Introduction

Capstone believes the Democrat-led Federal Communications Commission (FCC) will double down on its aggressive agenda ahead of the 2024 elections, posing a swath of underappreciated risks and opportunities across the telecommunication industry.

Now that the FCC is fully populated and Democrats have majority voting control, FCC Chair Jessica Rosenworcel has started aggressively pushing Democratic policy priorities through. These include the recently approved digital discrimination rule and a notice of proposed rulemaking on net neutrality that could open internet service providers up to utility-style regulations.

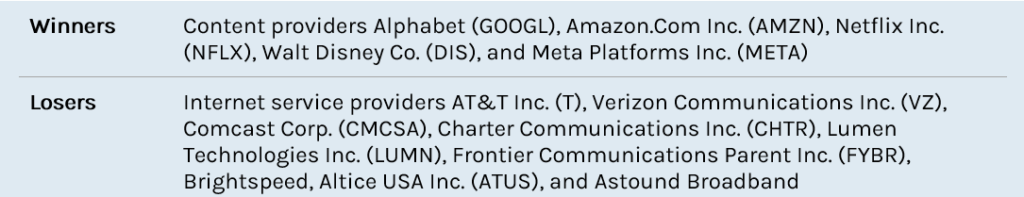

Capstone believes the FCC will continue to pursue an activist regulatory agenda that benefits content providers at the expense of internet service providers (ISPs). However, any potentially controversial rulemaking, such as net neutrality, must be completed early in 2024 to avoid being vulnerable to repeal under the Congressional Review Act (CRA) should Republicans take control of both the White House and Congress in the 2024 elections.

The uncertainty surrounding major telecommunications subsidy programs that support broadband deployment and make broadband more affordable for low-income households is a headwind for ISPs as programs like the Affordable Connectivity Program represent over $600 million a month in revenues for ISPs

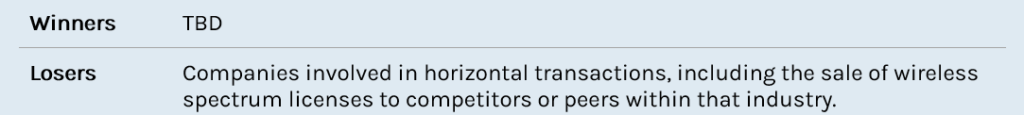

The Democrat-led FCC will continue to be somewhat hostile to consolidation in the telecommunications sector. It will scrutinize mergers between companies and any attempts by wireless companies to excessively consolidate their holdings of wireless spectrum licenses. The FCC views spectrum licenses as a scarce resource and regards attempts to aggregate too much spectrum as a potential threat to competition.

With speculation brewing that SpaceX will court external investors by selling part or all of its Starlink unit, investors should be aware of how expansive the FCC’s authority is over the company. SpaceX is seeking regulatory approval for Starlink’s second-generation satellite constellation, access to additional bands of spectrum, permission to provide supplemental coverage to T-Mobile US Inc. (TMUS) wireless subscribers, and is active in several other proceedings that could impact it and its Starlink unit moving forward.

Activist Agenda Favors Edge Providers at Expense of ISPs

Capstone believes a Democrat-led FFC will continue to promote policies that are broadly beneficial to content providers such as Google, Amazon, Netflix, Disney, and Meta Platforms’ Facebook unit. Chief among these policies is the recently approved digital discrimination rule and the net neutrality rule, which we believe will be approved in early 2024.

We expect the FCC will start implementing these two rulemakings, which initially will entail collecting data to help in future investigations related to allegations of digital discrimination and enforcing a prohibition against ISPs throttling, blocking, and accepting payment to prioritize particular sources of internet traffic. However, violations of either rule could lead to enforcement actions, so we expect ISPs to start adjusting their business practices to comply with both rules.

Capstone believes these rulemakings are not quite as friendly to ISPs as they initially, noting that they benefit companies that transmit data and content to ISP subscribers and place additional burdens and costs on ISPs. Chair Rosenworcel remains committed to carrying out the FCC’s top priority and making broadband service ubiquitous and affordable throughout the country. She is promoting both the widespread adoption of broadband and policies that facilitate competition and lower prices. Some policies, such as the newly approved digital discrimination rule, could put pressure on pricing and compel ISPs to invest in areas that may not make economic sense to invest in.

Even if the FCC were to implement both rules and enforce them rigorously, it would constrain the commission’s staff and resources. The FCC’s budget has not increased meaningfully in years and the commission has lost 20% of its staff in the last several years, limiting its ability to perform its duties, including investigating potential FCC rule violations. Furthermore, fines that the FCC collects are remitted straight to the US Department of the Treasury and are not available to support the commission’s operations or enforcement actions.

While it is too soon to tell exactly how aggressively these new rules will be enforced, we still view both the digital discrimination and net neutrality rules as negative for ISPs. Both are designed to make broadband easier and cheaper to access throughout the country. The rules could put pressure on pricing by encouraging ISPs to adopt more uniform pricing and service bundles nationally, potentially opening the door to price regulations, and requiring them to turn over data that could be used in future rulemaking and enforcement actions.

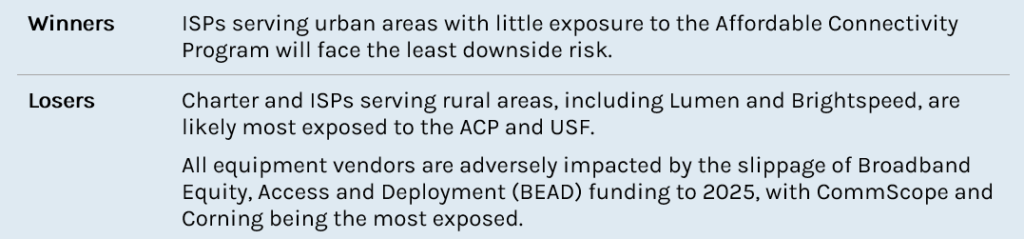

Uncertainty on Federal Subsidy Programs Increases Risk to ISPs and Vendors

Capstone believes the uncertainty surrounding funding and the financial viability of the ACP and Universal Service Fund (USF) poses a financial risk to ISPs and vendors that support the construction of high-speed broadband network deployments. Capstone also believes uncertainty about the timely deployment of funds from the $42.45 billion BEAD program to ISPs for the construction of broadband infrastructure in unserved and underserved areas, and the risk that these funds will not be available until sometime in 2025, poses a specific risk to vendors such as CommScope and Corning that were expecting significant orders for network infrastructure equipment like fiber, enclosures, utility poles, antennas, routers, and other networking equipment.

Both the ACP and USF lack sound financial footing. The ACP is funded through an appropriation from Congress and is set to run out of money by early 2024. Meanwhile, the USF, which is funded by a levy on interstate voice phone service, is becoming increasingly burdensome for traditional landline phone customers, who are its primary contributors. The USF and ACP are important subsidy programs for the consumer broadband industry. The $30-a-month ACP subsidy helps support affordable broadband service for low-income households. The USF provides more indirect support to consumers by using nearly half its $9 billion a year in funding to support the deployment and operations of telecommunications network infrastructure in rural communities that would otherwise not be economical to serve. The two programs work in tandem, with the ACP making broadband service more affordable for consumers and the USF making broadband service more accessible.

Both programs need to be shored up financially and the best way to do that quickly is through action from Congress. However, while members of Congress appear to be aware of the issue, it is unclear if additional ACP funding or a comprehensive fix for the USF is politically palatable enough to make it through such a deeply divided Congress that cannot even agree on a full-year budget for the federal government or other important legislation.

Exactly how much funding telecommunications providers receive from the USF and ACP is unclear because the FCC considers the information confidential. However, Senator Ted Cruz (R-TX) requested and received information on how the FCC used ACP funding. The data showed that Charter received $1.5 billion through the ACP and its predecessor, the Emergency Broadband Benefit (EBB) program, for slightly more than two years. This information was included in a report the FCC issued this spring and since then, the number of ACP subscribers has continued to grow. We believe Charter now could be generating several hundred million in revenues annually from ACP subscribers.

While this is not a huge amount for a company with $54 billion a year in revenue, should the ACP lapse for any reason, investors should expect Charter to lose customers in the following quarter or two. It also is important to remember that there is almost no variable cost associated with serving an additional customer on an already built-out network, so any losses in ACP revenues will have a significant impact on Charter’s profitability and net income. Charter generated $4.7 billion in net income in 2022, so we believe the impact of losing as much as several hundred million dollars a year in revenue because of a lapse of ACP funding will likely be consequential.

The impact of a delay in BEAD funding that states distribute to ISPs is a little harder to quantify. The effects are felt only when ISPs get the funding, vendors start to get orders, and suppliers such as CommScope and Corning see those orders translate into revenues. A delay in BEAD funding essentially has no impact on the total amount of funds spent and most companies feel it on their forward-looking guidance.

Capstone notes, however, that CommScope is an exception to this general rule, as the company faces a wall of upcoming debt maturities, including $1.3 billion maturing in 2025 and $4.5 billion in 2026. CommScope expects to generate only $1 billion in EBITDA in 2023 and has $9.5 billion in debt outstanding. We believe the company likely can handle the 2025 debt maturity without accessing the capital markets. However, the 2026 maturities are a different matter. They will have to be refinanced, which will not be possible if BEAD funding is delayed past early 2025 and there is no clear path to improvement in both revenues and EBITDA on a sustained basis.

FCC’s Pro-Consumer Mandate an Obstacle to Consolidation Under Democrats

Capstone believes a Democrat-led FCC will continue to be an obstacle to consolidation in the telecommunications industry in 2024. The Biden administration has taken a relatively hostile view toward transactions that could cost unionized workers their jobs or could lead to higher prices for consumers. While the FCC does not get involved with merger reviews to determine if a transaction could raise antitrust concerns, its approval is required for all license transfers. This means the FCC is involved in the following types of transactions that lead to consolidation:

- Telecommunications companies that have FCC licenses;

- Television and radio broadcasting industry transactions involving the transfer or sale of stations; and

- Licenses for wireless spectrum sold in the secondary market between license holders.

In some ways, the FCC could be a bigger obstacle to approval than the US Department of Justice (DOJ) Antitrust Division. This is because the FCC makes decisions using a public interest standard. Capstone views public interest standards to be relatively amorphous because they are not defined either by law or regulation. This gives the FCC wide latitude to determine what it deems to be in the public interest. However, DOJ is bound by both its legislative authority over antitrust violations and decades of legal precedent and bears the burden of proof in showing that a transaction is anticompetitive. This makes overcoming FCC objections on a transaction it views as not in the public interest to be a highly political process and exceedingly difficult to overcome without some sort of negotiated solution.

For example, Standard General’s failed acquisition of Tegna Inc. (TGNA) in early 2023 shows how the FCC can use its public interest standard to block a deal. This transaction appeared to face no real antitrust-related risk given DOJ did not object. However, public interest groups, Democratic lawmakers, and unions all lobbied the FCC to block the deal because of perceived threats to jobs in newsrooms and a loss of local programming content despite pledges from the companies to invest in local programming and newsroom staffing. Because the FCC was evenly split between Republicans and Democrats and no transaction could be approved or blocked while Democrats opposed the deal and Republicans supported it, Chair Rosenworcel sent the transaction to an administrative law judge for a review, where it lingered until it reached the merger termination date and the entire transaction was abandoned.

SpaceX Tender Potential IPO of Starlink Highlights Importance of FCC Regulatory Scrutiny

Capstone believes the regulatory scrutiny that SpaceX faces is not affected by speculation that it could raise money from outside investors or by the makeup of the current administration. However, we believe institutional investors considering investing in SpaceX or participating in a potential future Starlink initial public offering may not understand how exposed SpaceX and its Starlink subsidiary are to regulation and how expansive the FCC’s authority is over both companies.

With limited exceptions, the FCC regulates all satellite companies that provide domestic service. That includes licenses for satellite operators to broadcast on designated frequencies. This regulatory authority allows satellite companies to provide service only within the US. Companies like Starlink that offer internet access abroad also must work with regulators in other countries to provide service in those countries. In addition, satellite operators need FCC approval for domestic space launches and help to coordinate satellite placement and licensing of space stations with regulators in other countries.

We point out the importance of FCC regulations to SpaceX and its operating subsidiary, Starlink, as they have been among the most aggressive advocates for rulemaking and policy changes. Understanding which rulemakings are a priority for SpaceX can help investors better understand potential future risks and opportunities both for SpaceX and, more importantly, for Starlink. Issues the company currently is focused on include:

- Second-generation satellite approvals. The FCC recently approved an order giving SpaceX the authority to launch 7,500 second-generation satellites. However, SpaceX needs additional approvals to launch its entire planned constellation of 30,000 second-generation satellites. Getting approval for the remaining satellites is critical to the company’s future.

- Orbital debris rules. SpaceX satellites that are no longer functional are considered orbital debris. The FCC regulates orbital debris that commercial satellite operators launch under its authority to regulate space launches. Failure to adhere to the FCC’s orbital debris rules can result in fines and we expect the FCC will continue to tighten its regulations on orbital debris as launch activity continues to accelerate and the risk of debris in orbit rises.

- Expanding use of the 12.2-12.7 GHz band. DISH Network Corp. (DISH) currently uses this band and there is an ongoing proceeding regarding how these frequencies can be more intensely used. SpaceX wants to use this band in its next-generation satellite service on a shared basis with DISH and other satellite operators. This is one of several spectrum-related proceedings at the FCC that Starlink and SpaceX have a vested interest in.

- Rural Digital Opportunity Fund (RDOF). Starlink also has filed a petition asking the FCC to reconsider a decision to deny the company $885.5 million in RDOF funding, which the company had been awarded for serving 640,000 unserved locations in 35 states. While this appeal is unlikely to be approved, Starlink continues to push for the FCC to reverse its decision blocking it from participating in the RDOF program. It also is expected to compete for funding in the $42.45 billion BEAD program in areas where it is not economical to deploy fiber networks.

- Direct to cellular supplemental coverage. SpaceX is seeking to partner with T-Mobile to provide supplemental coverage to T-Mobile subscribers from its satellites. However, SpaceX must ensure that it can do so without causing harmful interference to any current or future in-band and out-of-band users. The FCC is actively exploring this issue collaboratively with several different companies to facilitate connectivity in hard-to-reach areas.