By Wylie Butler

Introduction

Capstone believes most healthcare providers will be pressured by sustained labor inflation in the wake of the pandemic as temporary federal boosts exit the system and a savings-focused Congress shuts the tap off. However, we expect regulatory and congressional inflection points to emerge in 2024 that will begin to set the scene for eventual relief.

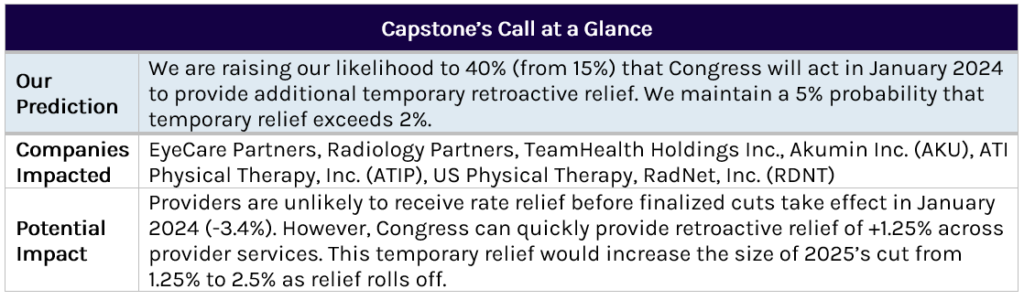

Capstone believes investors underappreciate the potential for long-term physician fee schedule relief (PFS) in 2024. The story surrounding PFS and most physician services since the pandemic has been: how large is the cut this year? And how much temporary relief can we receive? Congress is unlikely to provide temporary relief in upcoming January funding discussions retroactively but could begin to consider long-term inflationary fixes, including a market basket, more seriously in the 2024 and 2025 sessions.

Capstone believes Congress remains unlikely to provide a fix to the ongoing negative adjustments in Medicare home health. CMS has provided slightly positive updates in recent years – though still below inflation – which has masked the impact of cuts. However, there is growing momentum in the Senate to provide limited relief (+1.25%), causing us to raise our odds of January relief to 40% (from 15%). The overhang of clawbacks on future rate adjustments, potentially flat for the next six years, places significant pressure on the industry to win in Medicare Advantage contract negotiations.

The Biden Administration moved in April of 2023 to cap margins for personal care providers in Medicaid, seeking to align itself more strongly with labor unions ahead of a 2024 campaign run. Capstone continues to believe labor unions represent a growing power in healthcare across provider types. However, providers such as Addus will see multiple provider-friendly wins in a final rule, the industry expects in the first half of 2024.

Medicare PFS Approaches End of E/M Reform Aftershocks, 2026+ Inflation Fight Begins

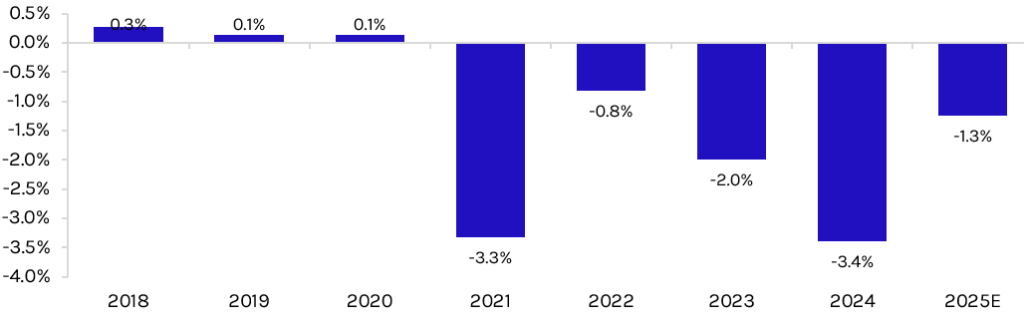

Evaluation and management (E&M) reform kicked off in 2021 as the culmination of a multi-year process involving the American Medical Association (AMA) and CMS to revalue and redefine physical therapy services. Due to a lack of annual inflation updates in the PFS, the increased rates for E&M services required significant offsets to all other physician groups. The cumulative ~10% cut has been phased in unevenly since 2021 and will be finished in 2025, barring any additional Congressional action. Investors are well aware of the doc fix process, and Capstone believes Congress is unlikely to provide retroactive relief in January. However, the Senate could push for a 1.25% lift for 2024 (which would increase the size of the 2025 cut to -2.5%).

As always, it is essential to note that this cut is technically budget neutral, as many providers with exposure to E&M codes are essentially held harmless, and primary care practices win significantly. To learn more about billing practices by provider type and spending trends over the last few years, investors can explore the new Medicare Reimbursement Data Tool the healthcare team released this month here.

Looking ahead, investors should watch growing debates on the Hill about a long-term solution to the PFS. It is the only payment system in Medicare without an annual update. Current law would establish a +0.25% annual update beginning in 2026 for all providers and +0.75% for providers in qualifying value-based care (VBC) arrangements. For now, Congress remains focused on improving VBC participation in Medicare and seems unreceptive to straight funding increases to fix doctor compensation. However, Capstone believes providers will continue to pound the table on the need for an annual inflationary update. Congress will eventually take their side after some compromises on VBC participation – though bill timing is up in the air due to an estimated $80-100B price tag.

Exhibit 1: Medicare PFS Conversion Factor Annual Updates, 2018-2025E

CMS Eases Home Health Cut for Second Year in a Row, but Overhang Remains

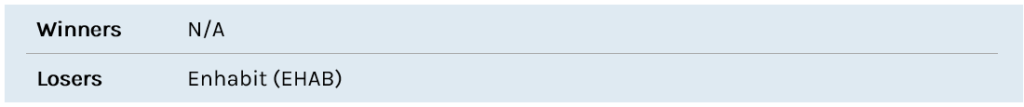

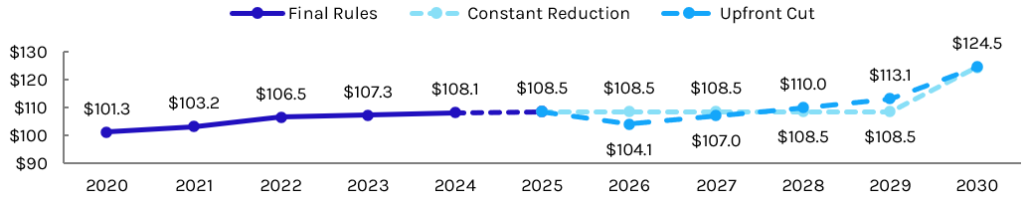

Home health providers will benefit in 2024 from near-term relief in reimbursement pressure after CMS elected to phase in proposed cuts between 2024 and 2025. In the long term, Capstone believes investors underappreciate the effect of stagnant Medicare rates on the industry. Medicare Advantage (MA) plan contracts and negotiations will become a key factor for providers’ success moving forward. However, payors face their own pressure from the Biden administration and Congress in 2024 (Read more here).

CMS’s approach to FFS rates signal that the agency will remain sensitive to annual updates for home health that are outright cuts, indicating a future clawback approach will likely take the form of a constant reduction that keeps rates flat through 2029. Following the release of the 2024 final rule, Capstone estimated eventual clawbacks the agency will seek to collect approximately $4.7B (Read more here).

Exhibit 2: Medicare Home Health Updates 2020-2030 – Base Rate Indexed at $100

80/20 Lingers in Proposed Status, Provider Friendly Changes Expected in Final Rule

In April 2023, CMS released a surprise proposed rule that would create a pass-through for most Medicaid personal care services that requires 80% of Medicaid payments to be directed as compensation for direct care workers. Since this rule is not part of an annual rulemaking process, CMS is given larger discretion over the timing of finalization. Shares of major personal care provider Addus Homecare (ADUS) immediately traded significantly lower and have not recovered, despite the existing pass-through of 77% in their largest state, Illinois.

Capstone believes the potential for heavily provider-friendly changes or a longer-term reconsideration of the rule under a Republican administration is underappreciated. Based on provider and state pushback against the proposed rule, we expect CMS to yield on three key changes to the rule in the final version – 1) extending the timeline for implementation from 4 years to 5-6 years post-final rule, 2) lowering the pass-through requirement from 80% to 75%, and 3) allowing a broader definition of compensation to include costs such as travel (Read more here).

Provider and/or state lawsuits have been floated as potential challenges to the rule, but a more potent threat to the rule’s implementation could be a Republican president. State pushback against the proposed rule has frequently mentioned CMS overstepping its role as the federal regulator for this rule – despite the agency and federal government shouldering most of the cost for PCS programs and Medicaid in general. Though this policy is unlikely to be at the forefront of any Republican campaign material, a Republican-led CMS would be more likely than the current administration to appease states and weaken or fully pull the rule before implementation. As we’ve seen with short-term plan availability (Obama, Trump, and Biden each altering the prior rule changes), this is a straightforward change at the Federal level and could easily be changed before 80/20’s implementation—even if finalized in the first half of 2024.