Introduction

Capstone expects consumer-friendly regulatory pressure to ratchet up for financial companies providing consumer-facing products and services as freed-up regulators race against the electoral clock to pursue Biden’s agenda before the 2024 election.

Capstone believes the US Supreme Court will find that the appropriations mechanism for the Consumer Financial Protection Bureau (CFPB) is constitutional in the first half of 2024, unshackling the bureau and leading it to aggressively pursue its agenda before the end of President Joe Biden’s first term.

The ongoing “junk fee” initiative will continue to drive regulatory priorities, particularly through rulemaking. We believe the Federal Trade Commission (FTC) will finalize its rule regulating fees charged by auto dealers. Additionally, the CFPB will finalize its rule lowering the credit card late fee safe harbor, both likely in the first half of the year, to avoid potential repeal through the Congressional Review Act.

We also believe there is an underappreciated risk that as the bureau pushes to complete as many rules as possible by the end of 2024, it could finalize new overdraft regulations that may be proposed as soon as December 2023. The bureau is also likely to finalize its rule designating large technology payment providers for supervision and propose a rule with expansive implications for data brokers – although that is unlikely to be finalized before the end of the year.

Finally, we expect enforcement activity to accelerate as the legal overhang from the Supreme Court case is lifted, and agency leadership seeks to finalize investigations it has opened in the past three years. We anticipate that junk fees will be a central theme of the increased enforcement activity, and the CFPB is likely to pursue more behavioral remedies, particularly as providers will not be able to delay court proceedings by claiming the bureau is unconstitutional.

CFPB Agenda Likely to be Unchained Following Constitutionality Decision

Capstone believes the Supreme Court will likely uphold the CFPB’s funding structure as constitutional, based on our analysis of the oral arguments held on October 3, 2023. Even if the bureau is found unconstitutional, we do not believe the CFPB will be dismantled as an agency, and there is low risk to other independent financial regulators. We expect the court to release its opinion on the case in the second quarter of 2024, no later than the end of June 2024.

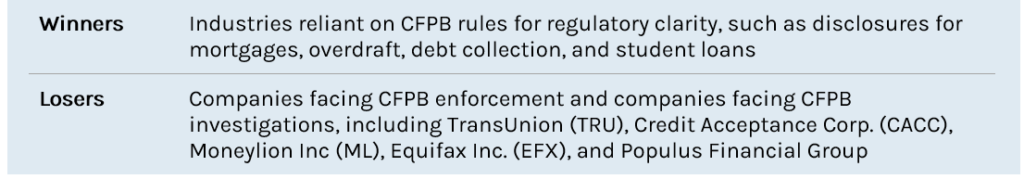

The CFPB has operated under a legal overhang since October 2022 when the Fifth Circuit released its decision in Community Financial Services Association of America Ltd. (CFSA) v. CFPB that found the bureau is unconstitutionally funded. Since then, courts have granted stays to companies facing enforcement action and blocked regulations issued by the CFPB, such as the small business lending disclosure rule. We believe this has created a level of complacency around the CFPB’s agenda, which we expect will accelerate following the Supreme Court’s opinion.

The CFPB has taken 64 enforcement actions since the beginning of 2021, averaging slightly over 21 per year. This is well below the average of over 31 enforcement actions per year from 2012 through 2020. While part of this decline reflects Director Chopra’s approach in which he seeks larger penalties and is willing to litigate cases rather than accept a settlement, we believe the legal challenges have also contributed to the slowdown. In particular, we believe targets of enforcement action have opted for litigation with the expectation they would get a stay and the case would make no progress until the Supreme Court decides on the CFSA case. At this time, it could be dismissed if the court rules against the CFPB.

With one less angle to challenge a CFPB enforcement action following the Supreme Court opinion, we expect more companies will settle allegations in the second half of 2024, and total enforcement activity will increase. Additionally, cases that have been stayed, such as Credit Acceptance Corp. (CACC), Moneylion Inc (ML), and Populus Financial Group, will resume their progress. While we still do not expect significant changes in these proceedings before the end of the year, at which point a potential new administration may step in, the companies are likely to incur higher legal costs while ultimately facing the risk of an adverse decision, particularly as Director Chopra has voiced his intention to seek more behavioral, non-monetary remedies.

A Supreme Court decision in favor of the CFPB will also allow it to resume rulemaking. We expect any challenge to a CFPB rule between now and the opinion release will be granted a stay, including controversial proposals such as the credit card late fee safe harbor rule. However, if the bureau’s funding is found to be constitutional, the stay could be lifted in time for rules to go into effect by the end of the year, pending a court’s willingness to stay the rulemaking based on more direct challenges, such as failure to comply with the Administrative Procedure Act (APA). We believe a strategy that relies on courts to intervene and prevent CFPB rules will incur greater risks in the second half of 2024.

We expect the bureau will proceed with proposing and finalizing regulations between now and the Supreme Court opinion, although it could slow the release of some final rules to prevent critics from being able to block it in court. While the CFPB attempts to continue with “business as usual,” the reality for the past year has been vastly different. We believe the bureau’s regulatory and enforcement agenda will become “unstuck” in 2024, creating a race to achieve its goals by the end of the year and potentially setting up significantly stricter regulation in a second Democratic administration beyond this year.

Push Against Junk Fees Accelerates, Posing Risk Card Issuers and Auto Dealers

We believe the regulators within the Biden Administration view its “junk fee” initiative as one of its most successful political angles and a way of demonstrating that the administration is reducing costs for everyday citizens. We expect the FTC and CFPB to finalize rulemaking related to product fees in 2024, in addition to an evolving enforcement approach that will likely target more consumer-finance product fees.

CFPB Credit Card Late Fee Rule

In February 2023, the CFPB published a notice of proposed rulemaking (NPRM) that proposed lowering the credit card late fee safe harbor to $8 from its current level of $30 for first violations and $41 for subsequent violations. We expect the rule to be finalized by April 1, 2024, and anticipate that it could be released before the end of 2023 – the CFPB’s submission to the unified agenda indicated that it planned to release the final rule in December.

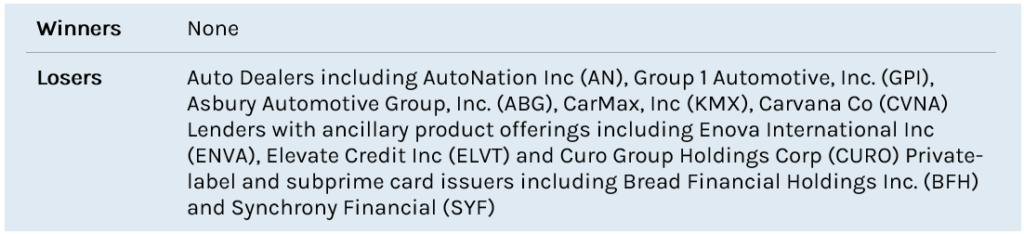

We believe implementation of the rule will be stayed while the CFPB awaits the Supreme Court decision in CFSA. However, if the stay is only granted for the constitutionality question and the CFPB wins the case, as we expect, then the rule would likely go into effect by the end of 2024. We expect that if the credit card issuers lowered their late fees to the proposed $8 safe harbor level with no other offsets, such as higher interest rates, it would reduce the revenue by 16.5% for Bread Financial Holdings Inc (BFH) and 14.0% for Synchrony Financial (SYF).

The most likely means by which the issuers may gain a reprieve beyond 2024 is a court-ordered stay based on the rule’s merits, rather than the CFPB’s constitutionality. We expect industry participants will argue that the CFPB violated the APA by using non-public data for its analysis, failing to consider the impact of deterrence on the safe harbor level, and failing to convene a Small Business Regulatory Enforcement Fairness Act (SBREFA) panel. While the CFPB clearly has the authority to set or amend the safe harbor level, we believe a friendly court could provide a temporary stay, given the potential for harm to credit card issuers.

FTC Auto Dealer Rule Likely

We also believe the FTC will release a final rule related to auto dealers in 2024, a rulemaking process that we think has been overlooked, given the time elapsed since it was proposed in June 2022.

The rule is designed to increase the transparency of fees in the auto market and would require an increased level of disclosure and standardization for the broadly defined “add-ons.” The rule would require dealerships to provide details of all add-on fees, including clear indications of which fees are optional and an “offering price” showing the vehicle price without any optional add-ons. The FTC’s fairly open-ended proposal has generated some concerns from members of Congress who requested further information from the commission. As a result, we believe the FTC could seek to finalize the rule before the middle of 2024, as it may otherwise be at risk of being repealed by the Congressional Review Act, particularly if Republicans win the presidency and control both chambers of Congress in the 2024 election.

Critics of the rule argue that it could make car purchases more difficult and stifle industry innovation. The FTC has already brought forth numerous enforcement actions against auto dealers for discriminatory practices or junk fees in the car buying process. We believe the FTC will continue to take enforcement actions against auto dealers allegedly engaging in discriminatory practices, but the finalized rule would allow for more significant financial penalties.

Junk Fee Enforcement a Priority

We expect the CFPB will prioritize junk fees in its enforcement actions, which can set de facto industry standards more quickly than a rulemaking process. We anticipate that ancillary product sales – an aspect of enforcement actions against OneMain Holdings Inc (OMF) and Credit Acceptance will continue to be a concern, representing risks to other personal lenders and auto lenders.

We anticipate that the bureau’s scrutiny of product fees that “far exceed the cost to the provider” will trickle down from the current focus on fees assessed by large financial institutions, such as credit card late fees and overdraft fees, to smaller industries. In particular, we anticipate the bureau could seek to address inactivity fees associated with prepaid cards, convenience fees, and unavoidable service fees, which have been criticized by consumer advocates but have less visibility than regulators’ targets to date.

We also anticipate that states will follow the lead of federal regulators and seek to limit junk fees, which can increase the risk of enforcement from state attorneys general (AGs), who regulate many of the fees and licenses for consumer finance providers, or new legislation. For example, in October 2023, California passed SB 478, which requires all fees to be disclosed in advance – the law goes into effect in July 2024. As California is often the bellwether for state regulatory trends, we anticipate other states could seek to leverage the political support for junk fee regulation, including laws that more explicitly focus on consumer finance products.

Regulators to Sprint to Finalize Outstanding Unified Agenda Rulemaking Processes

In addition to the above “junk fee” rules that have garnered significant attention and have a high likelihood of being finalized in 2024, we believe the remainder of the CFPB’s regulatory pipeline is underappreciated, especially if the legal tools to delay or prevent a rule from coming into effect are lost. We anticipate the CFPB and other regulatory agencies, will push to have any rules go into effect so they are not vacated if a Republican wins the 2024 presidential election and appoints new agency leadership in the beginning of 2025.

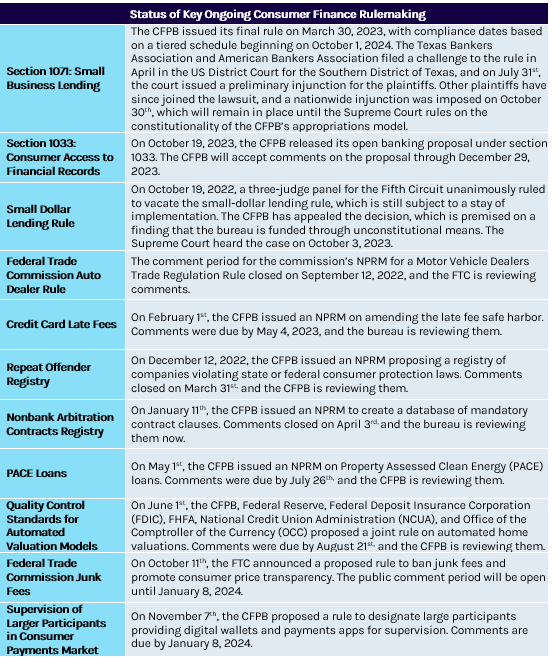

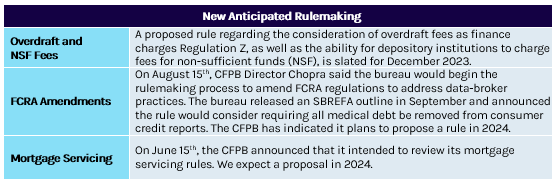

The CFPB rulemaking agenda remains ambitious, with numerous rulemakings still unfinished. In addition to the CFPB’s credit card late fee safe harbor rule and the FTC’s auto dealer rule discussed above, we believe the CFPB could finalize four other impactful rulemakings for consumer finance providers in 2024 – while we anticipate amendments to regulations for the Fair Credit Reporting Act (FCRA) will not be possible in the coming year.

Overdraft Rule Faces Difficult Path

At the end of November, Bloomberg reported that the CFPB will propose a much-anticipated overdraft rule in December. This was followed by the CFPB’s unified agenda update that was posted on December 6th, which was in line with the reporting – projecting a proposed rule in December. The details of what a proposal could entail have not been revealed. However, the unified agenda indicates that it will address whether certain overdraft models should continue to be exempt from the Truth in Lending Act (TILA). Additionally, the agenda states the bureau is considering amendments to Regulation Z, not Regulation E, which addresses opt-in requirements and disclosures, or Regulation DD, which requires the disclosure of total fees by statement cycle and year and regulates advertising for overdraft services.

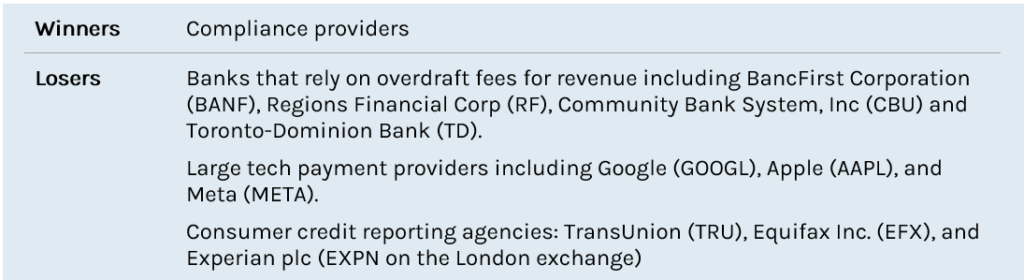

Despite this seemingly narrow scope, the financial services industry is wary of the proposal. In a press release, the Consumer Bankers Association warned that the CFPB could propose “forcing all banks to offer their overdraft products at certain government-imposed prices.” We believe a cap on overdraft charges or limits on the number of permissible overdrafts in a set time period would be a worst-case outcome for banks that generate up to 10% – 15% of net income from overdraft charges, including many community and regional banks and some large institutions like Regions Financial Corp. (RF) and Toronto-Dominion Bank (TD).

We believe it would be difficult, but possible, for the CFPB to finalize its overdraft rule before the end of 2024 if it is proposed in December 2023. If finalized, it would likely be in the fourth quarter, which would not provide adequate lead time for the rule to go into effect before 2025.

Supervision of Larger Participants in Consumer Payment Network

The CFPB proposed a rule in November 2023 to designate large technology firms providing payment services, like digital wallets, for supervision. The proposed rule is designed to level the playing field between banks and non-bank competitors and provide the CFPB with more insight into large companies with significant consumer data.

We believe the CFPB could finalize this rule by the middle of 2024, which would begin to subject covered companies, like Google (GOOGL), Apple (AAPL), and Meta (META), to regular examinations which typically leads to an uptick in enforcement actions after one to two years. While we believe this rule will be finalized in 2024, we also anticipate that it would likely be finalized under a Republican administration as it, along with the CFPB’s Section 1033 “open banking” proposal, has received positive feedback from Republican lawmakers and many participants in the financial services industry.

Contract Limitations Registry and Repeat Offenders Registry

The CFPB indicated in its unified agenda that it intends to finalize its rule, creating a registry for nonbank form contracts that limit consumer legal protections in March 2024. The rule was proposed in February 2023. While the proposed rule would only create a database of form contracts, industry participants see it as a first step towards limiting arbitration clauses in consumer finance contracts. The CFPB finalized a rule in 2017 that banned mandatory arbitration clauses, but it was overturned by the Congressional Review Act, which prohibits agencies from issuing a new rule that is “substantially the same.”

Financial services participants worry that the CFPB’s database will serve to increase the public and regulatory pressure to eliminate arbitration clauses from contracts. Further, the industry argues that the creation of the database suggests that arbitration is necessarily negative for consumers, which they dispute. We anticipate that the rule will be finalized in the first half of 2024, with tiered effective dates based on company size, with the largest operators subject to the registry before the end of the year.

Similarly, the CFPB expects to finalize its “Repeat Offender Registry” in March 2024. The registry, proposed in January 2023, would list non-bank companies subject to enforcement orders from state or federal regulators. Like the contract registry, the rule would not require any behavioral changes from the companies – but they worry a “name and shame” list will attract negative attention and hurt their reputation with consumers. We expect larger companies will also need to register for this database by the end of 2024.

Fair Credit Reporting Act

We do not believe the CFPB will finalize its ongoing rulemaking process to amend the regulations for the FCRA by the end of 2024, although we expect a proposed rule. According to the SBREFA outline, the rule will address two primary issues. First, it seeks to eliminate all medical debt from consumer credit reports. Director Chopra has argued medical debt is not predictive of a consumer’s creditworthiness and is often inaccurately reported. He has also been critical of medical credit cards and installment loans.

The second part of the rule would expand the definition of a consumer reporting agency under the FCRA to include data brokers or those that buy and sell consumer credit information. It would restrict the ability to sell covered information, including credit header information, to only “permissible purposes,” which critics argue would hamper uses, including law enforcement and certain fraud prevention models.

As the CFPB is unlikely to finalize the rule in the next year, we believe Director Chopra could accelerate his enforcement actions to address his concerns. For example, Equifax Inc (EFX) has disclosed that it received a civil investigative demand in July 2023 related to its Workforce Solutions business unit to determine whether it complied with the FCRA. The bureau could seek to agree to a consent order with a large data broker in 2024 if leadership anticipates they will not have the opportunity to finalize the rule in 2025.

Below, we summarize all the active consumer finance rulemaking processes.