Fiscal Cliffs to Drive Congressional Healthcare Policy as Hospitals, Home Health, and Physicians All Face Looming Cuts

January 7, 2023

Capstone believes Congressional healthcare policy in 2023 will be cliff-driven as lawmakers look to stave off a series of cuts facing providers, hospitals, and home health facilities. In this note, we walk through each fiscal cliff and the resulting impact of action (or inaction).

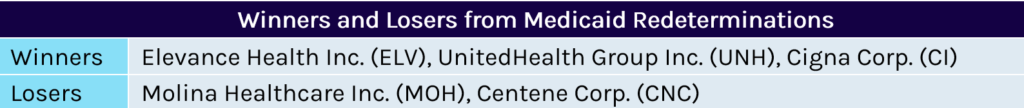

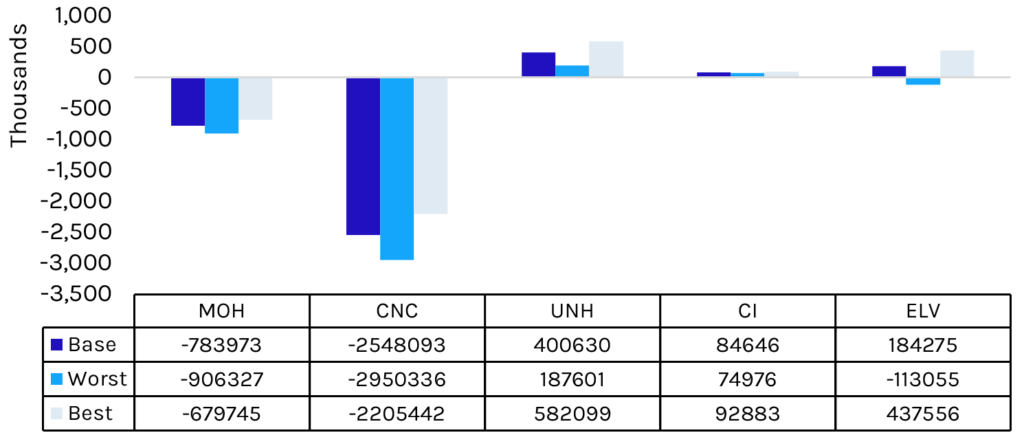

The 2022 year-end spending bill will catalyze a wind-down of the temporary 6.2% boost in federal funding for Medicaid programs beginning April 1, 2023, alongside the resumption of Medicaid redeterminations. We estimate Medicaid-focused insurers, namely Centene Corp. (CNC) and Molina Healthcare Inc. (MOH), will see membership reductions of 9.5% and 15.1%, respectively in 2023 and 2024.

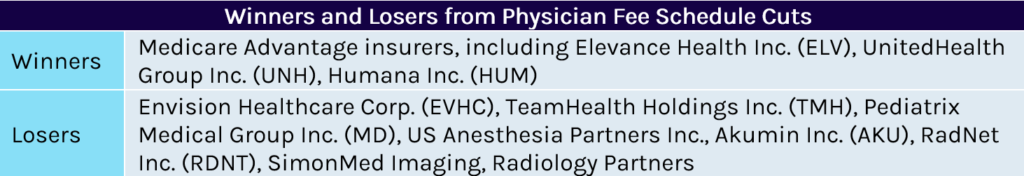

Disproportionate share hospital (DSH) payments, which help offset uncompensated care costs, will be slashed by $32 billion over four years without congressional action before October 31, 2023. The cuts have been repeatedly delayed since their enactment via the Affordable Care Act (ACA). Capstone believes this trend will continue, with Congress stepping in to appease the hospital lobby and dependent states.

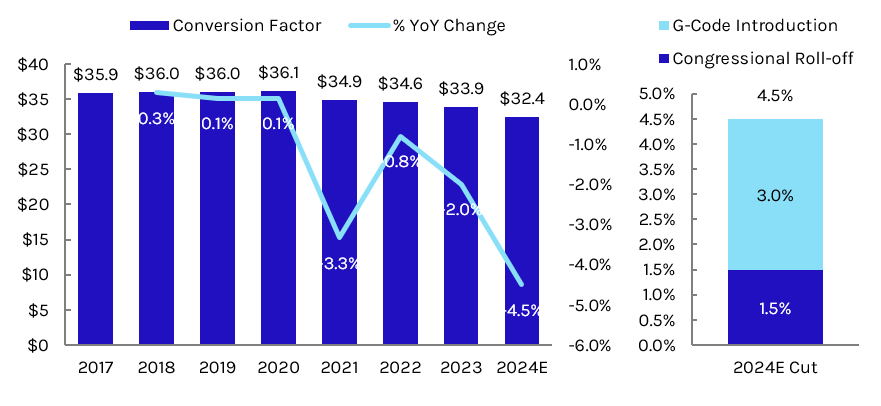

Congress is boosting physician fee schedule (PFS) payments by 2.5% in 2023 and 1.25% in 2024. The reduction in relief in 2024 will feel like a 1.25 percentage point cut to physicians, worsened by the arrival of a new G-code that will place an additional 3% cut on physician rates. Physician advocacy groups will need to work with the new Congress in 2023 to avert an overall reduction in 2024 and establish a permanent PFS solution.

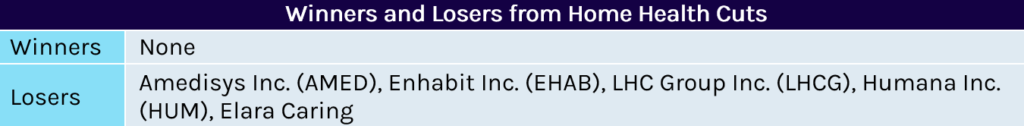

Home health providers are facing two types of cuts in the coming years: a 3.5% market basket reduction in 2024 in response to Patient-driven Groupings Model (PDGM) cuts and $2.1B in outstanding clawbacks due to Centers for Medicare & Medicaid Services (CMS) calculated overspending in 2020 and 2021. CMS has not released a timeline or updated projection for the clawbacks, which are expected to grow significantly to account for overspending in 2022 and 2023. Home health lobbyists will likely seek to have Congress remove the clawback requirement entirely.

Capstone believes CMS will look to bring back a wider selection of categories in the upcoming Round 2024, potentially including ventilators.

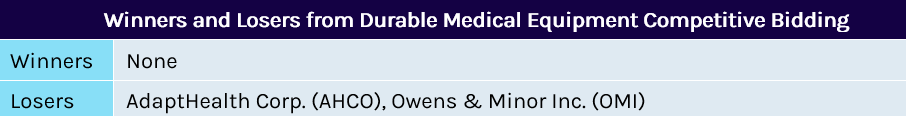

Round 2021 of the durable medical equipment (DME) competitive bidding program will end in 2023, setting the stage for new product categories to be introduced in 2024. In 2021, most product categories were scrapped from the program due to the pandemic and a lack of savings for CMS. Capstone believes CMS will look to bring back a wider selection of categories in the upcoming Round 2024, potentially including ventilators.

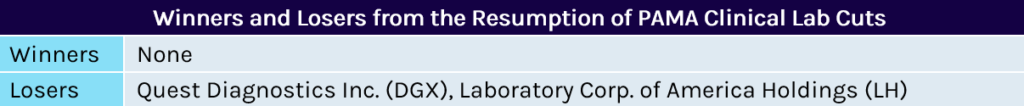

After winning a third consecutive delay to fee schedule cuts mandated by the Protecting Access to Medicare Act (PAMA), clinical labs are unlikely to continue avoiding Medicare payment cuts in 2024.

Medicaid Redeterminations to Begin April 1, 2023

The 2023 congressional year-end spending bill requires that states begin Medicaid redeterminations starting April 1, 2023. The pause on Medicaid redeterminations has been in effect since the passage of the Families First Coronavirus Response Act in March 2020. The legislation increased federal funding for Medicaid’s Federal Medical Assistance Percentage (FMAP) by 6.2% in exchange for states agreeing not to conduct eligibility checks and therefore not to kick any individual off of Medicaid. The pause on redeterminations has led to significant growth in the Medicaid program—Capstone projects total enrollment growth of 31% (over 20 million individuals) by March 2023 from March 2020.

The redetermination process is therefore expected to spur significant disenrollment. Democrats were unable to secure guardrails on the process that were included in the proposed Build Back Better redetermination, including limiting the number of people per month states could disenroll. However, Congress will attempt to control the disenrollment process by phasing down the enhanced FMAP through the end of 2023. The enhanced match will decrease to 5% on April 1st, 2.5% on July 1st, 1.5% on October 1st, and 0% on December 31, 2023.

With massive disenrollment, major Medicaid managed care insurers Molina and Centene will experience significant decreases in covered lives, with Molina set to lose an estimated $467 million in annual gross profit. Molina will experience further membership losses following the announcement that Centene has been issued new California Medicaid contracts beginning January 1, 2024. Large Affordable Care Act (ACA) Marketplace insurers Cigna, Elevance, and UnitedHealth are likely to see a neutral-to-positive impact of disenrolled Medicaid beneficiaries switching to an ACA plan.

Exhibit 1: Insurer Net Membership Change in Lives, Base/Best/Worst Case

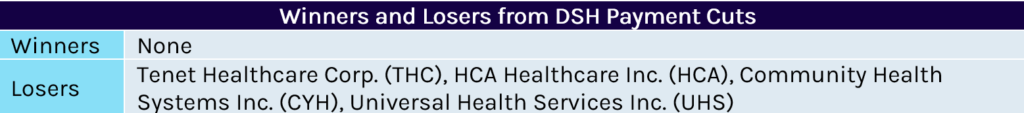

DSH Cuts to Come in October 2023 Without Congressional Intervention

Disproportionate Share Hospital (DSH) payments are federal payments to hospitals that serve a large number of Medicaid and uninsured patients. The ACA included a reduction in DSH payments of $18 billion beginning in 2014. The cuts were intended to incentivize states to expand Medicaid and invest in other reforms that would reduce the number of uninsured individuals. If the cuts proceed and states feel increased pressure to expand Medicaid to decrease uncompensated care costs, major Medicaid managed care organizations (MCOs) will see some benefits from increased enrollment. However, following hospital industry lobbying pushes, the cuts have not yet taken effect, having been delayed several times by Congress.

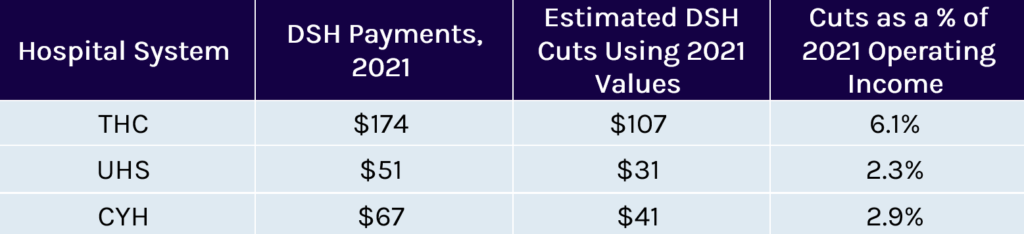

Most recently, the 2021 year-end spending bill delayed the cuts until October 31, 2023. If they proceed, $8 billion would be cut in each fiscal year from 2024 to 2027, totaling $32 billion. The cuts would slash federal 2022 DSH contributions by 59.7% and total federal and state DSH contributions by 34%. In addition to DSH payments, seven states, including Florida, Texas, and Tennessee (large non-expansion states), have uncompensated care (UCC) waivers that further supplement the amount of money hospitals receive for uncompensated care. The Biden administration has yet to pare back these waiver approvals and more states could seek similar approvals if DSH payments remain in jeopardy.

Capstone ultimately believes that the cuts will be delayed again to prevent extreme decreases in safety net hospital funding…

During 2021 Build Back Better (BBB) negotiations, Democrats tried to add DSH cuts for non-expansion states to the looming ACA cuts by reducing DSH allotments by 12.5% and limiting Medicaid UCC pool funding in non-expansion states. These policies would have been supplemented by a temporary FMAP increase to 93% for states that expanded Medicaid and subsidies to people in the coverage gap in non-expansion states. However, even with Congressional Budget Office (CBO) estimates of an $18 billion reduction in spending over five years (2022-2026) and a $35 billion reduction over 10 years (2022-2031), the proposal ultimately did not make it into the US Senate Committee on Finance’s published version of BBB or the final Inflation Reduction Act (IRA), largely due to hospital industry pushback. Even with Democratic disagreement on DSH allotments, Capstone ultimately believes that the cuts will be delayed again to prevent extreme decreases in safety net hospital funding, providing a vehicle for other Medicaid reform within Congress.

Exhibit 2: DSH Payments in 2021 (in millions)

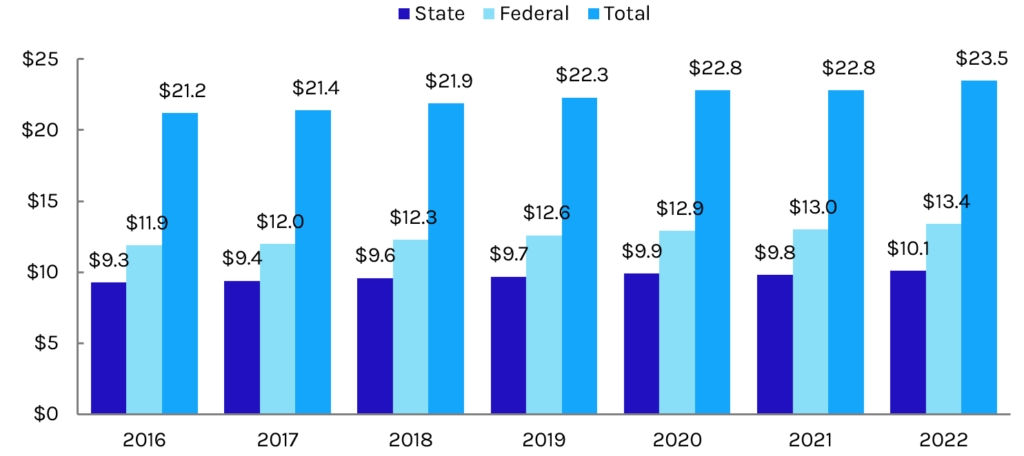

Exhibit 3: Federal and State DSH Allotments Since 2016 (in billions)

Medicare Physician Fee Schedule in Need of Congressional Revamp

Conversion factor reductions that began in 2021 from boosts to primary care codes continue to place pressure on fee schedule budget neutrality. Congressional mitigation has provided some relief, though a G-code delayed since 2021 combined with the roll-off of 2023 relief will create a new cliff in 2024. By acting on the 2024 fee schedule early, Congress has signaled to physicians the ball is in their court to propose a new permanent solution as we near the 10-year anniversary of the Medicare Access and CHIP Reauthorization Act of 2015. The American Medical Association (AMA) will be one of many physician groups working with the new Congress on a solution—including the potential for rates to be frozen at current levels and/or the introduction of an inflationary update. A permanent solution to the PFS system may modestly benefit Medicare Advantage insurers, who otherwise get hit by last minute changes to Medicare rates. Outside of budget neutrality pressure, physician specialties such as radiology will continue to be cut incrementally by the phase-in for clinical labor repricing through 2025.

Congress delayed statutory pay-as-you-go (PAYGO) cuts from 2023 to 2025 in the end-of-year spending bill. This will set up the same fight towards the end of 2024 to continue to avoid a 4% reduction across Medicare payment systems. Continuing to waive PAYGO will cost increasingly more, forcing Congress to either continue delaying it, to find more than $30 billion to pay for a waiver, or to let the cuts take effect in 2025.

Exhibit 4: Physician Fee Schedule Conversion Factor Trends and 2024 Expected Cuts

Home Health Providers Face Two Forms of Cuts Without Congressional Action

After failing to win a delay in cuts in the 2022 spending bill, home health companies face a 3.5% reduction to their market baskets in both 2023 and 2024. With 2023 resulting in a 0.7% net gain to Medicare rates, the 2024 update is likely to be very similar unless a large swing in inflation moves projections. A potentially larger threat to home health will be temporary clawbacks beginning as early as 2024. Overspending estimates between 2020 and 2021 would necessitate a ~12% cut, which could double after the inclusion of 2022 and 2023 estimates. CMS has not proposed a timeline for these clawbacks, but is required by law to complete them by 2026. It has cautioned in rulemaking that action by providers to reduce visits per patient to offset costs would result in greater reductions in the future, creating a downward spiral for Medicare reimbursement.

With 2023 resulting in a 0.7% net gain to Medicare rates, the 2024 update is likely to be very similar unless a large swing in inflation moves projections.

If CMS were to phase in a clawback of 20% between 2024 and 2026, the resulting impact would be a net negative of approximately 7% in 2024 (assuming a 3.5% market basket and 3.5% PDGM permanent cut), followed by market basket updates in 2025 and 2026. In 2027, the market basket update would be boosted by the return of the 6.7% temporary setback. Since all clawbacks will be temporary, each year’s expiring cut will be added to the following year’s boost after the first cut. In CMS’s eyes, the lagging 6.7% below benchmark for each year creates savings for the program that would satisfy the clawback requirement. Home health agencies and lobbying organizations are expected to begin lobbying efforts to avoid these cuts as early as this year.

DME Competitive Bidding to Return in 2024, Many Categories Have Been Excluded Since 2018

Following a gap between 2019 and 2020, competitive bidding for DME resumed in 2021 for only a portion of the original product categories due to COVID-19 disruptions. After not finding savings for most product categories, CMS removed ventilators, oxygen, and others from the process and only moved forward with off-the-shelf knee and orthotic braces. CMS is required by law to recompete the program at least every three years, indicating Round 2024 bidding will begin sometime in mid-to-late 2023.

The risk of payment reductions will be highest for product categories which have not previously been included in competitive bidding, such as non-invasive ventilators. Once included in competitive bidding, research has shown product prices drop by 45% on average. Pricing drops vary significantly by medical savings account (MSA) and have been shown to stabilize after an initial cliff. That said, the five-year gap for most product categories since the last round of competitive bidding suggests a market shake-up if competitive bidding is not further delayed.

PAMA Clinical Laboratory Reductions Scheduled to Resume in 2024, Capped at 15% Until 2026

The Protecting Access to Medicare Act of 2014 (PAMA) lined up a series of cuts for Medicare clinical laboratory payments over the following decade. From 2018-2020, Medicare fee schedule rates for clinical laboratory services began to be adjusted to match commercial median rates. Any reductions to services were capped at 10% each year. Payment reduction caps were set to increase to 15% for the 2021-2023 period before the Coronavirus Aid, Relief, and Economic Security (CARES) Act instituted the first delay to subsequent cuts. These cuts were delayed to 2024 through legislation in late 2021 and 2022.

Now, with COVID-19 receding, clinical laboratories are likely to see cuts resume. The impact of continued repricing will vary significantly by service, as previously, some services only felt cuts for one-to-two years of the phase-in while limited services received increases. However, for many services on the clinical lab fee schedule, reductions of up to 15% for the next three years present a significant overhang in the absence of additional congressional delay.

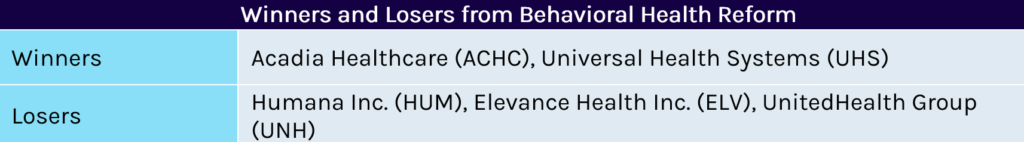

Mental Health Care Providers to Win on the Back of Legislative and Regulatory Reform, Parity Efforts to Come

Regulatory Reforms Boost Provider Power in ACA and MA Markets

As Capstone covered in our publication following the MA rule’s release, new regulations coming in 2024 for ACA and MA plans will require the plans to significantly expand provider networks for mental health care. Specifically, the plans will need to contract with at least 35% of all available mental health facilities and providers in a given service area. The proposed rules also responded to calls from advocates for simplified and explicit standards for mental health coverage by including standards for wait times and directly linking behavioral health services to emergency services, which removes prior authorization potential.

Legislative Efforts Address Access to Care, Provider Shortage, and Parity

In line with the Biden Administration’s regulatory efforts, Congress has focused mental health reform efforts on reauthorizing programs intended to boost access to care with increased funding. With insurance coverage being tackled through regulatory reforms, Congress has sought to build a pipeline of new providers with expanded training programs for the VA, student loan forgiveness for healthcare workers, and scholarships for medical programs. Parity reform continues to be a joint effort between agencies and Congress. Incremental changes—like eliminating ghost networks (“in-network” providers listed on an insurer’s page whose contracts have expired)—have been a positive for providers, but wider, more sweeping reform is being built. Congress will likely seek to address parity through a combination of oversight tools: increased plan transparency and reporting, and funding for states to pursue any plans out of compliance with federal standards.

2022 Legislative Wrap-Up: End-of-Year Spending Inclusions and Bills Likely to Resurface

Bipartisan support for major 2022 mental health reform bills showed the potential for a split Congress to continue making progress in the next session. The Bipartisan Safer Communities Act included batches of funding to expand community mental health services and pediatric mental health care access grants. The spending bill passed by Congress included reauthorization and increased funding for multiple federal programs in mental health and substance use disorder treatment. Key components tacked onto the bill included the removal of waivers to treat buprenorphine and of a requirement for patients to be addicted to opioids for one year before they could begin treatment. One piece of the original Build Back Better that was not included was a slate of new civil monetary penalties against plans that do not comply with current health parity laws. Republican opposition may be too formidable a hurdle in the upcoming Congress to reintroduce this piece, but Congress is likely to ensure eventual parity reform includes sharper teeth in the next iteration.