large surge of Chinese imports into the US during the reduced tariff period.

The temporary relief from reciprocal tariffs on Chinese products notwithstanding, we believe tariffs on China will be long-lasting and durable. Whether trade restrictions take the form of the Section 301 tariffs, fentanyl-based tariffs, or an alternative tariff structure, there is bi-partisan support for tariffs on China. For example, Trump’s Section 301 tariffs from his first term were not only extended by President Biden, but Biden also introduced new potential trade barriers against China, such as a Section 301 shipbuilding investigation.

Section 232 Tariffs and Their Impact on US Ports

Tariffs stemming from a Section 232 investigation tend to be durable, given the statute’s ability to withstand legal challenges. Furthermore, Trump’s Section 232 tariffs on steel and aluminum were left in place by the Biden administration. Due to the tariff’s durability and potential longevity, Capstone believes the impact of Trump’s Section 232 tariffs on US ports will last longer than other tariff measures. Section 232 tariffs, however, are also susceptible to exceptions. During Trump’s first term, he granted exemptions to steel and aluminum tariffs for countries including Australia, Canada, and Mexico, as well as numerous product-specific exclusions. During Biden’s term, he granted similar exemptions to Ukraine. Additionally, the recently announced trade deal between the US and UK includes exemptions for British steel, aluminum, and automobiles. However, we would note that the US trade surplus with the UK made it among the best-positioned countries to negotiate a tariff reduction with the US in our view, and even it was not successful in fully removing auto tariffs.

Currently, there are Section 232 tariffs of 25% on automobiles, steel and aluminum products. Furthermore, there are seven ongoing Section 232 investigations covering copper, lumber, semiconductors, pharmaceuticals, trucks, critical minerals and commercial aircraft. Capstone believes that Trump will impose tariffs following the Section 232 investigations if the Commerce Department provides an affirmative determination.

Other Trade Policy Impacts on US Ports

The ongoing Section 301 probe into Chinese shipbuilding proposes port fees on Chinese-built and operated vessels, increasing restrictions on import activity. The most recent changes from the US Trade Representative reduce and cap the negative effects of port fees.

We also believe ports dependent on USMCA trade such as Laredo, TX; Detroit, Mi; and Chicago, Il, are well positioned to mitigate future tariff risks. For Laredo and Detroit specifically, land-based imports will not be exposed to port fees. Furthermore, as USMCA trade renegotiations begin, Capstone believes Canada and Mexico will face fewer trade barriers than other trading partners.

Methodology Behind Tariff Impact Values

Throughout this report, all of the import and export values we provide include all Harmonized Schedule (HS) product codes related to President Trump’s executive orders. For example, for Steel and Aluminum products, all related products within the HS code have been included, despite a few product exemptions that have been granted. This is because for products currently ongoing investigation, it is unclear as to what products within the HS code may be exempt. As such, the values provided are likely an overestimation, however, they provide insights into the total scale of product imports, and how it will impact key US ports.

Impact of Chinese Tariffs on US Ports

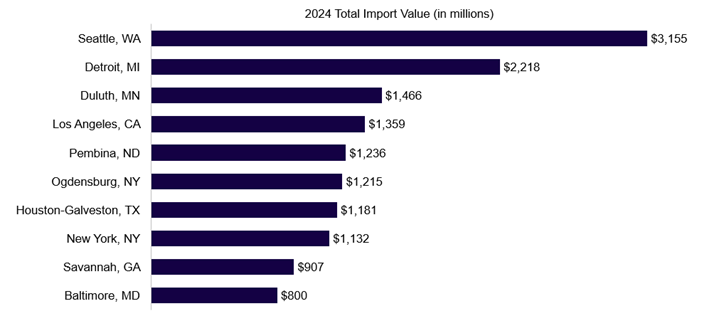

Capstone believes the Trump administration is unlikely to reach a comprehensive agreement with China, despite recent efforts to de-escalate and negotiate. For the short term, we believe US importers of Chinese products will take the 90-day period to import a substantial amount of goods. The port of Los Angeles and the Port of Long Beach, which combined to process 30% of all Chinese imports last year, will experience the largest short-term surge in imports. In the long term, however, we believe persistent tariffs on China or re-escalation, will result in significant slowdown of import activity across the most exposed ports (see Exhibit 2).

Exhibit 2: Top 10 US Ports Impacted by Tariffs on Chinese Products

Source: United States International Trade Commission

Impact of Section 232 Tariffs on US Ports

Projecting the Impact of Section 232 Tariffs

Capstone believes that heavy industrials and vehicles are disproportionally going to affect port revenues, as port fees are typically a function of tonnage or number of containers. Despite tariffs affecting high values of imported pharmaceuticals and semiconductors, the small size and weight of these products result in minimal impacts on port revenues.

Exhibit 3: Value of Heavy Industrials and Vehicles In-Scope for Section 232 Tariffs

| Section 232 Investigation | Potential Value ($ in billions) |

|---|---|

| Automobiles, Trucks and Parts | 355.2 |

| Steel and Aluminum | 107.7 |

| Lumber | 22.9 |

| Critical Minerals | 19.0 |

| Copper | 17.1 |

| Commercial Aircraft Parts & Engines | 12.3 |

| Semiconductor Manufacturing Equipment | 7.2 |

Source: United States International Trade Commission

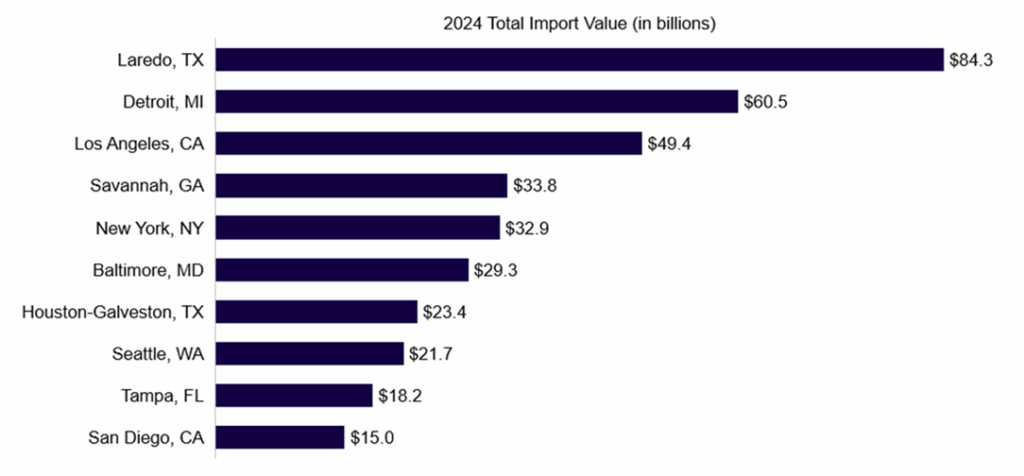

Exhibit 4 (see below) sums the value of all heavy industrial and vehicular products in scope for Section 232 tariffs and ongoing investigations. For this report, heavy industrials are defined as steel, aluminum, semiconductor manufacturing equipment, critical minerals, lumber, and copper. Vehicle products include automobiles, trucks, aircraft and their parts.

Exhibit 4: Top 10 US Ports Impacted by Section 232 Investigations and Tariffs on Heavy Industrials and Vehicles

Source: United States International Trade Commission

Automobiles, Trucks, and their Parts

On March 26th, Trump announced 25% tariffs on all imported automobiles and automobile parts, corresponding to a 2019 Section 232 investigation. The tariff includes passenger vehicles, light trucks, and select auto parts. The tariff on automobiles took effect on April 3rd while the tariff on parts took effect on May 3rd.

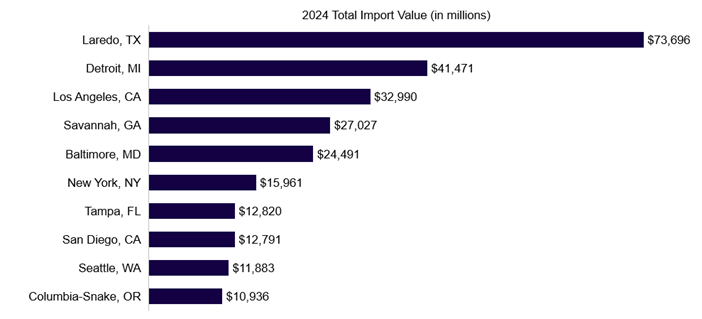

On April 22nd, the Commerce Department announced the initiation of a Section 232 investigation into trucks and truck parts. The ongoing investigation covers medium-duty trucks, heavy-duty trucks and their parts. The ports in which automobiles, trucks and their parts are imported are largely the same. The Port of Laredo is the most impacted by these tariffs. Exhibit 5 (see below) includes all related HS codes for the three product categories, as the Trump administration could expand the scope of the tariffs.

Exhibit 5: Top 10 US Ports Impacted by Automobile and Auto Part Tariffs (HS 8703, 8704, 8708)

Source: United States International Trade Commission

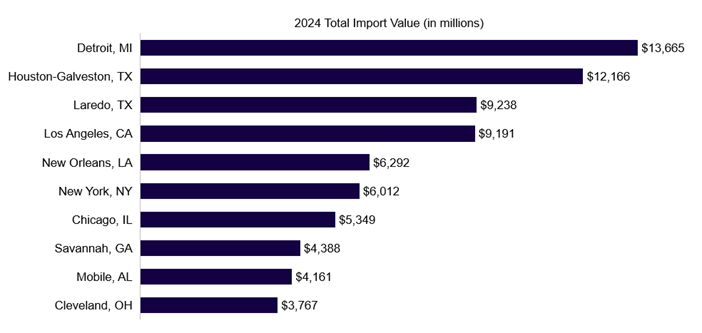

Steel and Aluminum

In 2018, Trump imposed 25% Section 232 tariffs on steel imports and 10% on aluminum imports. Both Trump and Biden granted exemptions to select countries. However, on March 12th, Trump increased tariffs to 25% for both steel and aluminum products and removed all exemptions. The Port of Detroit is most impacted by these tariffs (see Exhibit 6) includes all related HS codes, as the Trump administration could expand the scope of the tariffs.

Exhibit 6: Top 10 US Ports Impacted by Steel and Aluminum Tariffs (HS: 72, 73, 76)

Source: United States International Trade Commission

Lumber

On March 10th, the Commerce Department initiated a Section 232 investigation into lumber and derivative products (see Exhibit 7). In 2024, Canadian lumber made up 49% of US lumber imports. Ports in Seattle and Detroit will be the most impacted by these tariffs.

Exhibit 7: Top 10 US Ports Impacted by Potential Lumber Tariffs (HS 44)

Source: United States International Trade Commission

Critical Minerals

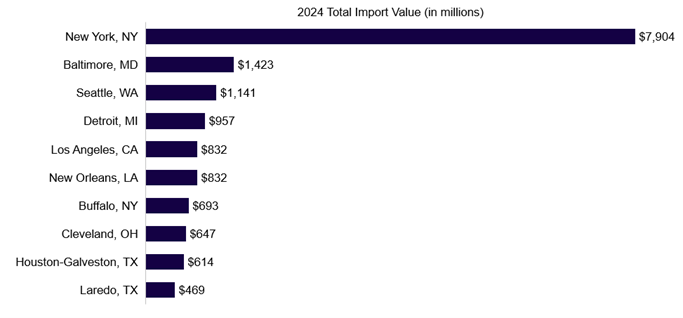

On April 22nd, the Commerce Department began a Section 232 investigation into critical minerals and their derivative products. The minerals being investigated are identified by US Geological Survey’s 2022 final list plus uranium. For the values in Exhibit 8 (see below), all products were matched to the most suitable HS code, excluding aluminum, which is covered by a different Section 232 tariff. The Port of New York and New Jersey would be the most impacted by potential tariffs on critical minerals.

Exhibit 8: Top 10 US Ports Impacted by Potential Critical Minerals Tariffs (All Relevant HS Codes Excluding Aluminum)

Source: United States International Trade Commission

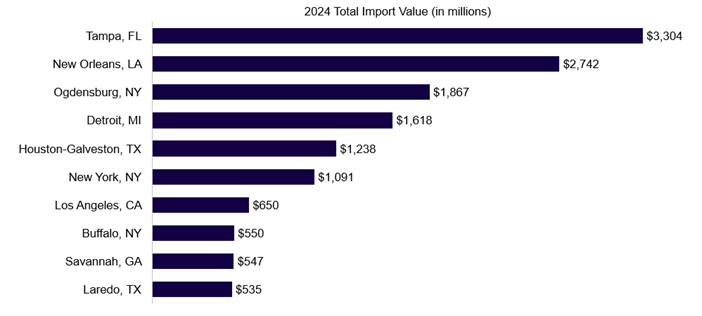

Copper

On March 10th, the Commerce Department initiated a Section 232 investigation into copper and derivative products. The Port of Tampa Bay will be the most impacted by these potential tariffs (see Exhibit 9)

Exhibit 9: Top 10 US Ports Impacted by Potential Copper Tariffs (HS 74)

Source: United States International Trade Commission

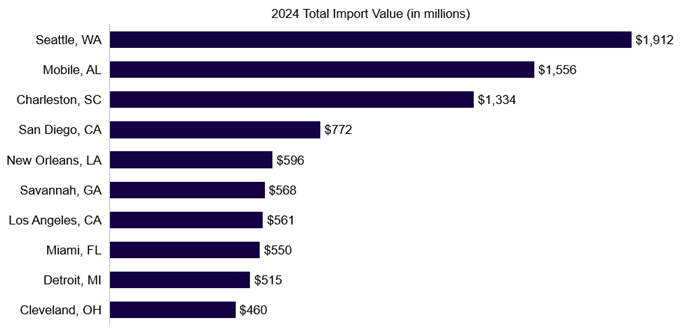

Commercial Aircraft Parts & Engines

On May 1st, the Commerce Department initiated a Section 232 investigation into Commercial Aircraft and Jet Engines and Parts. Exhibit 10 (see below) includes only aircraft parts and engines and excludes fully built aircraft. Aircraft engines and parts typically enter ports through traditional port infrastructure, while completed aircraft are typically flown to their clients. The exhibit has also excluded all military applications, which are out of scope according to the Department of Commerce’s announcement. The Port of Seattle will be the most impacted by these potential tariffs.

Exhibit 10: Top 10 US Ports Impacted by Commercial Aircraft Parts & Engines Tariffs (HS 8807 – excluding military and space applications)

Source: United States International Trade Commission

Semiconductor Manufacturing Equipment

On April 1st, the Commerce Department initiated a Section 232 investigation into semiconductors, semiconductor manufacturing equipment (SME), and their derivative products. Exhibit 11 (see below) only includes SMEs, as their large size and weight are more significant to port revenues than semiconductors. The Port of Los Angeles and the Port of Long Beach would be the most impacted by these tariffs.

Exhibit 11: Top 10 US Ports Impacted by Potential SME Tariffs (HS 848620)

Source: United States International Trade Commission

Retaliatory Tariffs on US Agriculture and its Impact on US Port Exports

If countries retaliate against Trump’s tariffs, they typically target agriculture. For example, in March China’s tariff targets included soybeans, chicken, and pork. If other countries retaliate in response to Trump’s reciprocal tariffs, we expect a decline in exporting activity for ports across the US. The Port of New Orleans would be most affected by a slowdown in US agriculture exports.

Exhibit 12: Top 10 US Ports Impacted by Retaliatory Tariffs on US Agriculture Products (HS 1-15)

Source: United States International Trade Commission

What’s Next

For the seven ongoing Section 232 investigations, the Commerce Department will have 270 days from the investigation’s initiation date to report findings to the President. If the investigation results in an affirmative determination, President Trump may choose to implement the recommendations from the Commerce report, take other action, or take no action. The President’s final action may take the form of tariffs or other import restriction measures. Following a decision, the trade action must be implemented within 15 days.

For tariffs on China, the Trump administration and the Chinese government will negotiate the terms of a more permanent agreement.

Risks to Our Thesis

The import and export values throughout the report are likely overestimations, as all products related to the executive order were included. As investigations conclude, we expect some products and countries to be exempt from Section 232 tariffs, decreasing the potential tariff risk to US ports.

Read more from Andrew:

President Trump’s Tariffs Have Shocked the World. What Now?

The Rules of Trump’s Trade War

Tariff Tango: Trump’s Trade Moves to Shake Up Global Markets