Clear signals of financial strain on consumers have emerged. Recent data releases have shown a fall in the personal savings rate and rising year-on-year credit card balances. In addition, consumer finance companies have downgraded performance outlooks.

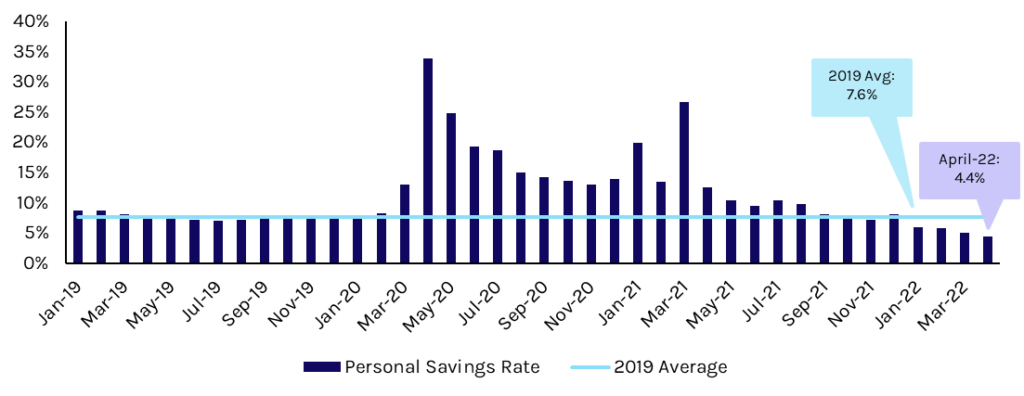

Consumers have been saving significantly less so far in 2022 compared to 2021 and 2020. After the personal savings rate spiked to nearly 34% in April 2020 (driven by pandemic lockdowns and federal stimulus), it normalized in the fourth quarter of 2021, before falling below the 2019 average of 7.6% in January and remaining there since. In April, the latest month for which data is available, the personal savings rate fell to 4.4%, its lowest since September 2008. We believe this trend, driven in part by increased spending due to significant price hikes for essentials such as food and gas, is increasing demand for consumer credit. According to the Federal Reserve Bank of New York’s quarterly report on household debt and credit, consumer credit card balances were up 9.2% y/y to $841 billion in the first quarter of 2022. We view this as a signal of increasing economic strain on borrowers.

Personal Savings Rate Fell to 14-Year Low in April

Consistent with this trend, on June 16th, PROG Holdings Inc. (PRG)—the fintech holding company for Progressive Leasing (a virtual provider of rent-to-own payment plans), Vive Financial (a private label credit card issuer), and Four Technologies (a buy now, pay later firm)—lowered its Q2 and full-year 2022 guidance to reflect what it categorized as a deteriorating operating environment in the US. The company pointed to increased delinquencies, higher write-offs, and decreasing demand as consumers are facing “rampant” inflation, which is forcing them to prioritize spending on essentials.

We believe these signs of consumer strain are likely to influence regulatory priorities including increased scrutiny of loan origination and servicing from the Consumer Financial Protection Bureau (CFPB). In particular, we anticipate a greater focus on underwriting practices (including evaluating the borrower’s ability to repay), credit reporting practices (for accuracy and to ensure equitable practices), and first and third-party collections.

This is an excerpt from John Donnelly’s June 2022 monthly consumer finance report, in which he shares with clients the latest regulatory and privacy-driven catalysts enforcement actions, and state-level developments investors and corporates should pay attention to. To read the full report or to learn more about Capstone’s consumer finance coverage, reach out to [email protected].